Prices and Charts

Sorry we’re a day late on our update for this week. Had a school cross country championship to attend now that we are “privileged” enough to be able to attend such things. So it ended up too late to send this out yesterday.

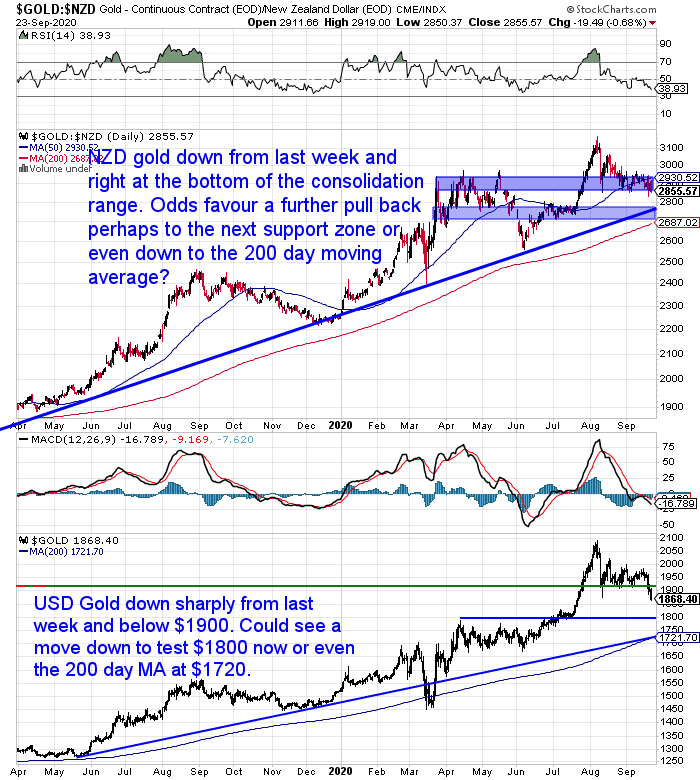

Gold Sitting Right on Horizontal Support

There has been a bit more action this week than we’ve seen lately. Gold in New Zealand Dollars is down 2.5% since last Wednesday. It’s now sitting right at the bottom of the sideways range it has been trading in since August. But to us it looks like odds favour a further pull back from here now. Perhaps down to $2800 or the next horizontal support zone just below that. Or maybe even right down to the 200 day moving average.

The weakening NZ dollar has shielded us from the harsher drop in USD gold (almost 5%). USD gold had been in a near perfect sideways consolidation. But that has ended with the fall of the past few days.

USD gold is looking like it has further to fall – down to perhaps $1800. So if that happens then the local gold price is also likely to head lower, to the levels mentioned above.

Silver Plummets

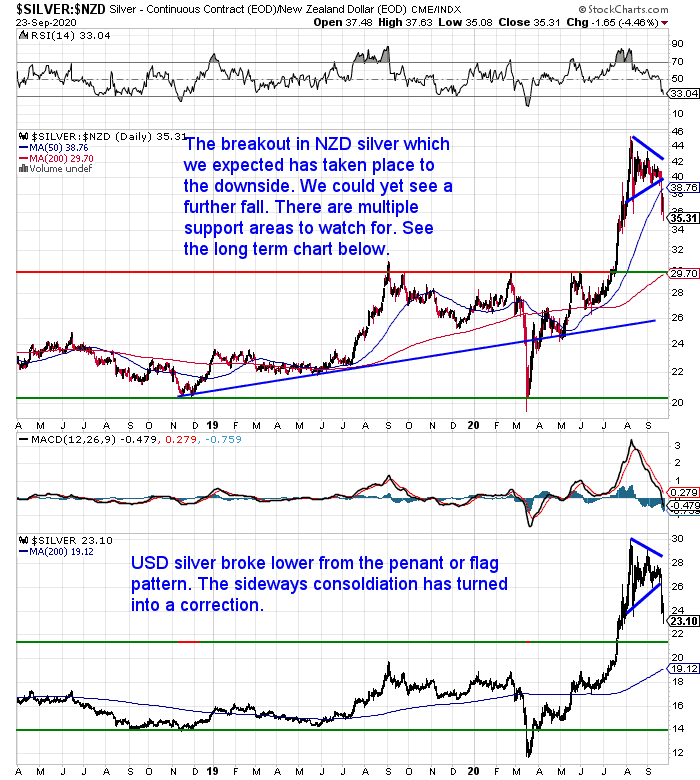

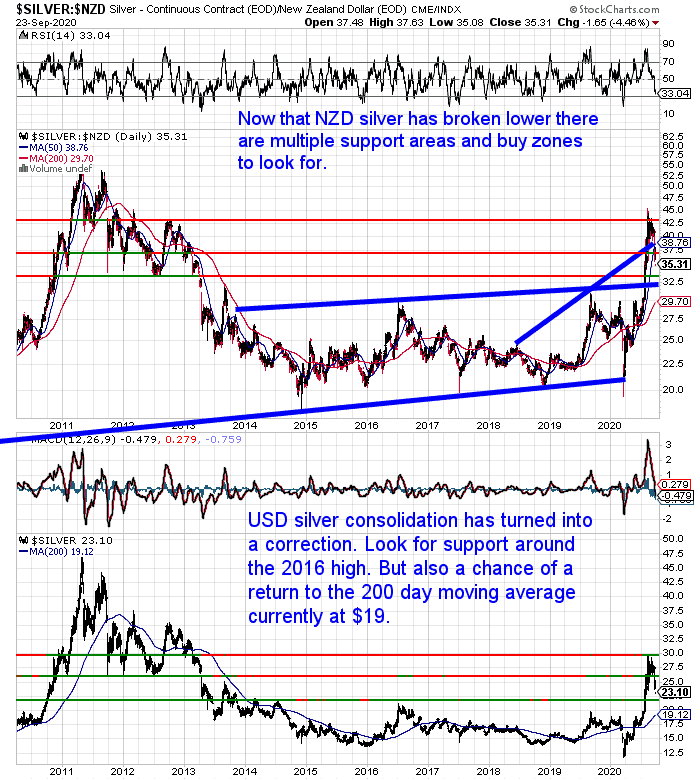

We had previously said how it was surprising that silver was holding up better than gold in this consolidation. But the past few days have shown we spoke too soon. With NZD silver dropping 14% since last Wednesday.

We were expecting a breakout though with the pennant of flag pattern that had formed. In this instance the breakout was lower. NZD silver looks like it could have further to fall now.

Check out the long term chart below for support levels to watch for when buying silver.

But it is now anyone’s guess as to whether we see a sharp fall and a rebound, or a drift lower over a longer period of time.

That is why we say it’s a good idea to split your purchase into a number of tranches rather than trying to bottom pick.

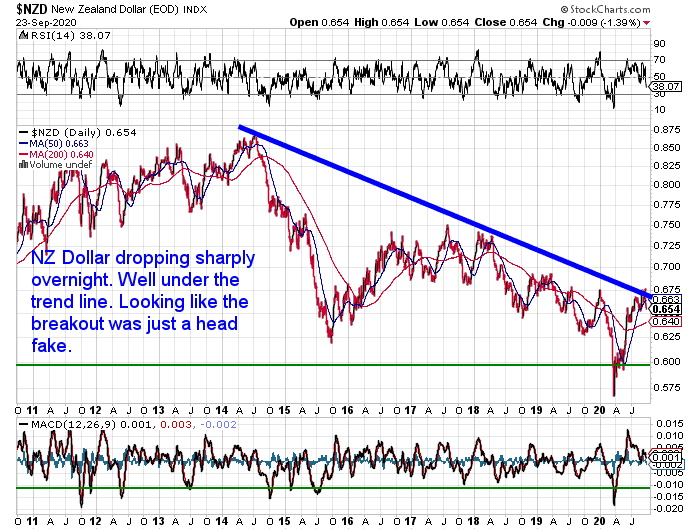

NZ Dollar Looks like a Fake Out Not a Break Out

We’ve been saying it was too early to confirm that the recent rise in the Kiwi dollar was a definite breakout of the downtrend it had been in.

So far it is looking like it was instead a fakeout. With the New Zealand dollar turning down and now well under the downtrend line and also the 50 day moving average.

As noted above, this fall of over 2% has shielded the local gold price from a more significant correction (so far at least anyway).

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Negative Interest Rates are Coming Next Year – But the RBNZ Has a New Plan First

ASB summarised yesterday’s wordy monetary policy announcement by the Reserve Bank where they kept the Official Cash Rate at 0.25%:

- As expected, the RBNZ maintained current settings and kept its easing bias.

- However, the RBNZ also cited that progress had been made on developing alternative monetary policy instruments, flagging that a Funding for Lending Programme will be introduced by the end of the year.

- We expect the RBNZ to sequence policy easing, with a funding for lending programme to be introduced later this year before the OCR is lowered in early 2021. Prior to this we expect the RBNZ to maintain a strong pace of asset purchases to push yields lower. Such moves are designed to further lower borrowing costs in the economy.

Actually now that we read that we need to further explain the ASB summary into everyday English too! Here’s our explanation of their 3 bullet points:

1. Interest rates are likely to head lower.

2. The Funding for Lending Programme (FLP) means the RBNZ is going to lend directly to banks. How is that different from what normally happens?

Westpac chief economist Dominick Stephens explained the FLP pretty well:

“Currently, banks source their funds from a mix of transactional deposits (at zero interest), term deposits (currently approximately 1.2%), and wholesale funds (currently about 1%).

“Under an FLP, the RBNZ would offer funding to banks at a low interest rate – perhaps close to the OCR, which is currently 0.25%, or close to current swap rates which are zero.

“If banks can bring in money more cheaply, they can subsequently lend it out more cheaply while maintaining the same bank margin.

“So by providing these cheap loans to banks, the RBNZ will engineer a decrease in mortgage rates.

“There will also be an indirect effect – banks will compete less vigorously for term deposits and wholesale funds, so the interest rates on these will also fall, further reducing banks’ funding costs.”

Source.

We have heard the justification that this funding for lending programme means that the RBNZ doesn’t have to cut the OCR in order to lower interest rates. Therefore deposit rates wouldn’t be affected. However Mr Stephens clearly spells out there would be less competition among banks for term deposits. So interest rates on these will fall too. You returns in the bank will continue dropping.

3. The FLP will come this year. The official cash rate will be lowered early next year. The RBNZ will continue quantitative easing i.e. currency printing to further lower interest rates.

Why Negative Interest Rates Don’t Even Do What they’re Meant To

So negative rates are clearly coming. In Australia the central bank is still trying to make out they aren’t. Even though they very likely are. While our once conservative central bank is just straight out telling us the crazy initiatives they have planned.

The thing is negative interest rates don’t even do what it is they are designed to! That is to force people to spend and borrow. We’ve seen it reported that overseas experience of negative interest rates is “mixed”.

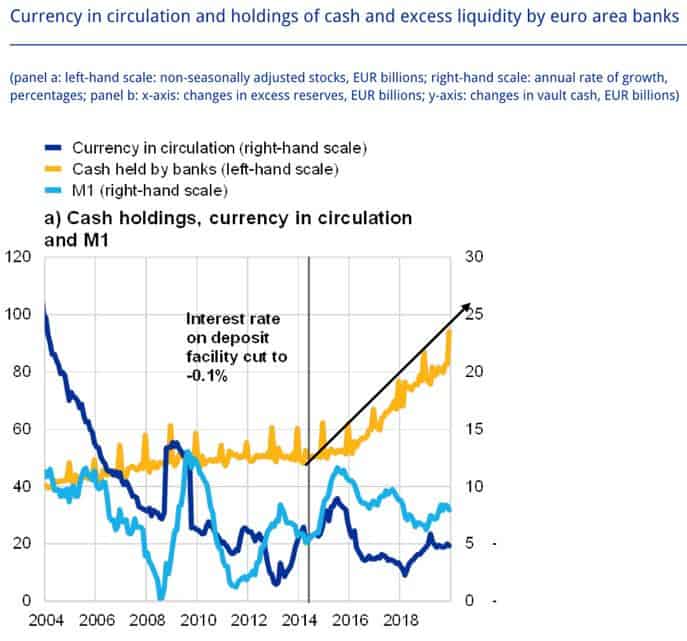

However the evidence is not mixed. It shows that negative interest rates make people do the exact opposite of what is intended. Check out this chart care of Vern Gowdie.

It shows that when rates went negative in Europe in 2014, cash holdings (yellow line) actually rose.

That is people saved more. Why is that? Well most people with a pulse realised that negative interest rates were signaling that all was not well in the economy. So they hunkered down, didn’t spend and made sure they had some surplus funds.

Odds are we’ll see the same thing here in New Zealand in the coming years as rates go negative.

We wouldn’t blame you if you decided to save more as a result of negative interest rates.

However, given you’re reading this newsletter, we’d hope you’d choose to save in gold and silver rather than cash in the bank!

The former gives you a good chance of increasing your purchasing power as rates go negative. While the latter pretty much guarantees you’ll lose it!

The Bankers Won’t Tell You This But Here’s Why Rates Are Already Negative

So negative interest rates are coming next year, except…

They’re already here!

How is that? Well this week’s feature article explains why you need to track the “real” interest rate. This “real” has changed quite dramatically this year in New Zealand. Not surprisingly so has the gold price…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Lower the Odds of the Theft of Your Gold and Silver

A client recently reported they had a box of 500 Canadian silver maple coins stolen. Actually they had removed one tube of 25. So if you see 475 silver maples for sale somewhere, please let us know so they can get the police involved.

But this theft is a painful reminder to take some time to think about where to store your gold and silver purchases.

It’s worth considering a vault such as our preferred provider based in Auckland and Wellington.

Otherwise you might want to think about having a home safe professionally installed. But there are quite a few things to consider in doing this.

Here’s 8 questions you should ask before you buy a home safe…

And if you have any questions about the process of buying gold and silver please get in touch…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

Back in Stock Again:

Berkey Water Purifier Systems

Free Shipping NZ Wide.

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: 27 Ounces of Ancient Gold to Buy “a Fancy House in One of the Best Neighborhoods” - Gold Survival Guide

Pingback: The Most Common Question When Buying Precious Metals - Gold Survival Guide