Prices and Charts

Bounce Back of the Kiwi Dollar Keeps NZ Metals Prices Flat for the Week

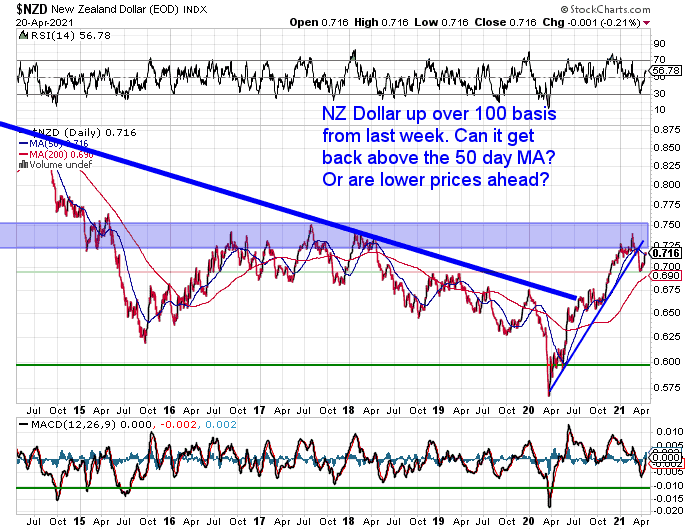

The NZ dollar gained by 1.6% for the week. So this dented the rise in both NZ dollar gold and silver prices over the past 7 days.

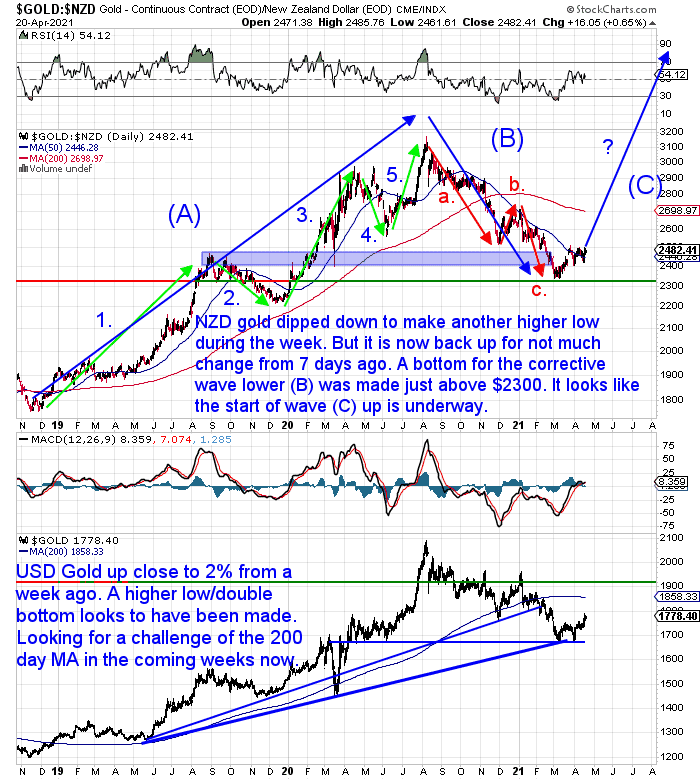

During the week gold in New Zealand dollars dipped down to make another higher low. But it is now back up to mean not much change from a week ago.

It looks very likely that a bottom has been made for the corrective wave lower just above $2300. We are more confident that the next wave up has started. This will eventually take us above last years high.

NZD Silver Also Not Much Change From Last Week

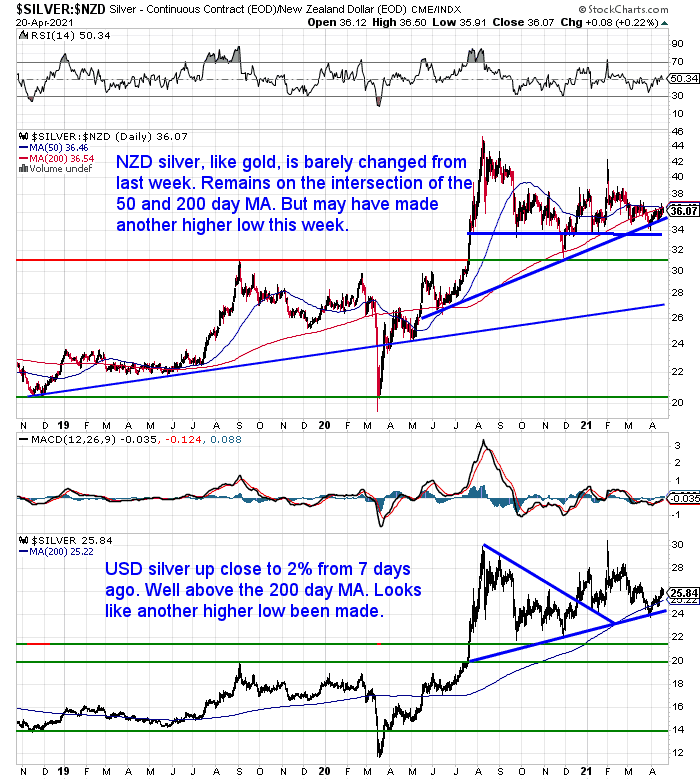

Silver in New Zealand dollars has also barely changed from a week ago. It remains right on the intersection of the 50 and 200 day moving averages. But like gold it may well have made another higher low this week.

This week’s feature article below focuses on silver. So check that out for a detailed wrap up of silver.

New Zealand Dollar Up Over 100 Basis Points

As noted already the Kiwi dollar was up sharply this week. Putting a dent in any gains for local gold and silver prices. The Kiwi is sitting right on the 50 day moving average, so is evenly poised. Can it break above that or will it dip lower from here?

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

An Excellent N.Z. Silver Buy Zone is Here – Charts Update Apr 2021

Silver got a whole lot of attention back in early February with the Reddit instigated silver short squeeze attempt. As we suspected at the time this failed to push silver to the moon as was planned.Silver has been in a corrective phase since then.

But we’re thinking that phase may now be over.

In this week’s feature article we look at various charts of silver. But we also point out 3 contrarian indicators that point to silver bottoming out currently.

Here’s what’s covered:

- The Big Picture NZD Silver: 4 Major Trends Since 2005

- Zoom In: Daily Chart From 2015 to 2018

- How Have Things Played Out Since late 2018?

- What About Right Now?

- Weekly NZD Silver Chart

- Monthly NZD Silver Chart

- 3 Contrarian Indicators That Silver Looks to be in an Excellent Buy Zone

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Rise of the Dragon – From Deflation to Reflation

Here’s a short excerpt from a great report by Chris Cole of Artemis.

“Unfortunately, with history as a guide, investors expecting the gains of the last 40 years with a traditional portfolio will be massively disappointed. The global economy is entering a period of change whereby deflation or manufactured inflation will destroy wealth to eliminate debt. The most significant systemic risk to investors is not de-dollarization or historic debt, but collective Recency Bias leaving most blind to the problem.

Suppose history rhymes, and at some point in the next twenty years, we face a global crisis in servicing the historic levels of leverage. In that case, global deflation or stagflation will erase the unprecedented level of corporate and government debt and wreak havoc on traditional retirement portfolios. Wealth and savings will be destroyed, and many pension systems will become insolvent or require multi-trillion-dollar bail-outs by the government. None of this will be free. YOU will pay for it, either through higher taxes or loss of purchasing power due to higher inflation. 2020 was not the climax but merely the first act of this epic Greek Tragedy. The Dragon Portfolio can be a tool.”

We’d agree that recency bias is probably the biggest risk most people face. That is assuming things such as:

- Interest rates staying at record lows.

- There will be little consumer price inflation.

- Getting the same returns from common investments such as bonds and shares (or in New Zealand, we’d add real estate).

However we doubt we’ll have to wait 20 years for the next crisis. Or the culmination of the many “smaller” crises of the past couple of decades. Maybe more like 5 or so perhaps?

The time frame is not really knowable. However the risks of expecting the next few years to play out as a repeat of the last 12 or so is very clear.

We’re not privy to what the “Artemis Dragon Portfolio” is exactly. The Artemis website states:

“Rather than focusing on excess returns, investors should be seeking secular non-correlation. The key is finding assets that are non-correlated to one another during regime shifts in markets. Investors do the opposite, layering on correlated risk at the end of business cycles searching for yield; distracted by short- term performance without seeing the big picture.”

We can think of a couple of assets that aren’t correlated during cycle changes. One is yellow and one is grey…

So you can likely create your own “Dragon” portfolio with the addition of gold and silver.

You might want to think about how much of these 2 substances you should own too.

Check out: What Percentage of Gold and Silver Should Be in My Portfolio?

Let us know if you’d like a no obligation quote to see how the buying process works.

Silver Maple, Krugerrand and Britannia 1 oz silver coins are now back in stock.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Roubini: Is Stagflation Coming? - Gold Survival Guide