Well another year bites the dust and as we have done for the past couple, it’s time to review the performance of Gold and Silver in New Zealand Dollars for 2012.

By now you’ve no doubt read that gold (when priced in US dollars) extended its run of positive year end results to 12 years in a row. Quite a feat indeed.

So How Did Gold Fair in NZ dollars?

Due to the strengthening of the NZ dollar versus the US dollar, gold did not rise as much for holders here down under. (Or rather the USD depreciated more than the NZ dollar for the year.)

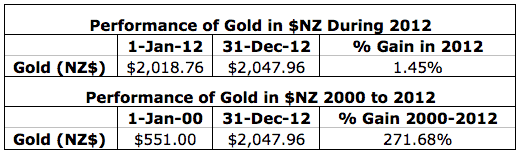

As you can see in the table below, gold in NZ dollars only rose by 1.45% during the 2012. So not adding too much to it’s gains since the start of the millennium. Although these gains do now stand at 271% over the last 12 years.

Performance of Gold in $NZ During 2012

So not a stellar year but still not a loss either.

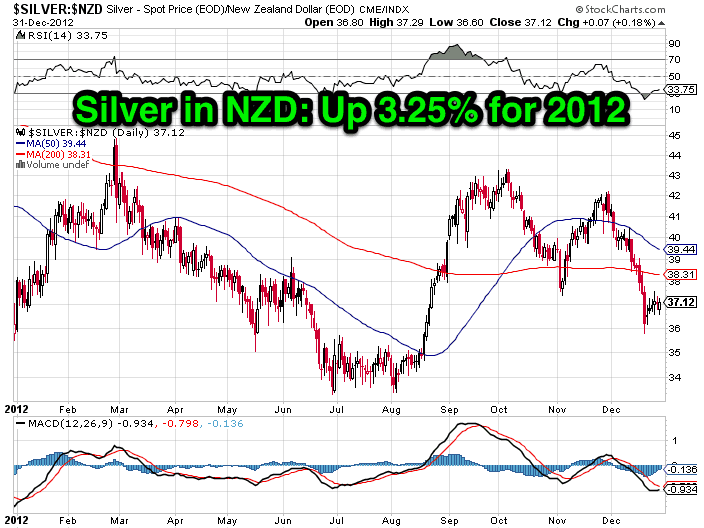

How About Silver in NZ Dollars?

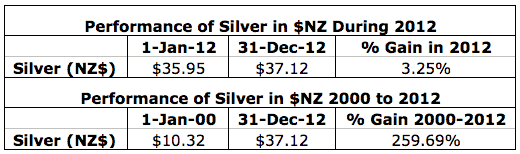

Silver in NZ dollars also didn’t do as well due to a stronger kiwi dollar. Putting in a gain of just 3.25%. So not a whole lot but still solid in a year with plenty of negative talk surrounding the precious metals.

Performance of Silver in $NZ During 2012

The table above also shows that silver has gained a pretty similar amount to gold over the past dozen years at around 260%.

A Look Back Before a Look Forward

We’ll have a crack at some predictions for what they’re worth shortly – more for fun than anything else.

But first we should revisit what we wrote at the start of 2012 to see how it turned out in comparison. No point in make calls if we don’t remind ourselves of them!

Looking in our crystal ball in January 2012 we said:

“Who knows exactly what 2012 will bring – but some surprises are almost certain. It wouldn’t surprise us to see it take a good part of the year before gold and silver beat their previous highs. During previous corrections it has taken many months to get back to old highs. But there’s plenty of uncertainty in the world still. Talk of war with Iran. Unresolved debt burdens in the Eurozone. And the US is again approaching it’s debt ceiling already (Yes in case you’d forgotten it’s not all beer and skittles over there either).

So there’s plenty of catalysts brewing for further gains in gold and silver.

That’s not to say we couldn’t see further falls. As we’ve mentioned before, in the 1970’s gold and silver both dropped by half in the middle of that bull market before the big gains were in.

And like it or not the masses still run to the USD, when things get sticky.”

Half a mark for that maybe. Back then more than a few were predicting new highs for gold and silver not too far into 2012. We did sit on the fence a bit there too by saying they could go down further yet. As it happens we are still to reach new highs in both metals. So since we said don’t expect new highs too fast we’ll give ourselves half a point for that.

We also commented:

“But if we had to guess we’d say we may well have seen the lows in both [gold and silver] already over the holiday break – a big call to make when the years only 10 days old! But as we mentioned earlier if you look at the chart above you can see that when gold dropped below its 200 day moving average (the red line) it was a good time to buy last year, so we reckon that could make now a good time to buy too. We’ll look to see if we have egg on our face a year from now!”

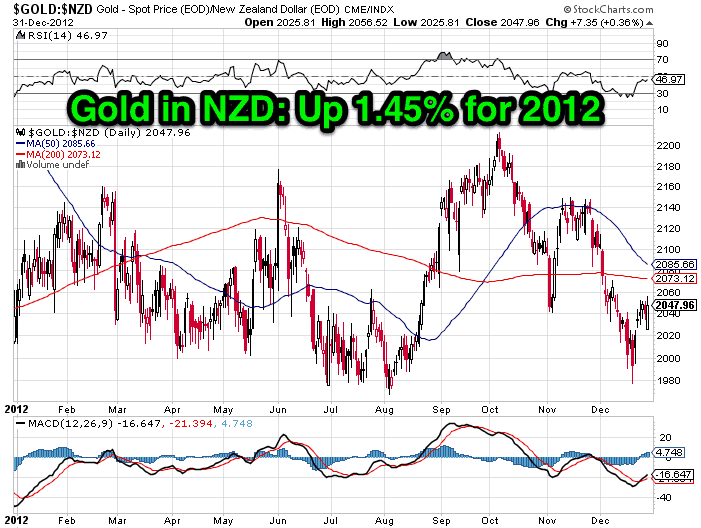

Splat – that is the sound of egg on our faces! As it happens the lows in both metals that occurred during the New Year holidays weren’t the absolute lows for the year. As you can see in the charts below, the lows came from late June to early August. Both gold and silver also weakened again in mid December and again in the past couple of days. Gold in particular, which is right now back again close to the mid year lows.

So no points for us there. Although the mid year lows weren’t too much further down from the low at the start of 2012.

Of course if you bought in the middle of the year when we were saying there looked to be a bit of support at those lower prices you’d be up much more than 1.45% and 3.25% right now.

What May 2013 Bring for Gold & Silver?

So what’s in store this year for gold and silver buyers in New Zealand?

Well things are interestingly poised at the moment. So far what we’ve mentioned in recent weeks is holding true, in that the NZ dollar has generally weakened when the big falls in gold and silver have happened. Thereby negating some of the impact of the falls.

As we’ve mentioned the past couple of days in our daily price alerts, both gold and silver are sitting close to what have been strong levels of support over the past year. So will these hold?

To be honest we wouldn’t be surprised to see them fall further yet. With the likes of Jim Rogers and Marc Faber both thinking gold may have further to fall yet it would be remiss of us to disagree with them. As we’ve mentioned many times in the past gold did fall 50% in the middle of the 1970’s bull market. Something that has not happened so far in the bull run from 2000. But would this happen from last year’s high of around US$1900 or could it happen from much higher levels of say $3000 or $5000? Who knows? But we are mentally prepared for it if it does.

But of course there’s no guarantee it will happen at all.

The 1970’s precious metals bull market was chiefly a western phenomenon. The closed economies of the Chinese and Eastern Europeans were not a part of this. So there are many more buyers present today.

Over the past year the dips in price have lasted very short periods of time (hours even) and been heavily bought (presumed to be by the likes of the Chinese et al).

So our guess (and of course that is all it is) is we won’t see a 50% fall right at this stage. However in the first half of 2013 maybe there is a chance of prices falling further than they have to date though. But with the US debt ceiling to again be in the headlines in the next couple of months any dip could be very temporary.

New Highs for Late 2013?

The kiwi dollar may well continue to rise and therefore dampen the rise of NZD gold and silver compared to the commonly quoted US dollar price, as it has done for most of this bull market. However we think new highs could be on the way later in 2013 for both USD and NZD priced gold.

Why then?

Because that would make it a 2 year correction or consolidation for gold and an almost 2 and a half year correction for silver. We’d imagine that should be long enough to shake out all the latecomers and when the weak hands are gone is usually when the bull markets run strongest.

But at the end of the day these are all just guesses. The key questions to answer are have any of the reasons to buy gold and silver changed?

And from what we can see nothing has changed, if anything the reasons continue to grow, with multiple central banks embarking on money printing campaigns, widening government deficits, and negative interest rates just to name a few.

See these 2 previous articles and check each of the points for yourself and see if our reasons to buy precious metals remain valid:

If you missed out on buying at the previous lows mid year and at the start of 2012, you currently have another chance here and now to convert some paper currency into real no counter-party risk money. We’re happy to help out. See our order page for products and pricing…

And with that sales pitch over to finish, here’s our final not particularly bold prediction…

A few years from now we’ll look back and these prices will look cheap.

Pingback: Fancy a Central Otago Gold Mining Franchise? | Gold Prices | Gold Investing Guide

http://www.telegraph.co.uk/finance/financialcrisis/9298180/Europes-debtors-must-pawn-their-gold-for-Eurobond-Redemption.html

What will this do for the price of gold?

Pingback: 3 Factors That Could Take Gold Higher From Here | Gold Prices | Gold Investing Guide

Pingback: Pleasure or Pain? Where to Now for Gold and Silver in New Zealand Dollars? | Gold Prices | Gold Investing Guide

Pingback: Where to for the NZ Dollar? | Gold Prices | Gold Investing Guide

Pingback: Gold and Silver in NZ dollars: 2013, the Year in Review and Some Guesses for 2014 | Gold Prices | Gold Investing Guide