Prices and Charts

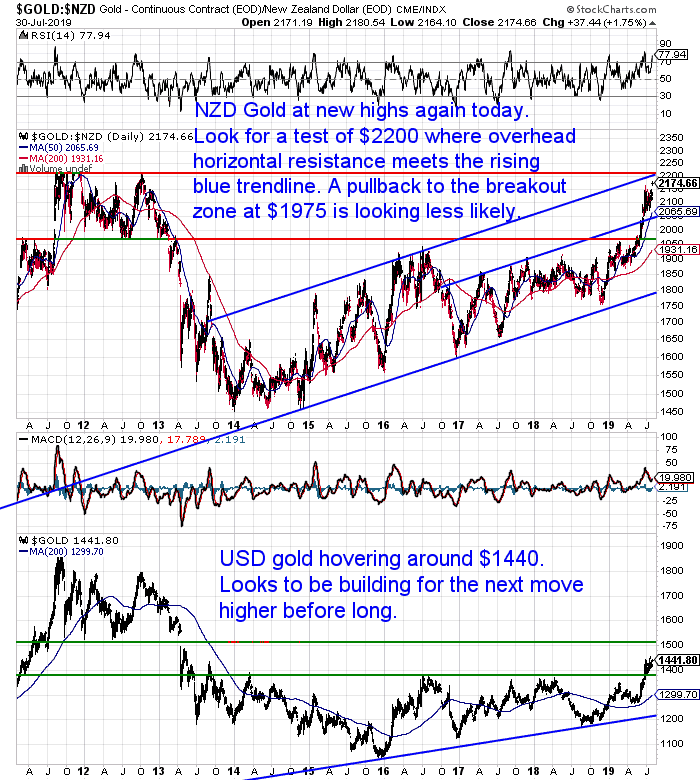

NZD Gold Moving Higher

Gold priced in New Zealand dollars has edged up to a new high today. Up over 2% since last week. Gold looks to be consolidating rather than correcting.

This is probably surprising many people (see this weeks feature article for more).

NZD may well be targeting the $2200 level now. This is where the overhead horizontal resistance line (red) and the multi year rising blue trend line coincide.

The odds of a return back to the break out level around $1975 appear to be diminishing.

It’s impossible to say what the price will do in the shorter term. However in the longer term we do look set up for much higher prices ahead. For more on this see: USD Gold Breakout – 6 Year High Above $1400 – What Happens Now?

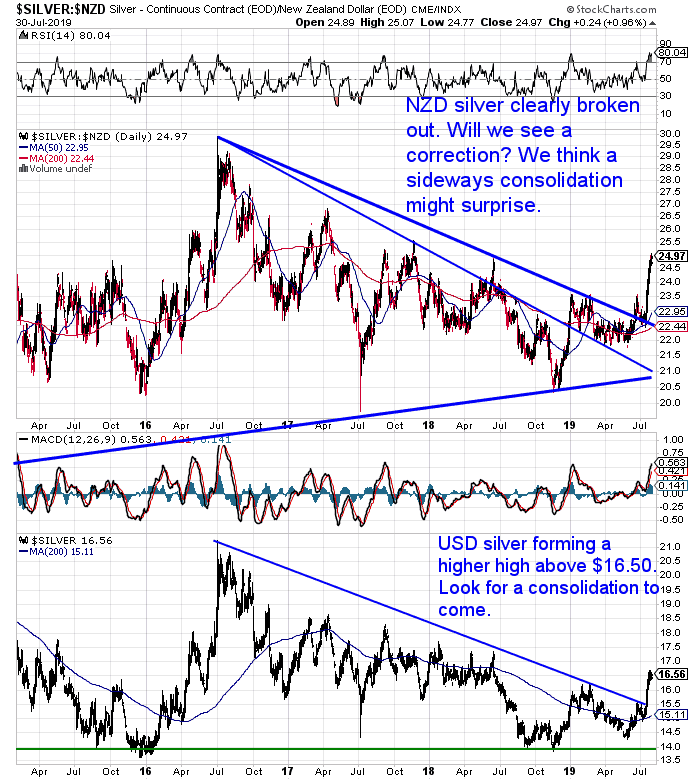

Silver is the Star This Week

NZD Silver also made a new high this morning. Edging above $25.00 for the first time since late 2017. Silver remains very overbought. But this can continue for a while. We will have to see either a correction or at least a consolidation before long.

Read on below for what our guess is…

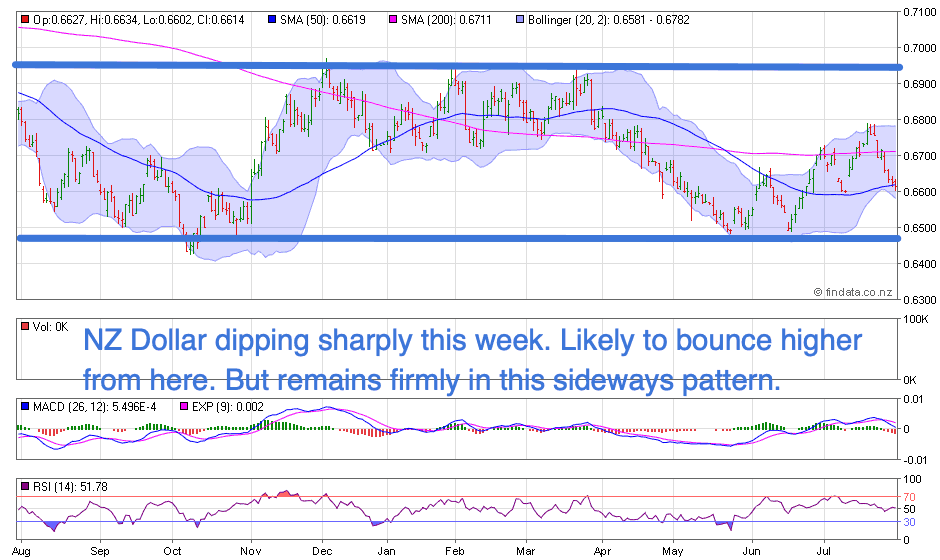

The New Zealand dollar is down sharply this week. This has helped boost local precious metal prices. With the price now sitting on the 50 day moving average, the odds point to a bounce higher from here.

Bigger picture. The Kiwi dollar is sitting firmly in a sideways trading pattern between 0.6500 and 0.6950.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

Why Gold and Silver Won’t Correct From Here: Two Contrarian Indicators

We get the impression that the majority of people are expecting a fairly decent correction in both gold and silver now.

We have the benefit of being able to read sentiment by looking at who is buying and who is selling. We’ve crunched some numbers that make us start to doubt that narrative.

No guarantees of course. But if you’re currently sitting on the sidelines waiting for gold or silver to pull back, we’d suggest you check this article out.

That pull back may not arrive…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

The “Time Price”: Why Gold is Money and Will Continue to be

We have spilt plenty of digital ink looking at various ways of valuing gold over the years. But using time is not something we’ve directly touched on before.

In this article you’ll learn:

- About the Tupy-Pooley Formula and the “Time Price” to Measure Value

- How the Time to Mine an Ounce of Gold Has Been Unchanged for Millennia

- The Problem with Measuring Gold in Dollars, and…

- Why Money Must Be “Anchored in Time”

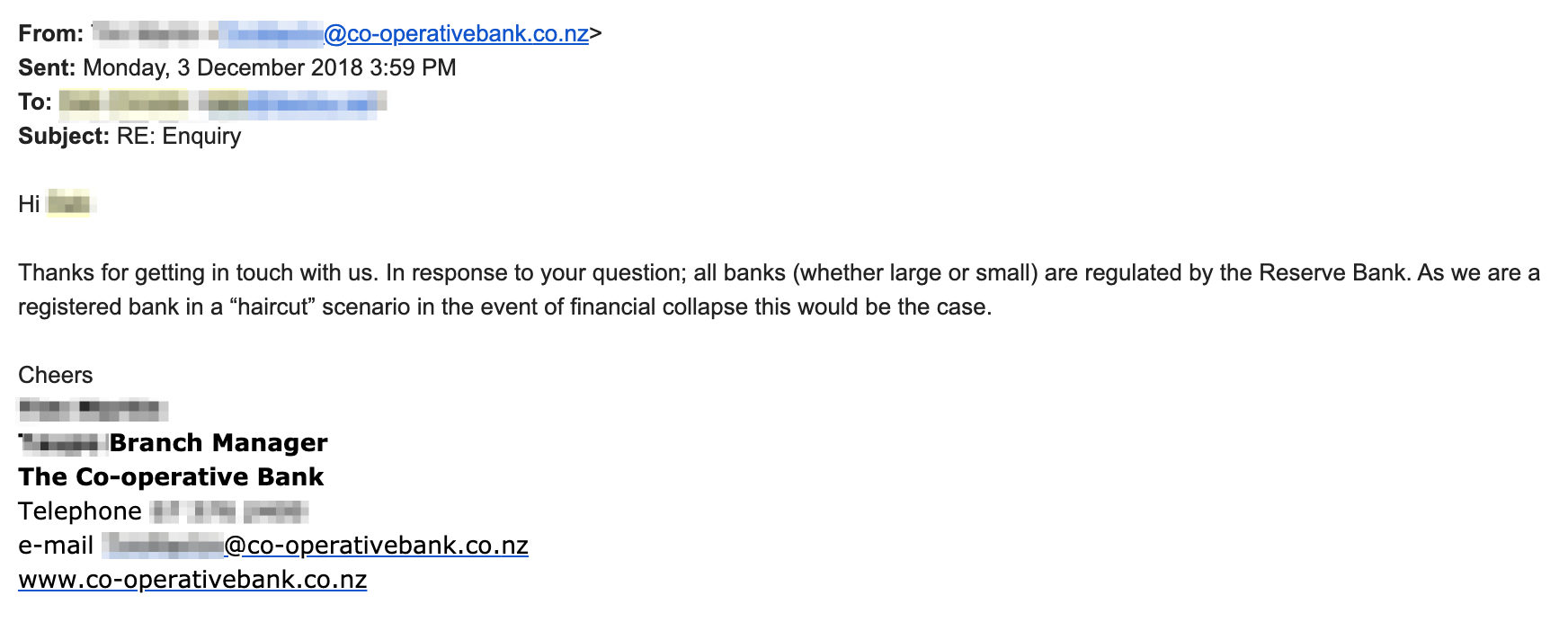

Yes the “Small” NZ Banks Are Still Subject to Bail-In

A client sent us the following email. She was seeking clarification from Co-operative Bank as to whether they were still subject to the RBNZ Open Bank Resolution policy (OBR). A.K.A. – A depositor haircut or bail-in in case of bank failure.

Just in case you were in any doubt that all banks in NZ are impacted by this…

Hello,

If a financial collapse were to happen, I have heard the term ‘Hair Cut’ used in reference to the type of response we could expect from the Major players (the Big Banks). I believe the term is interpreted this way: “The banks will keep depositors funds”. If I were to transfer my savings to your bank, could this potentially happen or do you have depositors insurance that will allow me within 24 hours, full access to all my funds?

Or better yet, is the Co-operative bank not under all of the same strict regulatory controls as the Big Banks?

Could a repeat of Cyprus happen in NZ and more specifically, at a NZ Co-operative bank in other words?

Thanks in advance.

D

The Response from her local bank manager…

“Thanks for getting in touch with us. In response to your question; all banks (whether large or small) are regulated by the Reserve Bank. As we are a registered bank in a “haircut” scenario in the event of financial collapse this would be the case.”

For more on the Bail-in and the planned bank deposit insurance see:

New Zealand Bank Deposit Protection Scheme – Does N. Z. Have Bank Deposit Insurance?

If you’re still sitting on the fence about buying then be sure to check out this weeks feature article.

We still have a limited number of Perth Mint 1kg silver bars selling for less than the usual price of local silver bars. Just 7% above spot. Only while stocks last though.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|