Prices and Charts

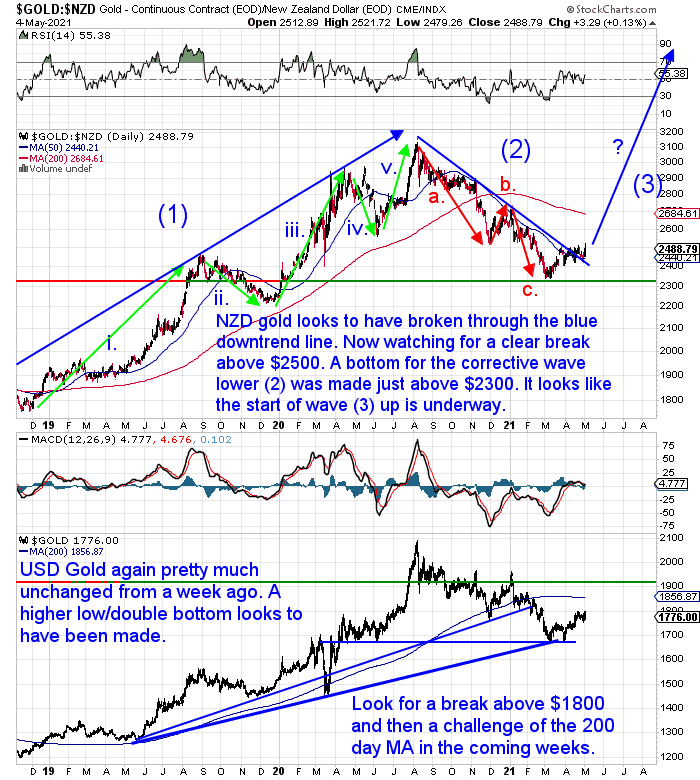

NZD Gold Breaking Above Downtrend Line

Further confirmation this week that the bottom seems to be in for gold in New Zealand dollars. The local NZ gold price has clearly broken through the blue downtrend line dating back to August last year.

We are now watching for a clear break above the round number of $2500. But it seems the next up-leg is underway.

Likewise on the USD section of the chart below, we are also watching for a clear break above the key $1800 level. But it also looks to be back in an uptrend.

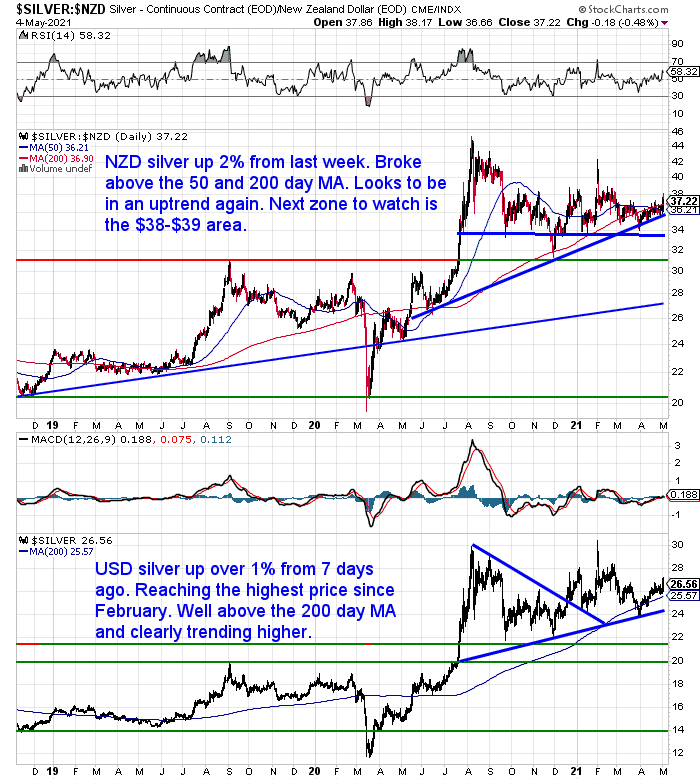

Silver Breaks Above Key 50 & 200 Day MA’s

Silver in New Zealand dollars this week broke clearly above the key 50 and 200 day moving averages (MA). Reaching the highest price since February. $38 is the next level to watch for now. Silver is clearly back in an uptrend. Once the $38-$39 region is broken, we could see $42 quite quickly.

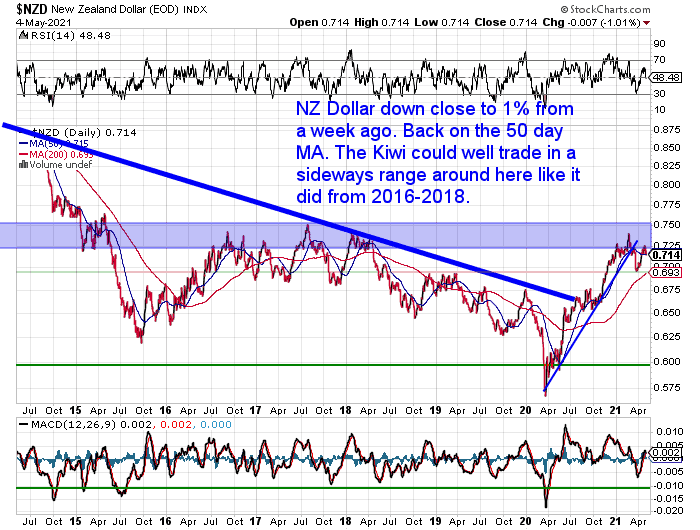

NZ Dollar Down as USD Bears Lose Some Ground

The Kiwi dollar is down close to 1% from 7 days ago. Back on the 50 day moving average line. While most people remain very bearish on the US dollar (which would lead to a stronger NZD), we think we could just see a sideways range like we did in 2016-2018. More on this below…

Zero Hedge’s “Market Ear” report today made some good points about the US dollar…

“Our dollar logic stays intact, the DXY is not a trending asset, and should be traded from a mean reversion point of view.

Pushing momentum is for losers when it comes to the dollar.

As we wrote in late April;

“Over past sessions, we have received an increasing amount of emails, all pointing out the [US] dollar should trade lower…Time for another contrarian bounce set up in the dollar, just when everybody turned bearish again?”

Since then the DXY has traded up, and is putting in a big up candle today, trading above the short term trend line. Nothing wow, but definitely frustrating for the most recent “shorters” (chart 2).

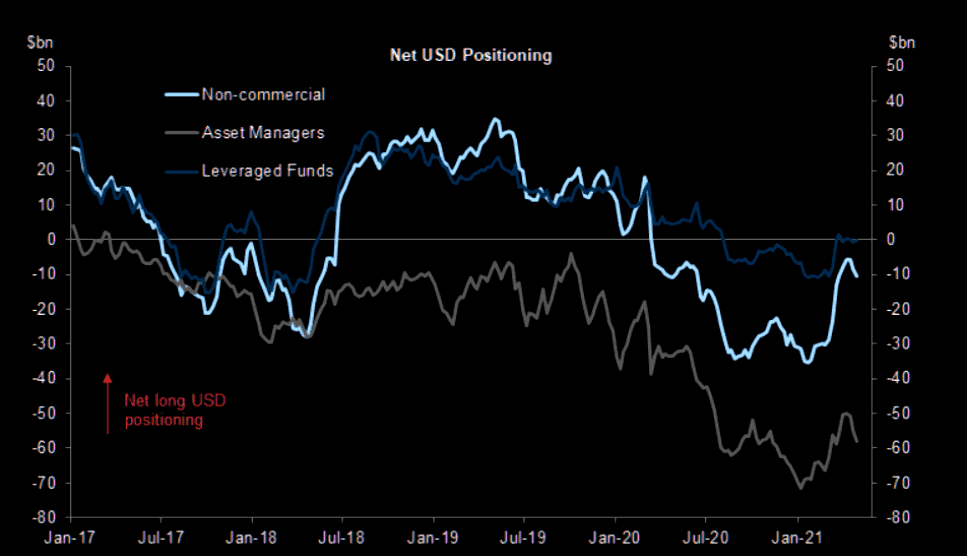

“Trends in CFTC FX futures data over the past eight weeks have been defined by significant reductions in JPY, CHF, NZD & EUR length, and the concurrent unwind in USD shorts. USD net positioning now stands at -10.5bn (-0.7-sigma), which compares to -5.7bn two weeks ago and peak shorts of -35.3bn this year.”

Basically this shows when everyone is on one side of the boat, it doesn’t take much of a move back in the other direction to cause the boat to roll sharply back the other way.

The shorts on the USD are down from records earlier this year but are higher than they were here a couple of weeks ago. Hence the recent move back down again in the Kiwi dollar.

This overall theme that “the US Dollar should be lower” is what made us say back in early January in our guesses for 2021:

“We get the impression that just about everyone is negative on the USA currently. Likewise most are expecting the US dollar to continue to fall and maybe even to lose its role as the global reserve currency in the near future. But when everyone is thinking the same markets like to surprise! So while we may see the NZ Dollar continue to rise against the US dollar in the early part of 2021, our guess is that by the year end it will have reversed course and be headed down. That may seem unlikely right now but our experience says currencies often do the unexpected.”

Hence our current thinking that the Kiwi may just trade in a sideways range for the next little while, like it did from 2016-2018. Those still looking for a big move lower in the US dollar may be in for a surprise.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

NZ Housing to Gold Ratio 1962 – 2021: Measuring House Prices in Gold

Housing continues to gain headlines here in New Zealand – as it always does. Take the recently announced government removal of the tax deductibility of mortgage interest on investment property. The discussion continues around the impact on house prices of this move. While interest rates are held down, our guess is many people will still continue to want to hold real estate. And if inflation picks up (more on this below) then that could also help push (nominal) house prices higher.

However we prefer to measure housing with a non elastic ruler. So here’s where the NZ housing to gold price ratio comes in.

We’ve updated this in response to a recent reader question – thanks Hamish:

“Is there any link to Gold and/or Silver prices and NZ house prices? Many people investing in Gold and Silver will have property portfolios and stocks in the share market. The relation between Gold and Silver and the stock market is a little more obvious, but if house prices were to plummet would this be linked to rising Gold and Silver prices, thus reducing the risk of your property portfolio? or would they both plummet?”

With regard to his final query:

“…but if house prices were to plummet would this be linked to rising Gold and Silver prices, thus reducing the risk of your property portfolio? or would they both plummet?”

We would say no we wouldn’t expect metals to plummet if house prices did. If gold and silver did fall did it might be a short term drop followed by a rebound. Like we saw with silver last year in the March COVID panic. Also in the 2008 crisis the same thing occurred. Metals fell before bouncing back. The ratio charts show that when housing has peaked, the metals have often been lower priced. Conversely when property bottoms metals are more likely to be fully valued. So peaks in each asset have often been a good time to move over into the other asset class. As the Housing to Gold article points out.

Here’s what’s also covered in it:

- How to Calculate the Housing to Gold Ratio

- Comparing the NZ Housing to Gold Ratio to the UK and USA

- Could NZ House Values Drop by 85 Percent?

- Comparing Some Numbers: If the Ratio Falls What Price Could Gold Reach?

- Paper Currency Varies – Gold Does Not

- Summary – Using the Housing to Gold Ratio

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

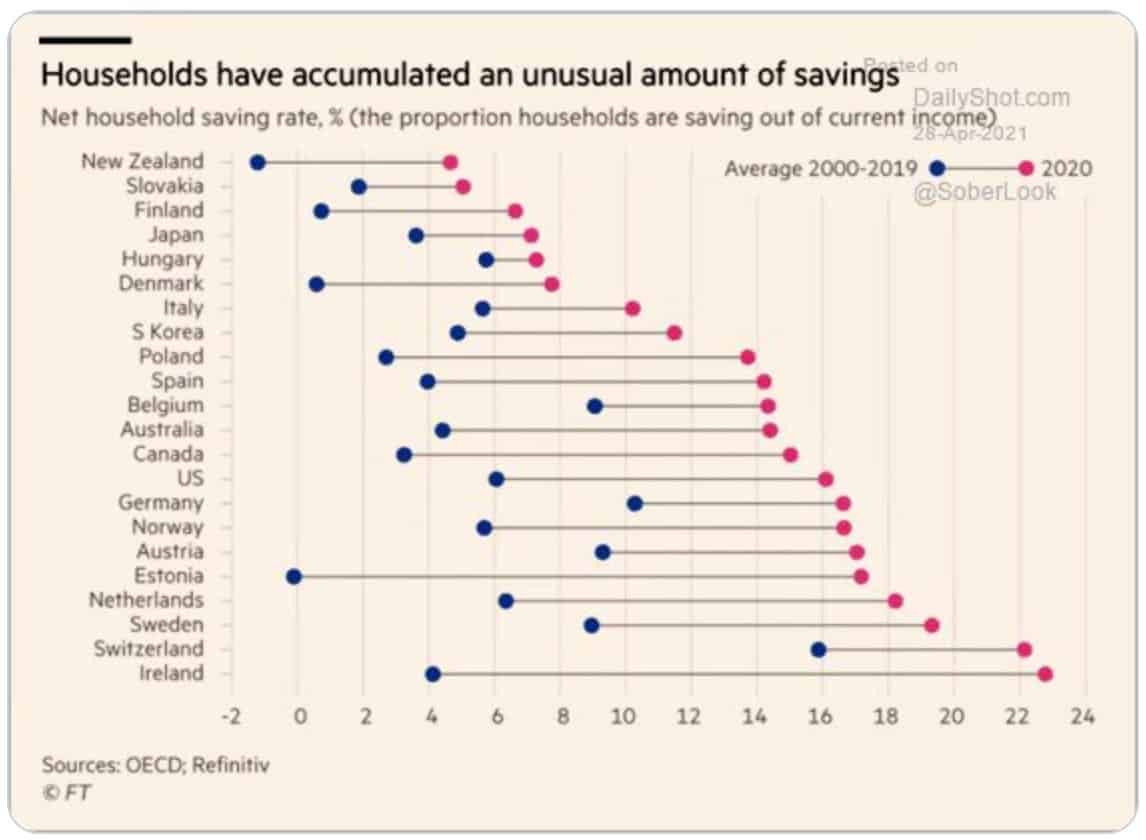

NZ Saving Rate Jumps – But Still the Lowest in OECD

Despite a big improvement from the 2000-2019 average, New Zealand still has the lowest household savings rate from the below list of OECD countries. Last year it moved from an average negative savings rate from 2000-2019 to just below 5%. But as the chart below shows this is still the worst out of 22 countries.

Of course, household savings may not be much help if inflation continues to rise and steadily eat into those savings…

Buffett: Inflation is Rising, and it’s Being Accepted

Zerohedge reports on the recent Berkshire Hathaway shareholder meeting…

“Speaking to Berkshire’s millions of shareholders on Saturday, Buffett said that he was surprised by the “red hot” US economic rebound and warned the company was being hit by inflationary pressures.

“We’re seeing very substantial inflation,” the 90-year-old billionaire who apparently does not have a Fed charge card, said in his nearly 6 hour long address to investors. But it’s what he said that was especially ominous: “It’s very interesting. We’re raising prices. People are raising prices to us and it’s being accepted.”

Why does this matter? Because the ability to pass on price increases and have them stick, means the surge in prices will not be transitory, no matter how many times the Biden admin, the Fed or the Treasury lie and vow the opposite.

Buffett’s comments came one day after the US revealed that household incomes rose by the most in recorded history in March as the latest round of Biden stimmies hit bank accounts.

…“It just won’t stop,” Buffett added. “People have money in their pocket and they’ll pay the higher prices…. There’s more inflation going on that people would have anticipated six months ago or thereabouts” he added.

Source.

The Law of Unintended Consequences

Have you heard of the Cobra effect? A Bear Trap report on Zerohedge stated:

“We believe we are at the early stage of the biggest Cobra Effect in the history of economics. As the massive monetary and massive fiscal stimuli (over $15T globally) conjoin to save the economy from a deflationary depression, instead they risk hyperinflation – overweight commodities.”

Source.

The Cobra effect refers to the unintended negative consequences of government actions. The name comes from the Indian government’s attempt to remove cobras from India. Where the government reward system actually led people to breed snakes at home to claim the reward!

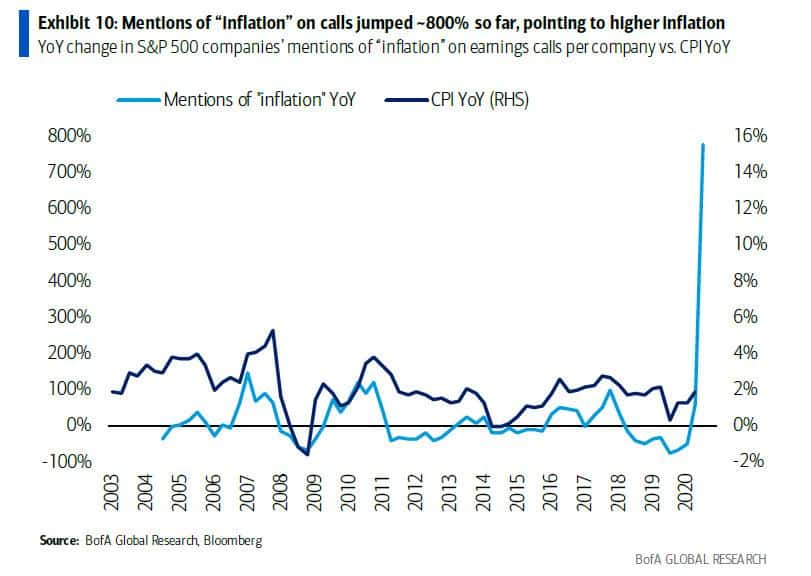

Bank of America: USA May Experience Hyper-inflation Soon – But Will Be “Transitory”

Hyper inflation may sound unlikely in a developed country like the USA. But this week a Bank of America report said it’s coming soon… but will be “transitory”:

BofA’s Savita Subramanian writes, after the third week of earnings [ie. earnings calls from listed companies]. mentions of “inflation” have now quadrupled YoY; and after last week, mentions have jumped nearly 800% YoY!

While the implications are obvious, we leave it to Bank of America to explain what this means:

On an absolute basis, [inflation] mentions skyrocketed to near record highs from 2011, pointing to at the very least, “transitory” hyper-inflation ahead.”

…Because if there is one thing hyperinflation is, it’s “transitory.”

So the transitory argument seems to be in stark contrast to Buffett’s theory that inflation is here to stay. We wouldn’t agree with everything the “oracle” has to say. But Berkshire Hathaway’s businesses are well placed to read what is going on in the US economy. So we’d go with him over a bank economist.

Speaking of hyperinflation in the USA. Jason is the winner of our silver coin for April with his question on how hyperinflation in the USA would affect NZ:

“What do you reckon would happen to the NZD direction and NZ interest

rates if hyperinflation were to occur in the US?”

Check that out here if you missed it:

How Would Hyperinflation in the USA Affect New Zealand?

Do you have enough inflation proof assets?

If not, let us know if you’d like a no obligation quote to see how the buying process works.

The 1kg ABC silver bars are a very good deal at the moment – but only 140 of them…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Record Gold Imports into New Zealand as Investors Seek Haven - Gold Survival Guide

Pingback: We Should Not Expect Inflationary Pressures To Ease Soon - Gold Survival Guide