Prices and Charts

Mega Volatility This Week

Volatility has been the operative word this week in most markets. We have seen huge swings up and down in global sharemarkets.

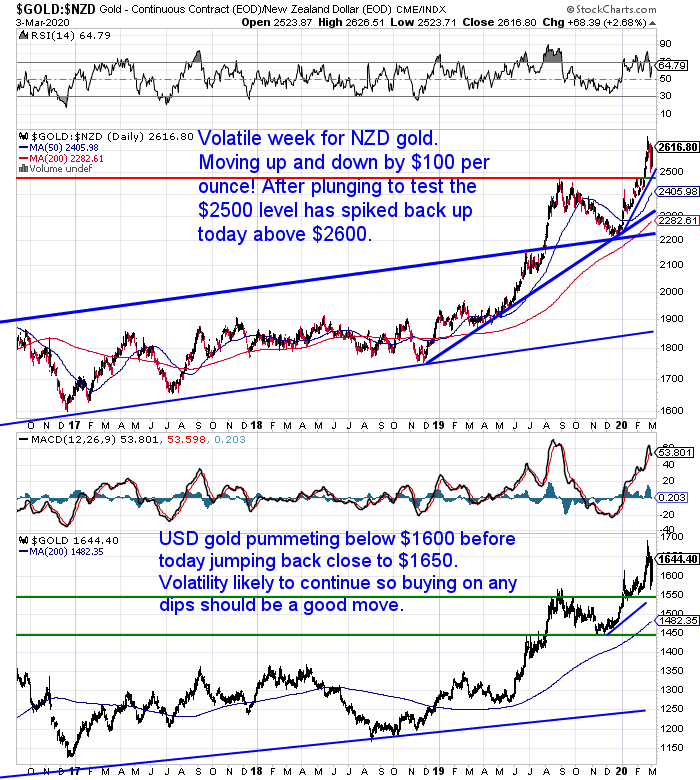

Gold in New Zealand dollars also suffered huge price movements. It plunged down by around $100 to the low $2500’s but today has spiked back up to over $2600. Gold jumped in response to the US central bank slashing interest rates by 0.50%.

The odds are this volatility is likely to continue. So buying the dips is usually a good move in a bull market like this one for gold.

The trouble is the dips may not last for long. If you’re looking to buy, we suggest getting our free daily price alerts here. That way you’ll know when the price spikes occur.

Silver Follows “Risk On” Assets Lower

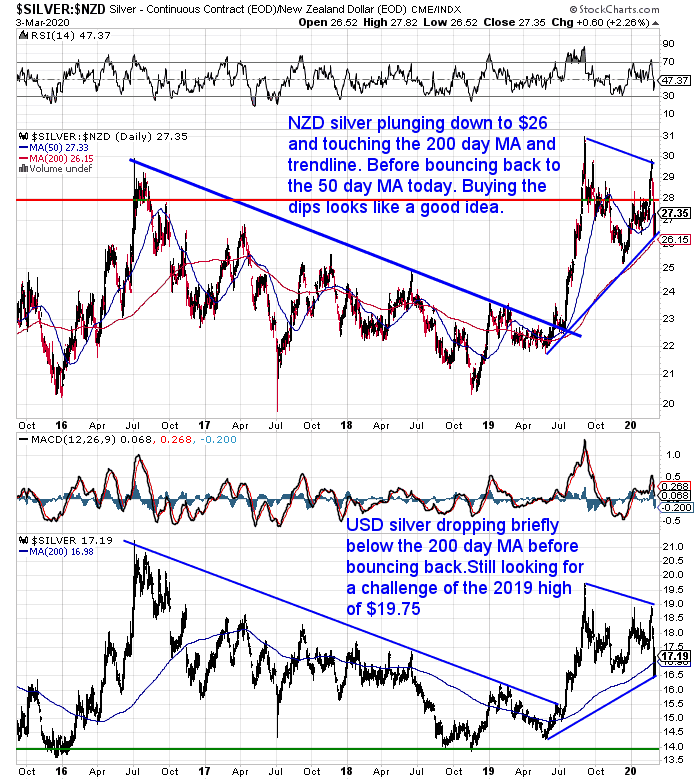

Silver this week continued to lag gold. Down over 3% compared to gold’s 1% rise. Silver seems to be following other “risk on” assets (such as stock markets) lower for now.

This is perhaps not a major surprise given the much higher industrial usages for silver compared to gold.

However this divergence is unlikely to last forever. Silver does look to have bounced nicely off the key 200 day moving average too. So while it may be lagging gold, buying the dip in silver also looks to be the way to go.

Gold Silver Ratio Spiked to 100 – Highest Level Since 1991

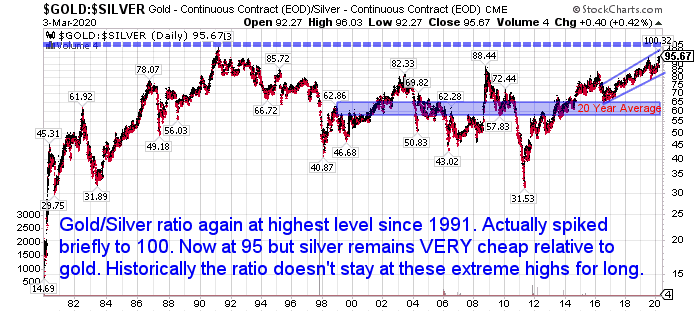

The gold to silver ratio chart shows just how undervalued silver is compared to gold. This week the ratio briefly spiked to 100 intraday. It’s only ever hit this level once way back in 1991! Currently it sits at 95 where it touched briefly last year.

A very long way from its 20 year average in the 50’s. And even further from the 2011 low of 31.

Silver will bounce back. But this is why we’ve always recommended having a bit of both metals. As they do behave differently at certain times.

Kiwi Dollar Touching Long Term Support

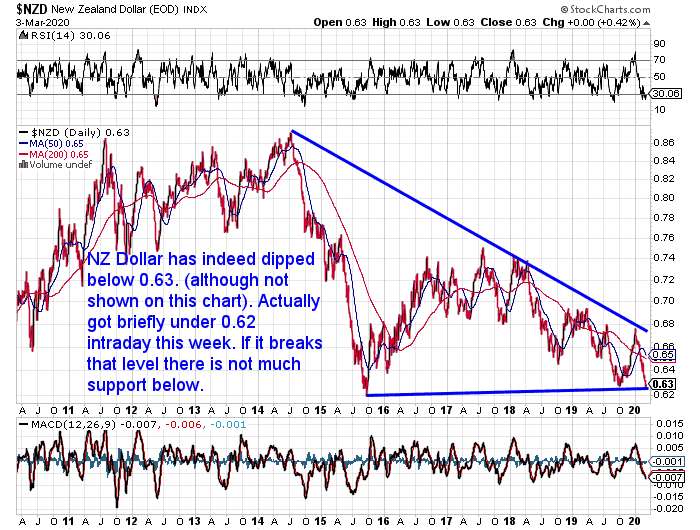

The New Zealand dollar took a hammering this week. Although today is up a little from the lows just under 0.6200. For some reason the stockchart below doesn’t show this dip.

There is not a lot of support if we see a clear break below 0.62. We have to go right back to the 2009 low around 0.50! However we’d guess we see a bit of a bounce from here. But in these crazy times it’s anyone’s guess where the Kiwi dollar goes in the medium to long term.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

What Type of Gold Bar Should I Buy? The 2020 Ultimate Guide

With the gold price rising sharply, it’s not a surprise to see more interest in buying gold in the last couple of weeks.

The most popular type of gold we sell is in gold bar form. But even with bars there are a lot of different types to choose between.

This week we have the ultimate guide to buying gold bars for 2020 including:

- When to choose gold bars over gold coins

- What size gold bar to buy

- Pros and cons of different bar sizes

- How you can borrow against 1kg gold bars

- What’s the most commonly purchased gold bar size

- Different brands of bars

- Cast bars vs minted bars

Gold Coins – Not Much More than Gold Bars

As we point out in this weeks feature post, gold bars are cheaper to buy than gold coins. Often by quite a bit. However currently we have a limited quantity deal on gold coins. Just 10 x backdated 1oz Gold Maple coins selling for only $7 more per ounce than a local 1oz gold bar. Quite a steal.

Be in quick though – as there’s only 10 left from the 20 we had yesterday.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Huh? Central Banks Fighting the Virus. While the World Health Organisation Talks Up the Markets!

As noted already, the US Federal Reserve, slashed the key lending rate by 0.50% today. It was the first 50-basis point cut since December 2008 and it came between scheduled Fed meetings.

Yesterday the Reserve Bank of Australia (RBA) cut its cash rate by 25 basis points to 0.50% to “support the economy as it responds to the global coronavirus outbreak.”

Source.

This morning the ASB has changed tack on interest rate cuts here in New Zealand too:

“Yesterday afternoon, after the Reserve Bank of Australia’s 25bp cash rate cut, we changed our OCR forecast to predict imminent OCR cuts. Until very recently, central banks had sounded reluctant to respond – that bar has quickly dropped considerably. The US Federal Reserve’s decision this morning to cut the Federal Funds rate by 50bp between scheduled meetings has strongly reinforced that view of a low threshold for the RBNZ to act.

We have pencilled in 25bp cuts for each of the March and May meetings, taking the OCR to a fresh low of 0.5%.”

This will be quite an about face given what the RBNZ said just 3 weeks ago on the 12 February:

The Reserve Bank said economic growth “is expected to accelerate over the second half of 2020”, and said the outlook for the economy was brighter amid increased infrastructure investment from the government.

The Reserve Bank’s forecast OCR track now has no further cuts penciled in, and has a hike forecast for 2021.

Back then we said: “It seems to us that the RBNZ forecast for an interest rate rise in 2021 looks pretty shakey at the moment.”

Source: RBNZ: CoronaVirus No Big Deal?

So the central banks seem to think they can shore things up by cutting rates? Even though for the moment the economic troubles are caused by a lack of supply out of China.

Is a lower borrowing rate going to force people to get on a plane and travel? Will it help closed factories to produce?

So we thought this Tweet was very insightful…

“We live in a system, in which the WHO is worried about stocks and the Central Banks are worried about Covid-19.”

This was in response to comments by the World Health Organisation (WHO) chief on the coronavirus, that global markets “should calm down and try to see reality”.

So, we have central bankers trying to fight the virus and the WHO head trying to fight the markets!

It doesn’t seem to be working. As after the Fed rate cut, gold spiked, and stock markets fell.

Also the Daily Reckoning reported today was a historic day as:

“…the 10-year Treasury yield dropped beneath 1% today as the stampede to safety continued.

Not once in history has the 10-year slipped below 1% — not once.”

It’s very hard to predict how all this plays out. Which is probably why we’re seeing (and will continue to see) so much volatility.

It can be tempting to get cute and try to pick bottoms and tops in this situation. But even seasoned investors have trouble doing this. Sovereign Man reports:

How I lost 100% of my investment on the Corona Virus

A few weeks ago when the virus started becoming more of a concern, I thought to myself, “if the virus really starts to spread, stock markets will take a big hit.”

So I bought some ‘out of the money’ put options on the S&P 500. If you’re not sure what that means, I was essentially betting a small amount of money that the stock market would fall. And if my prediction came true, the bet would have paid off probably 10x within 2-3 weeks.

The thing about options, though, is that they’re not open-ended. I had to bet that the market would fall by a specific date. And the date I chose was Friday, February 21st—last week.

Well, Friday February 21st came and went without any fuss whatsoever. So I lost all the money I bet.

The very next trading day, Monday morning, the market tanked. And the day after that. And the day after that. And the day after that.

So I was right that the market would plummet. But I was just barely wrong about the timing. I was wrong by literally one trading day… and as a result I lost 100% of my investment.

The good news is that the amount of money I put down was trivial, so no big deal.

But it is a nice reminder that, even when you get the trend right, it’s damn near impossible to predict the timing.

Frankly I should have just bought more gold.

Gold has surged as a result of the virus spreading around the world because it’s a safe haven asset. On top of that, gold has several supply and demand fundamentals that support higher prices.

But we’ll talk more about gold soon, and why I think it has even more room to run.”

Source.

Yes gold was rising before anyone had even heard of a Coronavirus. When the virus subsides we’ll likely see gold pull back. However it is on an upwards trajectory that will continue.

The virus response shows that the majority are still looking towards the government, central banks etc to “do something”.

The monetary system is slowly dying. Black swans like this virus merely help it along its way.

Gold will help shield you from the economic effects of the virus. But also from the ongoing death of the monetary system. But only if you have your financial insurance in place. Grab one of the deals we have going today.

- 1oz Gold Maple Coins

- 100 oz Perth Mint Cast Silver Bars (serial numbered)

- 10 oz NTR (Texas) Minted Silver Bars

These are all selling for close to local bar prices. So quite a steal that won’t last long. Get in touch for a quote today.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Gold - Once Again Best Friend in a Bear Market - Gold Survival Guide

Pingback: RBNZ Joins the Fed in the Race to The Bottom! - Gold Survival Guide