Prices and Charts

The Correction is Here

The long awaited correction in precious metals has finally arrived.

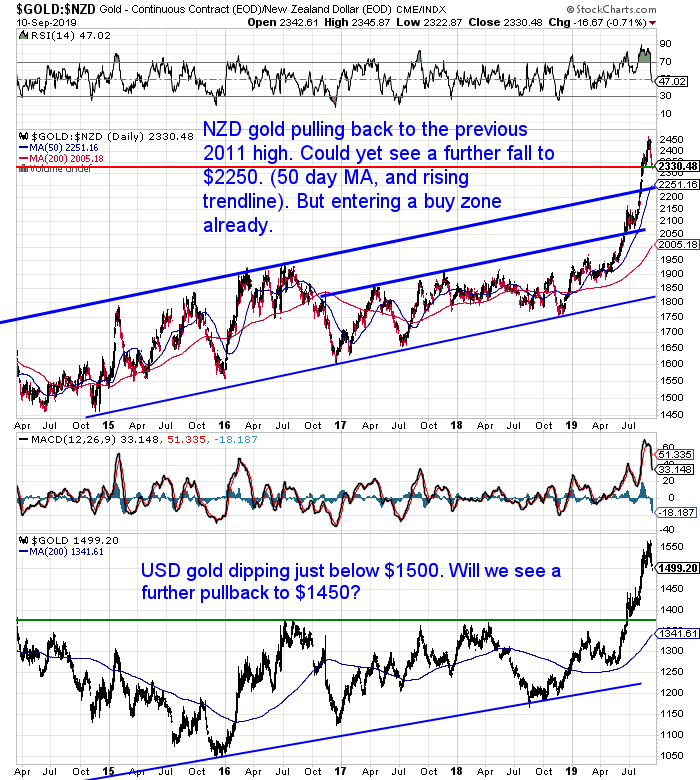

NZD gold is down 5% on a week ago. Today the price is hovering near the old all time high above $2300.

The big question now is how low will it go?

We could see the price dip lower to $2250. This is where the 50 day moving average and the rising trendline coincide.

But the RSI overbought/oversold indicator has now moved right back down below 50 to neutral territory. So there are no guarantees the price will fall much lower. We could instead see a period of consolidation around these levels.

More on that in this weeks feature article below…

Silver Fell Harder Than Gold

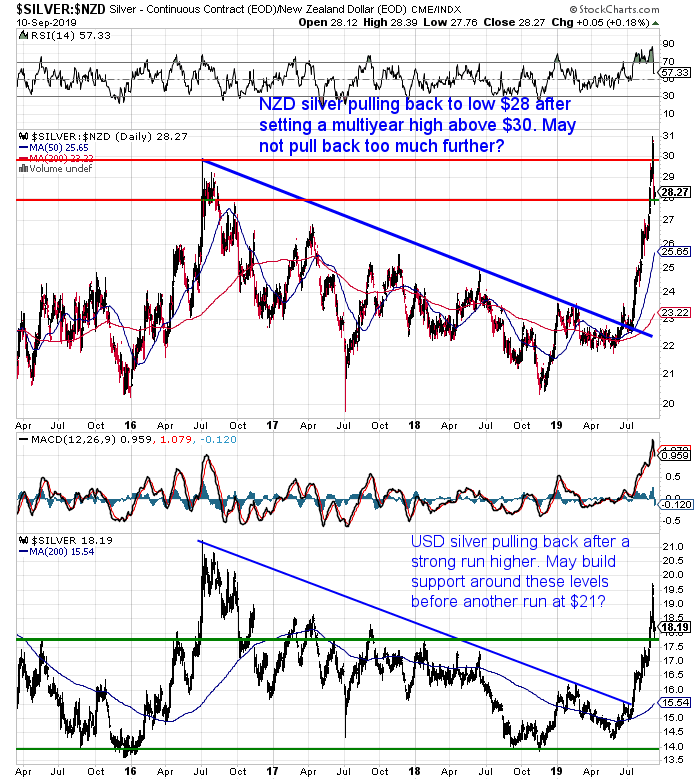

Meanwhile NZD silver is down almost 8% since last week! Perhaps not a big surprise after rising so quickly in August.

Silver too is taunting us with the same question now. Will it drop any further?

Silver appears to be trying to get a toe hold around the $28 level. It too is down into neutral territory already on the RSI.

It really is anyone’s guess where to from here. But we offer a word of caution to be careful about trying to pick the bottom of this correction.

It is a common mistake to get stuck on the sidelines wondering if the metals will go any lower.

NZ Dollar Bounced as Expected

This week we’ve also had the NZ dollar strengthening. Continuing the recent unusual trend of moving at odds with the gold and silver price.

The simultaneously falling dollar had amplified the recent gains in gold and silver. But this week the rising Kiwi has amplified the losses.

However it looks to us as though the NZ Dollar might struggle to get too much higher from here.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

The Anatomy of a (New) Gold Bull Market: Prices Rises. Sharp Correction. Bigger Rise to Come?

This week we dig into this new bull market in precious metals.

We look at:

- Why This Correction May Only be a Brief One

- How Most Have Yet to Accept That a New Precious Metals Bull Market is Underway

- How Very Few Are “Buying the Dip” and What This Means

- Why the Next Wave Up Could Be Even Bigger

- What Could Drive the Gold Bull Market Even Higher?

- What to Do if You’re Sitting and Waiting to Buy?

Should I Buy Gold or Silver in 2019? 7 Factors to Consider in Gold vs Silver

This is perhaps one of the most commonly asked questions we get: “Should I buy gold or silver?”

Of course in the end it comes down to personal preference what you do. However, here are 7 things we think you should take into consideration when making your decision:

- Crisis Hedge

- Volatility

- Affordability

- Mark Ups or Margins Over Spot Price

- Storage

- Ability to be Borrowed Against

- Potential Upside

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Do you need any further queries answered?

Give us a call. Or book a time online that suits you for a free bullion consultation.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Gold Prices Moving in Tandem with Negative Yielding Debt - Gold Survival Guide