It’s time for our annual review of the performance of gold and silver in New Zealand dollars. We’ll also look back on our predictions from the start of 2020. Then finish off by making a few guesses as to what 2021 might hold in store for us...

Table of Contents

Estimated reading time: 7 minutes

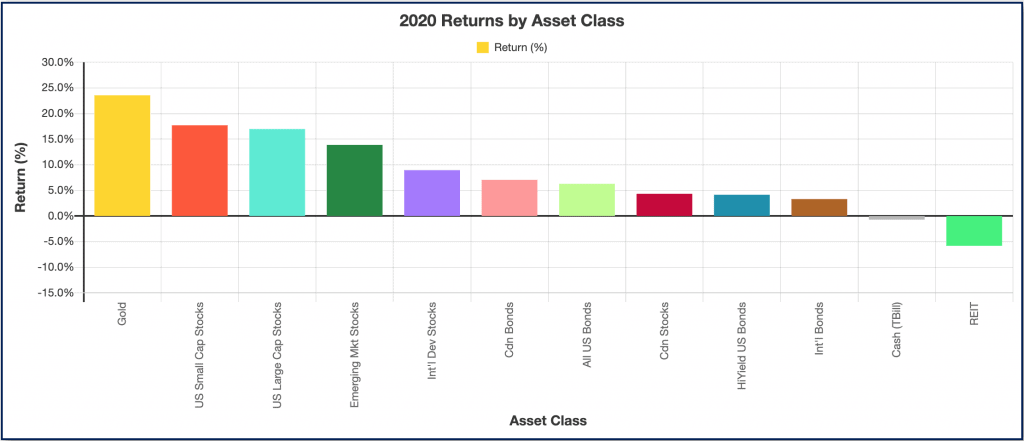

2020 was indeed an unprecedented year. With the Coronavirus causing stock market crashes early in the year. But then the unprecedented reaction from central banks and governments caused many assets to rise significantly in the latter half of 2020.

This table shows gold (priced in US dollars) was the top performing asset class in 2020 out of the 12 being tracked.

The only class performing better with a late but hefty surge and not listed in the table was bitcoin. It rose over 300% in 2020.

Learn more about our preferred method of investing in bitcoin and cryptocurrencies here.

But the above table looks at gold in US dollars. As we are in New Zealand we should track the NZ dollar gold and silver price, not the US dollar price. So how how did precious metals fare in 2020 in New Zealand Dollar terms?

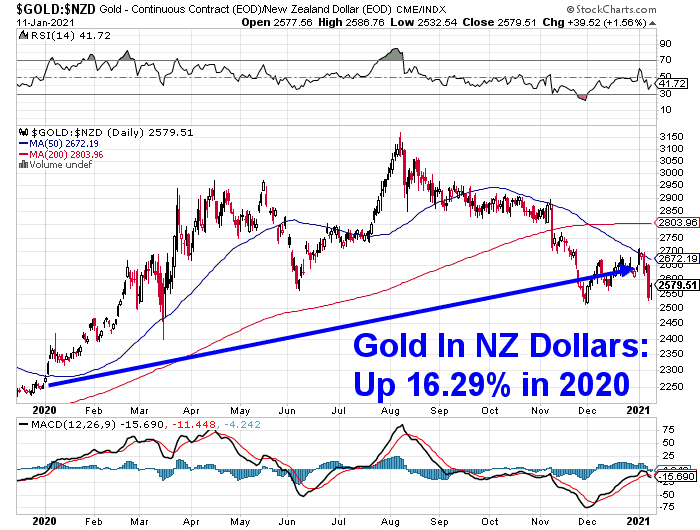

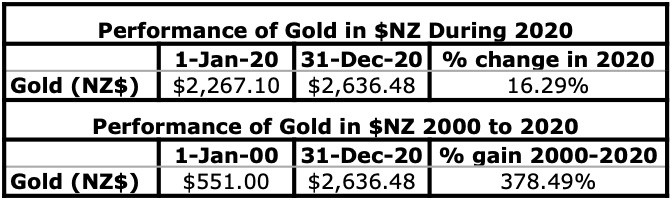

Gold in $NZ – Performance During 2020

Gold in New Zealand dollars started the year with a sharp rise right through until March when the Coronavirus panic hit. The gold price then dived from $2700 to the low $2400’s, before staging a powerful comeback rally up to $2900. Gold then travelled pretty much sideways until July when it surged to hit the all time high above $3100 in August.

Gold spent the later part of 2020 in a correction. Getting down to almost $2500 before bouncing back to end the year at a little over $2600.

So by the end of the year it was a very similar looking chart for gold in 2020 to that for 2019. NZD gold was also up a similar amount for 2020; 16.29% versus just over 17% for 2019.

Looking back to the start of the millennium, gold is now up a decent 378%.

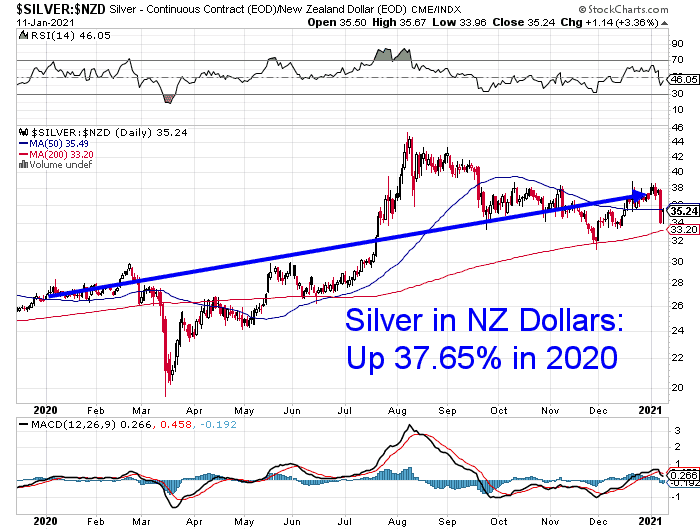

Silver in $NZ – Performance During 2020

2020 was all about silver though. Unlike the past couple of years silver actually outperformed gold in 2020.

This was despite a very sharp plunge in March during the height of the corona-panic. It took until May for silver in NZ dollars to get back above the price that it began 2020 at.

Then July saw silver surge all the way up to $45 per ounce. For the last third of the year silver was in correction mode. Although it was surprisingly a flatter looking correction for silver compared to gold. As a result silver finished 2020 up over 37% from the start of the year!

However over the much longer term silver continues to underperform gold. With silver up 256% since the year 2000. Although silver looks to finally be starting to catch up to gold.

As this precious metals bull market matures we’d expect silver to outperform gold. Albeit with periods of heightened volatility. Also unlike gold, silver is yet to reach new all time highs. That mark above NZ$60 is almost a double from where the price stands today.

So the big gains for silver likely aren’t over yet.

How Did We Go With Our 2020 Predictions?

Now, let’s see how accurate we with our 2020 predictions or perhaps more accurately “punts”? No point making any if we don’t take a look back!

Here were our 2020 predictions:

1. We think both gold and silver will once again end 2020 higher than where they began the year.

We got that one correct with gold and silver both up decent percentages during 2020.

2. In 2019 silver only slightly lagged gold. So let’s have a crack again and say that 2020 will finally be silver’s year. Silver will at last outperform gold.

Finally got that one right too with silver leading gold by a wide margin in 2020.

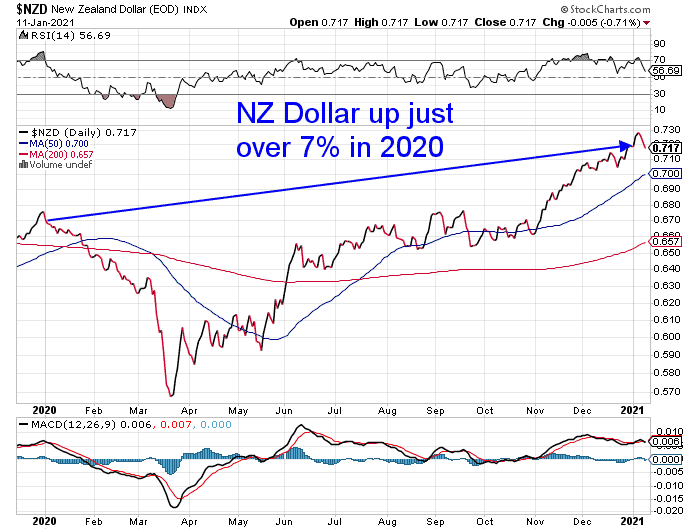

3. Now the performance of the Kiwi dollar. The last quarter of the year saw the Kiwi rising versus the USD. We’re going to say this will continue in 2020. So the year will end with the NZD/USD exchange rate higher than it began. So gold and silver may “rise” more in USD terms than in NZD in 2020. Check this post out for more on how a rising NZD might affect gold and silver prices in NZ: In a US Dollar Collapse Won’t The Rising NZ Dollar Cancel Out Any Gold/Silver Gains?

We got that one too.

The New Zealand dollar was up a fairly hefty 7% during 2020. But despite this gold and silver in New Zealand dollars still rose. Or put another way, all currencies including the Kiwi dollar, continue their decent against gold (and silver).

So that was 3 for 3 in 2020!

Now how about 2021? What might the new year hold in store for precious metals?

Our “Punts” for 2021

We’ll again have to stick to a couple of our predictions from last year.

- We think both gold and silver will once again end 2021 higher than where they began the year.

- The precious metals correction in the latter part of 2020 saw silver not do so badly as we might have expected. So in 2021 we’ll take the punt that silver will again outperform gold.

- Now to the direction for the New Zealand dollar. 2020 saw the US dollar go down against just about every other currency. We get the impression that just about everyone is negative on the USA currently. Likewise most are expecting the US dollar to continue to fall and maybe even to lose its role as the global reserve currency in the near future. But when everyone is thinking the same markets like to surprise! So while we may see the NZ Dollar continue to rise against the US dollar in the early part of 2021, our guess is that by the year end it will have reversed course and be headed down. That may seem unlikely right now but our experience says currencies often do the unexpected.

- Here’s a bonus 4th prediction for 2021. Maybe it will be the year that we see general consumer inflation finally peak its head out from the hole it has been hiding in? 2020 once again saw many asset prices rise on the back of the huge increase in currency printing across the globe. We have also seen major responses from governments. More stimulus payments are about to be sent to US citizens. So we think some of this free money is likely to push prices up by more than the 1-2% we’ve seen in recent years.

So can we go 4 for 4 in 2021? Pretty unlikely we’d say as it’s pretty hard to predict the markets over a defined timeframe. A better bet is to use dollar cost averaging and make regular purchases of gold and silver throughout the year.

Or use some technical indicators to time your purchases after a pull back in the precious metal prices.

After the rise through December, gold and silver have fallen sharply in recent days, making it a very good time to start buying right now. So sign up to our daily price alerts if you want to hear when other pull backs occur throughout the year.

Pingback: 2021: Many Hoping for a Better Year - But Still Many Uncertainties - Gold Survival Guide

Pingback: USD Gold Up But NZD Gold Down - Gold Survival Guide

Pingback: Bank of America: USA May Experience Hyper-inflation Soon - But Will Be “Transitory” - Gold Survival Guide

Pingback: Gold & Silver Performance: 2021 in Review & Our Guesses for 2022 - Gold Survival Guide

Pingback: Gold & Silver Performance: 2022 in Review & Our Punts for 2023 - Gold Survival Guide