Prices and Charts

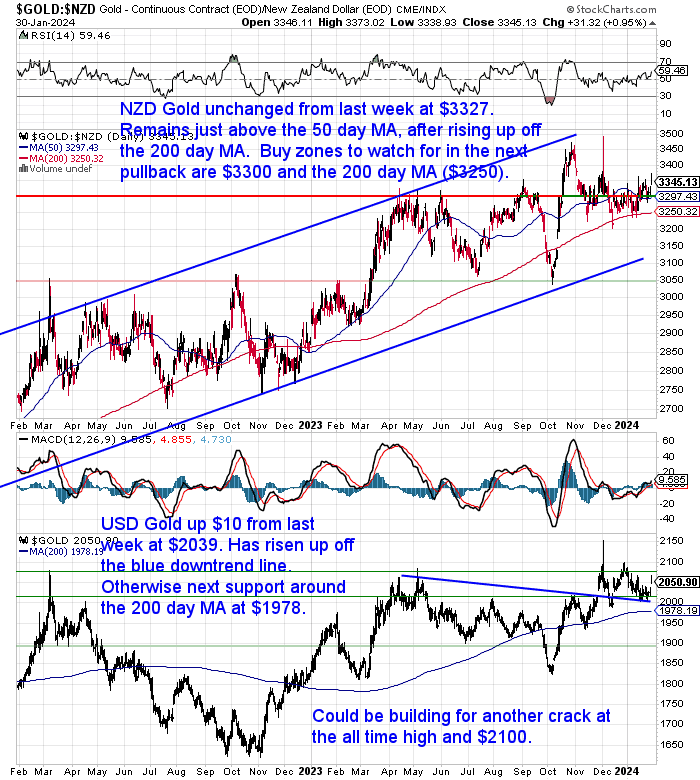

NZD Gold Unchanged From Last Week

Gold in New Zealand dollars is unchanged from a week ago at $3327. It remains just above the 50 day moving average (MA), having risen up from the 200 day MA. Late 2022 and October last year, are the only times NZD gold has dipped below the 200 day MA. That line continues to have strong support. So any return there should be seen as a very good buying zone. The 50 day MA also sits just below the round number of $3300 so that is another buy zone to watch for.

In US Dollars gold was up just $10 to $2039. It has risen up off the blue downtrend line again. Otherwise the next support area to watch for below that would be the 200 day MA at $1978. But so far USD gold continues to hold above the $2000 line.

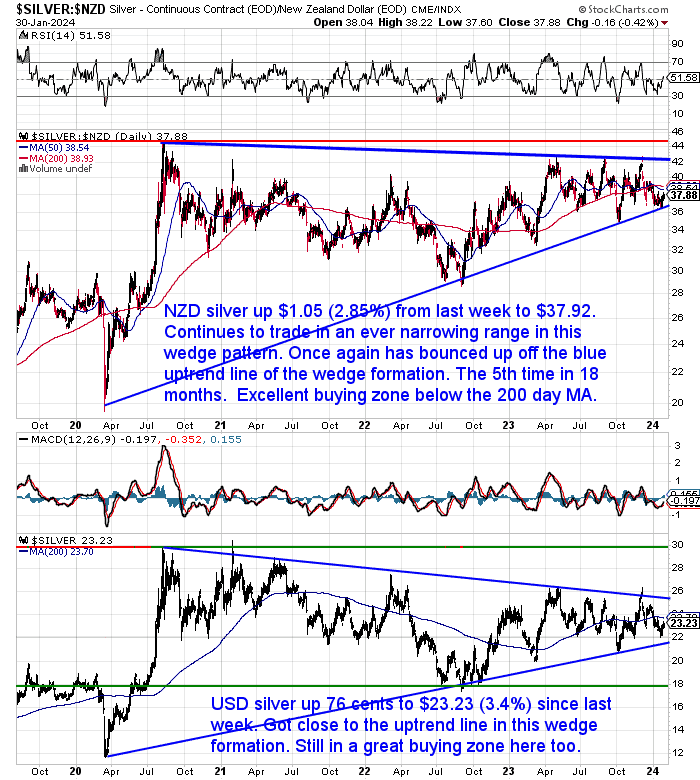

Silver Outperforms Gold by 3%

Silver in New Zealand dollars was up over $1 or almost 3% from last week. It once again bounced up off the blue uptrend line in this wedge or pennant formation. The 5th time in 18 months that this has occurred. So silver continues to trade in this ever narrowing wedge pattern. It will have to break out of that eventually as it gets more and more compressed. Like a coiled spring, when the break out happens, it will likely take us all by surprise.

So any return to the uptrend line should be considered an excellent buying zone. But anywhere between that and the 200 day MA will likely be a pretty good long term entry point too.

Silver in US dollars looks fairly similar, having got down close to the blue uptrend line in the wedge or pennant/flag pattern. So anywhere between that and the 200 day MA ($23.70) is also a great buying zone for silver in the US currency.

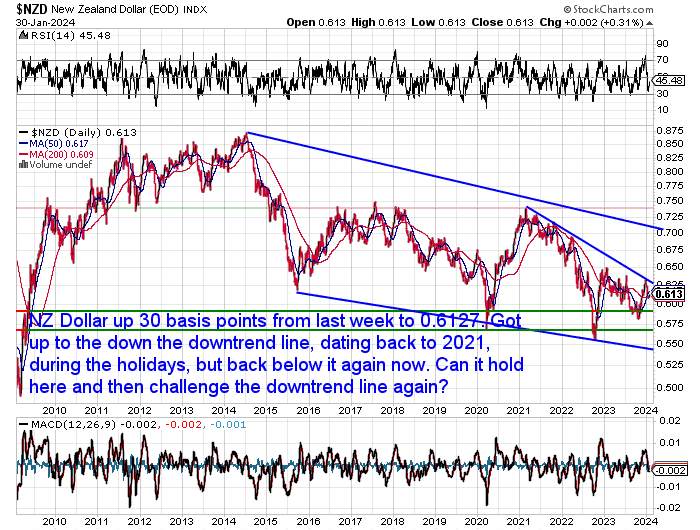

NZ Dollar Rising Off the 200 Day MA

The Kiwi dollar was up 30 basis points from a week ago to 0.6127. During the New year holidays it got up to the downtrend line which dates back to 2021. Then pulled back down from there to recently touch the 200 day MA. Can it hold its ground here and then make another challenge on the downtrend line again?

Still expecting the Kiwi to strengthen a little this year versus the US dollar. But we need to see that downtrend line clearly broken before we can say the trend has changed.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

How Has the NZD Gold Price Performed Versus Inflation?

Last week we reported how NZ CPI inflation had dropped in the December quarter. But it still remains historically high. So the purchasing power of people continues to be strongly affected by the current inflation rates. Many people buy gold as a way to hedge against inflation and protect their wealth. But how has the NZD gold price performed compared to the rate of inflation in New Zealand since the year 2000?

This week’s feature analyses the data and provides insights into the relationship between the NZ CPI Index and the NZD gold price. The article also discusses the break-even timeframe for buying gold and some of the common objections to investing in gold.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

New “Gold Rush” for New Zealand?

This week’s inflation and gold article was also featured in a report by Christchurch newspaper/website The Press.

New Zealand ‘on the precipice’ of a new gold rush

The article reports that New Zealand may be on the verge of a new gold rush, as some of the country’s gold exploration projects actually turn into mining projects in the next 5 years or so.

It states that the NZD gold price has reached a record high of over $3,000 per ounce, and features our chart, showing how much the price of gold has outperformed the CPI inflation rate since 2000.

The article also explores the history of gold mining in New Zealand, and the environmental and social challenges that it faces. The article features opinions of various stakeholders, such as gold miners, the new government resources minister, and environmentalists, who share their views and experiences on the industry.

It was a well balanced article on gold mining that did a good job of pointing out the potential benefits. Gold mining could become a vital part of New Zealand’s economy, and as the minister points out, help to pay down the enormous level of debt that was racked up as a result of the Covid spending. But of course it also requires careful management and regulation to ensure its sustainability.

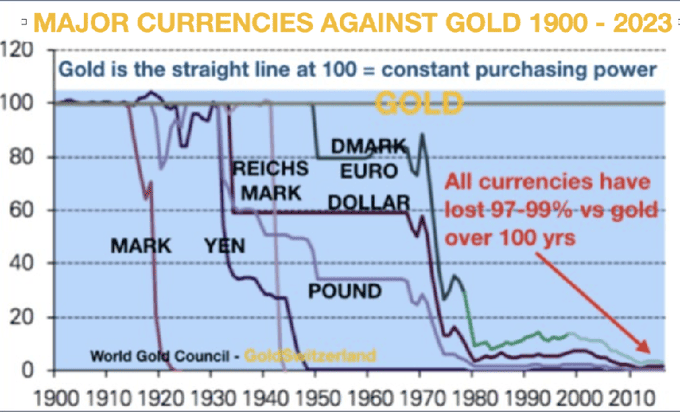

Gold Outperforms All Major Currencies over 100 Years

This week’s feature article highlights how much gold has outperformed inflation since the turn of this century.

But a chart we spotted last week shows how all major currencies have lost between 97-99% versus gold over the past 100 years!

What is happening? #Gold outperforms all major currencies over the last 100 years- hmm

Source.

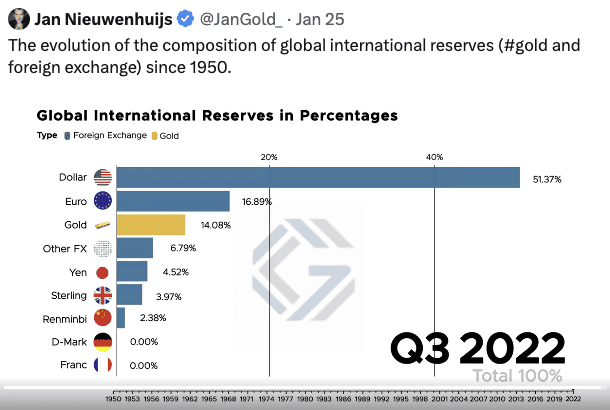

But Gold as a Percentage of International Reserves Has Fallen to 14%

But despite this out performance of gold versus all currencies, since the middle of last century, we have seen a steady fall in the level of gold held as a percentage of global international reserves.

This 49 second animation on X (Twitter) shows how this has tracked for the last 72 years.

From 72% in 1950. Falling all the way to 9% in 2015. It has ticked up since then to now stand at 14%.

Global International Central Bank Reserves

( .. also shows how the West tried to cancel gold as a monetary asset in the 1990’s)

Source.

After falling for so long there is probably a reason why central banks continue to exchange fiat currency for gold. Perhaps you should be doing the same? Especially while it remain under the radar…

Get in touch for a quote for gold or silver or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

New Australian Product: The Superoo 16 Litre Gravity Water Filter by Filteroo. Leak-free design with double the capacity of similar filters.

This filter will provide you and your family with safe drinking water for years to come. It’s simple, lightweight, easy to use, and very cost-effective. Comes complete with Stainless Steel Tap, Stand and Water Jug.

Shop the Range…

—–

|