Prices and Charts

Gold Correction Underway – How Much Further?

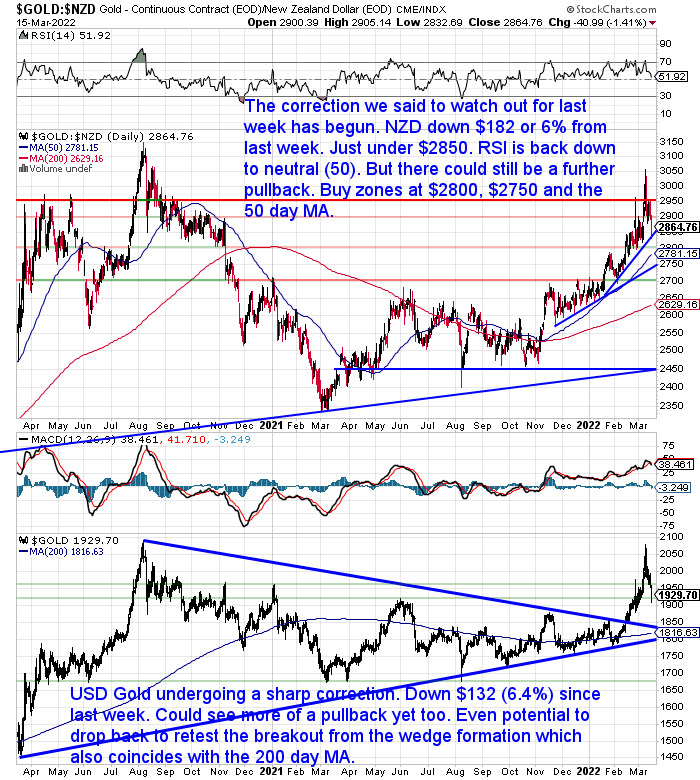

The gold correction we said to watch for last week is now underway. After such a sharp spike it is not a big surprise to see a pullback. So far it is pretty short and sharp – down NZ$182 or 6% from 7 days ago. The RSI overbought/oversold indicator is back down to neutral (around 50), so the fall in price has had the needed effect.

However we could yet see a further pullback. The next buy zones to watch for are $2800, the 50 day moving average (MA) at $2780. Then $2750 and a major horizontal support line at $2700.

If you’re sitting on the fence, then consider breaking up your purchases into a number of tranches. Buy some now and some at any of those areas if we see them.

From our “insiders” perspective, we did see an uptick in demand when gold spiked higher in the last couple of weeks, but it was not that significant an increase. So that to us says this could be a short sharp correction before the upward trend resumes.

Silver Correction – Close to Over Already?

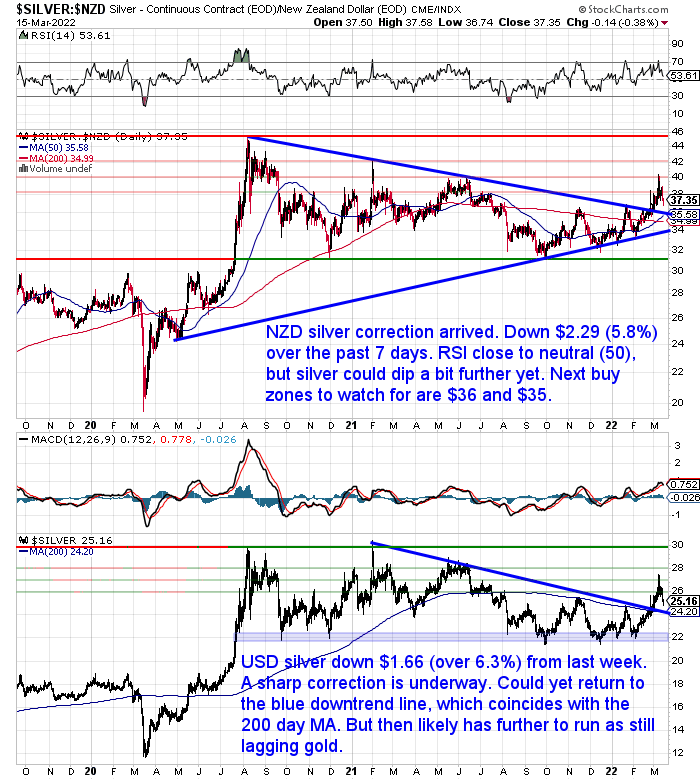

Silver is also down nearly 6% from a week ago. In NZD terms that’s a hefty $2.29 per ounce.

Like gold, the RSI is also back down to neutral. But again, we could yet see a further fall. Perhaps down to retest the breakout above the downtrend line? That mark also coincides with the 50 day moving average around $35.50. So you could consider buying from here down to the $34-$35 range.

Once this pullback is over, then it will likely be onwards and upwards again.

NZ Dollar Still in a Downtrend

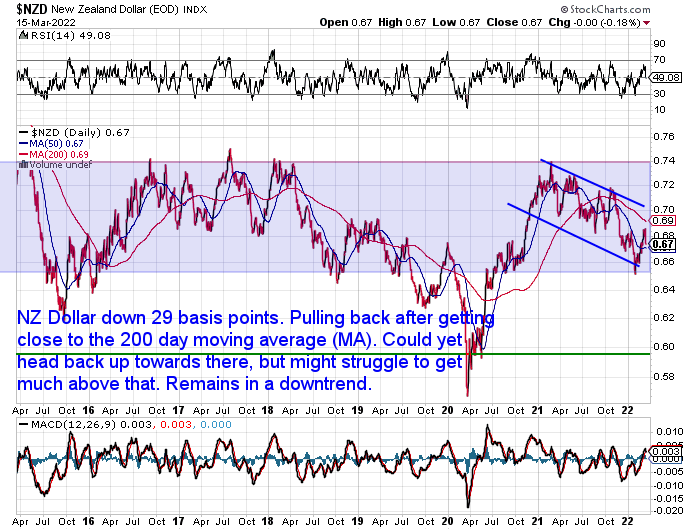

The New Zealand dollar is down 29 basis points from last week. Pulling back after it got close to the 200 day moving average. It likely will head back up to test that again before long. But overall the Kiwi remains in the downtrend it has been in for the past year.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Pre-order Now – Shipment Due 18 March

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Societal Breakdown: Are Gold and Silver Coins Better Than Tradable Items Like Tools, Water and Wine? 2022 Update

While we don’t think it’s necessarily that likely, many people still like to think and plan for the worst case scenario. That would be a complete societal breakdown. Here’s an excellent question on this topic:

“Considering the variety of things that might become tradable in the event of a breakdown of society, I wonder what might be the advantage of gold or silver coins over other tradable items such as tools, water or bottles of wine (for example), since the average person could not be expected to have all the technology required to authenticate the purity of materials claimed to be silver or gold but might easily recognise basic tools, clean water or wine?”

In our answer we cover:

- What You Should Buy Before You Buy Gold or Silver

- What is the Advantage of Gold and Silver Over Tradable Everyday Necessities?

- How Would Purity of Gold and Silver Coins Be Authenticated in a Societal Breakdown?

- When Exactly Are Gold and Silver Most Important and Useful?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

High Petrol Prices – It’s All Putin’s Fault! (Or is it?)

The government this week did an about face after initially saying there wasn’t a cost of living crisis in New Zealand. Cutting fuel taxes and public transport costs for 3 months.

The Prime Minister said:

“the crisis in Ukraine had brought about a “global energy crisis”.

Ardern said that while the crisis was not the responsibility of the Government, it would try to alleviate some of its most immediate costs.

“We cannot control the war in Ukraine nor the continued volatility of fuel prices, but we can take steps to reduce the impact on New Zealand families,” Ardern said.

Source.

Russia accounts for 10% of global oil production. Of course it is at the margins of supply that can affect price. Oil prices obviously have spiked since the invasion.

But it’s not accurate for politicians to blame high petrol prices solely on the Russian invasion. Just convenient.

Petrol prices have been rising for over a year. The chart below plots petrol prices in Auckland from 2018. We can see they took a dive at the start of the Covid panic in March 2020. But then they recovered. Since early 2021 petrol prices have been climbing, with a spike in February as Russian troop build ups increased on the Ukraine border and then the Russian invasion. But they had already risen from 2.11 in January 2021 to 2.83% on the 28th January 2022. A rise of 34%.

Also consider that food prices are up 6.8% in February.

“Prime Minister Jacinda Ardern may not think it is a crisis but the cost of living for most Kiwis took another hit after annual food prices rose a whopping 6.8 percent in February. The results, released by Stats New Zealand on Friday, were the largest annual increase since July 2011 and are going to make managing the household budget harder for a lot of Kiwis.

Read more

Maybe Central Banks and Governments are the Problem?

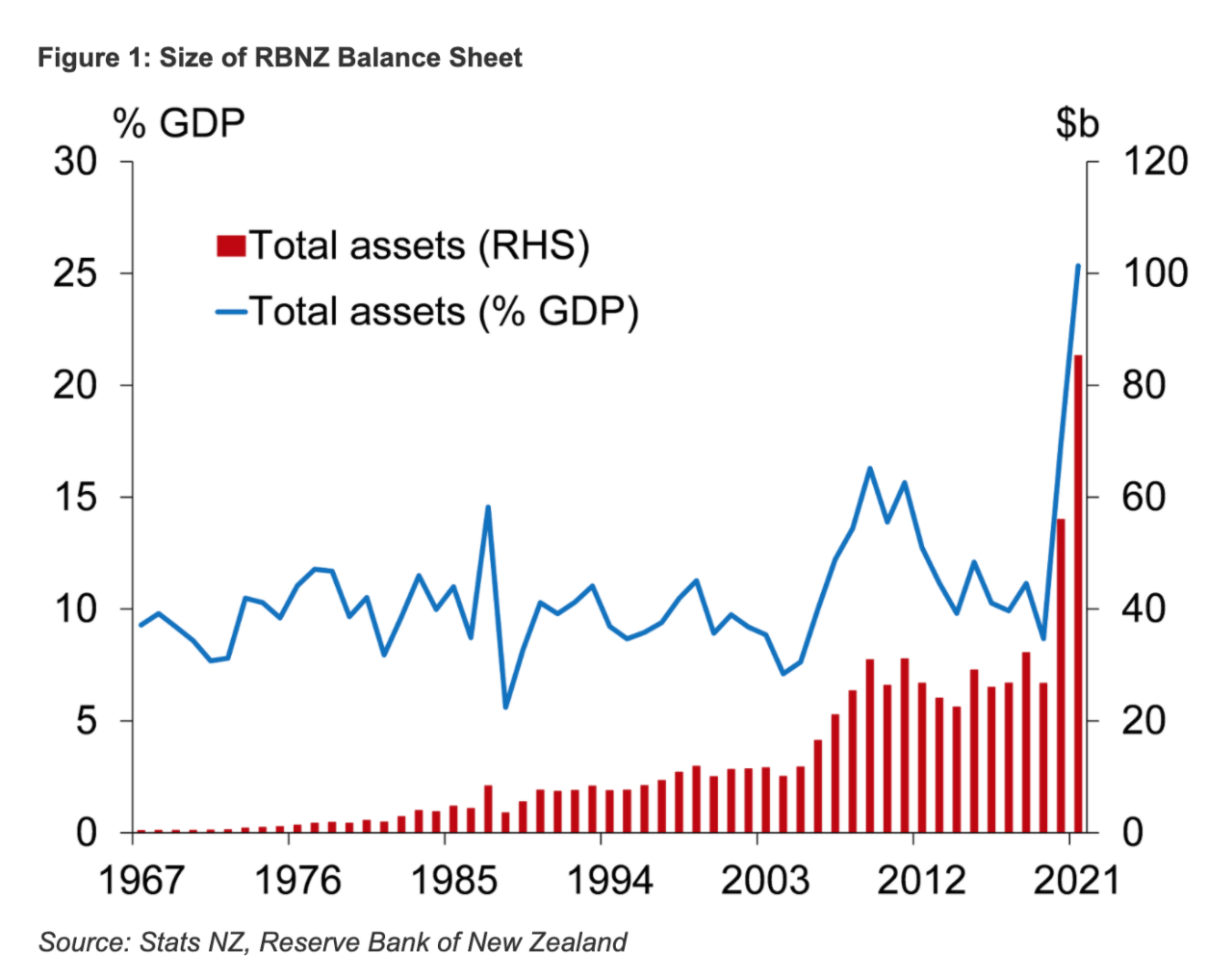

Our bet is that these increases in prices are mostly caused by the sharp increase in central bank balance sheets across the planet, the RBNZ included. You’ll recall that the US Federal Reserve doubled its balance sheet in the 2 years since Covid reared its ugly head. From $4 trillion to over $8 trillion.

The Reserve Bank of New Zealand (RBNZ) did even better in percentage terms. For the first time the RBNZ kicked off its own large-scale asset purchase (LSAP) program. AKA quantitative easing/currency printing.

As a result the RBNZ balance sheet ballooned from $24.5 billion pre-Covid in December 2019, to $89 billion at the end of 2021. An increase of over 3.6 times.

Source.

We said back on 23rd February when discussing the potential for a war in Ukraine:

“…maybe things are being set up to be able to blame inflation and rising fuel prices on those pesky foreigners?”

That certainly looks like being the case.

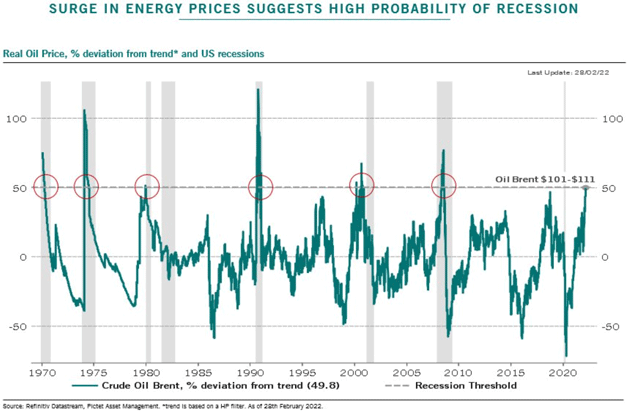

Recession Coming?

But the cause of the rise in fuel doesn’t really matter now. It’s already here. The effect is probably more important to consider. A recent article by John Mauldin contained this chart which shows past recessions have been preceded by a spike in oil prices. A global recession looks likely to be on the cards now.

We’ve already got the inflation. So, next it seems will be the stagnation. In the style of the old 1980s kids show the electric company, put them together and what have you got? – stag… flation…. stagflation!

For a long while we’ve been saying we think a repeat or a rhyming of the 1970’s was likely. As each month passes that is now looking more likely.

Our guess is we are entering a similar phase to that of 1973-74. What does that mean?

- A nasty stock market correction – already underway but likely to get worse.

- Oil prices up but likely to go even higher. Maybe a double?

- All commodities rising in price. So basic everyday necessities will also rise in price. CPI will go higher.

- As the stock market continues to fall and commodities continue to rise, more people will rotate from shares to commodities, further reinforcing this cyclical change.

- Interest rates will go higher still – but can indebted governments and citizens handle this?

That is a major difference between now and the 1970’s. Debt levels are so much worse across the board that there might be a limit to how high interest rates can go. So real (after inflation) interest rates could go much more negative yet.

Just when everyone thinks we can put Covid in the rearview mirror and things can get back to “normal”, they’ll be hit by rising inflation, rising interest rates and a stagnating global economy.

When recently increasing the OCR the Reserve Banks said:

“Headline CPI inflation is well above the Reserve Bank’s target range, but will return towards the 2 percent midpoint over coming years. The near-term rise in inflation is accentuated by higher oil prices, rising transport costs, and the impact of supply shortfalls.”

The inflation of the 1970’s didn’t end in 2 years. It took a whole decade.

How likely do you think a return to 1-2% inflation is within the next couple of years? If you think that is likely, we’ve got a bridge to sell you…

If you don’t then we could offer you some gold or silver instead…

Please get in touch if you’d like a quote.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: We should not expect inflationary pressures to ease soon - Gold Survival Guide

Pingback: Why the NZ Super Fund Should “Invest” in Gold - Gold Survival Guide