Prices and Charts

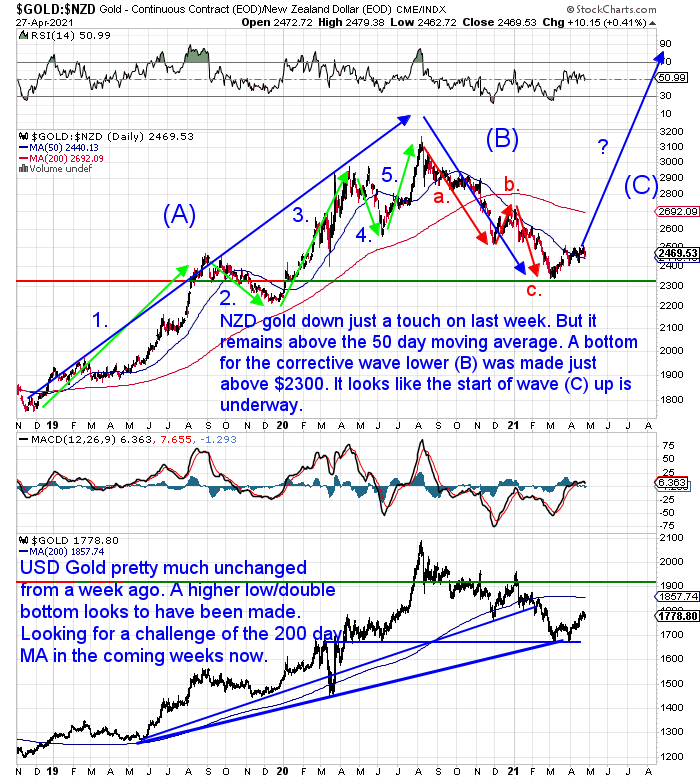

NZD Gold Down Half a Percent

Gold in New Zealand dollars was down just over half a percent from 7 days ago. But gold remains above the 50 day moving average (MA) – which it only recently edged above. NZD gold has also recently edged above the downtrend line dating back to last August’s high. We just don’t have that drawn on the already very busy looking chart below. Check out our daily price alerts for more detail on that.

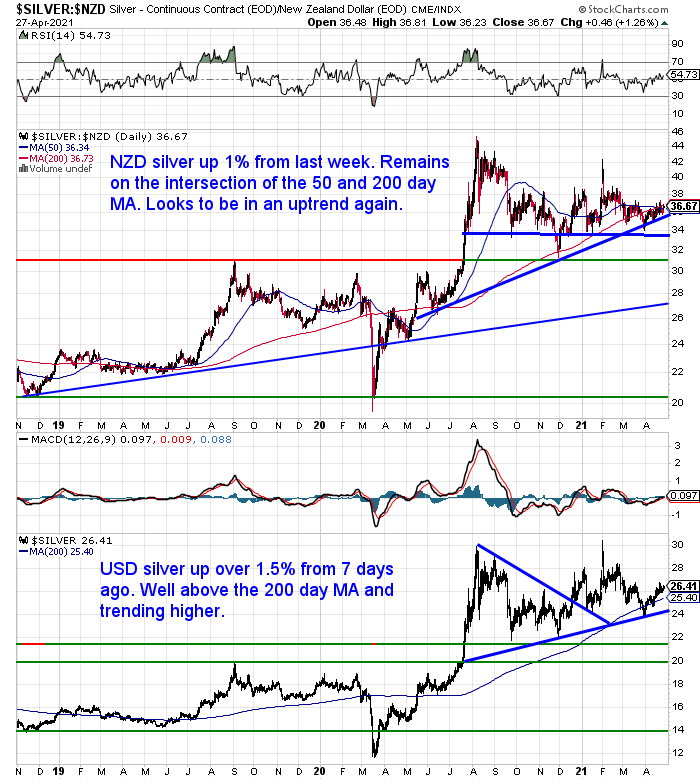

NZD Silver Remains in an Uptrend

Unlike gold, NZD silver was up for the week – by about 1%. Silver remains right on the intersection of the 50 and 200 day MA’s. It is also sitting above the rising uptrend line. Silver looks to be in an uptrend since bottoming out back in November.

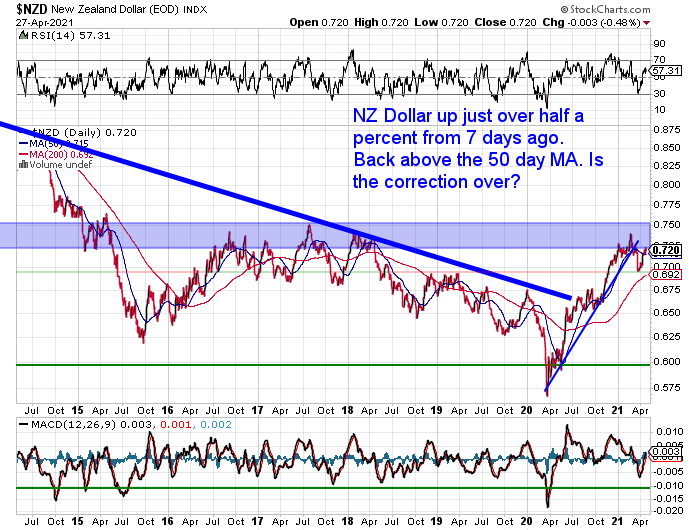

NZ Dollar Correction Over?

The Kiwi dollar was up just over half a percent this past 7 days. It is now back above the 50 day moving average. So we are starting to wonder if the correction in the NZ dollar is over now? That’s not to say it is necessarily about to launch higher. Back in 2016-2018, the Kiwi traded sideways around these current levels for a couple of years. So we could easily see a repeat of that.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Wages from Ancient Greece and NZ Housing: Both Say Silver Undervalued by a Factor of 20

Last week we pointed out that various charts are showing now is likely a great time to buy silver. We also highlighted 3 contrarian indicators that backed these up.

This week we look at how both wages from ancient Greece along with NZ housing show that silver is still very undervalued.

Read on to see how uncannily similar the ratios of a Greek labourer’s wages to silver and New Zealand housing compared to silver are.

Here’s what’s covered:

- Silver Very Undervalued From Historical Perspective of Ancient Greece

- How Does NZ Housing to Silver Ratio Compare to Frisby’s Wages Valuation?

- Will Silver Return to That Level in the Future?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Roubini: Is Stagflation Coming?

A couple of weeks ago we highlighted some commentary around whether the planned Biden tax Increases could help stop inflation in the USA.

This week we read an interesting piece by Nouriel Roubini pointing out why we should be concerned about the potential for a 1970’s style stagflation. That is high inflation combined with a recession (low growth).

We have pointed out previously how unlike the 1970’s the debt burden today is simply too high for central banks to raise interest rates to head off inflation. As they did at the conclusion of the 1970’s.

Roubini notes that one argument against a longer term inflation problem is that:

“…the monetization of fiscal deficits will not be inflationary; rather, it will merely prevent deflation. However, this assumes that the shock hitting the global economy resembles the one in 2008, when the collapse of an asset bubble created a credit crunch and thus an aggregate demand shock.

The problem today is that we are recovering from a negative aggregate supply shock. As such, overly loose monetary and fiscal policies could indeed lead to inflation or, worse, stagflation (high inflation alongside a recession). After all, the stagflation of the 1970s came after two negative oil-supply shocks following the 1973 Yom Kippur War and the 1979 Iranian Revolution.

In today’s context, we will need to worry about a number of potential negative supply shocks, both as threats to potential growth and as possible factors driving up production costs. These include trade hurdles such as de-globalization and rising protectionism; post-pandemic supply bottlenecks; the deepening Sino-American cold war; and the ensuing balkanization of global supply chains and reshoring of foreign direct investment from low-cost China to higher-cost locations.

Equally worrying is the demographic structure in both advanced and emerging economies. Just when elderly cohorts are boosting consumption by spending down their savings, new restrictions on migration will be putting upward pressure on labor costs.

Moreover, rising income and wealth inequalities mean that the threat of a populist backlash will remain in play. On one hand, this could take the form of fiscal and regulatory policies to support workers and unions – a further source of pressure on labor costs. On the other hand, the concentration of oligopolistic power in the corporate sector also could prove inflationary, because it boosts producers’ pricing power. And, of course, the backlash against Big Tech and capital-intensive, labor-saving technology could reduce innovation more broadly.”

Roubini concludes by saying:

“In the short run, the slack in markets for goods, labor, and commodities, and in some real-estate markets, will prevent a sustained inflationary surge. But over the next few years, loose monetary and fiscal policies will start to trigger persistent inflationary – and eventually stagflationary – pressure, owing to the emergence of any number of persistent negative supply shocks.

Make no mistake: inflation’s return would have severe economic and financial consequences. We would have gone from the “Great Moderation” to a new period of macro instability. The secular bull market in bonds would finally end, and rising nominal and real bond yields would make today’s debts unsustainable, crashing global equity markets. In due time, we could even witness the return of 1970s-style malaise.”

We wouldn’t agree with everything Roubini has said in the past. However this article makes a very good summary of the risks of future inflation we face. He highlights the countervailing arguments as to why inflation won’t happen. But then points out the holes in these arguments.

So we’d recommend you check that out over at Project Syndicate. It’s a pretty brief read for an economist!

Let us know if you’d like a no obligation quote to see how the buying process works.

Silver Maple, Krugerrand and Britannia 1 oz silver coins are once again available only on back order. 1kg local silver bars are up to a 2 week delay for delivery.

Let us know if you’d like a quote for anything…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Bank of America: USA May Experience Hyper-inflation Soon - But Will Be “Transitory” - Gold Survival Guide