Gold Survival Gold Article Updates:

26 Feb, 2015

This Week:

- Beginners guide to technical analysis

- Emergency Food NZ launches

- Got a question on gold or silver?

Prices and Charts

| Spot Price Today / oz | Weekly Change ($) | Weekly Change (%) | |

|---|---|---|---|

| NZD Gold | $1599.04 | – $2.63 | – 0.16% |

| USD Gold | $1205.36 | – $3.10 | – 0.25% |

| NZD Silver | $21.99 | + $0.17 | +0.77% |

| USD Silver | $16.58 | + $0.12 | +0.73% |

| NZD/USD | 0.7538 | – 0.0007 | – 0.09% |

Gold and silver have had a week of consolidating after the pull back from January’s highs.

As can be seen in the table above with percentage moves of less than one percent for both metals regardless of whether they are measured in US or NZ dollars.

After a sharp move higher the NZ dollar also was flat from a week ago.

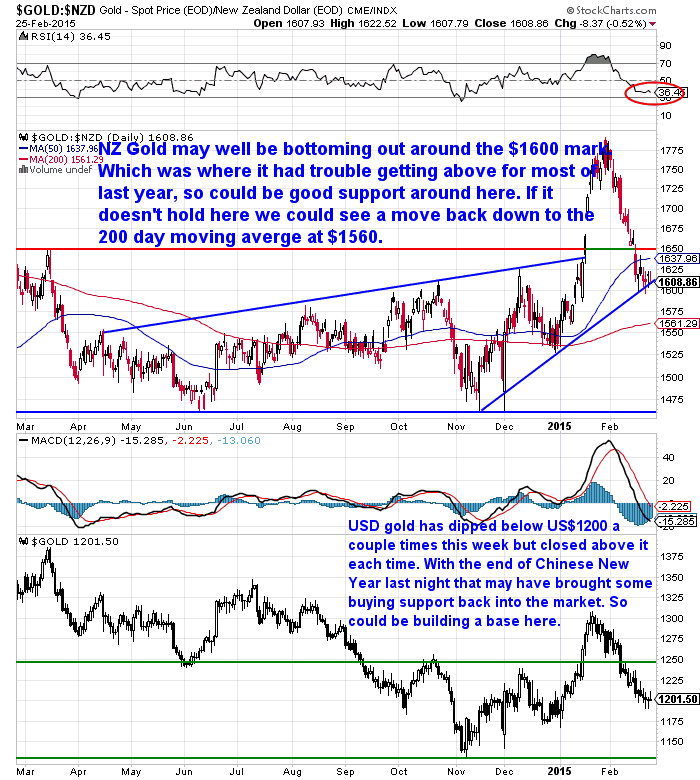

As you can see in the NZD gold chart below, we are currently sitting on the uptrend line from back in November. The RSI indicator has moved from really overbought to close to oversold. So there is a good chance we are bottoming out around here.

If not the next stop should be the 200 day moving average (MA) at around NZ$1560.

The 50 day MA line (Blue) crossed above the 200 day MA (Red) in August last and has remained above it since then. This is a broad indicator of bull (or rising) market. You can see that since then the NZD gold price has been trending slowly higher – albeit with a decent plunge down to test the lows in November last year.

So gun to our head, we remain of the opinion that, particularly in NZ dollars, gold has likely bottomed out and slowly trending back up. No guarantees of course, but odds favour that we reckon.

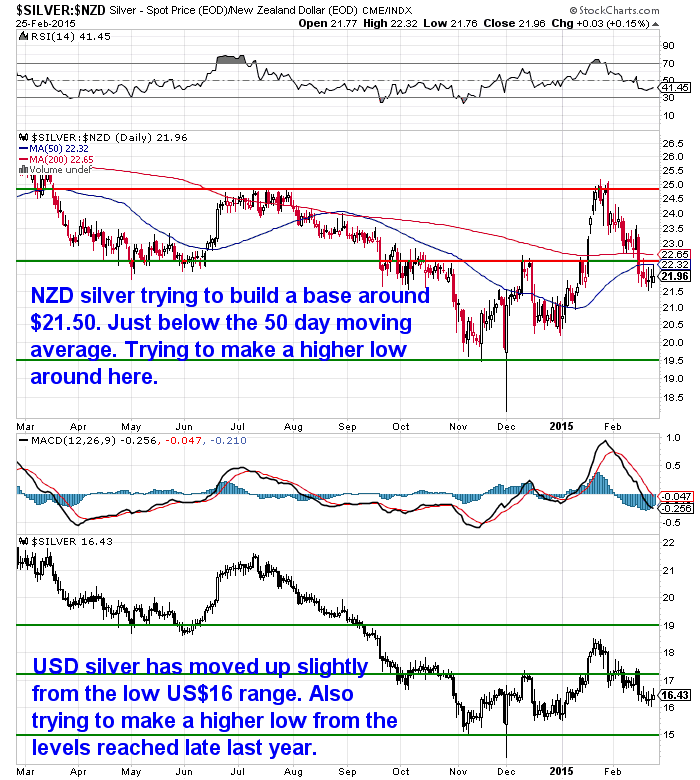

How about silver?

Well, it’s not quite as convincing as gold on a technical level anyway. While it too looks to be trying to eek out a higher low around current levels just under NZ$22, it is not so clearly in an uptrend longer term – yet.

Like NZD gold, the 50 day MA did cross above the 200 day MA in August last year, but soon after dipped back below it. It remains just below it now. So that indicator of a rising market has not been properly triggered yet.

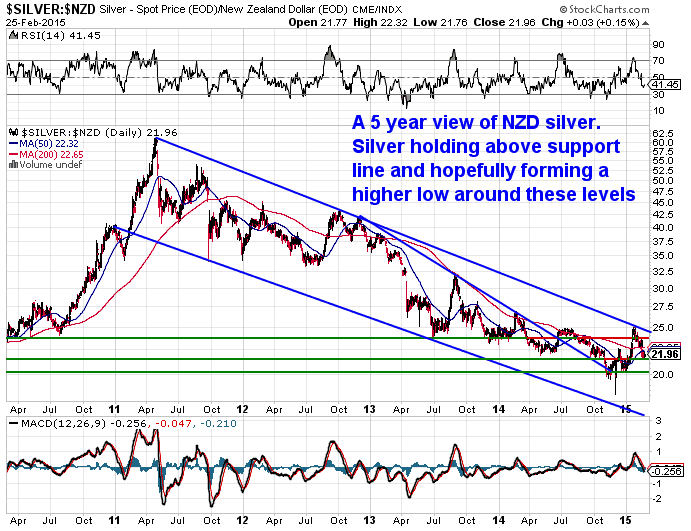

Also, the longer term chart below – from our daily price alerts – shows NZD silver is still in the downtrend it has been for more than 3 years. It did touch on the downtrend line in January, and if it keeps moving slowly up or even sideways from here, before very long it will break out of this trend too. But again – it is hasn’t yet.

Technical Analysis – What is it?

If you’re somewhat new to our site, then you might still be trying to get your head around various terms. Like support and resistance, RSI, MACD etc.

These are all technical analysis terms which in essence is really just taking buying and selling signals from what charts are saying.

We’ve had a couple of questions from people lately so thought we’d do a bit of a technical analysis run down today.

First Though, Technical Analysis – Why bother?

We had an excellent question on this last year from a client. Which prompted us to write a whole article on the subject:

Reader Question: “Why Bother With Technical Analysis if Gold & Silver are Manipulated?”

If you don’t want to read that – in a nutshell our answer was that there are still plenty of people that follow charts. Therefore there is an element of a “self fulfilling prophecy” about it. If enough people take notice then it is worth taking into account still.

Another thought which now springs to mind is that there’s a good chance most of the sellers of gold and silver had been purged from the market, with prices falling for the last few years. So any manipulations in the futures market by big sell orders are not likely to have such a significant impact on prices now as they may have in the past.

So that said, onto a few technical indicators we’ve covered in the past…

200 Day Moving Average (MA) and Relative Strength Indicator (RSI)

We covered these 2 indicators in this video:

Gold and Silver New Zealand | A beginners video guide to technical analysis

Or if you prefer to read, also in an article:

NZ Dollar Gold and Silver A Beginners Guide to Technical Analysis

Moving Average Convergence Divergence (MACD)

For a definition of the Moving Average Convergence Divergence (MACD) indicator, see this article from last year (It also shows how it can be used as a timing indicator):

Gold and Silver Technical Indicators Flash “Buy”

But that article also shows that these types of indicators are just guides, as silver actually fell further even after this indicator was “tripped”.

Here is another one looking at the MACD indicator on a monthly chart:

Another Gold Indicator Flashing Buy – 80% Gains Ahead?

We actually took an updated look at this chart in last weeks newsletter too in case you missed that. See “Number 3” here:

3 Reasons NZD Gold May Have Bottomed Out

There are a myriad of other technical indicators to track, but those are the basics we like to keep an eye on. As we’ve said in many of the articles above we don’t think just looking at charts in isolation is necessarily the best move.

But given they track where the price has been, by using them you can at least give yourself the chance to buy at potentially lower risk times.

So as we we’ve noted over the past couple of weeks, there are a few indicators showing that gold in particular is trying to edge higher from here.

If you agree then get in touch for a quote.

Emergency Food NZ Finally Launches

In case you missed it on Monday we have launched our new Emergency Food and Preparedness site…

For well over 6 months in our weekly gold & silver updates we’ve mentioned the long life emergency food we’ve been looking to offer.

Well, we’re finally there and can at last share the details.

http://freezedriedemergencyfood.co.nz/

But while this started out as just Emergency Food, we’re now expanding to more of an emergency preparedness/survivalist niche.

We’ve also personally got interests in being prepared for the unexpected along with natural health, independence, and off the grid living. As do many of the people we talk to each day about being prepared with the financial insurance that is gold and silver.

So you don’t just have to be interested in emergency food to check this out.

If you’ve got any interest in these other areas then head on over and sign up to our weekly Emergency Preppers Tips newsletter.

If you’d like a taste, here’s one of our recent blog posts that’s proven popular on facebook:

10 Smartphone Apps for Emergency Preparation & Survival Use

http://freezedriedemergencyfood.co.nz/10-smartphone-apps-emergency-preparation-survival-use/

A final thought: What else are you interested in?

What products would you like to see available to help you be better prepared for the unexpected? (Whether that be a natural disaster or a man made monetary one).

Give us your feedback as we’re looking to source other emergency preparedness products and would value your opinion.

Drop us an email or give us a call on 0800 888 465.

Got any questions on gold or silver that need answering?

Have you been thinking about buying gold or silver, but just aren’t quite sure about it?

Do any of the following sound like you?….

- I want to buy but my family doesn’t get it?

- I’ve been looking for a few years, but can’t quite make up my mind?

- I know somethings wrong with the system but I don’t know quite what to do?

- I seem to be all on my own and don’t know who to talk to?

- Should I buy silver or gold?

- What ratio of each?

- What percentage of my net worth should be in silver & gold?

- What about coins vs bars and local vs imported?

- Should I go to the trouble of buying physical gold and taking delivery?

- Why should I trust you?

- How do I know the gold or silver are authentic?

- Where should I store it?

- I want to keep some in Australia – can I do that via you?

- Do I pay GST?

If any of these (or any others) are on your mind then give us a call on 0800 888 465 (+64 9 281 3898 outside NZ).

We get plenty of questions like these. And there is no such thing as a stupid question – except the one that isn’t asked!

We’re real people on the other end of the line and happy to share our thoughts.

While we can’t give you advice we can share our personal thoughts and actions.

So pick up the phone and let us know what you need answered.

Or just reply to this email and we can give you a call back.

We look forward to speaking with you.

Free delivery anywhere in New Zealand and Australia

We’ve still got free delivery on boxes of 500 x 1oz Canadian Silver Maples delivered to your door via UPS, fully insured.

Todays price is $13,295 and delivery is now about 7-10 business days.

| This Weeks Articles: |

|

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| Today’s Spot Prices

Spot Gold |

|

| NZ $ 1599.04/ oz | US $ 1205.36 / oz |

| Spot Silver | |

| NZ $ 21.99 / oz

NZ $ 707.15 / kg |

US $ 16.58 / oz

US $ 533.05 / kg |

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy |

Note:

|

| Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

Our Mission

|

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) Ph: 0800 888 465 From outside NZ: +64 9 281 3898 |

|

|

| The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2013 Gold Survival Guide.

All Rights Reserved. |