Prices and Charts

Bank Failure and Bailouts Boost NZD Gold by 3%

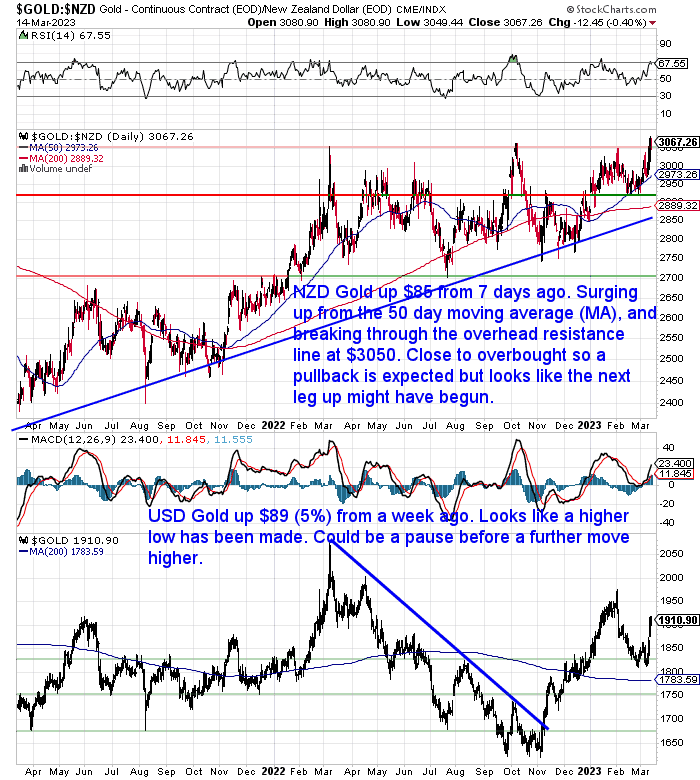

The unmissable news this week was of course the bank failure and subsequent bailout of Silicon Valley and Signature Banks (more on that below). This resulted in a boost to gold prices. Gold in New Zealand dollars was up $85 or almost 3% from a week ago. It surged up off the 50 day moving average and then went on to break through the overhead resistance at $3050. That was a level that had been tested, but not bettered, 3 times since early 2022. So this is likely a significant breakthrough. NZD gold did edge up into overbought territory on the RSI (above 70). So we could see a pullback before too long. Likely down to test the $3050 level. But the odds now favour the next leg up having begun.

Gold in USD jumped 5% from a week ago, getting back above US$1900. It looks like a higher low has been made. Could be a bit of a pause around here before a further run higher. But we will likely see a move back to test the February high at $1975 before too long.

NZD Silver Surges 6%

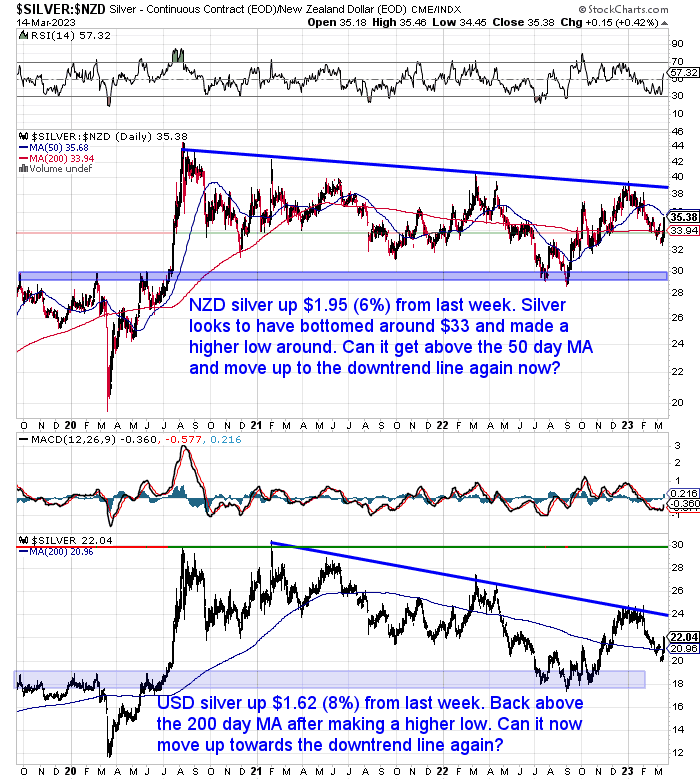

Silver in NZ dollars jumped by twice the amount gold did. Up nearly 6% or $1.95 from last week’s lows. It appears silver has bottomed around the $33 area. Now can it get above the 50 day MA at $35.68 and then move up towards the downtrend line again? That line and then above it $40 are still the key areas we need to see bettered to say that silver has resumed its run higher.

Silver in USD jumped 8% from 7 days ago. Getting back above the 200 day moving average after making what now looks like a higher low at $20. Can USD silver now also move back up to the downtrend line? We need to see that clearly better and then US$30 after that to see a new up leg in play.

NZ Dollar Jumps 2%

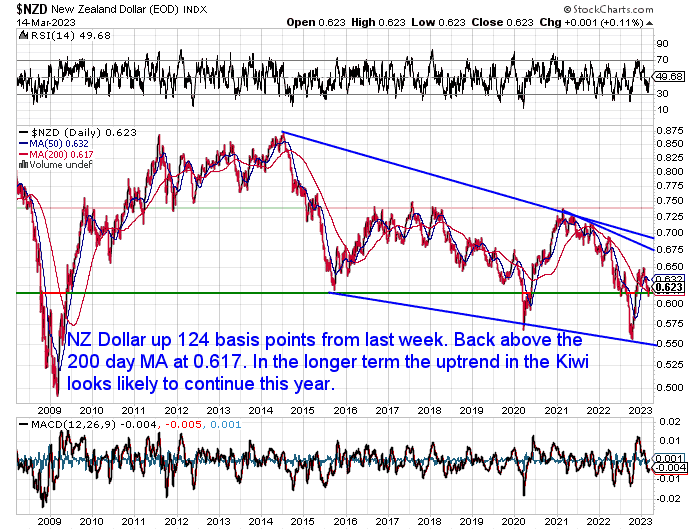

The NZ Dollar was up 124 basis points (2%) from last week. It got back above the 200 day moving average after initially taking a dip when the bank failure was announced. In the longer run we’d still expect the Kiwi to gain against the USD. However the counter to this is if we see further bank failures and a full blown crisis, the USD is likely to, somewhat counter-intuitively, strengthen as more currency moves into the perceived safety of dollars rather than other investments.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Bank Failure – Could it Happen in NZ? What does the SVB Bank Failure Mean for NZ?

Given the big news of the week we thought we should look at the impact of a bank failure in New Zealand.

[As a side note for a full and very easy to understand of the whole SVB situation see this video with Jim Rickards).

Most people don’t realise that currently there are no government guarantees or deposit insurance for NZ bank deposits. We have been highlighting this point for many years.

But we were very surprised to see this feature on TV One’s Monday morning news show:

“A banking expert says Kiwis’ deposits would not currently be protected if a New Zealand bank was to collapse after a $300 billion American bank closed. The collapse is the largest bank failure since the Global Financial Crisis in 2008 and comes after a rush of withdrawals from Silicon Valley Bank in California.”

Source.

Are NZ’s Australian Owned Banks At Risk?

Of course the thinking is that Australian and New Zealand banks should not be at any risk.

As this Herald article puts it:

“… these swift actions [of the US treasury and central bank] helped to stave off a contagion effect that could have seen these concerns spread to other banks.

This in turn meant that companies like Rocket Lab with large deposits would still be able to access their funds despite the problems.

As things stand, …analysts do not expect this to have an impact on the big Australian-owned banks operating here, given that their investments are quite different.”

Source.

This is true that the investments are quite different. SVB had invested heavily in long term US treasury bonds. Meaning they expected interest rates to remain low in the long run. (Bond prices go up when interest rates fall). Of course the opposite of this happened. Then SVB had to sell bonds at a loss when their tech start up companies ran into funding troubles and needed some cash themselves.

That is where SVB ran into trouble and when word spread the bank runs started.

Effectively they were doing the opposite of what many banks do. In that they were investing long to borrow short. They held long term bonds but had huge customer deposits on call.

Most banks including those here have the opposite problem. They borrow short to lend long. So they borrow in shorter time frames to lend to people on longer term mortgages. This is the very problem with modern day banking and is known as duration mismatch.

This is where you extend credit beyond the duration for which it was intended that the problems occur.

Where customers demand deposits are lent out over the long term. So when they “demand” them back they are not available. Whereas a “term” deposit you are agreeing to lend the bank your currency for an agreed timeframe that you won’t need it.

For more on this please see the full explanation here:

Why Fractional Reserve Banking is Not the Problem

So the (rather long winded!) point we are making is that this duration mismatch means any lack of confidence that spreads from bank to bank, means no modern bank will have sufficient funds on call to match the demand if many customers decide to withdraw all at once.

Therefore regardless of whether NZ and Aussie Banks have different investment strategies, if contagion occurs, all banks will be at risk.

So check out this week’s feature article for the full lowdown on what happens when a bank fails in New Zealand, including:

- Could a Bank Failure Occur Here in New Zealand?

- Bank Failures in New Zealand Would be Managed via RBNZ “Open Bank Resolution”

- What is the OBR?

- Aren’t NZ Bank Deposits Government Guaranteed?

- Don’t Leave All Your Eggs in One Basket

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

What Will the Longer Term Impacts of SVB and Signature Bank Bailouts Be?

As we explain in this week’s feature article the US treasury and Fed have bailed out all depositors in these 2 banks. The shareholders have lost out but customers have not. In the long run all holders of US dollars will pay for this via devaluation. But for now anyway they have averted a contagion that could have been systemic and catastrophic for the financial system. The fact they had to do this shows how fragile the system is. But the impacts continue to be felt.

As ASB reported today:

“Financial markets across the Asia-Pacific had a mini-meltdown yesterday as the reverberations from Silicon Valley National Bank’s failure continued. Taking cues from falls in Treasury yields the night before, the NZ 2-year government bond eased 20bps to 4.63% and the 10-year fell 10bps to 4.24%. The NZ 2-year swap fell 27bps to 5.04% and the 10-year swap slid 12bps to 4.36%. Similar moves took place across the pond in Aussie. A dramatic shift in market pricing for future rate hikes was the key driver as markets moved to price just 18bps of OCR hikes in April and a peak of just 5.16%. SVNB’s failure has triggered speculation central banks may have to scale back their monetary tightening plans lest they trigger some unfortunate unintended consequences in financial markets.”

So the very difficult and likely impossible situation that central banks find themselves in is this:

Inflation remains stubbornly high (which their past actions have caused). Central Banks want to raise rates with the view being this will stamp out inflation. (It’s likely not as simple as that after all the extra currency they have created over the years. So they also need to reduce the currency supply which they have been trying to do as well and which likely triggered the current issues). But the increase in interest rates has caused issues for some smaller banks (and who knows how many others?).

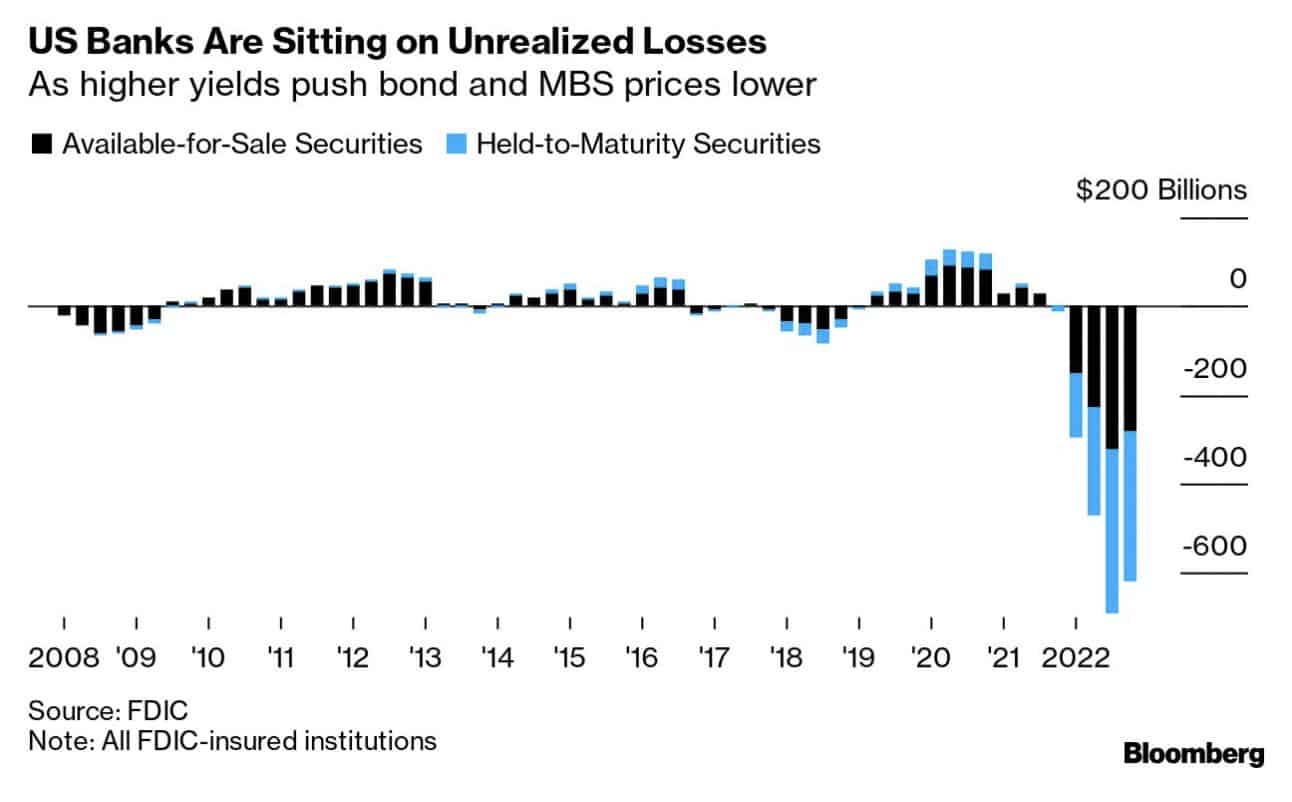

Actually this chart shows it may be many others:

“This chart reveals why Fed, US Treasury & FDIC now bailing out the whole US banking system. US banks are sitting on bond losses of $600bn. These are still book losses in HTM [Hold To Maturity] accounts, but if customers had withdrawn their money & banks had to sell, there could have been contagion.”

Source.

So can central banks continue to increase interest rates without creating bigger issues?

If they stop and then inflation stays high or even increases that is a whole other set of problems.

But our guess is that is the path they will prefer to travel rather than a systemic collapse.

Here’s another question for central banks to ponder…

If the Fed and other central banks “pivot” and start to cut interest rates that will affect short term interest rates. But, will long term rates actually come down? Will bond holders be prepared to lend for 10, 20 or 30 years at lower interest rates if inflation stays high or gets even higher?

Rock, meet hard place.

Speaking of rocks, we think some rocks of yellow and greyish colour are likely to be very valuable to hold in the coming years. Have you got enough?

Get a quote on gold or silver products:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|