Prices and Charts

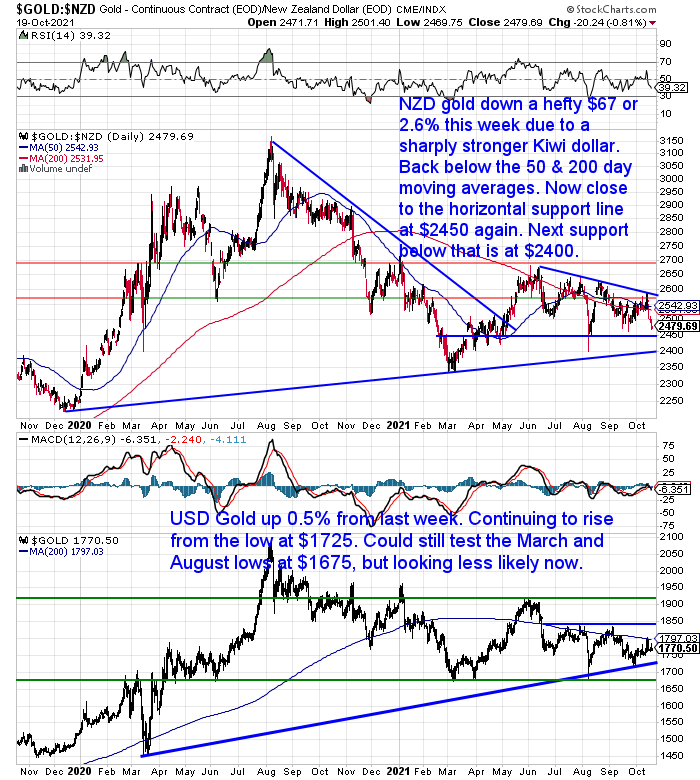

NZD Gold Plunges $67 Since Last Week

Gold in New Zealand dollars was down $67 or 2.6% from 7 days ago. This fall was solely due to the sharply stronger Kiwi dollar. More on that below.

Today the NZD gold price is back close to the horizontal support line at $2450. Also close to the lows from last month and back in August. Our guess is we are not far from bottoming out yet again. Especially because the Kiwi dollar is getting close to overbought. And of course a weaker NZ dollar will result in a boost to the NZD gold price.

Whereas USD gold is actually up about half a percent from last week. Continuing its rise off the low at $1725.

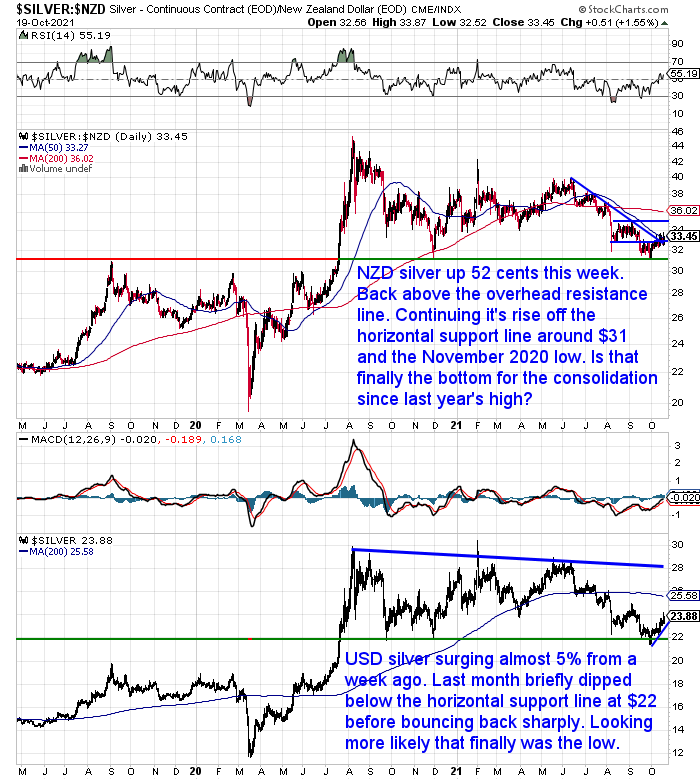

Silver Sharply Outperforming Gold Last Week

In contrast to gold, and despite the surging Kiwi dollar, silver in New Zealand dollars was up 62 cents or 1.59% from last week. NZD silver is back above the blue horizontal support/resistance line. Continuing its rise off the support line at $31, which also coincided with the November 2020 low. We are starting to think we may have finally seen the bottom for silver. There is a good chance we will see silver continue to outperform gold in the coming weeks. We now need to see a challenge of the overhead resistance line at $35.

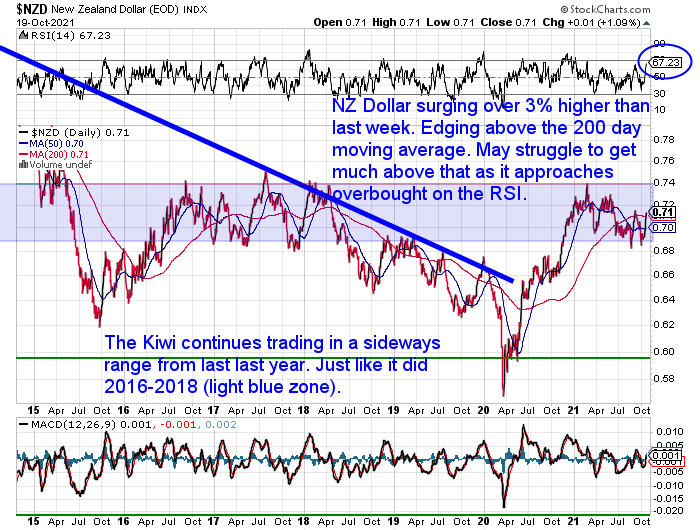

NZ Dollar Surges Over 3%

As noted already the big mover of the week was the New Zealand dollar. The Kiwi was up over 3% from 7 days ago. Edging up above the 200 day moving average, but now also getting close to overbought. So we doubt it will get too much higher than around here in this current move up.

Also the Kiwi could still rise another 2.5 cents (250 basis points) and it would still be in this large sideways trading range. So that could continue for some time yet.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

CPI Jumps to Highest Level Since 1987

On Monday the latest Consumer Price Index showed a surge of 2.2 per cent in the September 2021 quarter, much more than economists had expected.

“Excluding quarters impacted by increases to GST rates, the September quarter movement was the highest since the June 1987 quarter, which saw a 3.3 per cent rise, Stats NZ said.

Annual inflation was 4.9 per cent in the September 2021 quarter when compared with the September 2020 quarter.”

Source.

Economists might not have been expecting it, but higher prices shouldn’t come as a big surprise to our readers. As we have been warning of this for some months now. Here’s just some of what we’ve written in the topic on inflation this year.

Feb 2021: Inflation in 2021 and Beyond: What’s Different to 2009?

May 2021: Could a Record High NZ Crown Settlement Account Boost Inflation in NZ?

June 2021: Why Even if Inflation is “Transient” It Won’t Be. Huh?

June 2021: Copper to Gold Ratio: What Can it Tell Us About Inflation?

The NZ Herald report goes onto say:

“Globally, inflation has been on the rise, driven by pandemic-related production and shipping delays.

Most economists expect it to peak as restrictions ease globally over the coming months, although it is likely to take longer to fall back into the Reserve Bank target range of 1-3 per cent.”

We still have our doubts as to whether inflation will dissipate as quickly as “most economists” expect.

Higher than predicted inflation stats could be part of the reason for the jump we have seen in the New Zealand Dollar this week. As traders might think interest rate rises could come faster to combat higher consumer prices:

“While we think the recent surge in inflation should start to abate in the year ahead, the strength will surely be worrying the RBNZ, supporting the case for further rate hikes,” said Ben Udy of Sydney-based Capital Economics.

“We had already expected the RBNZ to continue hiking rates despite the Auckland lockdown. But the strength in consumer prices in Q3 will surely nudge the Bank towards an even more aggressive hiking cycle.”

We also have our doubts whether the RBNZ will be as “aggressive” in their rate hikes as the bank economists are calling for. Our experience so far, with the current iteration of the RBNZ, says that the once very conservative central bank is now much looser than it used to be.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

GST on Gold and Silver Bullion: Might the NZ Government Start Adding GST to Gold and Silver Bullion?

As noted already, GST may have been the cause of the biggest jump in the New Zealand CPI 10 years ago. So let’s continue on the GST theme today…

GST on gold and silver bullion is not quite as simple as a blanket yes or no. It depends upon the purity, so you can end up paying more if you buy the wrong product.

In this feature article you’ll discover:

- How There is No GST On Pure Gold and Silver Bullion

- But, There is GST on Some Common and Well Known Gold Coins

- The History of the Rules Covering GST on Precious Metals

But along with facts on GST, we also answer this reader question of the month from September:

“Would the NZ Government start adding GST to gold bullion anytime soon as I understand it is not applied at the moment?”

If we had to bet on it, we’d say the bottoms are finally in for gold and silver. The New Zealand dollar could continue to strengthen a little further. So in the short term we could see local prices still dip a little lower. But our best guess (still a guess mind you), is that we are at the beginning of the next move up in precious metals. Making now a likely good time to be adding to your insurance.

Local refinery operations continue under Level 3. But dispatches to Auckland addresses and collections have been suspended as goods cannot be inspected, counted or signed for by the customer.

Dispatches will stored and insured free of charge until it is safe again to dispatch them and signatures can be obtained. When we drop down a level, you will be advised when your order is ready to collect and to book in a collection time to ensure an adequate distance between customers.

Although, currently imported orders are continuing to be delivered via Fedex. So that is an option if you are looking to spend more than around NZ$10-15,000.

Please get in contact if you’d like a quote or have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|