Prices and Charts

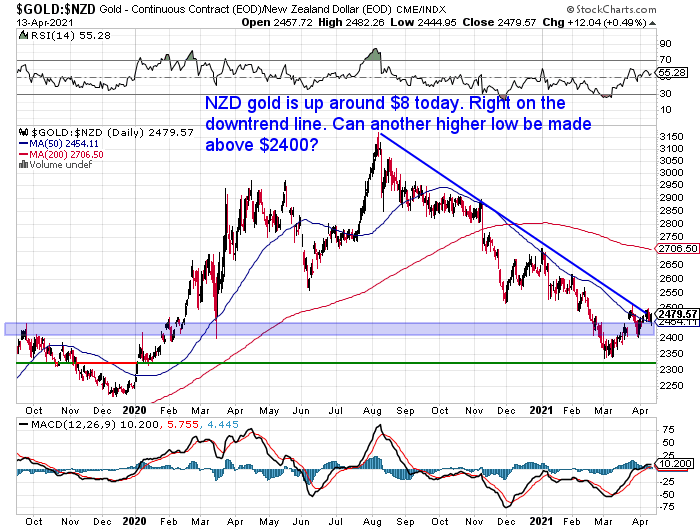

Gold Unchanged – Still Awaiting a Clear Break Above Downtrend

Gold in New Zealand Dollars is almost unchanged from last week’s update. It did dip yesterday but recouped all those losses today. It is just above the 50 day moving average. Plus it still sits right on the downtrend line dating back to the high of last year. We need to see a clear break above that line.

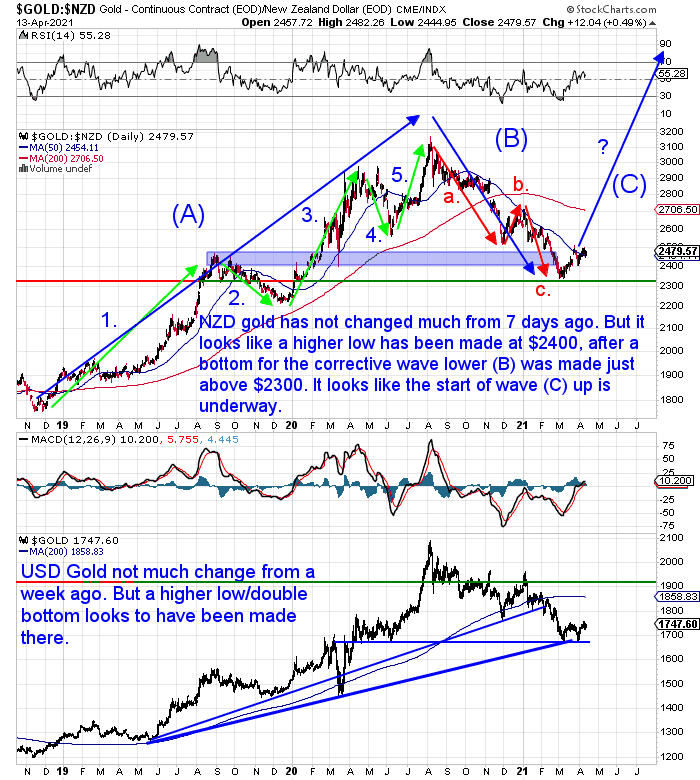

However on the longer view below, it looks like a good chance that major wave (C) up has begun.

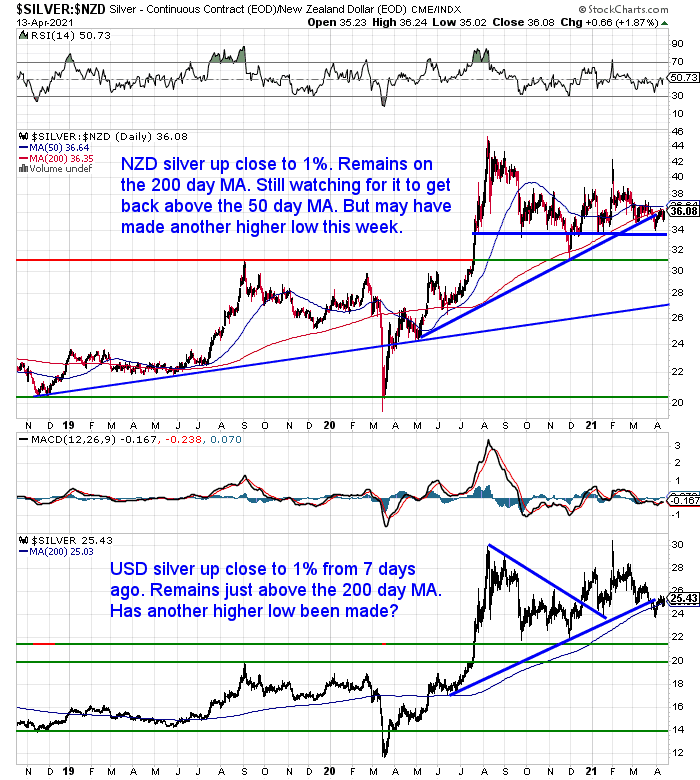

Silver Up Just Under 1%

NZD Silver is up close to 1% from 7 days ago. It remains on the 200 day moving average (MA). We are still waiting for a clean move above the 50 day MA. However silver may have put in another higher low this past week.

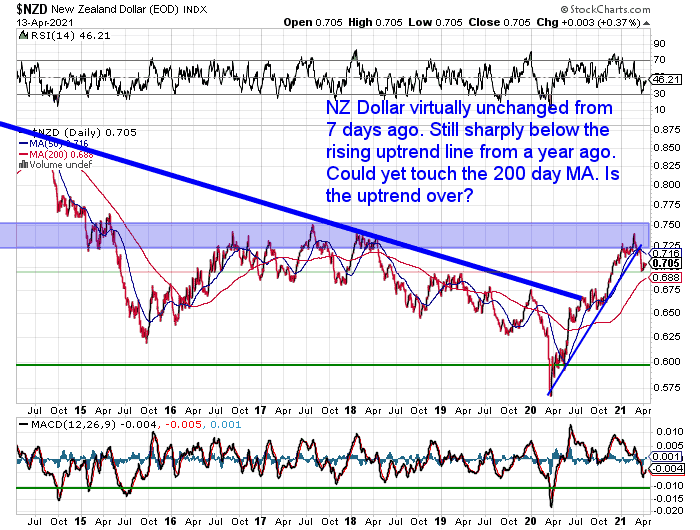

No Change in the NZ Dollar

Not much to report with the NZ dollar this week. Basically unchanged from last week after the prior sharp fall.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Will Biden’s Tax Increases Mean No Inflation?

An email from The Market Ear earlier this week reported:

“The Inflation debate rages on and will dominate the market narrative this year and beyond. Question: if the stimulus in the US is fully funded through taxes does this remove inflationary pressures as demand simply migrates from Personal/Corporate sphere to Government spending? Sanford Bernstein thinks not.

“Firstly there is still the question of the very sizable blip in inflation over the next 12 months – and with the degree of fiscal support plus very constrained supply it means that price increases over that time horizon are almost mechanical. Longer term tax can have some effect at offsetting it, but higher taxes are aimed at the upper end of income distribution where there is less propensity to spend marginal extra dollar anyway. In addition the ability to provide on-going fiscal support and maintain high debt levels creates an asymmetry around inflation risks which is different compared to recent years. Also bear in mind that whilst the Trump tax cut was meant to get companies investing and hiring, a lot of it just went to buybacks. Now it looks like we’ll get more direct spending, specific areas/projects and hopefully much more direct impact on new jobs”

In the same email they also point out:

“Currency in circulation [USA] is now growing at its largest pace in a year. $43.7B just in the last 4 weeks. Inflation is of course not as easy as just increasing money in the system, but….”

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

How Would Hyperinflation in the USA Affect New Zealand?

It’s likely these sorts of reports which have got at least one reader thinking. Jason asks what would happen if the inflation rate really took off in the USA:

“What do you reckon would happen to the NZD direction and NZ interest

rates if hyperinflation were to occur in the US?”

Thanks for this one Jason. Our reply is in this week’s feature article. We cover:

- What Is Hyperinflation?

- A Real World Hyperinflation Example

- How Could Hyperinflation Occur in the USA?

- A Historic First: Global Reserve Currency Hyperinflation

- How Did New Zealand Compare to the USA in the Inflationary 1970’s?

- What About the New Zealand Dollar in a Hyperinflationary USA?

- USA M3 Money Supply vs New Zealand M3 Money Supply

- Hyperinflation Isn’t Needed to Destroy a Currency

As we conclude in this week’s feature article, you don’t need hyperinflation to destroy a currency. Just enough time to pass with consistent steady monetary inflation.

So make sure you own some real assets to shield yourself from this ongoing loss of purchasing power. Assets with no counter-party risk like gold and silver.

Please get in touch if you’d like a no obligation quote to see how the buying process works.

Silver Maple, Krugerrand and Britannia 1 oz silver coins are now back in stock.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: 3 Contrarian Indicators Show it’s a Great Time to Buy Silver - Gold Survival Guide