Prices and Charts

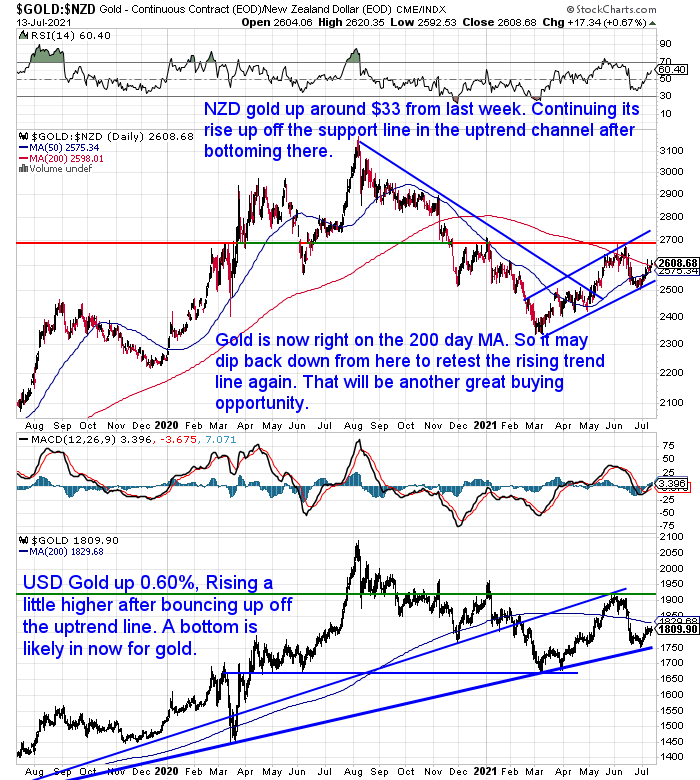

NZD Gold Rising Further Off Uptrend Line

Gold in New Zealand Dollars was up further from the uptrend line this week. Rising $33 dollars to now be right on the 200 day moving average (MA) line. From here we may see NZD gold dip back down to retest the blue uptrend line. If that happens it will likely be another great buying opportunity for anyone who has been sitting on the sidelines.

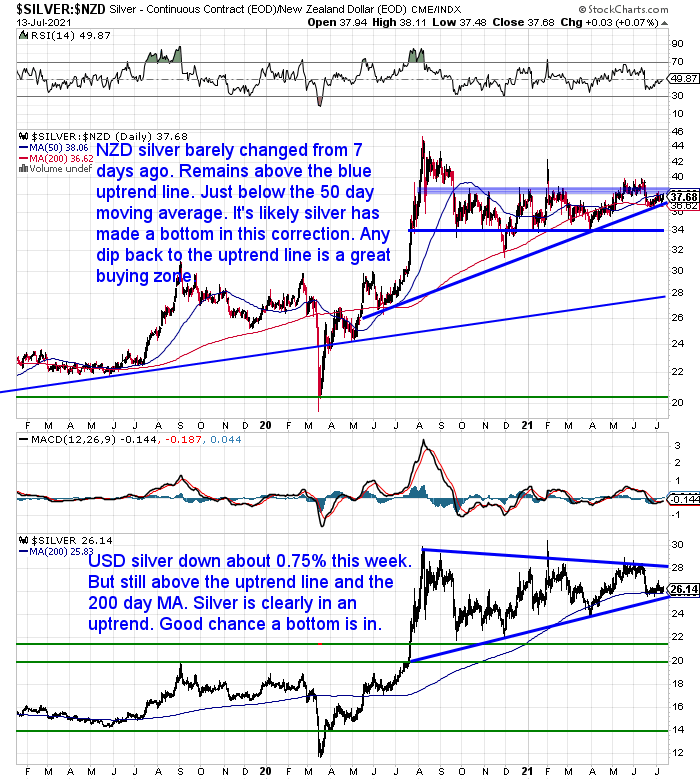

No Change for NZD Silver

Silver in New Zealand dollars is basically unchanged from last week. It remains a little up off the rising blue trendline. Sitting in between the 50 and 200 day moving averages. It’s likely silver has made a bottom in this correction. So any dip back to the blue uptrend line is likely to be a good buying opportunity.

The weaker Kiwi dollar has helped to hold the local silver price up, with the US silver price down 0.75%. Silver is trading in a clear wedge formation. With a fair bit of room to run higher before it touches the upper boundary of this wedge.

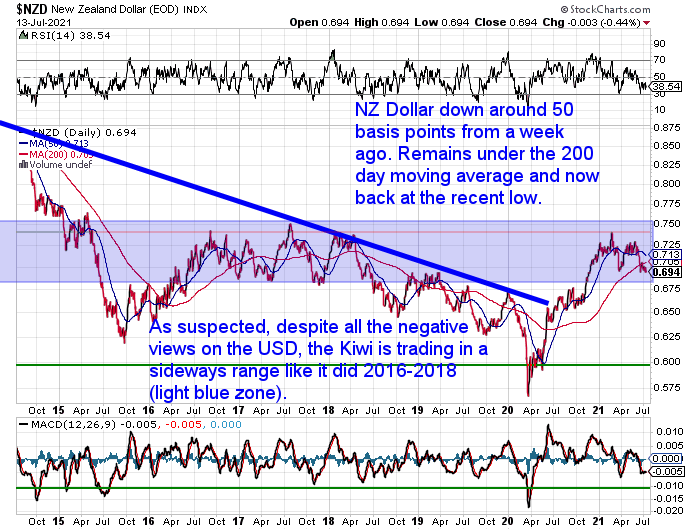

NZ Dollar Down almost 50 Basis Points This Week

As noted already the New Zealand dollar was markedly lower this past 7 days. The NZD remains well under the 200 day MA. Today it is back down close to the recent low.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

NZ Bank Economists vs Global FX Markets

There is much talk from the bank economists that the RBNZ will have to raise interest rates before the end of the year.

But despite this the NZD has remained fairly subdued – trading sideways all this year. In fact, shorter term, the trend has been down for the past few weeks.

So this points to the foreign currency traders not believing that interest rate hikes are as close as the bank economists say they are. Roger Kerr pointed this out earlier in the week:

“The higher than expected GDP growth result in the March quarter of +1.60% and the increase in business confidence in the NZIER quarterly survey last week have convinced the bank economists and NZ interest rate markets that the RBNZ will be hiking the OCR before the end of the year. In years gone by, such a sudden ramping up of pricing and expectations would have sent the Kiwi dollar value northwards.

However, over this last week the NZD has moved in completely the opposite direction i.e. the FX markets do not buy into the local hype about how our economy will perform over the next 12 months and the RBNZ responses to that unfolding economic picture.

You would have to back the global FX markets as being on the right side of this massive divergence in opinion.

The FX markets are saying, which aligns to the author’s view, that New Zealand will not achieve the 4% to 5% GDP growth the RBNZ and banks are all forecasting, as we have lost our largest industry and productive output will be constrained by the severe labour shortages due to no immigration.

It would only take further falls in dairy and log commodity prices over coming months to further dent our GDP growth prospects.”

Source.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Carrying Gold into a Foreign Country in 2021. What are the Rules?

There are not so many people crossing the borders at the moment. But there are still people trying to return to or even to immigrate to New Zealand and elsewhere.

We had a question just last week from someone who had a family member arriving in New Zealand and wanted to know about the best way to bring their gold into the country. In the past we have organised fully insured shipping of bullion from one country to another. So if you or someone you know requires that then get in touch.

Anyway this question prompted us to take a further look at the rules around carrying gold across borders. We also look at the rules in terms of importing gold (and silver) into New Zealand.

This week’s feature article covers:

- Is Carrying Gold into A Foreign Country Illegal?

- When Carrying Gold into a Foreign Country, Do You Have to Declare Legal Tender Gold Coins Face Value or Metal Value?

- Carrying Gold into The USA

- What About Importing or Carrying Gold into New Zealand?

- What is the Safest Course of Action When Carrying Gold into a Foreign Country?

- An Alternative To Carrying Gold Into A Foreign Country

- Bonus Tip on Carrying Gold to Foreign Countries

Late Update: RBNZ to Stop QE This Month

Just as we were getting ready to send this out, the Reserve Bank has announced that they will end their Large-Scale Asset Purchase (LSAP) programme by July 23. This is central banker speak for currency printing. Where the central bank buys NZ government bonds with currency it creates from nothing.

Originally the LSAP was due to continue into 2022. However it seems the RBNZ is finally realising how much of an impact this has had in distorting the New Zealand economy.

The Official Cash Rate (OCR) remains at the record low of 0.25%. The Funding for Lending Programme (FLP) is also unchanged. This gives banks access to lending at the (OCR) for a term of three years. Where normally this is of a short term duration only.

So in a nutshell credit remains very easy and is likely to further stoke distortions in the New Zealand economy yet. Don’t expect a collapse in house prices any time soon.

The Kiwi dollar has jumped in response, but is still up only around 60 basis points. So not a huge jump considering. But that puts the dollar back about where it was a week ago. As a result NZD gold is down about $18 from what we had written earlier. While silver is down a further 27 cents.

So if you were looking to buy you get a further discount care of the RBNZ. Right now is even better buying than it was an hour ago.

Local Silver Bars Available Again

Local silver bars are finally in stock again. Local suppliers have 1kg silver bars available again. Along with local silver 5oz bars, we also now have 10 oz bars and 500g local silver bars. Limited stock but available now. The 500g bars are not yet on the website. So phone or email for a quote for those.

We also again have ABC serial numbered 1kg bars in stock. These are actually cheaper than comparable bars we’ve seen advertised lately in the USA. So silver down under is well priced globally at the moment.

Also now in stock are 10oz ABC silver bars and 500g ABC silver bars. Phone or email to order them.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Shop the Range…

—–

|

Pingback: Gold is Cheap Compared to Inflation Protected US Government Bonds - Gold Survival Guide