Prices and Charts

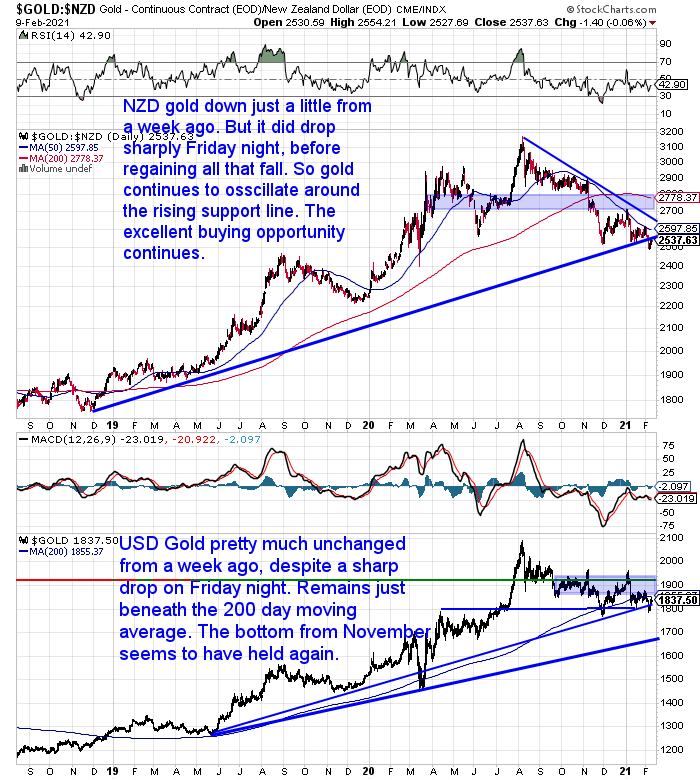

Gold Down But Back Up Again

Not much change from a week ago for gold in New Zealand dollars. However gold did dip sharply over the weekend but then pretty much regained all the move yesterday.

So gold continues to oscillate around the rising support line. An excellent buying opportunity on gold continues.

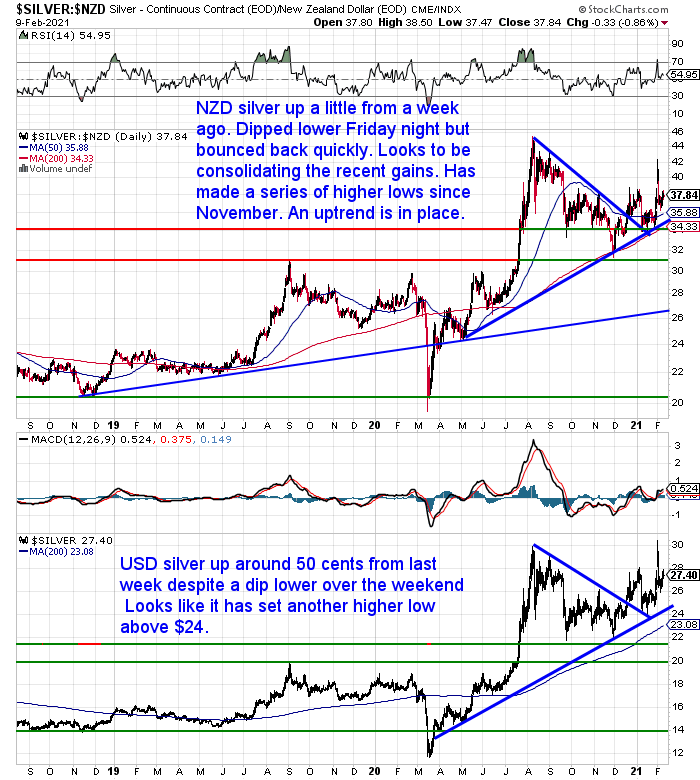

Silver Outperforming Gold Again

Silver did better than gold once again this past week. In New Zealand dollar terms silver was up 1.69%. Like gold silver dipped over the weekend but then also bounced back yesterday.

To our eyes it looks like silver has put in a series of higher lows since the November low. It seems an uptrend in silver is back in place.

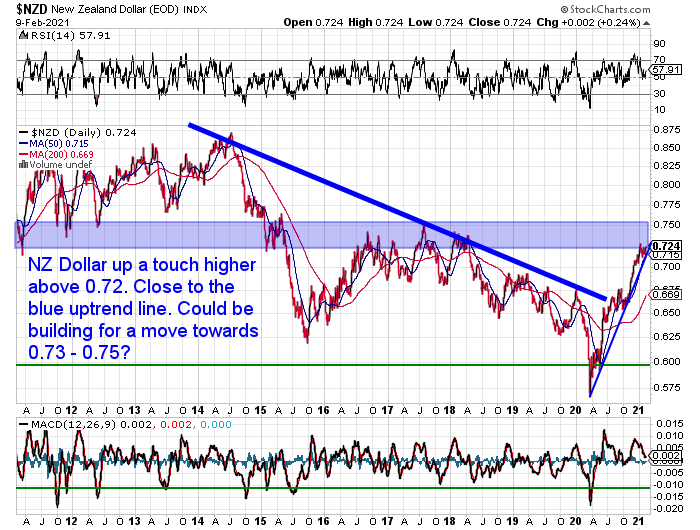

NZ Dollar Up over Half a Percent

The Kiwi dollar was up just over half a percent over the past 7 days. It’s holding at the rising blue uptrend line. It looks like the NZ dollar is building for a move towards the 0.73-0.75 range.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Elon Musk’s Tesla Buys $1.5 Billion in Digital Currencies – Read the Small Print

You’ve no doubt heard the news that Tesla has divested some of their US dollar reserves into digital currencies. Well actually $1.5 Billion is probably more than “some”.

(See here for our preferred method of buying digital currencies. Learn more.)

There has been a great deal of discussion of this announcement but many people (including ourselves initially!) have missed what else was in the stock filing announcement by Tesla.

Although somewhat surprisingly Radio NZ spotted it (hat tip to Roger for forwarding this to us):

“In a stock market filing, Tesla said it “updated its investment policy” in January and now wanted to invest in “reserve assets” such as digital currencies, gold bullion or gold exchange-traded funds.”

Source.

So not just digital currencies, but also Gold bullion or gold exchange traded funds. There has been very little publicity of the gold angle.

Hopefully when/if Tesla moves into gold it is not into exchange traded funds (ETF’s, )but rather into gold bullion itself.

See here for the reason to choose physical gold over paper gold like ETF’s: Paper Gold vs Physical Gold – What Should You Buy The reasons listed are the same reasons Tesla should buy bullion not ETF’s too.

The other thing that Tesla should be doing is moving into physical silver. There are 2 reasons for this:

- They use a lot of silver in the production of their vehicles. So they could hedge the future cost by buying silver now

- By buying silver as a reserve asset on a large scale, they could have a very big impact on the silver price. They could likely disrupt the silver market in a big way. When they made that announcement it would likely push the silver price much higher. Now that would be a really huge move. Much bigger than a move into digital currencies.

So buying silver would be a really disruptive move. Maybe too disruptive for Elon Musk and Co right now?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

If the US Dollar or SDR Was Linked to Gold, How Would This Affect New Zealand?

This move by Tesla will likely nudge other companies to move some funds out of the US dollar.

It is just part of the steady decline in the US dollar to the eventual end as the global reserve currency.

Could the demise of the dollar be circumvented? While unlikely, perhaps it could. One way would be a move back to link the dollar to gold.

This weeks article looks at how this might affect New Zealand, along with also covering:

- How Would a New Gold Standard Come into Being?

- A New Bretton Woods?

- Or a Gold Backed SDR?

- If the World Did Return to a Gold Standard, How Would This Affect Price, Availability and Production of Gold?

- Gold Price is Currently Too Low For a Return to a Gold Standard

- How Would a Return to a Gold Standard Affect Availability and Production?

- Here’s Why New Zealand Couldn’t Peg It’s Dollar to Gold

- How Likely is the US Dollar to Remain the Global Reserve Currency?

- What Else Might the Future Monetary System Look Like?

Update on the Silver Short Squeeze

So far the attempted silver short squeeze seems to be playing out much as we discussed in last week’s article: Will The “Reddit Raiders” Cause Silver to Skyrocket?

As we suspected it might, the price shot up, pulled back but so far not to the same level as we saw prior. It has certainly increased the level of interest in physical silver.

So far the main impact seems to have been this increase in demand for physical silver. The spot price has not been impacted to the degree that the redditors might have hoped. But as we said last week that will only happen when the masses buy actual physical silver.

If you are looking for silver, there are very few silver products available for delivery currently.

In silver coins we only have Royal Mint Britannia and some Perth Mint Kookaburra 1oz coins. Plus our ongoing special of Cayman Islands Marlins. Everything else has not only got huge premiums above spot, but unknown wait times, so we don’t sell any of those.

Silver bars can be locked in but there is a 4 week wait on ABC bars and a 6 week wait on local silver bars.

There are a lot more options available in gold.

Get in touch if you have any questions about buying…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|

Pingback: Current Stock Levels Update - Gold Survival Guide