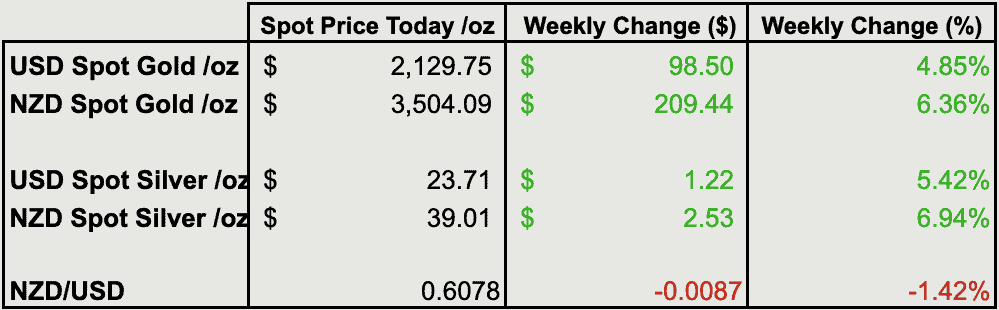

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $3255 |

| Buying Back 1kg NZ Silver 999 Purity | $1197 |

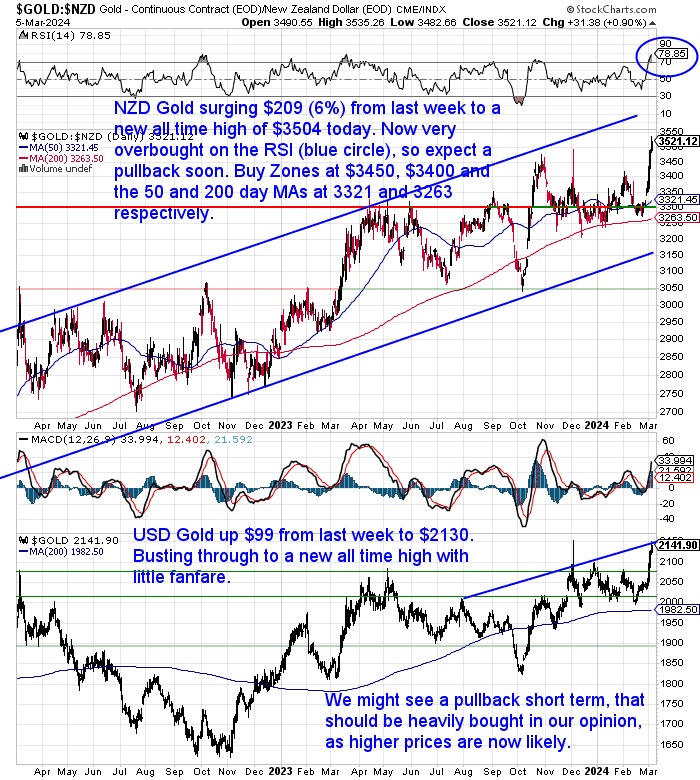

Gold Hits New All-Time Highs in Both NZD and USD

What a difference a week makes! Last week we were saying how there had been no change in prices and precious metals were looking pretty boring. Just 7 days later and NZD gold has surged higher by $209 or 6%. Getting above NZ$3500 for the first time ever. But that sharp jump has pushed NZD gold into very overbought territory on the Relative Strength Index (RSI). So we’d expect a pullback fairly soon. Although perhaps it could extend up toward the overhead uptrend line first? Previous overbought occasions have seen a fairly sharp pullback to follow. Buy zones when this happens are $3450, $3400 and then the 50-day moving average (MA) at $3321 and below that the 200 MA at $3263.

It’s telling that this all-time high in NZD Gold also coincides with a new all-time high in USD Gold as well. With USD Gold jumping $99 to bust through $2100 to reach a new all-time high today of $2130. As stated for NZD gold, USD gold is also very overbought so expect a pullback before too long. In our opinion any pullback should be heavily bought. As this may be the last time to see gold below US$2100.

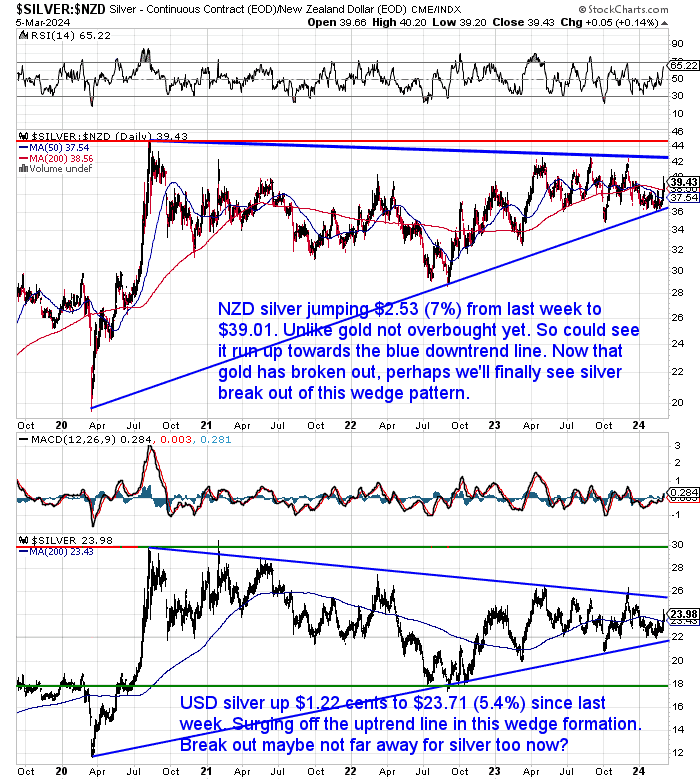

Silver Also Surging – But With a Lot of Catching Up to Do

NZD silver also jumped higher over the past 7 days. Up $2.53 or 7% to $39.01. However unlike gold, silver is not yet overbought. So it could yet run up towards the overhead downtrend line.

It was much the same story with silver in USD. It ran higher by $1.22 or over 5% in the past week. Surging up off the uptrend line in the wedge formation. We get the feeling that a breakout in silver might not be too far away now.

But now that gold has broken out to new highs, there’s a good chance we may finally see silver break out of this wedge pattern it has been in since 2020. Silver has a lot of catching up to do. When it happens it will probably take us by surprise and happen very fast. So be on board before that happens. Any pullback in the short term may be the last chance at these lower levels.

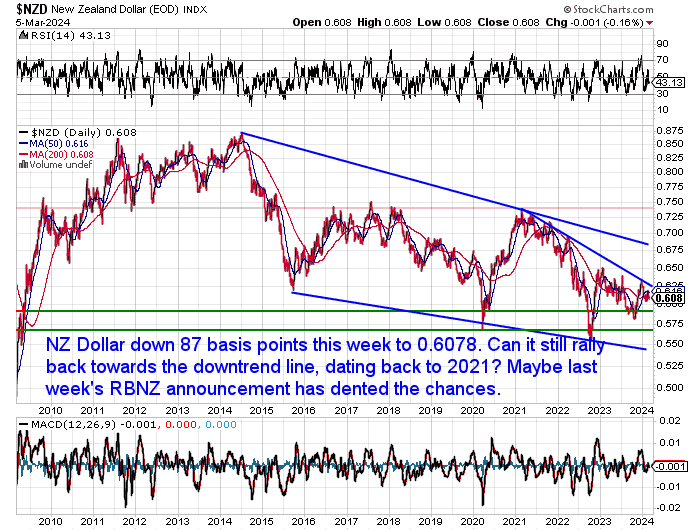

Kiwi Dollar Still Down After Last Week’s RBNZ Monetary Policy Statement

The Kiwi dollar was down 87 basis points this week to 0.6078. That gave a little boost to the already flying local precious metals prices. It looks like last week’s RBNZ announcement, which made it sound like they weren’t so likely to raise rates again, might have dented the chances of a short-term move back towards the downtrend line.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Is Gold a Useless Rock in a Crisis? Think Again!

When disaster strikes, many people imagine gold as a useless luxury. But this week’s feature article challenges that assumption, exploring the potential value of gold in various economic scenarios. You’ll discover:

Why gold might still be valuable even if the shelves are empty

How gold has historically acted as a hedge against inflation and economic turmoil

What you should also have before you buy physical gold.

So, before you dismiss gold as irrelevant in a crisis, take a few minutes to check out the insights in this week’s article. You might be surprised at what you learn!

You’ll also see how many ounces of gold you need to own to be in the top 1% of wealth holders in the world. The answer might surprise you…

What Good is a Bar of Gold If the Shelves Were Empty in 2024?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Reality Check Radio Interview: Why the NZ Super Fund Should “Invest” in Gold

Following our recent article, Why the NZ Super Fund Should “Invest” in Gold in 2024, we were invited back onto Reality Check Radio with NZ radio veteran Paul Brenna to discuss the topic further. You can listen to the 20-minute interview here.

The interview covers:

- Should the Superfund even be mining gold?

- How much gold does NZ have as a nation?

- What is diversification?

- What is risk?

- And plenty more.

Tech Insiders Selling. Buying Gold and Prepping?

First up, a follow on from last week’s comments about smart money selling from the tech sector. But they are also moving into the undervalued commodities sector:

The Fed flooded the market with liquidity to rescue the banks last year. This is powering the big move in stocks, but also note that smart money is starting to take profits and move money into the undervalued commodity sector. Liquidity is “leaking” into inflation assets.

This is what smart money does. They take profits when things get overvalued and move into undervalued assets.

Dumb money just keeps chasing the hot sector until they get caught in the inevitable crash and lose everything. This is why almost no one ever makes any money (other than briefly on paper) during bubbles.

Then we also saw this headline during the week:

Granted it was in the US version of The Sun. And it may just be a gold dealer in California trying to get some publicity. But it is true that Sam Altman, CEO of OpenAI has said he is a prepper who buys gold:

“Tech boss Altman told The New Yorker in 2016, “I prep for survival. … I have guns, gold, potassium iodide, antibiotics, batteries, water, gas masks from the Israeli Defense Force, and a big patch of land in Big Sur I can fly to.”

More on US Money Supply Decline

Also another follow on from last week, a piece from stock tipping website The Motley Fool. Just like we pointed out (care of our favourite newsletter writer Chris Weber), the author highlights the current decline in the US money supply, a very rare event:

“According to research conducted by Reventure Consulting CEO Nick Gerli, which relied on data from the U.S. Census Bureau and the Federal Reserve, there have only been five instances, when back-tested to 1870, where M2 has declined by at least 2%: 1878, 1893, 1921, 1931-1933, and July 2022 through at least January 2024. The previous four instances all coincided with deflationary depressions and double-digit unemployment rates.

If I can offer a ray of hope, two of the four previous incidences occurred prior to the creation of the nation’s central bank, and the other two date back more than nine decades. The Federal Reserve’s knowledge of monetary policy, and the fiscal tools available to the federal government, make it highly unlikely that a depression would materialize today.”

The author, Sean Williams, makes a good point. But while a central bank response might stop a deflationary depression, it’s instead likely to create some serious inflation. So it could be just a case of choosing which poison is preferred.

Williams also points out there has also been a recent decline in commercial bank lending:

“Just as M2 rising over time makes complete sense, so does the regular expansion of commercial bank credit. As the U.S. economy grows, it’s only natural that consumers and businesses are going to increase their borrowing. Furthermore, commercial banks offset the cost of taking in deposits by lending.

Trouble arises when this steadily climbing metric heads decisively south.

Since data reporting began in January 1973, there have only been three instances where commercial bank credit has pulled back at least 2% from its all-time high:

- In October 2001, during the dot-com bubble, commercial bank credit slipped a maximum of 2.09%.

- In March 2010, shortly after the Great Recession, commercial bank credit troughed at a 6.94% decline.

- In November 2023, commercial bank credit hit a peak drop of 2.07%.”

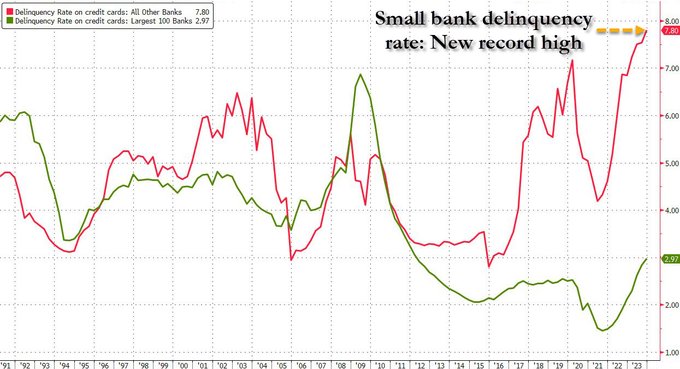

US Small Banks Overdue Loans – Highest on Record

Not only have US banks been lending less recently, the number of overdue loans they have are also hitting highs:

The delinquency rate among large banks hits 3%, the highest in 11 years.

The delinquency rate among small banks hits 7.80%, the highest on record.

Here’s a very specific piece of evidence of the trouble in the banking sector. This from the same bank we reported falling 38% in early February:

“BREAKING: New York Community Bank stock, $NYCB, crashes 20%+ after reporting “material weakness in internal controls.”The weakness is reportedly related to loan review resulting from ineffective oversight and risk assessment.

NYCB is the same bank that acquired the collapsed Signature Bank during the regional bank crisis.

This comes just weeks after the bank posted an unexpected $260 million loss in Q4 2023.

The stock is now at its lowest level since 1997.”

Source.

Note the bolding we added. This is the same bank that took over Signature Bank in last year’s banking crisis.

More Kiwi’s Also in Arrears on Their Mortgage

The percentages aren’t as high as even the Major US banks, but mortgage arrears in New Zealand are also the highest in 7 years.

The number of Kiwis with mortgage arrears has risen to its highest level since before the Covid-19 pandemic, new numbers show. In Centrix’s latest credit indicator report, the number of homeowners behind on their mortgage payments climbed to 1.47% in January, up from from 1.40% in December 2023.

Almost half a million people living in New Zealand are behind on paying their bills. Data for January this year from consumer credit company Centrix shows arrears hit a seven-year high.

Plus New Zealand businesses are also on the whole struggling:

Companies remain under pressure from high inflation, interest rates

Struggling businesses and households could be one of the reasons why we have seen more sales of gold and silver over the past year than ever before. These sales are one of the reasons why premiums on previous year gold coins, such as gold maples and gold kangaroos, are at the lowest we can remember.

Last week’s newsletter in hindsight now looks quite prescient. With gold breaking out to new all time highs in US dollar terms but also in many other currencies including the NZ dollar.

As last week we discussed how gold volatility has been at similar lows to previous times when the gold price rose significantly soon after. We didn’t necessarily think it was going to start just a few days later!

Despite these new all time highs there is still little interest in the yellow metal. From either the investing public or the media. And unlike previous all time highs we have the margins above spot price on various coins actually at the lowest we can remember.

To us this looks like a stealth bull market. Gold could easily run many hundreds of dollars higher from here. The fact that it so easily jumped to a new all time high says a lot. In the past we might have seen it bump up against it a few times first.

As noted in today’s charts, gold is now overbought, so a pullback won’t be a surprise. But if it happens, this may be the last chance to buy gold below NZ$3500 and US$2100.

We’ll also be watching silver closely and we’d expect it should start to play catch up with gold before too long as well.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Shop the Range…

—–

This Weeks Articles:

What Good is a Bar of Gold If the Shelves Are Empty in 2024?

Mon, 4 Mar 2024 12:16 PM NZST

Demand for Larger Volumes of Emergency Food Increasing Back in January 2020 our sister website – Emergency Food NZ – saw a huge increase in sales of long life freeze dried emergency food. In hindsight, it seems a small group of people started to become concerned about the potential for the Corona Virus reaching these […]

The post What Good is a Bar of Gold If the Shelves Are Empty in 2024? appeared first on Gold Survival Guide.

Read More…

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

Tube of 25: 1229.00 (pick up price – dispatched in 3 weeks)

Box of 500 coins (dispatched in 4 weeks):

2024 coins: $22,918.22

Backdated coins: $22,671.40

Including shipping/insurance (4 weeks delivery)

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info

We look forward to hearing from you soon. Have a golden week!

David (and Glenn)

GoldSurvivalGuide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Copyright © 2022 Gold Survival Guide.

All Rights Reserved.