Prices and Charts

NZD Gold Down 1.5% Into Next Buying Zone

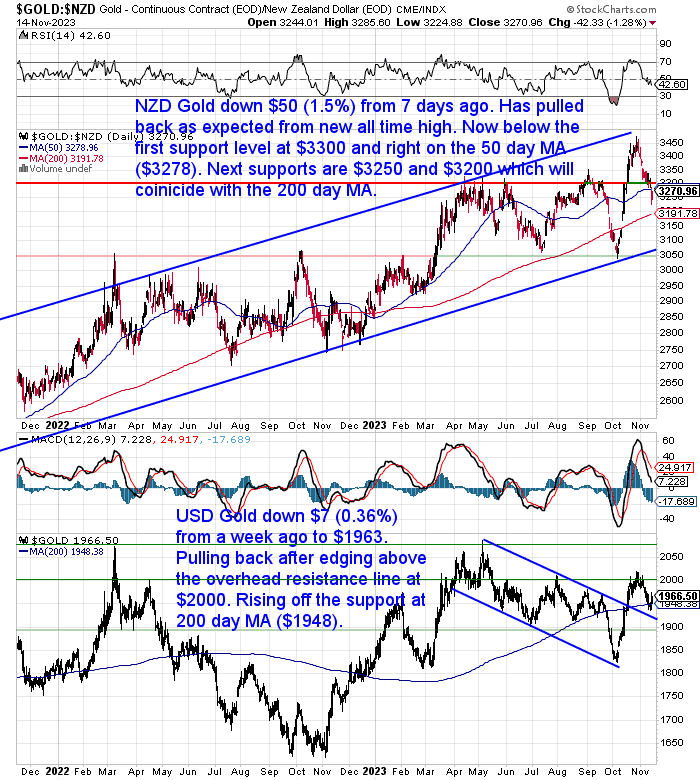

The whipsaw action in NZ gold continued this past week. With NZD gold down $96 (-2.8%). So we have seen it get extremely oversold around $3050, before shooting to a new all time high and overbought. Now it is back down to neutral on the RSI (circled). Most of this fall has come from a sharply stronger NZ dollar. The next support levels and buy zones to watch for are, $3300, the 50 day MA at $3279, then $3250 and $3200.

While gold in US dollars was down just $10 or 0.5% from 7 days ago. After edging briefly above $2000 USD gold has dipped lower. Possible support at the 200 day MA at $1947. Or it could retest the breakout from the downward trend channel.

But NZD Silver Up 1%

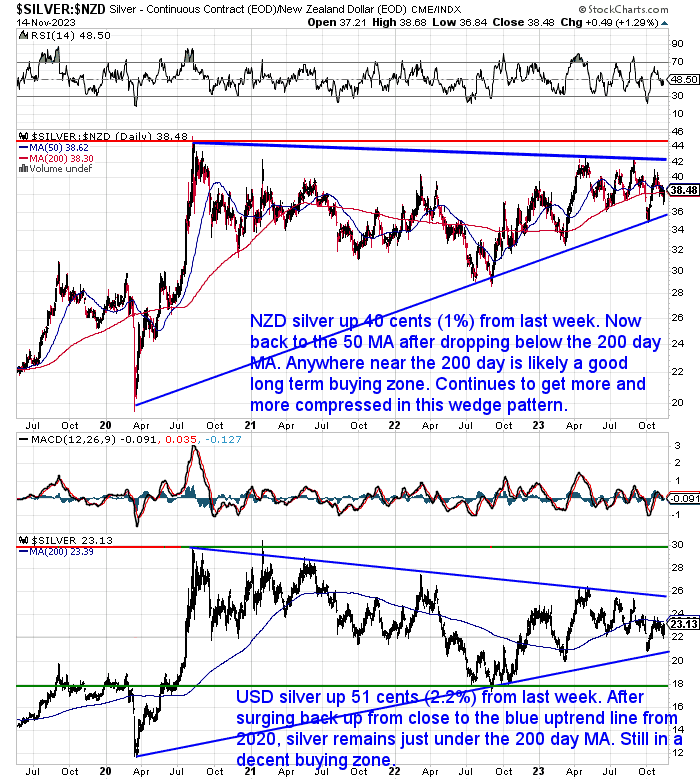

Meanwhile silver in New Zealand dollars actually rose for the week. Up 40 cents or 1.05% from 7 days ago. It is back up to the 50 day MA after dropping below the 200 day MA. Anywhere near that mark is likely a good long term buying zone. Like gold any further dip down to the blue uptrend line should be bought. NZD silver continues to get more and more compressed within this wedge or ascending flag pattern. It will have to break out of this pattern before too long as it is running out of room.

IN USD, silver was up 2.23% or 51 cents. It continues to trade just below the 200 day MA. Currently sitting midway between the 2 blue lines in this flag or pennant formation. Anything between here and the lower of these 2 lines is likely to be good buying.

Stronger Kiwi Dollar Dents Local Precious Metals Prices

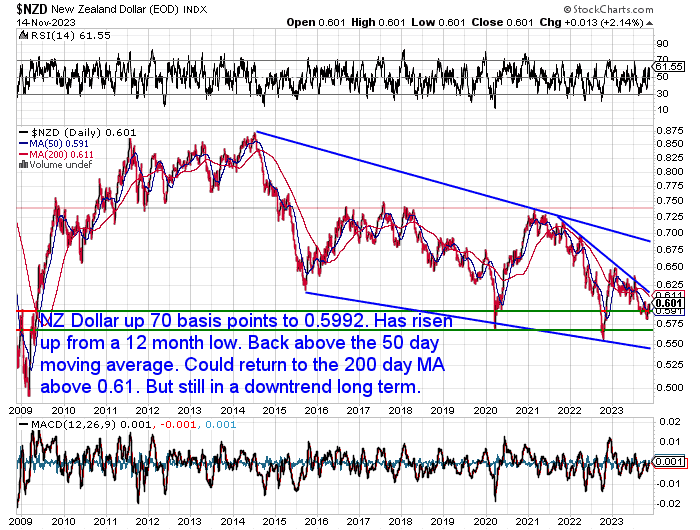

The New Zealand dollar was up 70 basis points or 1.18% this week. Putting a damper on local gold and silver prices. After rising up from a 12 month low, the Kiwi is now back above the 50 day MA. Could get back up to the 200 day MA yet. But it still remains in a medium and long term downtrend.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Interest Payments on US Debt Tops $1 Trillion

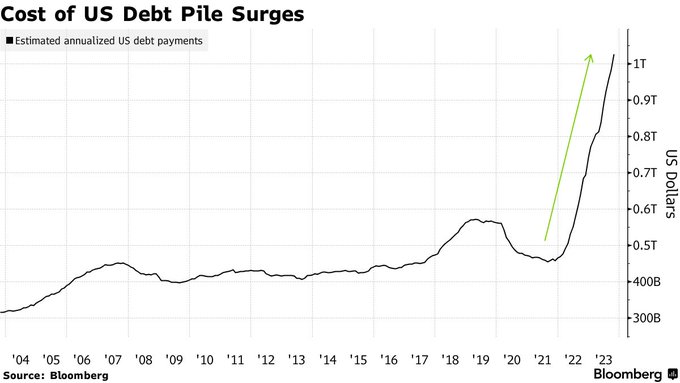

Paulo Macro highlights a chart shared by Jesse Felder and notes that:

“The lack of appreciation I note among most investors for what exactly this does to “the maths” – and complacency therein – still astounds me.”

…

‘Estimated annualized interest payments on the US government debt pile climbed past $1 trillion at the end of last month. That amount has doubled in the past 19 months, and is equivalent to 15.9% of the entire Federal budget for fiscal year 2022.’ Bloomberg: US Debt Bill Rockets Past a cool 1 Trillion a year

Source.

We’re not that bright, but if we had to guess we’d say “the maths” that Paula Macro refers to is that this massive interest bill means that the US debt levels will continue to rise even higher. As even more new debt is required to pay the interest on the existing debt.

This is likely why bond interest rates were recently soaring.

Economist Dr. Sung Won Sohn points out that:

“Surging national debt, now accruing at $1.5-2T annually, is reshaping the US economy.

With interest expenses set to eclipse defense spending and major Treasury buyers stepping back, industries like real estate and tech face a crunch as higher rates reconfigure investment landscapes.”

Source.

Maybe this is a factor in why Bloomberg’s Senior Commodity Strategist believes Gold is moving towards $3000…

Bloomberg’s Senior Commodity Strategist: Gold to $3000

Copper $3, Gold Toward $3,000: US Recession Could Be 2024 Path – #Gold’s highest-ever average annual price — $1,930 an ounce in 2023 to Oct. 27 despite a stronger dollar, stock market and rising rates — may portend a firming foundation for the metal. Declining #copper and industrial #metals appear consistent with deteriorating global growth and Bloomberg Economics’ outlook for a US #recession to start at about year-end.

@BBGIntelligence

Source.

However, this week’s feature article looks at what current debt levels would mean for the price of gold if we had a reset similar to 1934 and 1980. As the title alludes, the price is much higher than $3000…

Gold Backing to Debt Ratio: A Reset Like in 1934 and 1980 Would Mean $33,000 Gold

How do you determine gold’s value? Or put another way, what price should gold be at?

In this week’s feature article, you will learn about the gold backing to debt ratio, which is a method of valuing gold in terms of US debt. You will also discover what the gold price would need to be today to match two previous periods of debt reset in 1934 and 1980. When the US government changed the official price of gold (1934) and when the market pushed the gold price significantly higher (1980). You’ll see how on both occasions the gold backing to debt ratio was around 26%. Here’s what that would mean today…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

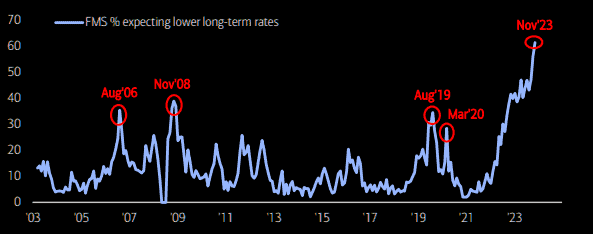

Fund Managers Consensus is Lower Interest Rates 12 Months from Now. Contrarian Indicator?

Despite these alarming numbers for US debt levels and interest payment requirements, the consensus among fund managers overwhelmingly expects that long-term yields will be lower 12 months from now. She’ll be right mate! Nothing to worry about here.

Lower rates is so consensus

Everybody believes in the rates moving lower thesis.

Source: BofA

But what if they’re not? What if we are merely in a pause in a long term secular market of rising interest rates? Higher interest rates for the long term have profound implications for today’s record levels of debt and it seems most just simply don’t expect it.

Could this expectation that rates have peaked be why we yesterday saw headlines like these for house prices here in NZ?

House values continue to strengthen, with first time buyers continuing to drive modest price growth. The latest QV House Price Index shows the value of the average home increased in value by 2.1 percent over the three months to the end of October – a lift on the 0.9 percent quarterly home value increase reported at the end of September.

Read more

‘It feels like the start of the last boom’: House price rises gather pace

Read more

Fear of missing out (FOMO) is starting to creep back into the property market again. The number of new listings on the market not keeping up with demand and putting upward pressure on house prices, Quotable Value’s (QV) latest House Price Index data show.

Read more

But would long term house price increases be sustainable if interest rates end up being higher for longer?

Or like interest rates are these housing moves just a shorter term uptick in a longer term downtrend or flattening?

Regardless of what house prices do it seems a solid bet that debt levels are going to continue to rise. The current monetary system guarantees it. Today’s feature article shows that as these debt levels rise so too does the potential end or reset price for gold.

It’s a long way from the current price…

Please get in contact for a quote for gold or silver or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 liters of safe drinking water. It’s simple, lightweight, easy to use, and very cost-effective.

Shop the Range…

—–

|

Pingback: Higher Interest Bill = Bank Reserves Becoming More Imperiled - Gold Survival Guide

Pingback: Coming Soon: The Next Wave of Bank Failures - Gold Survival Guide