Prices and Charts

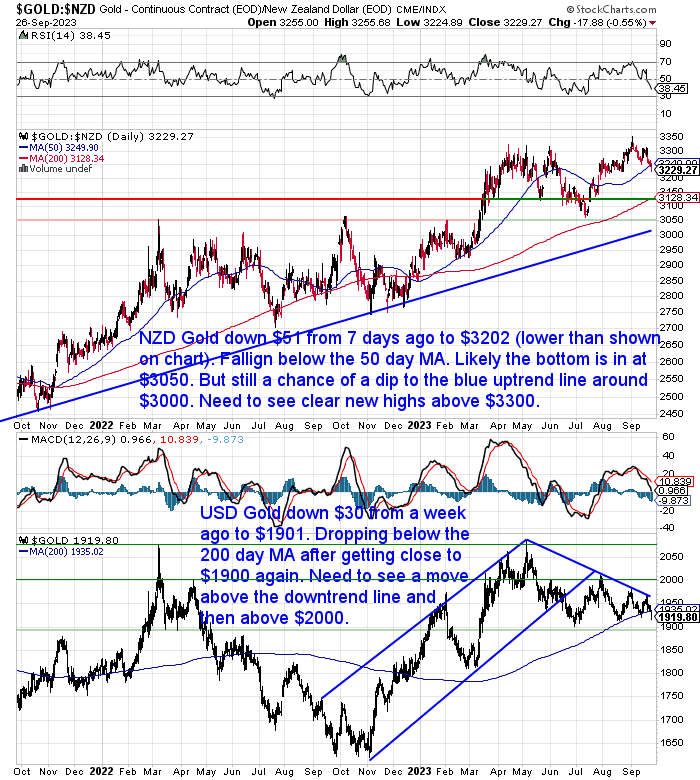

NZD Gold Back Below the 50 Day MA

Gold in New Zealand dollars is down $51 (1.6%) from a week ago. Dropping back below the 50 day moving average and sitting just above $3200 today. While there remains a chance of a dip all the way down to the blue uptrend line, we still think it’s likely the bottom is in at $3050. So any further pullback towards the 200 day MA ($3128) should be seen as a buying opportunity.

USD gold was down $30 (1.5%) from last week. Unlike NZD gold it is already back below the 200 day MA. Sitting just above $1900 today. We’d expect a bounce back up fairly soon. But we still need to see a clear move above the downtrend line and then back above $2000 to confirm an uptrend is in place.

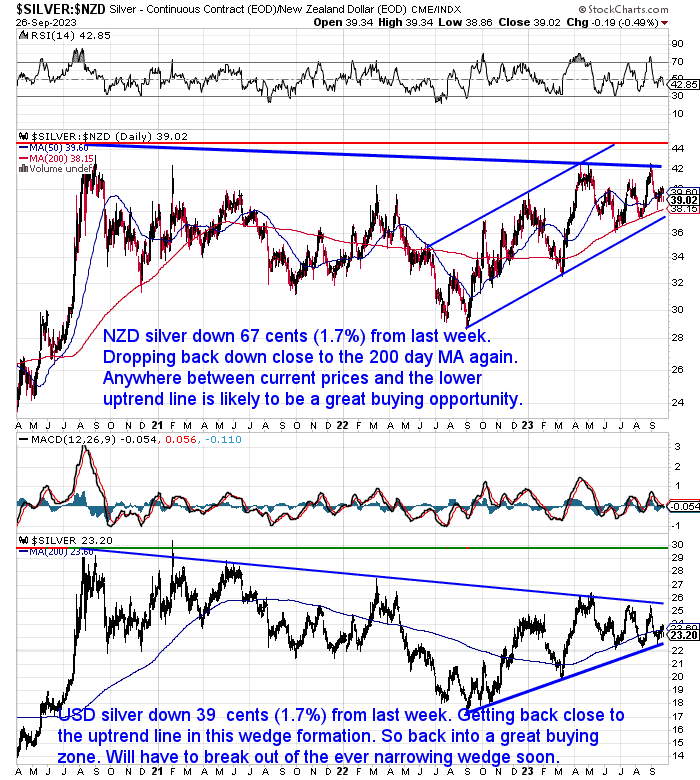

NZD Silver Entering Great Buying Zone Again

NZD silver had an even bigger drop. Down 67 cents or 1.7% from a week prior. Once again it’s not far above the 200 day moving average. So we’d say that any dip lower from here to the uptrend line is likely to be a great buying opportunity.

USD silver was also down 1.7% or 39 cents from last week. It’s now very close to the uptrend line so black into a great buying zone already.

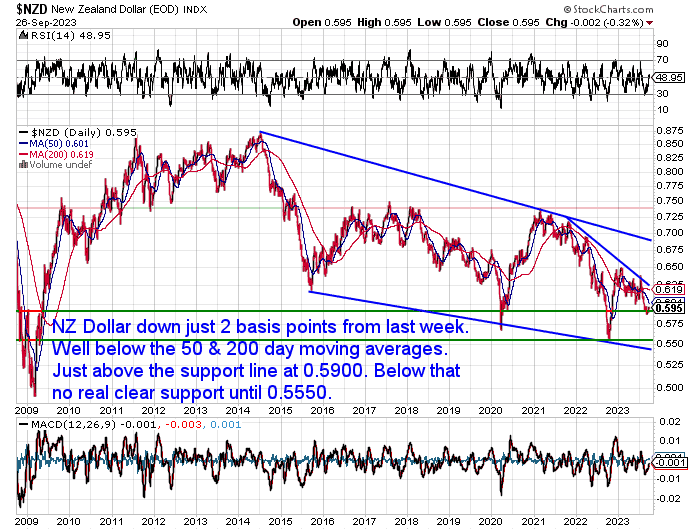

NZ Dollar Unchanged

The New Zealand dollar was down just 2 basis points from last week. So it was basically unchanged from a week ago. Continues to hover around 0.59.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Societal Breakdown: Are Gold and Silver Coins Better Than Tradable Items Like Tools, Water and Wine?

Are you prepared for a societal breakdown? If so, what kind of items would you use for trading in a post-apocalyptic scenario? Many people might think that gold and silver coins are useless in such a situation, and that they would be better off with more practical goods like tools, water, or wine. But is that really the case?

In this article, we explore the advantages of gold and silver coins over other tradable items in a societal breakdown. We also discuss how to authenticate the purity of precious metals, and when they are most important and useful. Read on to find out why gold and silver coins are not only a good investment, but also a vital form of insurance for the worst-case scenario.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

China’s US Treasury Bond Holding Lowest Since 2009 – While Consumer Gold Demand Surges

Last week we shared a chart from Tavi Costa which showed that for the first time in 45 years, US Treasuries have higher downside volatility than gold.

At first glance that could be one reason why China’s holdings of US treasuries have been reduced so much:

“Foreign holdings of US Treasuries increase in July, China holdings plunge

China’s stash of Treasuries dropped to $821.8 billion, the lowest since May 2009, when it had $776.4 billion, data showed.”

Source.

However, according to Reuters…

“Analysts said China has been under pressure to defend its weakening currency, the yuan, and the selling of U.S. debt may have been used for intervention purposes to prop it up.”

The weak yuan may also be why gold demand is so high in China right now. According to the South China Morning Post (SCMP)…

Why a weak yuan is spurring a retail gold rush in China

- The spread between the domestic and international price for the precious metal is at a decade high

- Chinese consumers are racing for safety as they see their assets dwindle

“With the yuan weak, housing in the doldrums and stocks as insecure as ever, China’s working and middle class are turning to one investment option that is regaining some shine: gold.

For Chinese consumers with limited access to overseas investment products, the precious metal is one of the few ways they can try to counter the shrinking value of their other assets.

The yuan is only expected to weaken, but most Chinese individuals cannot buy US dollars or US dollar-denominated products to hedge against the Chinese currency’s fall.”

Source.

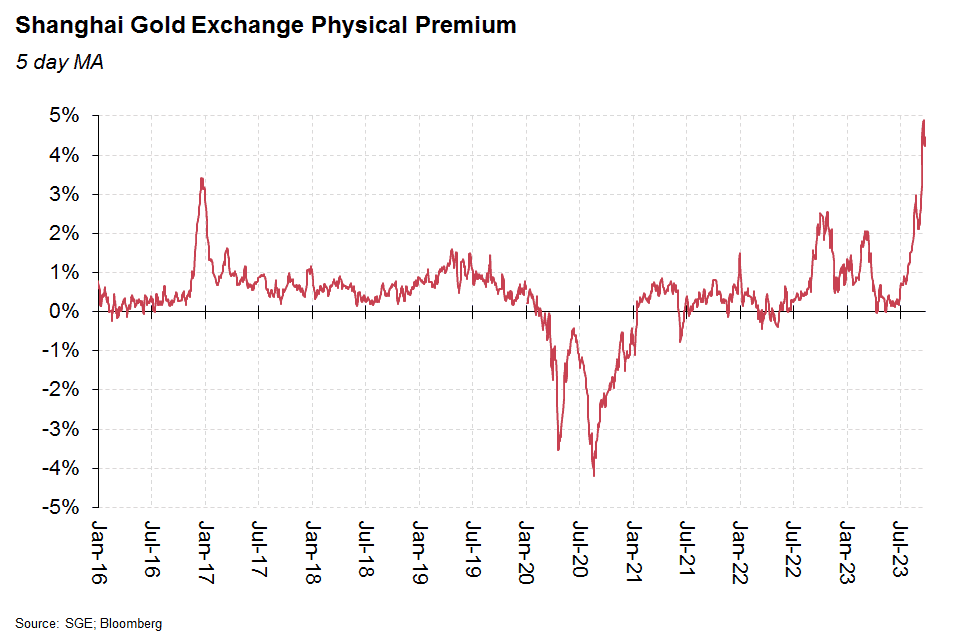

As the SCMP article above alludes to, when buying gold in China right now there is a very large spread compared to London gold market prices. The premium recently hitting over 6%:

Source

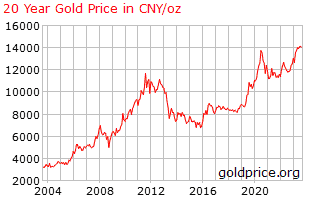

Much like we discussed with Japan last week, the gold price in Chinese Yuan also recently hit a new all time high.

So it’s not surprising that Chinese citizens are turning to gold to protect their purchasing power from their weakening home currency. However what is surprising – and unusual – is for eastern buyers to keep buying so strongly, when prices are at record highs and when they are also paying a premium over the London physical gold price.

Unlike in the west, usually in places like China and India we see demand drop off when prices get really high.

But it might be a case of not much choice for the average Chinese consumer who can’t buy offshore investments to protect them from the falling Yuan.

Estimated World Official Gold Holdings Reach Record High

Last week we shared how “Central Banks Preparing for the End of Fiat”. A sign of this was the People’s Bank of China increasing their gold reserves by almost 29 tons.

China is not the only one…

Jan Nieuwenhuijs estimates that:

…”global official gold reserves hit 38,764 tonnes in Q2 2023, breaking its previous record from 1965. The new high confirms the world has entered a new era of gold. Central banks will continue to accumulate gold and the metal’s role in the international monetary system will increase to the detriment of the US dollar.”

Source.

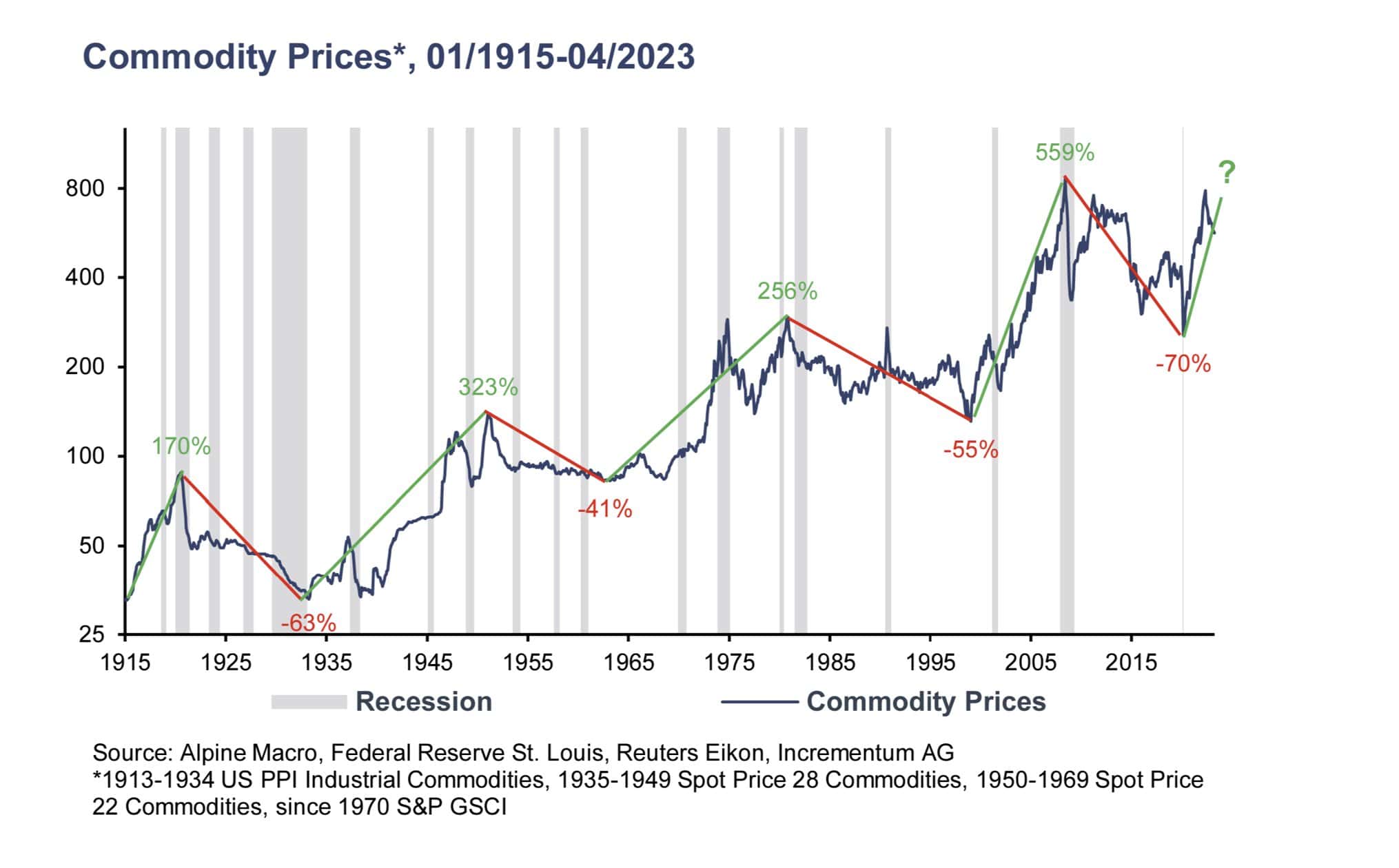

Start of the Next Commodity Price Cycle?

This increase in central bank gold demand could be as we also see the beginning of the next upwards commodity cycle. Tavi Costa points out that:

“Since the 1900s we had four notable commodity cycles.

Three of them occurred during inflationary periods:

1910s, 1940s, 1970s.

The fourth cycle took place in the early 2000s, coinciding with China’s entry into the World Trade Organization and its emergence as the manufacturing hub of the global economy, leading to one of the most extensive construction booms in history.

Now, we stand on the cusp of witnessing these two macro tailwinds at once:

1) The onset of another long-term inflationary era

2) A global manufacturing revamp particularly from G-7 economies to reduce reliance on authoritarian regimes

Another commodity cycle is underway.”

Source: @IGWTreport and Tavi Costa

What If More People Expect Higher Inflation?

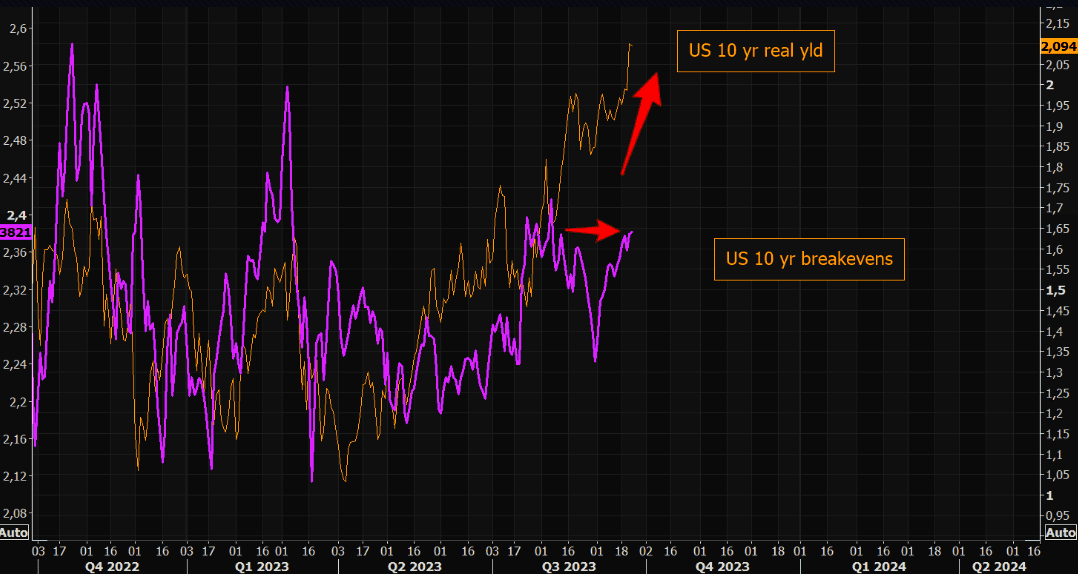

Tavi believes we are at the start of another long-term inflationary era. We are also seeing interest rates continue to rise.

However this chart care of The Market Ear shows the rise in US 10 year bond yields this past quarter has come while US 10 year bond breakevens is largely flat.

Real tightening in a pic

The latest rise in yields is not about inflation fears. Imagine the market starts to care about inflation making a comeback…

Source.

So what does this mean?

“The breakeven inflation rate represents a measure of expected inflation derived from 10-Year Treasury Constant Maturity Securities (BC_10YEAR) and 10-Year Treasury Inflation-Indexed Constant Maturity Securities (TC_10YEAR). The latest value implies what market participants expect inflation to be in the next 10 years, on average.”

Source.

So in short, “the market” thinks inflation will average just 2.37% over the next 10 years.

Therefore it will get interesting if people start to think inflation may be rising again.

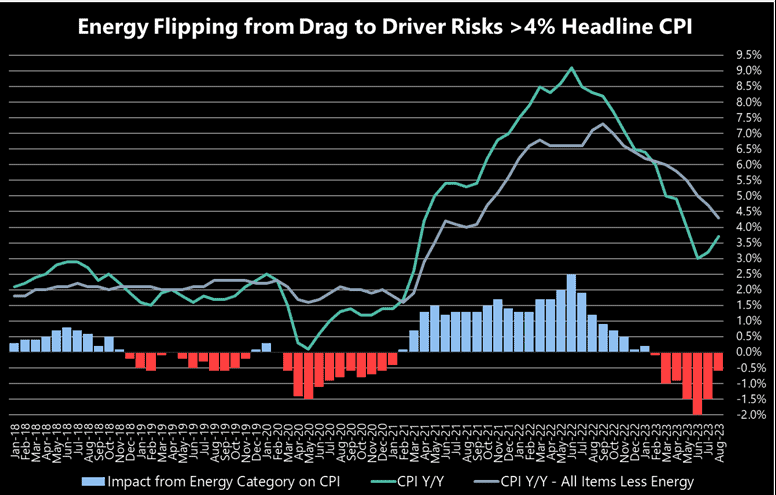

Meanwhile, after a period of falling, oil and fuel prices are steadily moving higher again. So energy prices are about to change from a drag on, to a driver of, inflation.

Inflation alert: Energy flipping from drag to driver

Energy prices have acted as a drag on headline CPI for nearly the entirety of this year. But that is likely set to reverse in the September data, which has typically led to a higher headline CPI.

Source.

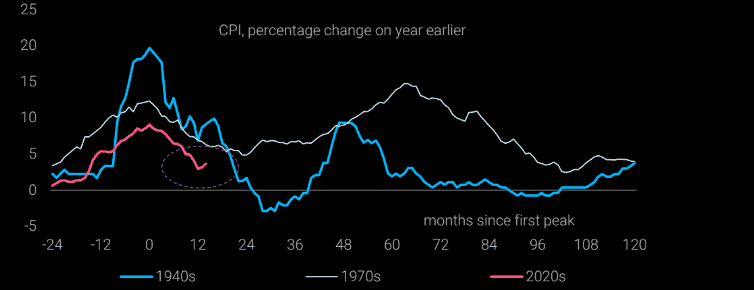

This next chart shows what inflation could do if history is any guide…

Inflation waves

“Some say inflation always comes in waves, which is worrying given oil prices. The spike in oil prices is a timely reminder that inflation volatility is not going away”

Source.

Gold prices here in New Zealand remain under all time highs. But the likes of China and Japan with their all time highs in gold and surging demand, might be giving us a glimpse of the future here. While the Kiwi dollar is weak, China and Japan remind us it could always get weaker… versus gold.

Best to be in before the masses.

Please get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Record High Interest Rates - What will Break First? - Gold Survival Guide