Prices and Charts

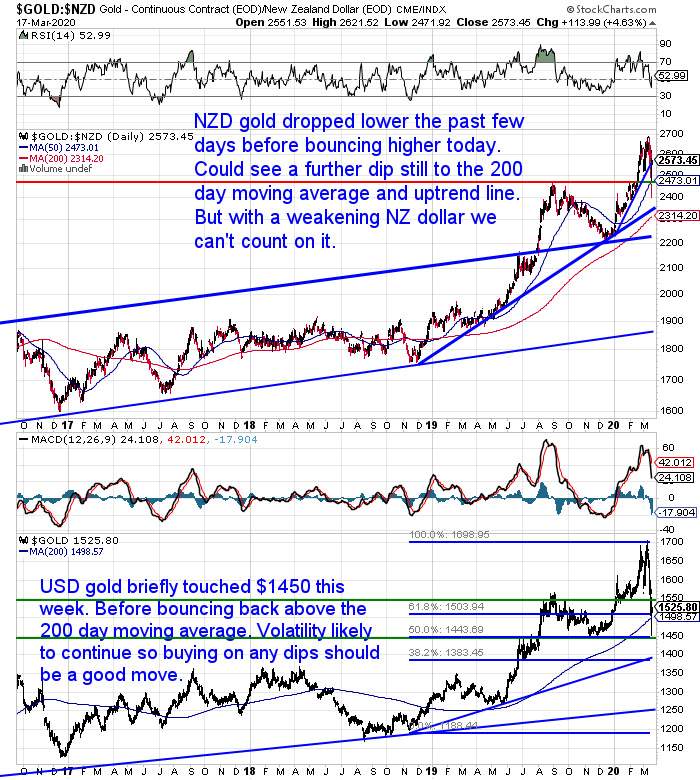

Gold Down – But Not Much In NZ Dollars

Gold followed everything else lower this past week. Although not by as much as stocks and most other markets. In NZ Dollars it is actually only down just under 3% for the week.

There was a short sharp plunge the last 2 days before bouncing back today, care of the ever weaker Kiwi Dollar.

So we are now only about $100 below the all time high from last week.

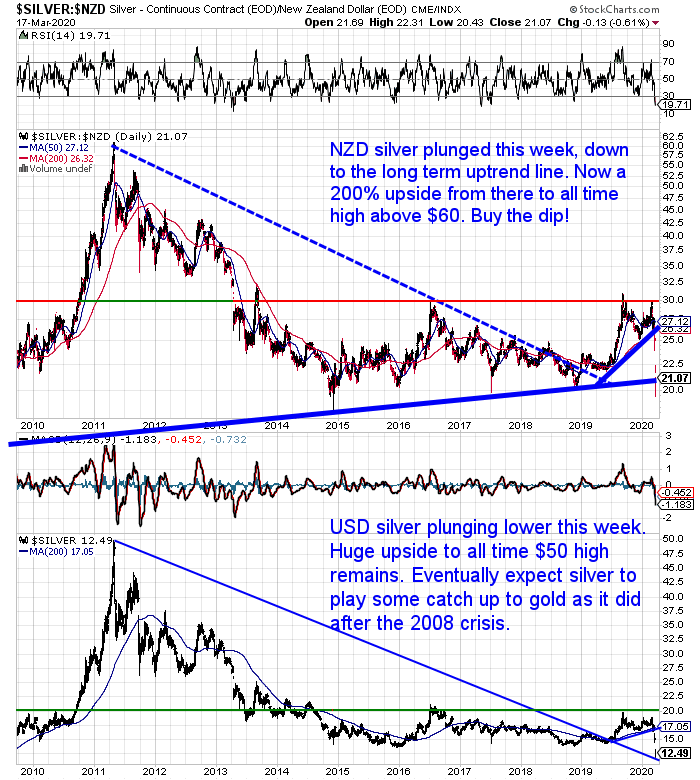

Silver – down 22%!

It was a different story in silver though. Plunging almost 22% from a week ago. Most of that happened yesterday in a monster fall. NZD Silver now sits right on the long term support line.

Check out this week’s feature article on the gold to silver ratio for more on why silver may have fallen.

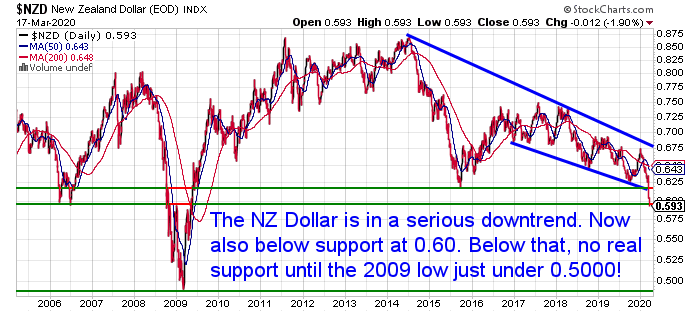

Kiwi Dollar Breaks Below Support and then Does So Again

The Kiwi dollar fell below 0.62. Then today it has also dropped below 0.60! There is now very little support between here and the 2008 lows just under 0.50.

As we said in last week’s article, gold is a great way to hedge a lower Kiwi dollar. And since 2008 seemed to be repeating there is every chance the NZ dollar goes lower yet.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

So Much News – So Much Demand – So Little Time to Report

So much has happened in a week we don’t know where to start!

On top of this we (like all bullion dealers worldwide have been swamped with orders), so finding the time to write this week has been difficult to say the least.

Thank you for your patience if you’ve requested a quote in the past few days. We are going as quickly as we can. But demand has been unprecedented.

This demand means we are seeing a repeat of many of the things that occurred in 2008:

- Popular silver coins have sold out.

- There are multi-week waits on some products.

- While the spot price has fallen, margins have also increased.

- So like 2008 the physical price is getting out of whack with the spot price.

This shortage is likely to spread into other products in coming days/weeks. For now local gold is in good supply. Local silver is starting to see delays creep in.

We have Pamp silver bars available for immediate delivery – though for how long who can be sure?

But like 2008, we’ll see refiners and mints ramp up production and likely get these delays back under control.

What is the Gold Silver Ratio? What are New Highs in the Ratio Telling Us?

As noted already, silver plummeted this week. Resulting in a massive spike in the gold to silver ratio to an all time record high. Silver is the most unloved it has ever been – compared to gold.

In this weeks feature post we look at why this might have happened and what might happen with the ratio from here:

- What is the Gold Silver Ratio?

- How is the Gold to Silver Ratio Used?

- What is the Ratio Telling Us Now?

- Why did the Gold to Silver Ratio Reach New Highs This Week?

- What to Do Now?

RBNZ Joins the Fed in the Race to The Bottom! (and Beyond?)

Yes indeed it has been a week of action! Monday saw the Reserve Bank of New Zealand slash the official cash rate by 0.75 down to a new record low 0.25%.

At around the same time, in what was Sunday in the USA, the Federal Reserve also cut their interest rate to basically zero.

The Corona Virus has served to pop the “just about everything bubble”.

There is a lot going on behind the scenes. There are likely some large financial institutions in trouble. But as usual these days who knows what is really happening?

Graham Summers had a guess in the weekend:

“Yesterday, the Federal Reserve, the single most important central bank in the world, announced a $1.5 TRILLION repo operation as well as a new quantitative easing (QE) program…

And stocks only rallied for FIVE minutes. Before closing on the LOWS.

Again, stocks had their worst day since the 1987 Crash on the day the Fed announced a $1.5 TRILLION intervention. That is THE story of this week.

The implication?

Something truly HORRIFIC is happening behind the scenes. We’re talking about something far worse than Lehman Brothers.

Some large, and I mean LARGE, entity is in MAJOR trouble. Think Deutsche Bank, UBS, or something of that size.

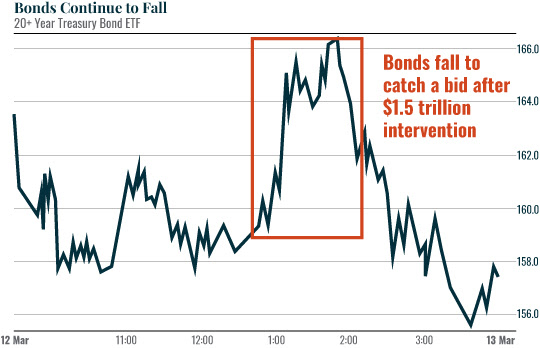

A Collapsing Bond Market Spells Trouble

What’s TRULY horrifying is that bonds actually COLLAPSED yesterday, despite the Fed announcing this $1.5 trillion program.

If bonds cannot find a floor when the Fed announces QE 5 as well as $1.5 trillion in repos, then we have a problem that is far, far greater than anything the world has ever seen.

Let’s be clear here…

What the Fed did was not a bazooka… it was a NUCLEAR option. And it didn’t stop the collapse.

The Fed now has few options left. Meaning if the market bounce doesn’t last, and stocks turn down again… the Fed is effectively POWERLESS to stop what’s coming.

So what happens now?

The S&P 500 is down 27% since its peak in only 16 days.

The only two comparable situations in history that I know of are the 1987 Crash and the 1929 Crash, which saw stocks lose 34% in 11 days and 20 days, respectively.

In both instances, stocks bounced only two days or so before revisiting the lows or falling to new lows.

This time may be different, but history suggests the lows are not in on this bear market just yet.”

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Governments Also Launch Bazooka Package

On top of central bank actions, we have also seen government support packages announced both at home and abroad.

Odds are these are just the first of many.

Dan Denning of the Bill Bonner Letter makes some good points today on this topic:

“The pandemic has accelerated many of the financial and social trends we’ve all been writing about for years. Universal Basic Income has arrived early in an unexpected guise, as relief for people who can’t go to work or lose their jobs from the lock down. It will be here to stay.

The same could be said for Modern Monetary Theory. The idea of a government debt-to-GDP ratio being a real constraint on emergency spending will simply go away. Governments will borrow through the bond market and central banks will print to buy it. Or, governments will simply sideline the borrowing part and ‘print’ money to give to people.

I say ‘print’ but we may see the rapid emergence of central bank digital money. You don’t even have to mail a check. You just debit a bank account or issue a debit card. This money, unlike cash, can be tracked, tagged, and taxed (it can also come with an expiration date so that people HAVE to spend it each month, not save it).”

Here in New Zealand we’re likely to see more happening too. With interest rates at only 0.25% we are only 1 cut away from zero. It’s likely we’ll see some of the unconventional tools rolled out before long too. Like negative interest rates, money printing etc. The RBNZ has been quietly preparing for this. It’s going to happen…

Stay tuned, it’s going to get interesting. And if you don’t have any gold or silver yet. What’s stopping you?

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Update on Bullion in New Zealand Post Lock Down - Gold Survival Guide