This article looks at the development of central bank digital currencies (CBDC) in New Zealand and around the world. It then explores how a CBDC might affect the value and use of gold and silver in New Zealand and around the world.

Table of contents

- What is a CBDC?

- Why Consider a CBDC?

- Where is New Zealand With a CBDC?

- Why Would People Choose a CBDC Over Commercial Bank Currency?

- Global CBDC Landscape: How many Central Banks Are Planning Their Own Digital Currencies?

- What are the (Unmentioned) Downsides to a CBDC?

- If New Zealand Introduces a CBDC, How Will Precious Metals be Valued and How Will One Use Them?

- Conclusion

Estimated reading time: 13 minutes

What is a CBDC?

A CBDC is a digital form of central bank money. Unlike cryptocurrencies, it’s issued and controlled by the central bank. The Reserve Bank of New Zealand (RBNZ) is considering issuing a CBDC, which would be similar to cash but accessible digitally. People could choose to use a CBDC to make secure digital payments instead of the current commercial bank currency.

Why Consider a CBDC?

The RBNZ is exploring the potential benefits of a CBDC, which they say could include:

- Increased efficiency and security of payments

- Improved financial inclusion

- Greater control over monetary policy

Where is New Zealand With a CBDC?

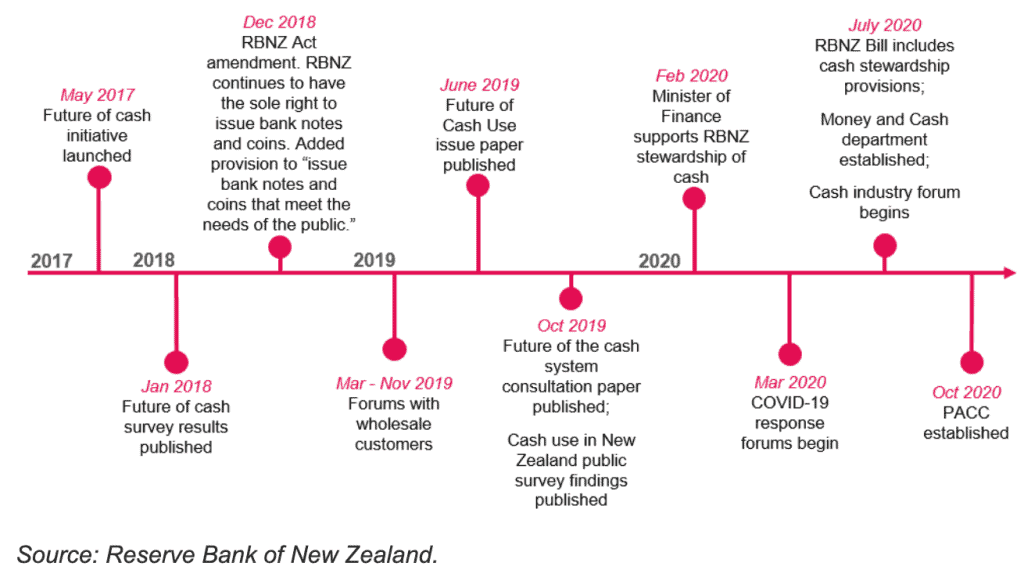

The RBNZ has been exploring CBDCs since at least 2018. They’ve issued discussion documents and conducted public consultations to gauge interest and potential implications. In 2023, they launched a second consultation focusing on the design and positioning of a potential CBDC.

RBNZ’s CBDC Development Timeline:

Here’s a timeline of what the RBNZ has released so far in terms of looking at CBDCs, but also the future of cash. As to us they seem closely related…

November 2017 Crypto-currencies – An introduction to not-so-funny moneys – Would it “be feasible for the Reserve Bank to replace the physical currency that currently circulates with a digital alternative.”

June 2018 In search of gold: Exploring central bank digital currency: “Currently, it is still too early to determine whether a digital currency should be issued”

June 2021 Statement of Intent 1 July 2021 – 30 June 2024 “We will consult the public on the high-level public policy cases surrounding CBDC and develop a work plan to test the perceived benefits and challenges.”

July 2023 Stage 2 of 4 stage process: “exploring high level design options for the CBDC, and their costs and benefits.” “The Reserve Bank (RBNZ) is years away from deciding whether it wants to introduce a central bank digital currency (CBDC) in New Zealand.” Source.

April 2024 Whereas now in 2024 they say: “New Zealand’s money must innovate to stay relevant and useful and ensure our monetary sovereignty.” Consultation is now open to the public with a survey and consultation documents. So you can go and have your say ( for what it’s worth).

Quite a lot has happened since 2018 including some legislative changes as shown below. Changes to the way cash is used seems inevitable.

To us it seems the CBDC is being positioned as the “obvious answer” to the reduction in cash usage. A CBDC will “solve” all these issues such as not enough bank branches or ATMs. Along with the rising per transaction cost as less cash is used.

But the removal of cash is not better for the public. But then again a monetary system based upon debt isn’t either. Neither is the requirement of yearly loss of purchasing power through inflation. But we still have both of those currently!

The real risk of the loss of cash is that the public no longer has an escape from the likes of negative interest rates. It also makes it much easier to implement the likes of “helicopter money”. This may even be how citizens are “encouraged” to take up the CBDC. Maybe we’ll be “given” some free CBDC in exchange for signing up for their new RBNZ “e-wallet”.

Whereas from the governments perspective, a major benefit of a CBDC is that they can track exactly what money you are receiving and spending. They could also effectively freeze someone out of the system. Plus bank runs become impossible as you can’t withdraw cash.

Future of Money

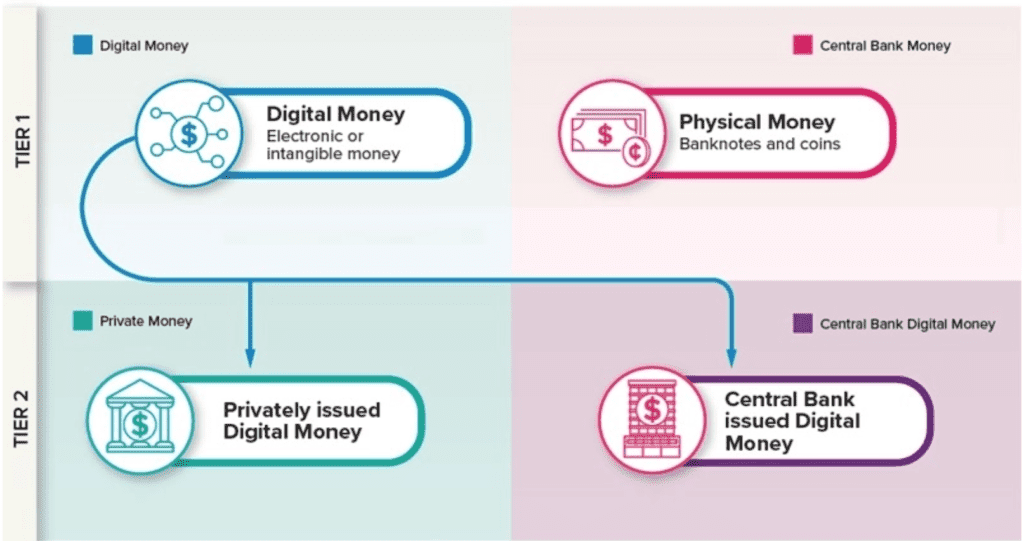

On the RBNZ website under their “Future of Money” section is a page with a simplified explanation of what “money” is – well, according to the RBNZ anyway.

They outline how the fall in the use of cash means they need to come up with another way to ensure everyone has access to their “central bank money”.

They explain the difference between current central bank money (i.e. cash) and private money (currency held in a commercial bank account).

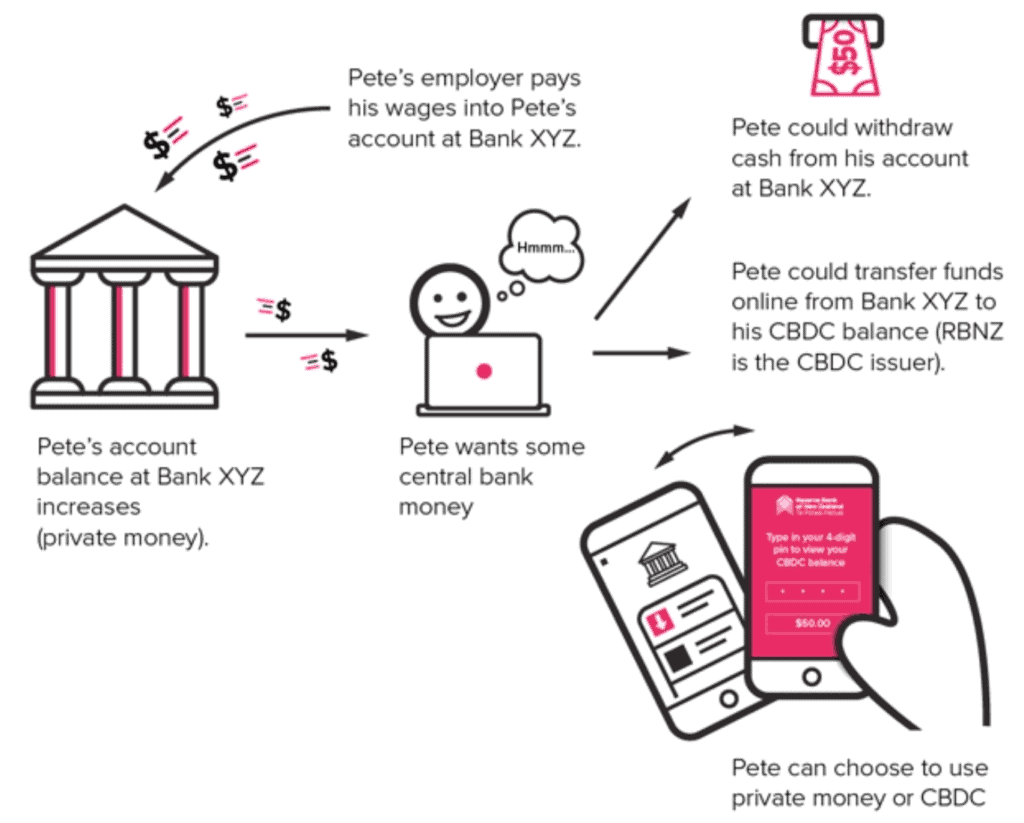

The RBNZ explainer then outlines how a new central bank digital currency would work alongside cash.

They end with this statement:

“If New Zealand was to have central bank digital currency (CBDC) it would exist alongside cash. People could choose to access their CBDC balance, rather than their private money account, to make online payments. CBDC would be similar to private money because it would be digital, but would be less risky than private money. CBDC could be accessed and viewed digitally, for example, it might be accessed using a phone app.”

Why Would People Choose a CBDC Over Commercial Bank Currency?

However the RBNZ doesn’t really get into why people would choose a CBDC over the current private money, other than to say it is “less risky”.

But, there is a very real risk to commercial banks if a CBDC were to exist. They may eventually find they are simply not necessary!

Our guess is that we will be incentivised to use the CBDC. We may be offered some for free to increase the uptake. There could also be requirements like potentially having to use it to pay taxes.

Given the ability to track your transactions with a CBDC, you could take up any “freebies” and then just use that to buy run of the mill everyday items like groceries etc.

Reading Between the Lines

We think you need to “read between the lines” when it comes to what central banks are saying about CBDC’s.

Because the rationale for the implementation of a central bank digital currency is couched in the need to “better meet the needs of the public”.

The Reserve Bank uses flowery terms such as a “new stewardship mandate for cash and a broader currency system that supports the prosperity and wellbeing of New Zealanders“. The RBNZ’s new focus on climate change and also incorporating Maori culture are other distractions from what the central bank really does. That is to guarantee a loss of purchasing power of the Kiwi dollar every year. “Inflation targeting” might sound good. But a guaranteed loss of purchasing power of the Kiwi dollar every year is what it actually means.

But we got a little sidetracked there. Can we do some reading between the lines to see where all this central bank digital currency talk may be heading?

To us there are a few key points dotted amongst the many press releases from the RBNZ on the topic of CBDC.

But this looks to be the main reason for this monetary system review. Namely to, “…ensure the role of fiat money is preserved into the future”. Because the central bank would have no reason to exist if fiat money didn’t exist!

Global CBDC Landscape: How many Central Banks Are Planning Their Own Digital Currencies?

However, New Zealand isn’t alone in exploring CBDCs.

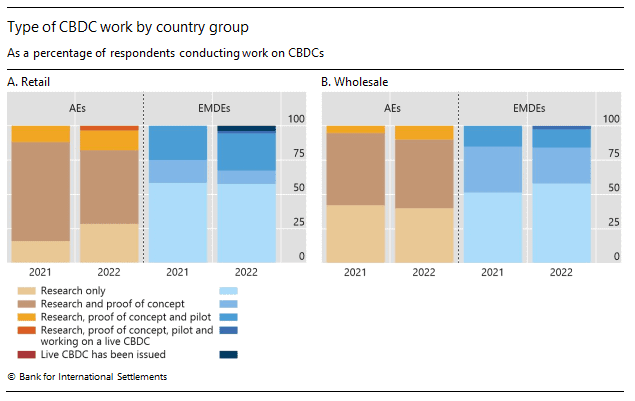

According to a 2021 survey by the BIS, the RBNZ was among the 86% of central banks investigating CBDC’s. While 60% were experimenting with the technology and 14% were deploying pilot projects.

But the latest BIS survey results published on 10 July 2023, showed that

“the proportion engaged in some form of CBDC work has risen to 93%” and that “about a quarter of central banks are piloting a retail CBDC.”

“…In addition, this paper shows that most central banks see potential value in having both a retail CBDC and a fast payment system, and that there could be 15 retail and nine wholesale CBDCs publicly circulating in 2030.”

What are the (Unmentioned) Downsides to a CBDC?

While CBDCs offer potential benefits (although mostly just to the central planners!), there are plenty of drawbacks to consider:

- More control over the currency and economy.

- Cybersecurity risks: A CBDC system could be vulnerable to hacking or cyberattacks.

- Potential for financial exclusion: Not everyone has access to the technology needed to use a CBDC.

- No privacy – all your spending would be tracked.

- Social credit scores – A CBDC would be a lethal combination to use with social credit scores. This is where citizens are scored on their behaviour and potentially are restricted from purchasing certain items. A CBDC could allow the government to stop you from making certain purchases or even lock your funds if you weren’t perceived to be behaving in the right way.

- Programmed expiration – CBDCs could be programmed to be valid for a limited time, with the aim to force currency into circulation during times when an economy is stagnant.

This move towards CBDC’s is likely a part of the wider and longer running “war on cash” which is being waged because it allows the government to do a number of things:

- Track and tax every payment you make or receive – there is no “cash economy”, no “cash jobs”

- Freeze deposits and then bail-in deposits in case of a failing bank – see here for more on what happens to your deposits in a bank failure in New Zealand

- Enact negative interest rates without people escaping to cash

- No bank runs – Once all money is digital, there can’t be a run on a bank anymore. You won’t be able to remove your money if you see it coming in advance.

If New Zealand Introduces a CBDC, How Will Precious Metals be Valued and How Will One Use Them?

A CBDC May Be Inevitable – But That Doesn’t Mean it Will Work

So it seems likely a CBDC of some sort will arrive eventually. With some already being piloted elsewhere, it seems they are inevitable. But, just because CBDC’s are implemented, it doesn’t mean they will “work”. They are merely a change in the current fiat currency environment. Not a fix. As to us it seems the system is on its last legs anyway.

The RBNZ “Future of Money” release unwittingly explains the issues with fiat currency when they say:

“Why is central bank money so special?

…central bank money underpins the trust and confidence in private money. We call this acting as a value anchor for private money. This value anchor is the reason everyone, irrespective of the money they use, is able to transact in New Zealand dollars with confidence and the reason we can use monetary policy to help keep prices stable and employment at the maximum sustainable level.Secondly, because everyone can use it, cash contributes directly to financial and social inclusion.

Value anchor

Central bank money is a value anchor because:– It allows people to easily work out what their private money is worth

– People know they can convert their private money 1:1 into cash whenever they want, so they are willing to trust the private IOU that underpins private money.

This “value anchor” is exactly where fiat currency fails! $10 may always be $10. But $10 earned today is not likely to buy the same amount of stuff 10 years from now. That is what more and more people are starting to realise. That is why the RBNZ definition of money falls short. They are talking about currency – as in a unit of account and medium of exchange. But the New Zealand dollar fails in the other feature that money needs – that of a store of value.

So that leads us into a few questions on the topic of CBDCs and gold from readers…

Suzanne: With this new digital currency system they are talking about, how will gold or silver be useful?

Chris C: If NZ were to introduce a CBDC, how will precious metals be valued and how will one use them?

Lorna: When our money is digitalised and every purchase we make gets tracked, will we be stopped from buying gold and silver?

If a CBDC Exists How Will Precious Metals be Valued?

In much the same way as they are now we’d say. That is, an oz of gold or silver will still have an NZ dollar “price” attached to it. This price is likely to rise as it has been since the early 2000’s, as the central bank currency continues to be devalued. A CBDC will be an alternative to cash. Supposedly it will be available to use at the same time as cash. It would seem unlikely that it will affect how gold or silver is valued. Just as implementing a CBDC won’t really affect the pricing of everyday goods and services. Well not any more than the inflationary effect we already have anyway.

So we don’t see there being much impact on how gold and silver is valued. But it may increase the demand for gold and silver (and therefore the price) as a CBDC may be even easier to inflate through helicopter drops direct from the central bank.

Therefore, valuing gold and silver would still be best done by comparing them to other tangible assets such as property, shares etc. Rather than an elastic measure in dollars.

For more on this topic see:

Dow Gold Ratio: How Does Gold Compare to Shares For the Past 100 Years? Where to From Here in 2021?

NZ Housing to Gold Ratio 1962 – 2021: Measuring House Prices in Gold

NZ Housing to Silver Ratio 1968 – 2021 – Measuring NZ House Prices in Silver

If a CBDC is Created How Will Precious Metals be Used?

Again our answer is much like they are currently. That is, as a store of value and as an insurance against financial crisis and loss of purchasing power.

As explained above, a CBDC is likely to come with the same issues that cash currently faces – loss of purchasing power.

So it’s likely people will continue to buy gold and silver as a hedge against this. You will simply swap your CBDC for physical gold and silver, just as you do your commercial bank currency in your bank account currently.

When you want to “spend” your gold or silver you could exchange them back into a CBDC or alternatively swap them for another asset you’d like to own. Or maybe you will wait until the monetary system completely changes (as we think it will) and then “spend” your precious metals.

Related: Why New Zealand Won’t Have Any Say in a Global Currency Reset

CBDCs could also increase the already high demand for gold as central banks and governments themselves look to protect the value of their own national currencies.

If a CBDC is Created Will We Be Stopped From Buying Gold and Silver?

Well nothing can be discounted. Although we don’t necessarily think it will come to this.

But if this level of financial repression were to take place, then you may well be very glad to already hold some physical gold and silver! As it would be likely that the fiat currency and CBDC would be losing significant value.

Also, history shows us that in times like these, people have a way of finding alternatives and black markets arrive. Maybe this is why we have seen an increase in silver coin purchases in recent years?

Conclusion

All we have written so far is a best guess based upon logic and taking a bit of history into account. There are no guarantees how any of this plays out.

But it seems that CBDCs are looking pretty inevitable given how widespread the planning of them is worldwide.

We still hope for our preferred monetary system, a decentralised free market for money. Where people would decide how they wish to transact with each other. See: The Gold Standard & A Free Market For Money: What Do We Think About It?

But overall, we think CBDCs are in fact likely to speed up the inevitable change in the monetary system. As it will awaken more people to the problems of a centrally controlled currency. An even more centrally controlled currency is pretty much guaranteed to make things worse.

Editor’s note: This post was originally published 24 November 2024. Updated and expanded 8 May 2024 to include:

Reading Between the Lines, RBNZ’s CBDC Development Timeline, What are the (Unmentioned) Downsides to a CBDC?, Global CBDC Landscape: How many Central Banks Are Planning Their Own Digital Currencies?, and If a CBDC is Created Will We Be Stopped From Buying Gold and Silver?

I am hoping to learn more and buy gold ASAP. Any help will be greatly appreciated!

Hi Richard, You can email us via our contact page https://goldsurvivalguide.co.nz/ask-us-a-question/ or phone 0800 888 465 with any queries you have. Cheers

Pingback: The Queens Death and N.Z. Currency - Gold Survival Guide

Thanks for all your helpful articles! I just wonder – given the way we are hurtling towards ever more losses of choice and rights (WHO Pandemic Treaty, the very recent potential “Ministry of Truth” censorship tyranny etc – that they might simply outlaw private ownership of metals and demand we relinquish them. Especially if they haven’t been bothered to store any themselves. In which case, preparing and becoming one’s own bank won’t help us. What are your thoughts on this level of risk? Many thanks!

Sophie

Hi Sophie, We have written on this subject previously. So check out this article for our thoughts on confiscation: https://goldsurvivalguide.co.nz/gold-confiscation-could-it-happen-in-new-zealand/

CBDC is just about the government trying to control every aspect of our lives, criticize the government and they will freeze or wipe your bank account- this is happening overseas…

Hard to argue with you Roger. Yes the social credit system is already underway in China. Not something we’d want to replicate here that’s for sure.

Pingback: Crazy Low Silver Price Forecasts = Silver to Have Big Rise? - Gold Survival Guide

Great article. A major Bullion dealer in Australia (I won’t mention their name) told me last year that the banks told them that all Aussie banks will be cashless by November this year.

Can you please elaborate on why you think this? >”Or maybe you will wait until the monetary system completely changes (as we think it will) and then “spend” your precious metals.”<

Do you think DBDC's are temporary or set to fail?

Hi Liv, We simply mean that when the monetary system resets or changes, it’s likely gold will have reached full valuation by then. Hopefully CBDCs are set to fail, they might well speed up the failure of the monetary system as they will likely amplify the frailties of it.

Pingback: Why Buy Gold in 2024? No Fiat Currency Lasts Forever - Even the NZ Dollar. Devalued 7 Times in 17 Years... - Gold Survival Guide