Prices and Charts

Gold – Looking for a Higher Low

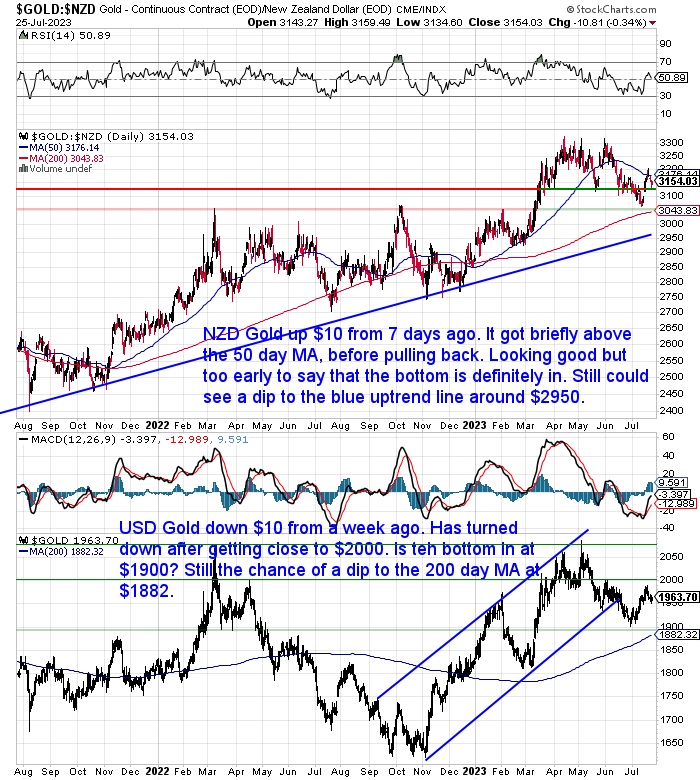

Gold in New Zealand dollars was up $10 from 7 days ago. It rose sharply from the horizontal support/resistance line at $3050, to get briefly above the 50 day moving average (MA). But then pulled back to $3150. Now we watch to see if it can put in a higher low above $3050. It is looking promising although it’s still too early to say that the bottom is in. There still remains a chance NZD gold could dip down to the blue uptrend line. Or maybe just to the 200 day moving average (red line).

In US dollar terms, gold turned down after getting close to $2000. So have we seen the bottom at $1900? Still a chance of a dip down to the 200 day moving average. But the 200 day MA continues to rise, so it won’t be long before this line is above $1900 anyway. Our guess is that the bottom might well be in at US$1900.

Silver Has Already Made a Higher High – Watching for a Higher Low Too

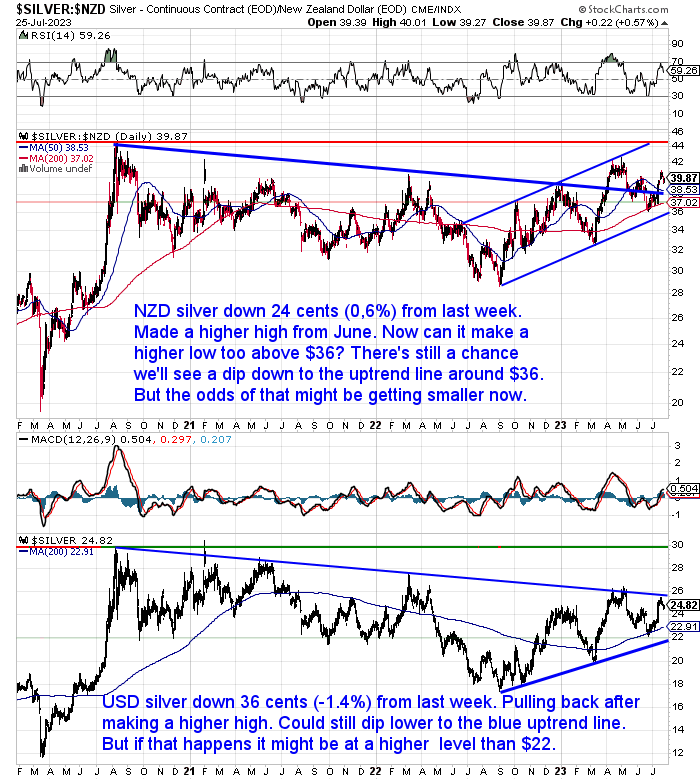

Unlike gold, silver in NZ dollars has already made a higher high this week. Rising sharply to get back above $40. Despite pulling back it is still up 24 cents (0.6%) from a week ago. Now the question is, can it make a higher low as well above $36? There remains a chance of a further dip down to the blue uptrend line. But our guess is that the odds of such a move are likely getting smaller now. Maybe look for a dip to the 200 day MA to make that higher low?

USD silver has also made a higher high. Rising sharply to pull back once it hit the downtrend line. Silver could still dip lower to the bleu uptrend line. But that could occur at a higher level than $22. Meaning that the bottom might be in already. USD silver continues to trade in this steadily diminishing wedge pattern. It’s going to have to break out of that before too long.

Sharp Pullback For the NZ Dollar – Downtrend Still in Play

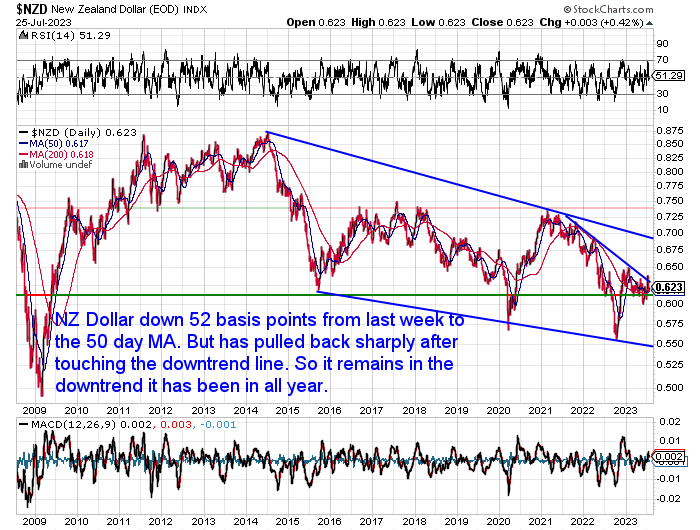

The Kiwi Dollar was down 52 basis points from a week prior. Dropping down to the 50 day MA. It was a sharp pullback after nudging the overhead downtrend line. So far it has been unable to get above this and remains in the same downtrend it has been in dating back to the start of 2021.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

How Many People Own Gold? New Zealand vs Other Countries

Ever wondered how many people own gold and how it compares to historical figures? In this week’s newsletter, we dive into the world of gold ownership and do our best to shed some light on the opaque world of gold ownership data.

You’ll also see how many ounces of gold you need to own to be in the top 1% of wealth holders in the world. The answer might surprise you…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Is the New Zealand Economy Worse Off than Others in the OECD?

It’s fair to say the weather (particularly in the northern half of New Zealand) over the past year has left many of us feeling a bit gloomy. Is this potentially clouding our judgement on how “bad” things are in NZ currently?

Here’s a comparison of New Zealand to other countries in the Organisation for Economic Co-operation and Development (OECD). Here’s how New Zealand measures up on a number of key metrics:

- Inflation in New Zealand is not actually a global outlier, as we have similar rates to other countries like Australia, the US, and the UK.

- Economic growth in New Zealand is forecasted to be slower than Australia and the US but better than the UK.

- Unemployment in New Zealand is lower than in the US, Australia, and the UK, but it is projected to climb faster.

- New Zealand’s government debt is much lower than other countries like the UK and the US.

- The country has lower income taxes but also lower average wages compared to Australia and the US.

- Overall, the writer believes New Zealand’s economy is broadly similar to other countries, and it is not facing economic ruin compared to others.

Source.

The grass is often greener on the other side. However, it seems to us that most western countries have struck broadly similar paths over the past few years and so we are all experiencing broadly similar results.

So we’re probably no worse off than anywhere else. However when others aren’t doing great that means neither are we!

China Slowdown Starting to Bite

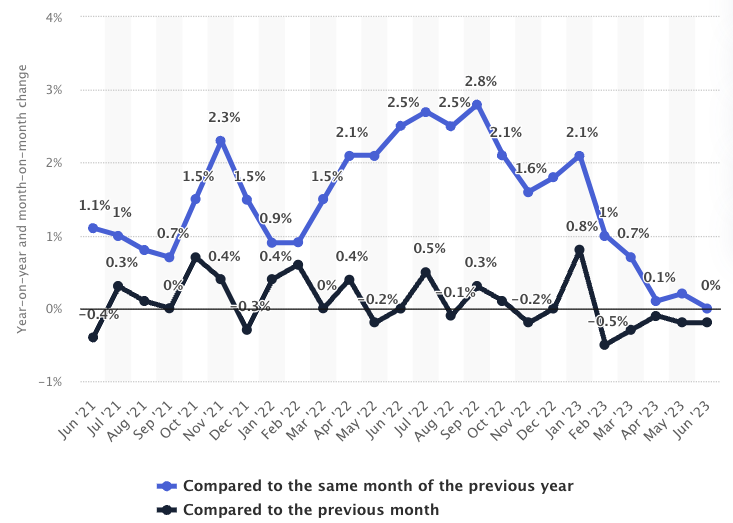

China is a real outlier in the global economy at the moment. While much of the world has been struggling with high rates of inflation, in China inflation was just 0% in June.

Source.

That may sound good to us here, but a very sluggish economy has resulted in numbers like youth unemployment hitting a record 21.3%!

Of course all this was caused by their insane lockdown measures that went on for far longer than anywhere else (and these were already pretty insane in most other places!). The Chinese government is considering stimulus packages. Although growing debt risks may limit just how far they go.

Economist Brad Olsen, this week discussed how this slow-down in China’s economic growth is starting to impact New Zealand.

Chinese exports to the rest of the world fell by about 12 percent in June. While imports, including some New Zealand goods, dropped by around 7 percent over the past year. This lower demand in China makes it challenging for New Zealand businesses to sell their products in the Chinese market. On top of this key New Zealand exports like agricultural products and forestry have been fetching lower prices.

China’s economic developments have major implications for New Zealand and other trading partners. New Zealand’s current account balance is near its worst in decades. This simply means that the country is spending more on imports than earning from exports, which is a concerning situation for New Zealand exporters.

Bottom line: Things could be sluggish here and elsewhere for a while. We might not get a massive stimulus boost from China like we did post 2008.

New BRICS Currency – More Hype Than Anything?

We’ll keep the theme of the last few weeks alive by again looking at the latest reports on the supposed new BRICS currency.

Via Reuters, JOHANNESBURG, July 20:

A BRICS currency will not be on the agenda of the bloc’s summit in South Africa next month, but Brazil, Russia, India, China and South Africa will continue to switch away from the U.S. dollar, South Africa’s senior BRICS diplomat said on Thursday.

Source.

But a day later there was this:

“BRICS to discuss dollar alternatives at August summit: Russia”

“…Experts said that the dollar, used as a tool for the US to exercise international hegemony, has resulted in great uncertainty for the recovery of the world economy.

“Given the current international situation, this issue will be addressed during the upcoming meeting of the bloc’s leaders,” the Russian ministry said, RT reported on July 21.”

…South Africa’s Minister of International Relations and Cooperation Naledi Pandor said after the BRICS foreign ministers’ meeting on June 1 that the New Development Bank (NDB) is studying the potential use of alternative currencies to the dollar “to ensure that we do not become victim to sanctions,” Reuters reported.

Brazil’s President Luiz Inacio Lula da Silva in April called on BRICS countries to come up with an alternative to the dollar in foreign trade, Bloomberg reported.”

Source.

However, discussing “dollar alternatives” doesn’t mean they will issue a new currency. They could simply increase the trade between one another in their national currencies. That might well be the first step.

Chinese Gold and silver analyst Bai Xiaojun seemed to be indicating this when he commented:

“A BRICS common currency is a very complex issue. The South African meeting in August will discuss, but not result in a resolution, although it has been researched and designed for almost 10 years. The goal of the BRICS countries is to establish a multi-polar currency system, a process that will take a long time. To be precise, it is to establish a multipolar monetary system, rather dedollarization.”

Source.

It would seem to be a big surprise if a gold backed BRICS currency was announced in August. But these conflicting reports likely mean dollar alternatives are being discussed behind closed doors.

Jim Rickards, who first brought our attention to this possibility a couple months back, said in an interview this week, that a BRICS currency would be a competitor to the U.S. dollar, but that:

“It’s not a reserve currency. . . .I think it may be 8 grams of gold to one “BRIC” (currency), but I don’t know. What I do know is it does not matter. What does matter is they are going to anchor it to a weight of gold. . . . It’s NOT redeemable in gold, it is anchored to it. . . . Let’s says [sic] a “BRIC” is worth one ounce of gold. Today that is $1,970 per ounce, except the “BRIC” is NOT anchored to the dollar. It is anchored to gold, which stands in the middle of this equation. So, the dollar price of gold is going to be going up and down all the time, which means the dollar/“BRIC” exchange rate is going to be going up and down all the time. They don’t have to defend the “BRIC.” They have gold, but they don’t have to back it up with gold. . . . They actually don’t need any gold. . . . If you have made your currency anchored to gold . . . do you want the price to go up or down? You want the price of gold to go up because that means the “BRIC” is worth more dollars, and the dollar is crashing. It’s a way to destroy the dollar. You don’t need dollars and you don’t need gold. You just need to be smart enough to anchor your currency to gold, and when dollar inflation starts to go up, your currency is going to be worth more because of how you pegged it, not to dollars, but how you pegged it to gold.”

Source: New BRICS Currency Boosts Gold & Destroys Dollar – Jim Rickards

So in summary, our guess is that there is likely more hype to this than what will happen in reality in August.

There is no currency ready to take over from the dollar in the near term. And putting one together will take a lot of planning. It might also take some sort of “emergency” to force it into being.

So the US dollar will continue until there is a more worthy alternative. We’d guess that it will not be a single currency of another nation. So perhaps a basket of currencies is the more likely outcome?

Meanwhile all currencies will continue to lose value and this rate will likely speed up in the coming years. Be sure you have sufficient protection from this.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|