Prices and Charts

Gold Down Almost 4%

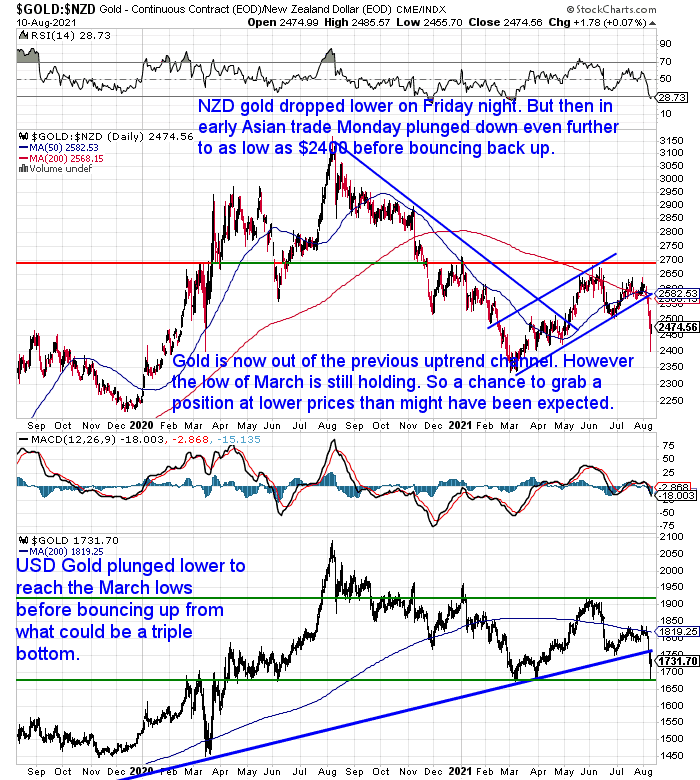

It has been an eventful past week for precious metals. On Friday night in US markets gold plunged lower to break below the uptrend line. Then in early (and thinly traded) Asian markets Monday morning, they were whacked even further down (more commentary on these shenanigans below).

As a result gold in New Zealand dollars is down just under 4% from 7 days ago. It has now fallen out of the uptrend channel it had been in. Bottoming out around $2400 before bouncing back, NZD gold did not reach the March low. Gold remains oversold today with the RSI well under 30. We’re now watching for gold to mount some kind of a comeback from these levels. That would create a higher low from the March bottom.

Silver Plummets 8%

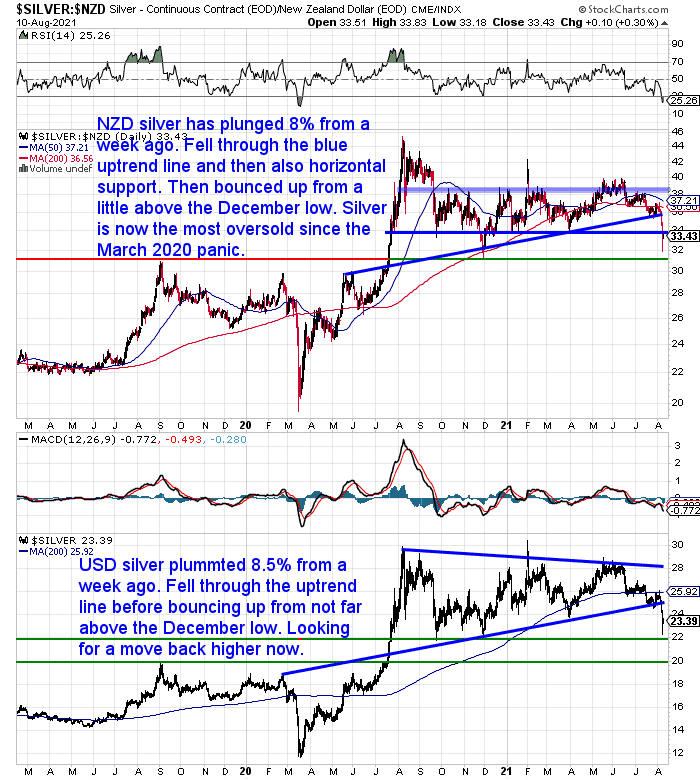

As is usually the case, silver took even more of a toweling than gold. Now down 8% from a week ago.

Like gold, silver also fell through the blue uptrend line and then also through the next level of horizontal support. NZD silver got close to but didn’t actually reach the December low, before bouncing back up. It’s now sitting close to the previous horizontal support (now resistance line) near $33.50. Silver is also now the most oversold it has been since the March 2020 panic.

So we’ll watch and see if the intraday bottom from Monday at $32 can hold and silver can stage a comeback of sorts.

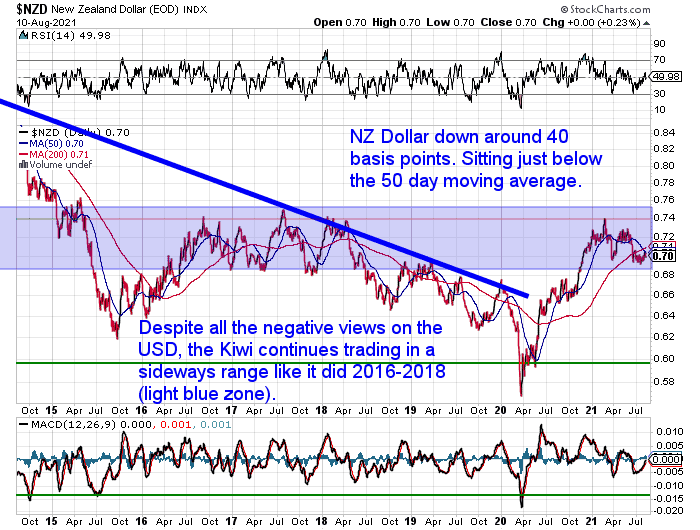

NZ Dollar a Little Lower

The Kiwi dollar was down just over 0.5% this past week. Still sitting just below the 50 day moving average. But the NZ dollar continues to trade in this wide sideways range we have been tracking all year.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Deja Vu – Precious Metals Smashed Lower… Again

So what was the cause of this plummet lower?

On Friday night, US jobs data came out showing the supply of jobs in the US exceeded demand for the first time since the pandemic struck. As a result interest rates went a little higher. This was given as the rationale for the initial plunge in gold. But as ZeroHedges’ pseudonymous Tyler Durden tweeted:

So gold crashed because of this move in real yields?

Real interest rates remain negative and a blip upwards is unlikely to spook everyone that much.

Then things got even more fishy on Monday morning when gold fell almost US$100 in a flash crash.. When $4 billion worth of gold futures were sold in thinly traded early Asian markets as an open market order. This resulted in a “nuking” of what is called the “bid stack”. The existing bids in the futures system.

Now, no one looking to get the best price they could would sell then!

There can be no other reason for such a move than to push the price lower. The seller would know where the bids and stop losses were for other traders.

So they would know exactly how far down the price would go. As a result they could exit their sell orders on the way down. But because the price is still lower than before the flash crash they could also make money by pushing the price below their own short positions.

Then they could also be making money knowing the price would bounce back up as well. So they could go long at or near the bottom.

This would make much more sense than just wanting to lose $4billion. They might have sold $4 billion in what would seem to be a loser’s fashion, but yet still made a profit!

So the only rational explanation for this latest flash crash is manipulation.

Deja Vu – All Over Again

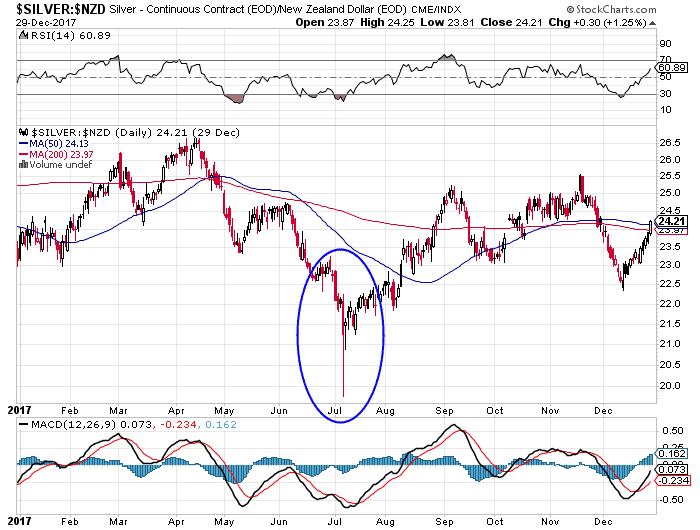

This is not the first flash crash by any means. Back in 2017 we discussed a similar take down: Flash Crash in Silver & a Tale of Two Gold Markets

If you have doubts about the possibility of manipulation, then check out these articles which share the details that GATA have gathered over the years confirming gold manipulation:

Chris Powell: London Update on Gold Market Manipulation

If Precious Metals Prices Are Manipulated, Why Does the Price Rise at All?

Many still dismiss GATA’s theories as tinfoil hat material. However it seems to us not a case of if but rather how widespread the manipulation is.

It is easy to be discouraged at times like these. Particularly if you have purchased at higher prices.

If so then these thoughts from one commentator back in 2017 are worth repeating:

“Keep in mind, if you are of the manipulation mindset, be encouraged that the bullion banks would not be cycling out of massive numbers of short positions if they thought the price was going to go down significantly. One can then rest on the rationale that prices are about to go up.”

That seems like a good argument to us. As it happened, the flash crash back in 2017 did indeed prove to be the bottom for silver at that time.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

July Question of the Month Winner

We forgot to pick the question of the month winner for July last week. So today we can announce that Chris C is the winner with his question:

“What is going on with RBNZ and their decision to stop QE? and what does it mean for PM prices going forward?”

In case you missed it here were our thoughts:

RBNZ Ends Q.E./Currency Printing Early. How Will This Impact Precious Metals Prices?

What Good is a Bar of Gold When the Shelves are Empty?

In January 2020 our sister website – Emergency Food NZ – saw a huge increase in sales of long life freeze dried emergency food. In hindsight, it seems a small group of people started to become concerned about the potential for the Corona Virus reaching these shores much earlier than most. We had sold out of most supplies by February. This was well before many people were at all concerned.

Then, during the March 2020 lockdown we got a taste of how quickly the “just in time” delivery system can be strained. Supermarkets saw their shelves cleaned out of many products. You’ll recall the somewhat bizarre run on the likes of toilet paper! And perhaps more sensibly, flour.

Well, judging by the large increase in sales of emergency supplies we have seen again in recent weeks, it seems the concern is rising once more. Most likely due to the surge in COVID19 cases being reported in Australia, many people are worrying about us seeing similar lockdowns again here.

In light of the return of this issue, the following question from a reader is likely to be of interest to you too…

What Good is a Bar of Gold When the Shelves are Empty?

It covers:

You Can’t Eat Gold

- How In a Monetary Breakdown, the Shelves May Not Fill Up Again

- Even if an Apocalyptic Scenario Doesn’t Happen, Paper Currency Will Likely Continue to be Devalued Due to the Massive Global Debt Load

- Gold (and Silver) Also Acts as Insurance in Case of a Complete Breakdown of the Monetary System.

- But That’s Not to Say You Shouldn’t Also Have Other Necessities Put Aside First

Here’s hoping this latest flash crash plays out the same as it did in 2017 and the bottom is now in for gold and silver.

All we can do is look at this latest fall as a buying opportunity, with prices that may not come around again in a hurry – if at all.

So get in contact if you’d like a quote:

Here’s hoping this latest flash crash plays out the same as it did in 2017 and the bottom is now in for gold and silver.

All we can do is look at this latest fall as a buying opportunity, with prices that may not come around again in a hurry – if at all.

So get in contact if you’d like a quote:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: The Latest on Gold and Silver Manipulation Exposed - Gold Survival Guide

Pingback: RBNZ Cheap Loans Continue - Official Cash Rate On Hold at 0.25 Percent - Gold Survival Guide