We’ve written extensively on the war on cash over the past few years. (Here’s a full list of the topics we’ve covered: https://goldsurvivalguide.co.nz/tag/war-on-cash/). Now here’s the latest on the moves toward a cashless society down under…

Is Australia Going Cashless?

Hidden in the 2018 Australian Government budget was a plan to save $5.3 billion by banning cash payments of $10,000 or more. Australian Treasurer Scott Morrison said back then that it was a crackdown on the black economy, which is exactly what voters want to hear.

Money Morning reported at the time on the move towards a cashless society in Australia:

“Of course, the motive is far simpler. Moving towards a cashless society will save billions that the government wastes every year.

Australia is late to the party

It will be bad news for criminal gangs, Morrison said. But really, who believes any sort of government ban will deter criminals from committing crimes.

The Australian Financial Review writes:

‘Cash payments of more than $10,000 will be outlawed under a widespread crackdown on the cash economy expected to raise more than $7 billion and improve the budget bottom line by $5.3 billion.

‘…An additional $318.5 million in funding will be used to expand the Tax Office’s data analytics and data-matching capabilities and to introduce a hotline for the public to report information on the cash economy and identify illegal phoenixing activity. The measure is expected to raise up to $3 billion and net more than $1.9 billion over the next four years. There is also additional money for Treasury and the Director of Public Prosecutions.

‘…The government is also introducing an economy-wide cash payment limit of $10,000, applying to payments made for goods and services from July 1, 2019 with “no quantifiable estimated [budget] impact”.’

You could say Australia is a little slow to the party. In India, where corruption is a real problem, the government banned high valued notes overnight.

It would be as if Australia’s government said ‘…the $100 and $50 bill is no good anymore.’ India’s 10-month ban didn’t have the desired effect. Meaning it didn’t reduce bribery and similar acts.

Similar bans have rolled out across Europe as well.

And while it doesn’t always reduce criminal activity, it can save a whole lot of money. Consider what happens when central banks want to stimulate an economy. They reduce interest rates and pump more money into the system.

Now imagine they don’t have to produce, distribute, handle and replace a whole bunch of coins or cash.

It’s why China, the world’s largest cashless society, went off bills years ago. While you can still find paper bills in the country, the overwhelming payment preference now is cashless.

…South China Morning Post wrote earlier this year:

‘Mobile payments have made major inroads as a medium of settlement in Chinese cities. Aside from convenience stores, shopping malls, and fine dining, mobile payments are even the norm among vegetable markets and other small scale vendors.’

And today, it’s one of the most popular methods of payment in China.

Last year more than US$16.8 trillion was transacted via mobile in China. Even among the poor and the super-rich, a majority like to pay via mobile, online and off.

Want to know where Australia or North America stands?

The US only makes around US$49.3 billion in mobile transactions. And for Australia figures are far lower. According to MasterCard, only about 1% of Aussies pay via smartphone in-store.

For China, that number is more than 42% and growing fast.”

Then last Friday night the Australian government quietly (and cunningly on a Friday night) released a draft bill to implement these changes.

Red Alert: ScoMo Declares War On The Australian People

The Sydney Morning Herald headline read, ‘New cash transaction rules slated for next year’.

These new rules will ban Australian businesses from paying or taking in more than $10,000 in cash payments. Large fines or even prison sentences could apply…

‘An exposure draft for the government’s “restrictions on the use of cash” laws outlines fines of more than $25,000 and possible prison sentences of two years for business owners who knowingly accept or pay large transactions in cash after January 1, 2021…

‘Minister for Housing and Assistant Treasurer Michael Sukkar said the government was “committed to continually ensuring our financial system is hardened against criminals and terrorists without placing undue burden on industry”…

‘Australia’s black economy costs the country more than $50 billion in lost revenue each year, according to [black economy] taskforce projections.’

So as usual the argument is that cash is costing Australia billions a year in lost revenue due to tax evasion. On top of this they argue that cash enables criminals and terrorists.

But a point not mentioned by the Australian government is that the central bank set interest rate is steadily dropping towards zero. Or maybe even lower…

Here’s the likely real reasons for going cashless…

Why Go Cashless? Is it Just to Save Money?

Despite the Money Morning report above, the reason for the war on cash is unlikely to be purely to save money on printing and distributing physical cash. Here are the much more likely reasons we reckon:

The war on cash is being waged because it allows the government to do a number of things:

- Track and tax every payment you make or receive – there is no “cash economy”, no “cash jobs”.

- Freeze deposits and then bail-in deposits in case of a failing bank – see here for more on what happens to your deposits in a bank failure in New Zealand.

- Enact negative interest rates without people escaping to cash (see: Could Negative Interest Rates Be in Store for New Zealand).

- No bank runs – Once all money is digital, there can’t be a run on a bank anymore. You won’t be able to remove your money if you see it coming in advance.

Going cashless might seem user friendly. Hey, if it were left up to the free market it’s also likely that cashless payment systems would be the norm.

The problem is when the government controls money and gives you no other options. So beware of the “simplicity” and “ease of use” of only having credit cards or Apple pay. It is on the horizon.

Read more: War on Cash: Implications for New Zealand

Remove Cash to Implement Negative Interest Rates

The idea of negative interest rates in New Zealand and Australia is gaining traction. Only last year the talk was of central banks continuing to raise interest rates.

Now we’re seeing articles like these appear in the local press:

Brian Gaynor: Learning to live with negative interest rates

When interest rates fall below zero, things could get weird

Others in the alternative media are also reporting on the real reasons behind the war on cash:

2 August 2019 – The CEC Report – Cash ban won’t stop money laundering, it will trap you into bail-in

How About New Zealand – Is NZ Moving Towards a Cashless Society?

Unlike Australia, there is no current plan in New Zealand for the likes of banning cash transactions of certain sizes.

However late in 2017 new rules came into force requiring New Zealand banks to report any cash transactions over $10,000 to the police.

See: Here’s Proof the NZ Government is Following the IMF’s “War on Cash” Doctrine

So that may well just be a small step on the road to a cashless New Zealand.

As far as a number on the adoption of mobile payments in New Zealand, it’s hard to find anything concrete. Given only certain banks support specific mobile payment methods (such as Apple Pay or Android Pay), the odds are adoption has not reached huge numbers yet. Our numbers are likely no more than Australia at 1% – not yet anyway.

But the trend is likely towards more and more people using mobile payment options. And less and less using cash.

RBNZ Examines What Will Happen When Cash is No Longer King

Interestingly a recent RBNZ paper looks at the problems in removing cash…

New Reserve Bank paper says with the declining use of cash, Kiwis already ‘left out’ of the banking or digital worlds may be ‘severely disadvantaged’

The Reserve Bank is warning that if cash becomes less accepted and available as a means of payment then Kiwis that are already “left out” of the banking or digital worlds may be “severely disadvantaged”. The RBNZ said in its recent Financial Stability Report that it was undertaking analysis of the future of cash.

Source.

But that’s not to say it won’t happen here in New Zealand either. As you’ll see below the central bank has also been looking into digital currencies…

RBNZ Also Looking at Digital Currencies

Apart from banning cash outright, there are other more gradual and not so obvious arrows in the central planners quiver in the war on cash. One of these is to simply move us towards digital currencies.

In Februay 2018, the Reserve Bank of New Zealand (RBNZ) reported on cryptocurrencies in: Crypto-currencies – An introduction to not-so-funny moneys. Read more: RBNZ Cryptocurrency to Replace NZ Physical Currency with a Digital Alternative?

Then a couple of months later the RBNZ issued a bulletin article more generally discussing digital currencies.

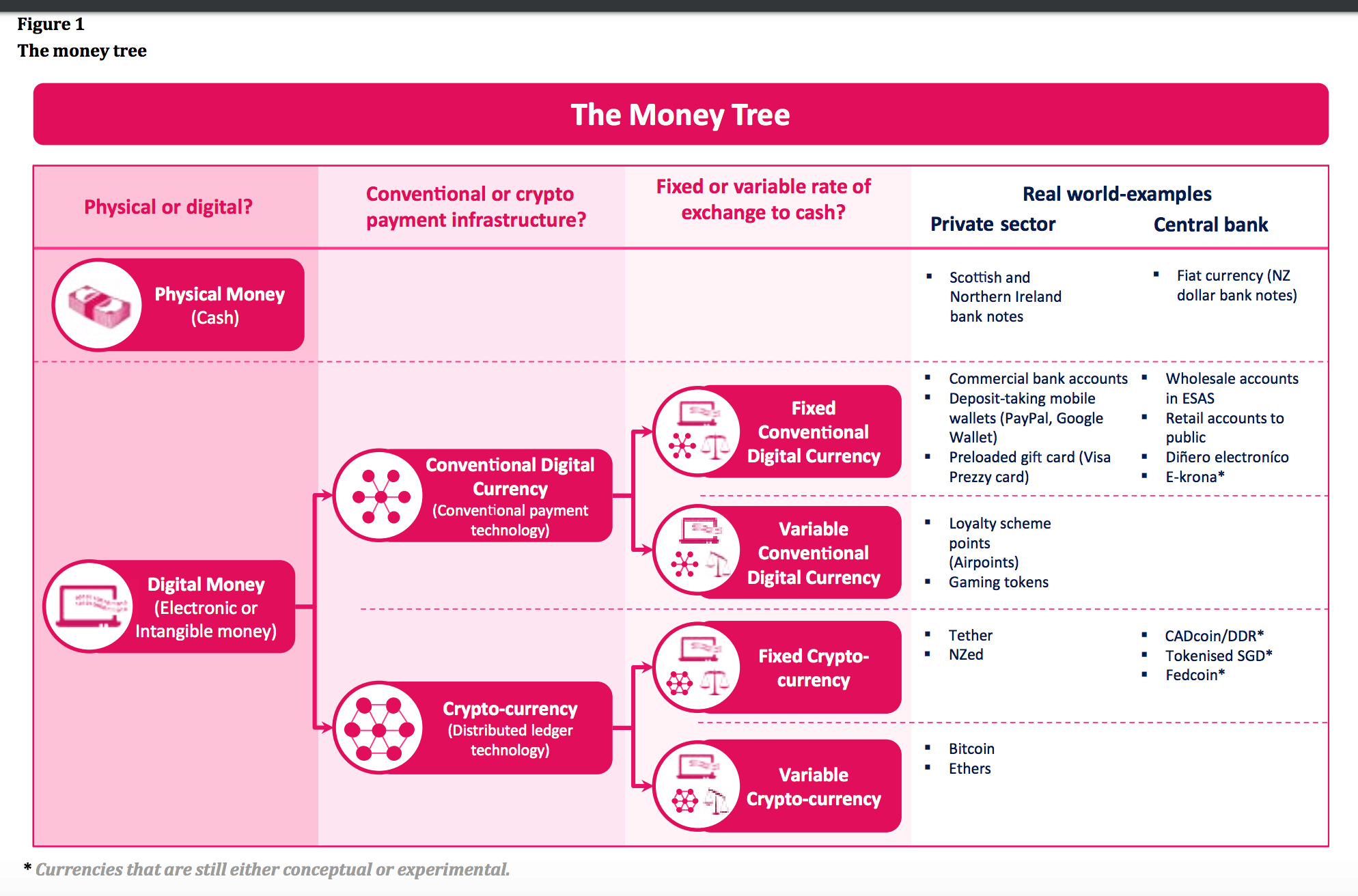

The Bulletin outlines different forms of digital currencies as shown in the money tree below.

In the RBNZ press release they say [emphasis added is ours]:

“…central banks, which have a role as national issuers of cash around the world, are considering the implications of these new technologies, including the potential for issuing their own digital currencies.

This article by Amber Wadsworth is the first of a series to be released over the next few months.

It explores different forms of digital currencies using a money tree classification. Future articles will compare distributed ledger technology to existing financial market infrastructure for payments, and assess the pros and cons of a central bank issuing its own digital currency.

These articles do not propose a design for a digital currency or suggest that the Reserve Bank will issue digital currency.”

However reading between the lines, it seems likely the RBNZ will follow other central banks in a move towards digital currency issuance.

The bulletin concludes:

“Exploring digital currencies using the money tree classification leads to three observations.

1. Despite the recent attention to digital currencies, most forms of digital currencies are not new and are not significantly different from each other. Crypto-currencies with variable exchange rates to fiat currencies are the most novel digital currencies.

2. A central bank could issue either a conventional digital currency or a crypto-currency to the public. A central bank could also choose to issue a digital currency with a par value or variable exchange rate to cash. However, it is conceptually easier to image a central bank issuing a digital currency that trades at par value with cash.

3. Crypto-currencies have been issued by private institutions but not by central banks. It appears that crypto-currencies that have fixed exchange rates to fiat currencies are a better unit of account, medium of exchange and store of value than crypto-currencies which do not have fixed exchange rates to cash. “

We’ll keep an eye out for the further reports on digital currencies from the Reserve Bank. The odds are we won’t see a cashless society happen overnight. Rather it will resemble the fabled frog in the pot of slowly heated water, not noticing it is being cooked.

Sign up below to be kept up to date on the latest happenings in the war on cash.

Update: Here’s the details of the third report from the RBNZ on central bank issued digital currencies.

Editors note: This post was first published in May 2018. Updated 7 August 2019 to include draft bill update, expanded section on negative interest rates, and RBNZ report on when cash is no longer king.

Pingback: RBNZ Slashes OCR - The Race to the Bottom is Speeding Up and NZ Won’t Be Left Behind! - Gold Survival Guide

Pingback: RBNZ: Too Early to Say for Central Bank Digital Currency – Reading Between the Lines - Gold Survival Guide