| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

|

1 oz RCM Silver Maple Coin

Tube of 25: 1474.25 (pick up price – dispatched in 3 weeks) Box of 500 coins (dispatched in 4 weeks): |

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

| We look forward to hearing from you soon. Have a golden week! David (and Glenn) GoldSurvivalGuide.co.nz Ph: 0800 888 465 From outside NZ: +64 9 281 3898 email: orders@goldsurvivalguide.co.nz |

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

|

Copyright © 2022 Gold Survival Guide. |

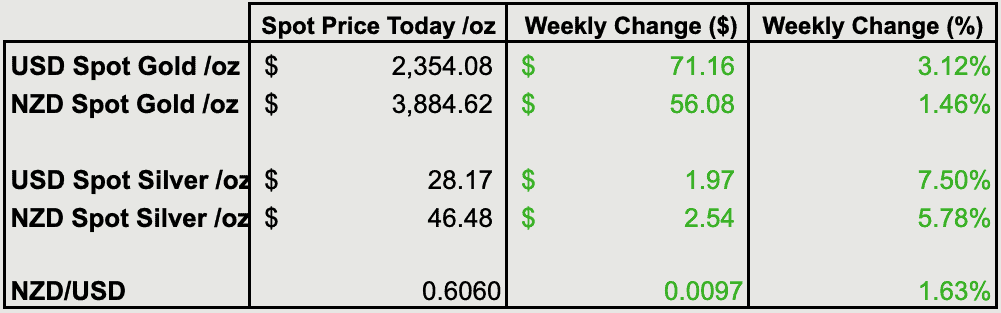

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $3717 |

| Buying Back 1kg NZ Silver 999 Purity | $1385 |

More All Time Highs for Gold in NZD and USD

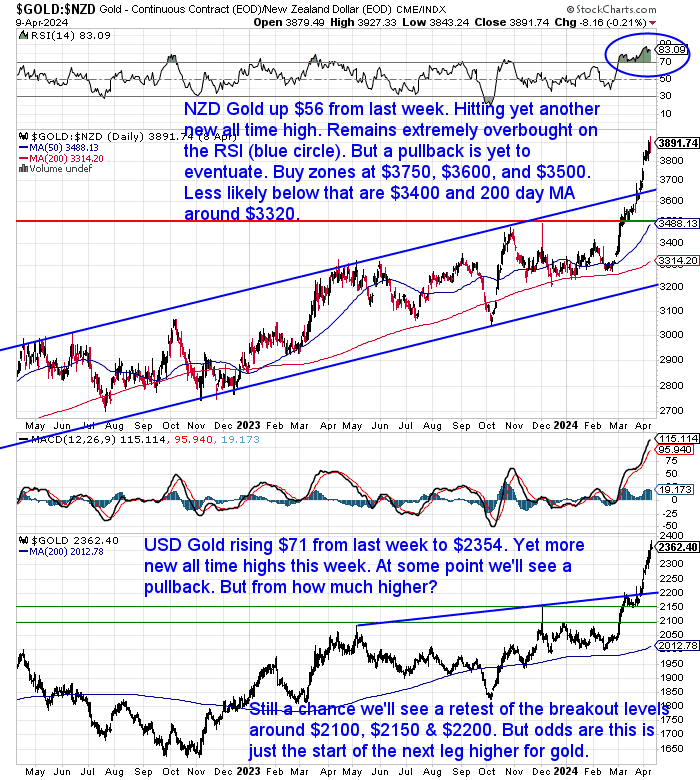

Yet another week with our precious metals table all in the green. Even a sharply stronger NZ dollar couldn’t dampen the rise in NZ dollar gold. It was up $56 hitting all time highs again this week. Sitting just under $3900. Suddenly it is within spitting distance of $4000!

Likewise in US dollars, gold also hit more new all time highs. Up $71, busting through $2300 to now be at $2354.

So a pullback is yet to eventuate. It will come but from how much higher is anybody’s guess. Hard to know how many of the marks in our buy zones could actually be hit when the pullback eventuates.

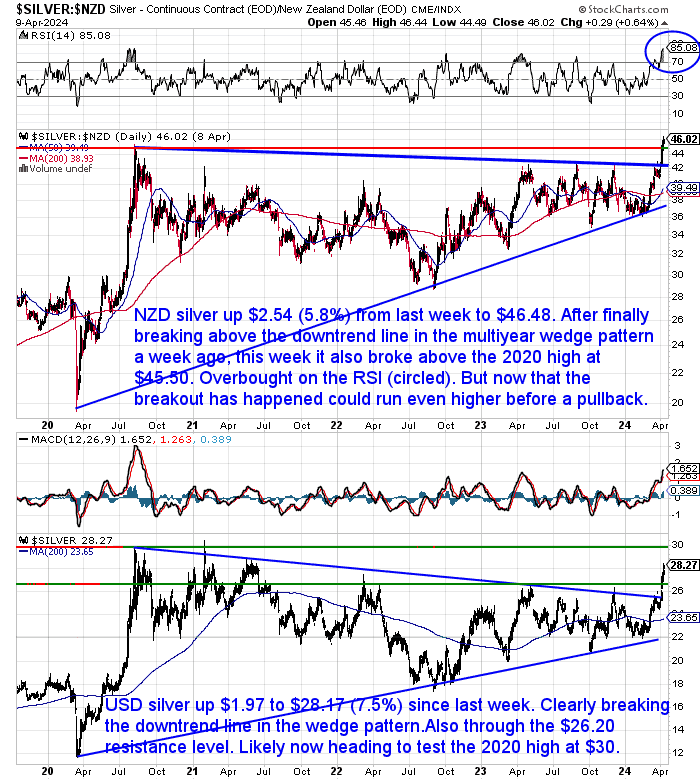

Silver Playing Some Catch Up to Gold

Silver strongly outperformed gold this week. In NZ dollars silver was up a hefty $2.54 (5.8%) from 7 days prior. Of significance this week was that the 2020 high at $45.50 has also been broken above. So now that the multi-year consolidation is over, even higher prices are now likely.

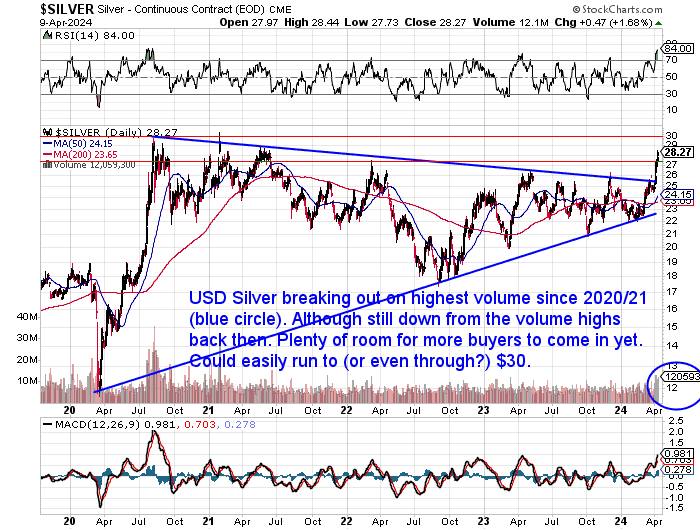

USD silver did even better. Up $1.97 (7.5%) to get above not only the resistance level at $26.20 but also now $28. It’s likely we’ll see $30 tested now.

This week’s feature article is all about the silver breakout vs fakeout debate. We have longer term silver charts in there so be sure to click through to that.

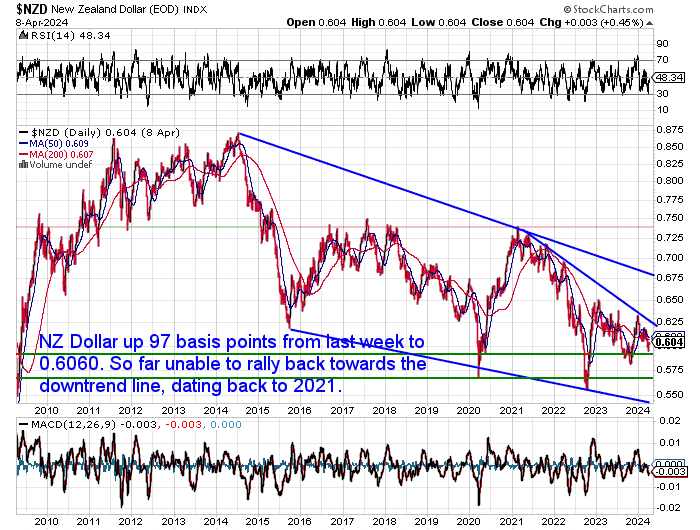

The New Zealand dollar was up 97 basis points from a week ago. Getting back above 0.6000 again. But the chart shows it is still clearly in a downtrend versus the US dollar. Holding gold and silver continues to give great protection against that weakening.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Silver on the Move: Breakout or False Start? What Investors Need to Know

Silver prices have been on a tear lately, but is this a genuine breakout or a temporary blip? This week’s feature article takes a look behind the recent silver surge, exploring:

- Whether historical trends suggest this rally has legs or is a “fakeout”

- If the consolidation phase is over and if a new bull market in silver is just starting

- Possible price levels and targets to look for in silver in both USD and NZD

Curious if the silver rally signals a long-term price increase or a short-term blip? This article provides valuable insights to help you navigate the current silver market and make informed decisions, regardless of whether you’re a seasoned stacker or just starting to explore precious metals.

P.S. Curious if silver is poised to follow in gold’s footsteps? Read the full article to find out!

Silver Breakout or Silver Fakeout? – Where to Next for Silver in 2024?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Tavi Costa: Silver Best Looking Chart in my Career

Crescat Capital macro strategist Tavi Costa shared a silver chart this week. The difference compared to our chart of daily prices above, is that his chart plots quarterly closing prices. So it is a big picture view. It clearly shows a breakout of which Tavi says:

“This is undoubtedly the best-looking chart I’ve seen in my career.

One of the most important macro developments unfolding as of late.

If you ask me, the silver rush is just getting started.”

“Meanwhile:

India just reported record monthly imports of silver.”

They were actually up by 260% in February to a record high. While India’s gold imports took a pause. Indians have an affinity for gold and silver, along with a knack for buying what is cheap. We’d agreed that silver is the better deal right now. Only just starting to run and with a long way to go just to get back to all time highs.

Another Indicator of the Start of the Silver Rush

Tavi believes the silver rush is just getting started. Another indicator of this is that volume in the silver futures market has jumped noticeably this past week. See the blue circle in the chart below. (It’s in USD dollars as there is no NZD silver futures market to show volume in that specifically). This is another indicator that likely confirms the breakout is for real:

Why is Gold Rising? 4 Possible Reasons…

Most people haven’t noticed that gold has risen to all time highs in just about every currency. While those that have are likely a bit mystified as to why this has happened.

So today we’ll delve into a few theories we’ve come across lately as to what is causing the rise in gold.

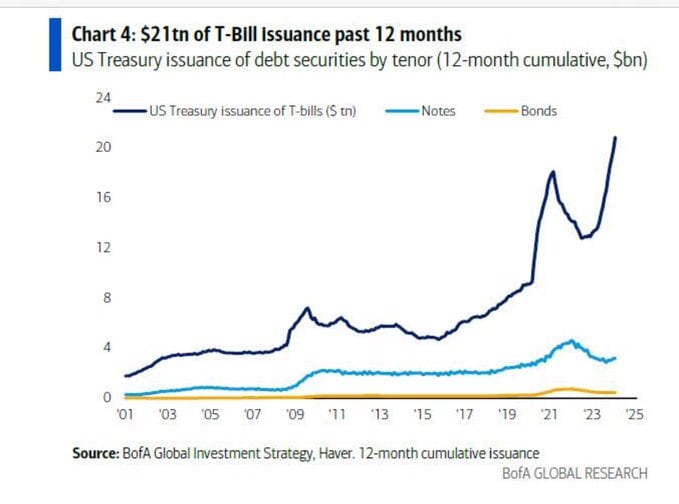

Possible Reason 1: The Federal Reserve and other Central Banks need to cut interest rates to support high government borrowings. The rise in gold is an early warning of this

“Issuing more t-bills at an accelerating pace is a precondition to becoming a banana republic. This is the type of thing you see emerging markets do, not the issuer of the world’s reserve currency and neutral reserve asset.

If you believe that the Fed’s primary goal is smooth market functioning for the UST market rather than their dual mandate of maximum employment and price stability, you can begin to understand why Powell is so keen on starting a rate cutting cycle soon despite the fact that the data we are seeing suggests current monetary policy is not restrictive enough to return inflation to 2%.

In a fiscal dominance regime, the central bank is forced to lower rates to help fund the government deficits. Given the dysfunction in DC where both tax increases and spending cuts are off the table as the CBO projects 5-7% deficits for the next couple decades, the only real lever to pull is to lower interest rates on government borrowings as the government continues to shifts borrowings to the front end.

It seems like Gold is already starting to snif out this dynamic as a cutting of interest rates to support government borrowings will lead to currency weakness and higher inflation over time.”

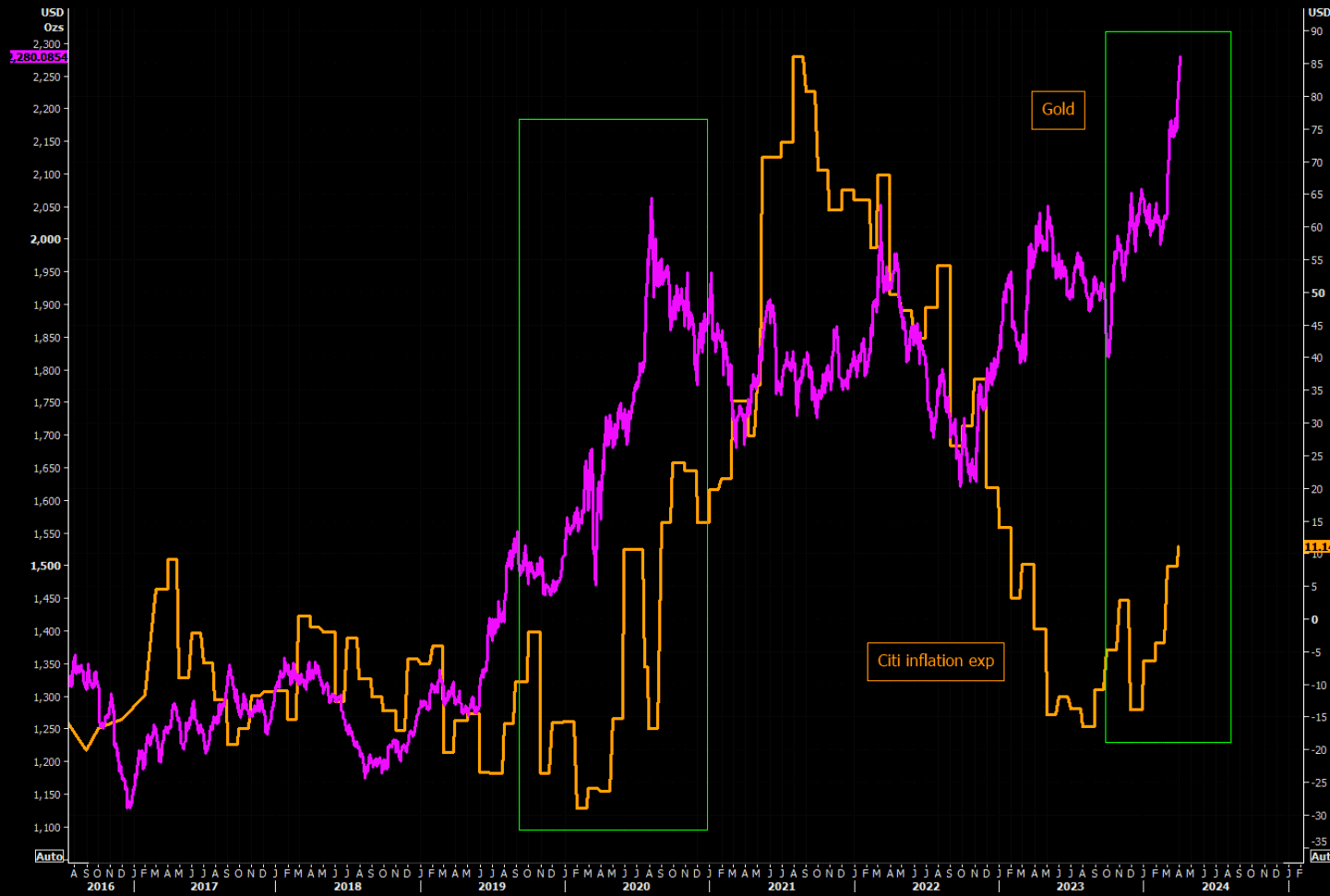

Possible Reason 2: Gold is sniffing the possibility of another wave of inflation

Since 2022 we’ve been talking about the chance of multiple waves of inflation to come over the next number of years. The chart below shows inflation expectations have been rising since late last year. So gold may be wondering if the next wave is on the horizon…

“The biggest scare story of them all

Inflation of course – the one that moves in mysterious waves. What if the move in Gold really (partly…) was about smelling inflation…?”

Possible Reason 3: Gold is warning of “US full blown debt monetisation” i.e. printing currency to pay off the nation’s debts

“Jared Dillian of the Daily Dirtnap produced a valuable X thread on gold yesterday. In it, he posited that the US will begin full-blown debt monetization this year and throughout the entire term of the next POTUS.

The way Dillian discusses ‘full-blow monetization’ he is implying that the Federal Reserve will begin to purchase US Treasuries in order to help the Treasury control the yield-curve, yield-curve control (YCC). Due to the fact that the Fed can create new money with a keystroke this would in turn serve to increase the money supply. In theory, it would also increase inflation and cause all sorts of tangential knock-on effects throughout the economy and financial markets.

Higher Treasury yields are an increasingly large problem for the US Treasury as it is constantly refinancing its $34 trillion debt pool. Dillian believes that higher interest rates are now bullish for gold because it increases the probability that we will reach a full-blow debt monetization scenario.

Dillian’s analysis rings true.”

Specifically Dillian said:

“You’re probably noticed that rates and gold are now positively correlated. Why?

Because when interest rates go higher, it actually increases the probability of monetization.

In a normal environment, high rates are bad for gold because gold yields nothing in comparison. Now, high rates are actually good for gold. Few understand this.

Gold responds to a number of different economic variables, but the one that it has the highest correlation to is budget deficits. When deficits are large (like 2009-2011), gold goes up. When deficits are small (like 2011-2016), gold goes down.

The one thing we know about the 2024 election is that no matter who gets elected, the deficit is likely to get even larger. Outside of some big disinflationary impulse, we are likely to get much higher rates.

And if we get a war–Katy bar the door.

…I have always thought debt monetization was possible since we started QE in 2008. And it’s worth talking about QE. How is QE different from monetization?

With QE, you set aside a finite amount of money to buy bonds. With monetization, you set aside an infinite amount.

We’ve been inching closer to this for the last 16 years. Things always take longer than you think in finance, but I wouldn’t be surprised if we’re doing full-blown monetization in 2024-2028. That is the endgame. /fin”

Possible Reason 4: Gold and bond yields are rising as foreign (mainly asian) wealth Funds Are Buying Gold to Escape the Dollar

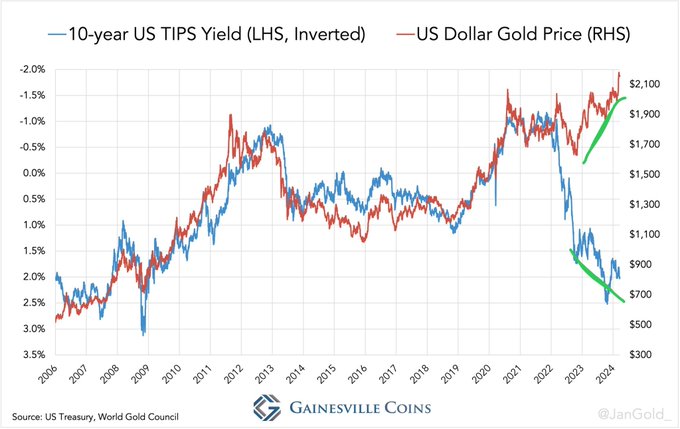

As Jared Dillian pointed out above, gold is rising with real (i.e. after inflation) interest rates. Something that gold usually does when real interest rates fall. This is shown in the chart below:

“Gold is going up together with real yields (inverted axis in the chart). Who would have thought?!!”

“Why are gold and bond yields rising together?

The answer can only be that the big, mainly Asian wealth funds look at the US Government’s finances and see deep trouble. The only way the US Government can satisfy its voracious appetite for debt is at higher interest rates and bond yields. And if interest rates go higher, they will crash financial markets, bring about commercial property and corporate insolvencies, and threaten the entire banking system. In short, foreigners are desperate to reduce their exposure to dollar credit as much as possible and the only way to do that is to buy real money without counterparty risk, which is gold.

To confuse traders, there is liquidity in smaller gold transactions. You can still buy kilo bars and coin. But if, for example, on the London market you are committed to deliver 400-ounce bars in quantity by next Tuesday, they are simply not available. I guess that’s where the problem lies.

If this squeeze on one or more bullion banks eases, then the price should too. But the problem will not be resolved: the evidence is that foreigners are increasingly turning their backs on the fiat dollar and the entire credit system.”

What Do We Think is Causing Gold to Rise?

We always find it interesting when analysts say gold went up today because of [enter financial market happening]. Why? Because who can say? The only definitely known reason gold went up is because more people bought than sold. As to their individual reasons? Who knows? It’s likely that everyone who was going to sell has, therefore it doesn’t take many buyers to push the price higher. As a higher price is needed to encourage the remaining holders to sell.

So by our reckoning it could be that all the above reasons are correct!

They’re likely all interconnected too. You see, foreign (mainly Asian) wealth funds could be buying gold to “reduce their exposure to dollar credit as much as possible” (Reason 4) . But also because they are worried about the need for the Fed to cut interest rates to support high government borrowings (Reason 1), along with the possibility of debt monetization in the next few years (Reason 3), and therefore higher inflation down the track (Reason 2).

In short, gold is rising because of all these clear future risks.

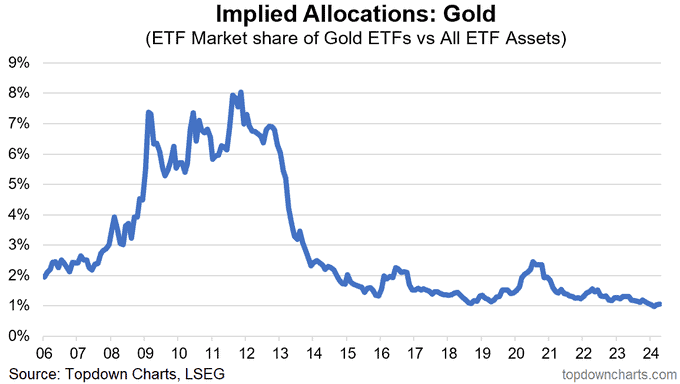

The Rally in Gold is *Not* (Yet) a Retail Thing

But as Alistair Macleod pointed out above, the rally in gold (and silver) is not happening at a retail level. With plenty of coins and bars available. The below chart is further evidence of this. With Gold ETF holdings versus all other ETF’s pretty much at 20 year lows.

“The rally in Gold is *not* (yet) a retail thing

Retail implied allocations to gold (via ETFs) are still at the bottom of the range, barely moved [despite gold breaking out to new all-time highs, and beating stocks YTD, up more than 10%]”

There’s some other very interesting charts in the same tweet, worth clicking through to.

So if you’re waiting for a pullback in gold or silver, it’s very hard to say when it’s going to arrive. For sure there will be one at some point. But there are still a lot of potential buyers to come out of the woodwork yet. Plus with a possible short squeeze in play a pullback could come from even higher levels yet.

We think in the long run it won’t matter too much as any pullback will just be a dip in what looks like the start of a significant and lengthy move higher in precious metals.

Bottom line. Don’t be too clever in trimming to time an entry after a breakout.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Shop the Range…

—–

|

|||||||||||||||||||||||

|