Prices and Charts

Stronger NZ Dollar Pushes NZD Gold down Nearly 3%

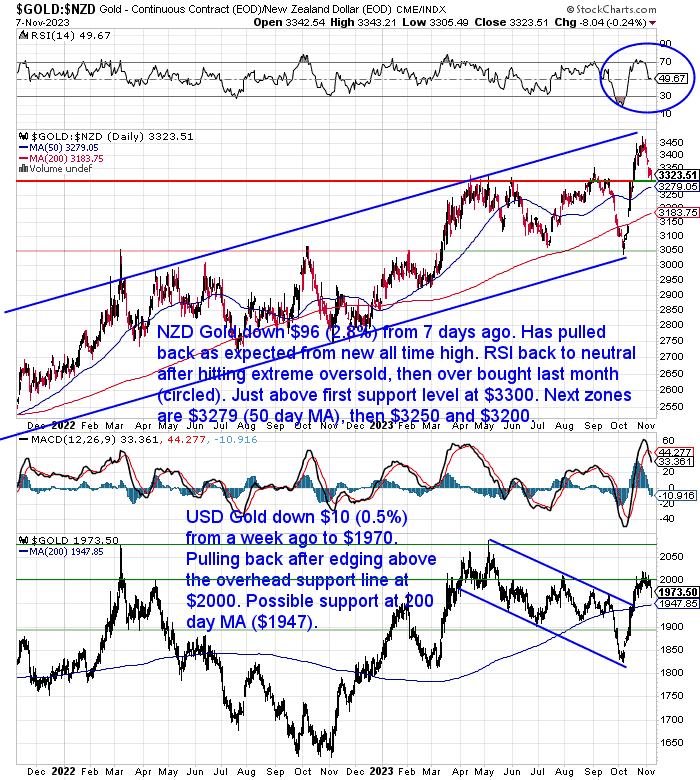

The whipsaw action in NZ gold continued this past week. With NZD gold down $96 (-2.8%). So we have seen it get extremely oversold around $3050, before shooting to a new all time high and overbought. Now it is back down to neutral on the RSI (circled). Most of this fall has come from a sharply stronger NZ dollar. The next support levels and buy zones to watch for are, $3300, the 50 day MA at $3279, then $3250 and $3200.

While gold in US dollars was down just $10 or 0.5% from 7 days ago. After edging briefly above $2000 USD gold has dipped lower. Possible support at the 200 day MA at $1947. Or it could retest the breakout from the downward trend channel.

NZD Silver Also Down Close to 3%

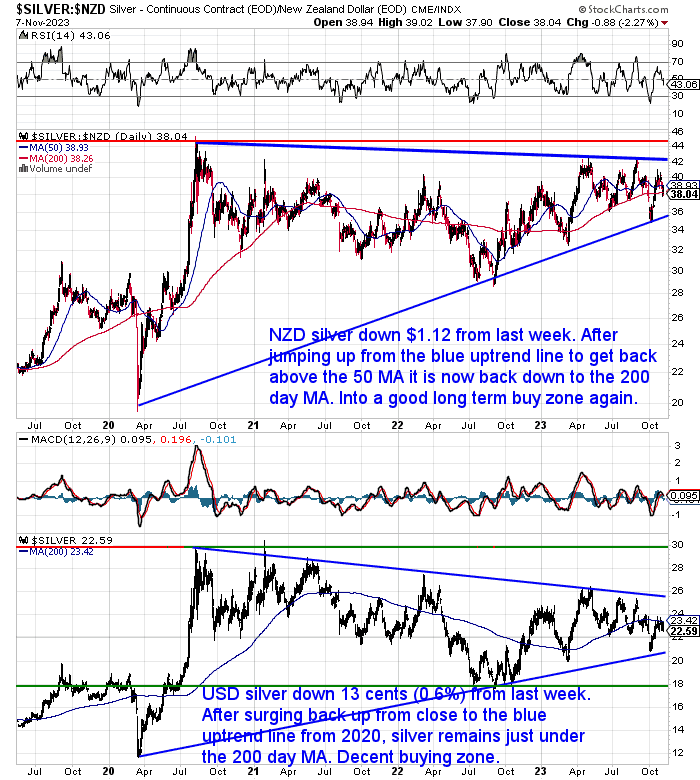

Silver in New Zealand dollars was down pretty much the same in percentage terms as NZD gold. Or $1.12. Again mostly due to the much stronger Kiwi dollar. After surging up from the blue uptrend line and getting back above the 50 day MA, NZD silver is now back close to the 200 day MA. So into a good long term buying zone. Anywhere between here and the blue uptrend line should be great buying.

The USD silver chart looks quite similar, although this week it was only down 13 cents. It sits just below the 200 day MA. So still in a decent buying zone.

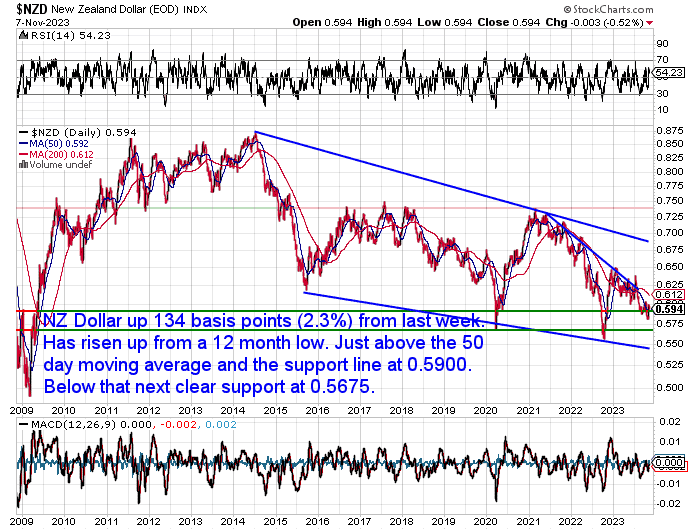

NZ Dollar Surges 2.3%

As noted already the Kiwi dollars strength was the key driving in the lower NZ Dollar precious metals prices this past week. Jumping 134 basis points (2.3%) from 7 days ago. After hitting a 12 month low it wouldn’t be a surprise to see some further gains in the Kiwi. Maybe right back up to the 200 day MA at 0.6120?

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

What Price Could Silver Reach?

In our recent Q&A call (see the replay here), there were a few requests for projections of future prices. So this week we have a go at silver price projections…

Silver is one of the most undervalued assets in the world today. But how high could the silver price go in the future?

In this week’s feature article, we explore several methods to estimate the potential value of silver in the coming years, based on historical trends, ratios, and projections. We look at how the gold to silver ratio, the inflation adjusted silver price, and the Dow to silver ratio can help us determine the fair price of silver in different scenarios. Read on to find out why silver potentially has a lot of upside and how to calculate its future value.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Will Silver Repeat Mid 70’s and Mid 00’s Break Out?

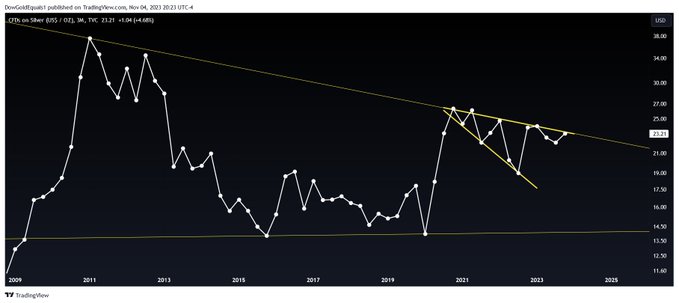

Sticking to silver, some technical analysts think that this current flag formation is looking very bullish. As it looks similar to 2 previous break outs…

“$Silver is flagging along the midline of its historic channel, something it has done before with impulsively bullish resolutions.”

Source.

Here’s a zoom in showing the silver price bumping along this downtrend line.

“$Silver is going to melt faces when this bull flag breaks out. Expect new ATH.”

Source.

Melting faces sounds a bit over the top! But new all time highs (ATH) means the price would have to more than double from here.

NZ Bank Depositor Compensation Scheme Not Before Late 2024

The Deposit Takers Act was passed in July which includes $100,000 compensation for bank deposits in case of a bank failure.

Full details of that here: New Zealand Bank Deposit Protection Scheme – Does N. Z. Have Bank Deposit Insurance in 2023?

However the latest details show that it will be some time before a New Zealand Bank Depositor Compensation Scheme [DCS] is actually in place. The official timeline says late 2024.

But as this article shows there is a lot of work to be done before then:

Reserve Bank to prepare and maintain a plan for dealing with every deposit taker in case it fails.

This week’s bi-annual Reserve Bank Financial Stability Report (FRS) highlights just what a slow burner the Deposit Takers Act (DTA) will be.

[The RBNZ is] required to prepare and maintain a resolution plan for each deposit taker and publish a Statement of Resolution Approach (SoRA). The SoRA will set out our expected strategies for dealing with failing deposit takers, and our intended approach to cooperating and engaging with relevant agencies, both domestically and internationally,” the Reserve Bank says.

Source.

So the conclusion in our above article remains the same regardless of when the deposit compensation scheme is in place…

“So would the implementation of a deposit protection scheme mean you simply don’t have to worry about the financial soundness of your bank?

No. As we’ve said before, if there was a problem with one bank in New Zealand, there would likely be problems with many of them. The small number of banks in New Zealand means the risk of contagion is very high.

So a failure of one could soon turn into a failure of many. Result? The government would likely have to bail out many banks by way of a loan to the bank deposit scheme fund. On top of this, depositors holding more than $100,000 with a bank would be “bailed in” via the OBR.

A government bailout would likely still be funded by the individual. Just indirectly – through higher taxes, higher inflation etc.

With inflation rates currently higher than bank deposit rates (and likely to stay that way for some time in our opinion), this could lead many people to question the benefit of leaving large amounts on deposit with a bank.

Why take the risk of leaving money in the bank for virtually no return? Or when inflation is taken into account, possibly a negative return. A.K.A. – A loss.

We think more and more people are likely to seriously consider turning a good part of their savings into gold and silver instead.”

Source.

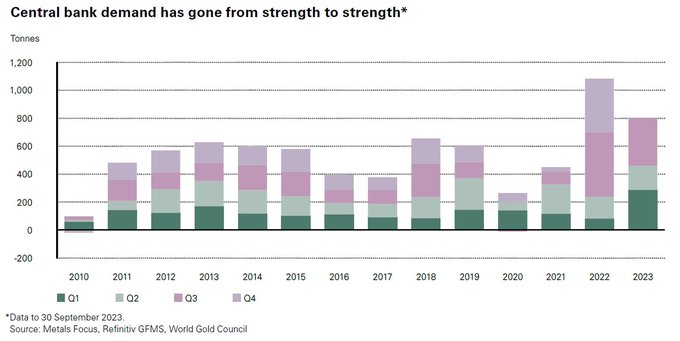

Central Bank Gold Buying Hits a New Year To Date Record

Latest data is out from the World Gold Council for central bank gold purchases. It shows no let up in demand, hitting a year to date record in Q3 2023:

“Central bank #gold demand saw no let-up in Q3: net buying hit 337t, +120% q/q. On a y-t-d basis, central banks demand totals an astonishing net 800t, 14% higher than the same period last year. Read more in our latest Gold Demand Trends report here.”

Source.

As this Bloomberg article alludes, it’s likely these central bank purchases that have kept gold prices up this year. Despite higher interest rates and weaker retail demand.

This is definitely a case of watching what they do and not what they say. Because record gold purchases indicate they must be expecting and preparing for something.

If you haven’t already, maybe you should be preparing too?

Please get in contact for a quote for gold or silver or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Shop the Range…

—–

|