Covid responses have seen the government encroaching more and more into everyday life, both here and across the planet. As a result we have more people getting concerned about the potential for gold confiscation. In various gold and silver newsletters we read, we’ve seen a few queries on the topic of confiscation of gold in the USA.

We received a couple of questions from readers about the confiscation of gold in New Zealand. From J.M…

“I just wanted to know if you had any info on if the NZ Government has the ability to ‘confiscate’ investors gold & silver. I have read some articles about this happening in the USA in the thirties and wonder if our govt. has the power/laws to do so?”

Table of Contents

Estimated reading time: 8 minutes

Gold Confiscation: A (Very) Short History Lesson

Firstly, a little background in case you didn’t know.

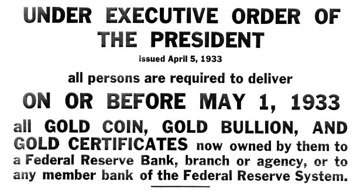

What J.M. is referring to above is the 1933 Executive Order (pictured to the right) issued by U.S. President Franklin D Roosevelt (FDR). This effectively outlawed the ownership of gold bullion for US citizens. They were required to turn any gold bullion and coins (collectible coins were excluded) into the Federal Reserve under penalty of, what was for the times, a massive $10,000 fine or 10 years imprisonment.

The effect of this law change was it allowed the US government to devalue the US dollar over the next few months against gold, having also increased the US Treasuries gold hoard.

The idea was basically to force people into spending their paper money and thus end the depression. It just happened to be at the expense of the citizenry and as a result of theft but hey, government will be government.

Here is the full wording of the order, including what was excluded.

There’s plenty of information on this across the “interweb”. If you want to learn more just Google “gold confiscation”. Also James Rickards book Currency Wars is perhaps one of the best summaries of this period and is highly recommended as a history lesson.

Related: Why Gold Bullion is Your Financial Insurance

So Where Does New Zealand Stand on Gold Confiscation?

Firstly there was no gold confiscation in New Zealand at the time of FDR’s Executive Order in 1933. Why was this?

Well, Britain left the gold standard in 1931. New Zealand (along with Australia) had, prior to 1931, already left the Gold Standard. So it could be argued that there was no need for the government to confiscate gold. As it had been removed from the New Zealand monetary system already. They were free to devalue their currency as the likes of France had done in 1925 and as Britain later did in 1931.

No Confiscation of Gold in New Zealand’s History

So for starters we have got history on our side. There has not been a confiscation of gold here in New Zealand to date.

No Gold Confiscation Law in Place in New Zealand

Secondly, there is no gold confiscation law in place in New Zealand. Unlike Australia, which already has a gold confiscation law written but not enacted (for more detail on these Australian gold confiscation laws see this comprehensive explanation by Paul Behan).

Of course, the fact that a gold confiscation law doesn’t currently exist in New Zealand, doesn’t preclude it from being written in to law at some point in the future.

But, with any luck, it would at least mean there would be some warning. Whereas in Australia, it would merely take a stroke of the pen from the Governor General to enact the existing provision.

The Difference Between Today and the US Confiscation of the 1930’s

The US Dollar Was Still Backed by Gold in 1933

Unlike today, the US dollar was still gold backed in 1933.

So taking gold from the people enabled the US Government to devalue their currency. Then following the confiscation with the stroke of a pen, the people then had no recourse. They could no longer take their dollars to the bank and swap it for gold.

Whereas today, Governments the world over are free to devalue their nation’s currency to their hearts content. All without needing to confiscate gold from their citizens.

People Less Trusting Of Government Today

Another difference is that citizens today would seem to have a lot less trust in government than they did in the 1930’s.

By all accounts most people followed along with FDR’s Executive Order in 1933.

Whereas, perhaps today with the internet and social media, there would likely be a backlash of sorts against such a move? (Although this is perhaps balanced out somewhat here in New Zealand by the fact that holders of gold still seem to be pretty few and far between).

What Else Might the G-Man Resort To?

This article on SovereignMan.com discusses 3 things that the government may do to discourage gold ownership:

Step 1: Just make gold ‘harder’. To buy. To transport. To own. Think about the changes we’ve seen over the last two years; government-regulated exchanges are continually hiking their gold margin requirements, increasing investors’ burden to buy.

On the physical side, the US government buried some insane regulations deep within last year’s healthcare bill. The new rules required a mountain of paperwork such that anyone who purchased a single ounce of gold from a coin shop would have to submit a special 1099 form to the IRS.

(The rule was later modified under intense pressure from various lobby groups, but it still gives you a good idea of what these people are thinking…)

Then there’s the new Dodd-Frank legislation that makes it nearly impossible for US citizens to trade securities and commodities from overseas accounts beyond the reach of the federal government.

Then there’s the Liberty Dollar debacle in which the US government used obscure counterfeit laws to seize millions of dollars of silver coins that were owned by the firm’s customers!

Then earlier this year, the Financial Crimes Enforcement Network (FinCEN) issued new guidance requiring that US taxpayers who hold gold in certain offshore financial accounts report such holdings on their annual FBAR. Conveniently, this ruling put up a barrier for Americans to use GoldMoney.

Step 2: Plant seeds of doubt [via economists and media]…

Step 3: Tie gold to terrorism. Plant evidence.

Source.

However the counter balance is that in New Zealand gold does pass under the radar significantly more than in the USA. There is no GST on pure gold or silver bullion either. Plus none of the instances mentioned in the above SovereignMan.com article have occurred in New Zealand to date.

What About Silver Confiscation?

Another consideration is that silver was not confiscated in 1933. Although according to this article a year later it was…

“Silver also suffered the fate of gold. On August 9, 1934 a Presidential Proclamation ordered all silver bullion surrendered to the Treasury within 90 days and a 50 percent tax was levied on any profits from the sale of silver. The sellers were paid 50.1 cents per ounce.”

However, until 1964 silver certificates in the USA could still be redeemed for silver. So if gold was confiscated in the future, you could argue that silver may well be at a slightly lower risk than gold.

Other Options to Hedge Against Gold Confiscation?

The 1933 Executive Order excluded numismatic or collectible coins. So you could consider holding some of these.

The downside is these coins often sell for a large premium over the spot price of gold. So you will pay for this hedge against confiscation. Plus of course if it were to happen there’s no guarantee numismatic coins would not be targeted this time.

Related: The Number One Reason to Buy Gold in New Zealand Today >>

So, What are the Odds of a New Zealand Government Gold Confiscation?

Who knows really?

The government are unlikely to cut spending significantly. So the odds are the they will need to grab more revenue in the future. This revenue grab could be through higher taxes, higher inflation, and who knows what else?

But given the current low rate of people holding gold here in New Zealand, it would perhaps be more likely they would go after “wealthy” property investors with a new tax.

After all the government did just that in 2011 with a rejig of property depreciation rules. Since then we have also seen other changes to the taxation of real estate. The “bright line” test means any property sold within 2 years would be taxed. This was extended to 5 years in March 2018.

Maybe we’ll see a new “wealth tax”? Of which the government refuses to rule out if re-elected.

So in summary, like most everything these days it’s anybody’s guess. When rules aren’t set in stone, making financial plans can be difficult. But, if we had to make a guess with a gun to our heads, we would say the odds would be against gold confiscation in New Zealand.

But, either way we believe we’re better off having some gold (and silver) than not. As the risks of not having any gold (e.g. currency devaluation, sovereign debt, negative real interest rates, etc), seem much higher than the risk of holding some.

Plus, if we didn’t act because of a possibility of something occurring in the future, then it’s likely we’d make no decisions in this life!

See this article for more on this topic: 4 Reasons You Should Store Some Precious Metals Outside of New Zealand >>

If you’d like to know the exact process for selling gold and silver see: Sell Gold & Silver Bullion, Bars or Coins >>

Editors Note: This article was first published 17 January 2012. Updated 16 March 2018 to include new taxes implemented on fuel and property, and corrected links to various source articles. Last updated 6 July 2022.

Pingback: Windfall Tax on Gold? - a New Zealand Perspective | Gold Prices | Gold Investing Guide

Pingback: Reader Question: Why is Gold More Valuable Than Worthless Paper? | Gold Prices | Gold Investing Guide

Pingback: China's gold imports from Hong Kong surge | Gold Prices | Gold Investing Guide

Pingback: Gold in NZ Dollars: We Have Been Here Before | Gold Prices | Gold Investing Guide

Pingback: Don’t Dismiss the Possibility of Gold Confiscation | Gold Prices | Gold Investing Guide

Pingback: Privacy: Are purchases of gold and silver in NZ reported? | Gold Prices | Gold Investing Guide

Pingback: When Gold Is Declared Illegal - Gold Prices | Gold Investing Guide

What happens to the share price (mining shares) in gold when it is confiscated? If gold is revalue higher by the confiscator would this not be reflected in higher share price? So… apart from the down side in third party involvement, would it not be better to own gold and silver mining stocks with their much higher return on investment?

We’d say it is more of an “if” question than a “when”. There likely isn’t any need for the central planners to confiscate gold this time around. The level of ownership is minute compared to the 30’s when gold was still widely held by the public. Even if gold ends up in a bubble the ownership level will still likely be much less than most other assets. Perhaps some kind of “windfall profits” tax is more likely than confiscation. In this case we would expect to have some advance warning of this. Plus it likely wouldn’t happen until we had seen a rush into gold. Perhaps this would be the same time it would be a good idea to “spend” your gold and buy a cheaper asset anyway? Mining stocks may well also be picked don in this case. They could have some kind of “windfall tax placed on their revenues. So a higher gold price might not translate into a higher share price if their earnings are nailed by a windfall tax. Mining stocks have higher potential returns, but if the last 6 or so years is anything to go by they have much higher risk too. So we look at them as an “and” rather than an “or”. Have some of both.

Pingback: 4 Reasons You Should Store Some Precious Metals Outside of New Zealand - Gold Survival Guide

Pingback: CoronaVirus Spreads Into Italy - Sharemarkets Plunge - Gold Survival Guide

I would not trust any Gov’t they all do what suits there purposes ,To day l called NZ Mint to enquire about selling Gold Kiwi Coins ,was told no trading during period the Lock down ,l am not happy about being dictated to by Government ,like many people l purchased gold for security ,now the Government says l cant sell ,they will not get my vote next election.

Pingback: What Do These Recent Large Purchases of Gold Around the Globe Signify? - Gold Survival Guide

Pingback: Two Veteran Investors Recommending Gold - Gold Survival Guide

Pingback: Please Change to: Everything is Falling - Including Gold - Gold Survival Guide

Pingback: Fund Manager: Are We At A Turning Point for Stock Markets? - Gold Survival Guide

While I agree with the essence of this article, I think an argument can be made that NZ has in the past confiscated gold. And in 1933 too. From section 15(2) of the Reserve Bank of New Zealand Act 1933:

“…every bank carrying on business in New Zealand shall transfer to the Reserve Bank, in exchange for the equivalent value of bank-notes of the Reserve Bank, or for credit with that bank, all gold coin or bullion then held by it on its own account.” Who’s gold exactly? The last three words of section 15(2) leave this question open. Who was the owner of the gold? The bank(s), as an asset (e.g. shareholder equity), or their customers (i.e. a liability). I guess only an examination of balance sheets would reveal that.

The full Act here…(http://www.nzlii.org/nz/legis/hist_act/rbonza193324gv1933n11316/)

[PS Also, don’t forget, the Reserve Bank stole the last bit out of silver out of our coins in 1947, so their record is out there for all to see]

Thanks for sharing Craig. It could be open to interpretation, although in the wording “all gold coin or bullion then held by it on its own account” the key words would seem to be “on its own account”. That would imply it was the Banks gold not gold held for a customer. But the point is that private holders of gold were not required to hand it over to the reserve bank and take cash in return as happened in the USA. At the end of the day a new law could still be passed anyway. We still think gold is not so likely to be targeted simply because of how few people still hold it. And unlike in the 20’s and 30’s there is no need to take it now since the cnetral bank is free to devalue the currency any day they like.

I agree with your analysis Glenn (thought I’d still like to see the balance sheets in 1933-34; I’m currently writing a book on this subject, a political history of money & currency as it applies to NZ including the shenanigans of the RBNZ). For many reasons, Government agents are very unlikely to turn up at private homes to confiscate private property (gold). The resources required alone. At worst they might pass a statute or two to coerce people into handing it in, in exchange for fiat (think guns post Chch 2019 – innocent people criminalized…). But it would require compliance. I wont be complying.

However I’m also aware that many central banks are buying gold in record quantities (BRICS et. al). The NZRB doesn’t have any (nor any agency of the NZ government as far as I can see). And the RBNZ do have a record of theft (the whole issue if debt based fiat aside, silver in coins in 1947 as I said above). What this means, time will tell. It’s the engineer in me; scenario planning aka risk management.

Anyway I’m glad I found your website. Some good considered analysis. Something NZ is seriously lacking.

Look forward to seeing your book released then Craig! We’ve written a bit on the topic of NZ currency here too: https://goldsurvivalguide.co.nz/why-buy-gold-no-fiat-currency-lasts-forever-what-about-the-nz-dollar/ Although I’m sure none of that will come as news to you given the research you must be undertaking. You are correct that no gold reserves are held by the RBNZ or any other govt department either. For sure there is no reason to trust any of the central planners. Anyway all the best for the completion of the book. Please do drop us a line when it’s done.