This week we stumbled across an old article by Sandeep Jaitly of FeketeResearch and the Gold Basis Service on the topic of “bimetallism” that we thought was well worth sharing. Bimetallism is defined on wikipedia as:

“In economics, bimetallism is a monetary standard in which the value of the monetary unit is defined as equivalent both[1] to a certain quantity of gold and to a certain quantity of silver; such a system establishes a fixed rate of exchange between the two metals.”

The “fixed rate of exchange between the two metals” is the key part of the definition to take note of, as this is what bimetallism is most commonly thought of as. However as Sandeep shows by delving back a bit further into history this is not necessarily the way it needs to be – or in fact should be…

The Validity of Bimetallism

Sandeep Jaitly

FeketeResearch.com

Bimetallism is often thought of as an unworkable system of monetary arrangement. In the last form that bimetallism existed prior to the ‘de-monetisation’ of silver across the globe in the 19th century, this is certainly true. But in its original form, with floating ratios, it is a perfectly valid monetary system.

The problem, as ever, comes with the attempt to fix prices. Bimetallism – on the strict proviso that the ratio of gold to silver is not fixed – is a perfectly viable system. Since time immemorial, money was defined in terms of silver, not gold. The Pound Sterling was originally defined as 5,400 Troy grains of silver; 240 Pfennigs originally equalled one Troy pound of silver and the Indian Rupee was equal to 175 Troy grains to name but a few. Gold coinage, in so far that it existed, was very much limited in circulation. An often overlooked fact is that gold coinage was never originally defined in terms of silver. Trying to enforce a fixed relationship between gold and silver is like trying to enforce a fixed relationship between the exchange of chalk and cheese.

The United Kingdom’s Pound Sterling will be used as an example to show the blunder- filled journey from a silver based monetary unit to a gold one. Dating back to Saxon times, the Pound Sterling was defined as 5,400 Troy grains of silver divided into 240 pennies or 20 shillings. Henry VIII was the first gross monetary debaser in British history – mixing copper with silver in a ratio of 2:1 thus causing one Troy pound of silver to produce 60 shillings instead of 20. He earned the sobriquet ‘old copper nose’ when his debased coins, after minimal use, produced a coppery shine on the king’s nose.

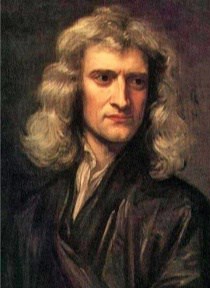

There had been occasional dalliances with gold coinage in the early medieval period, but each attempt involved fixing the gold/silver ratio such that the gold coins were undervalued leading to them being melted for silver. The first serious attempt at a ‘floating’ gold coin was the guinea issued in 1663. 441⁄2 guineas were defined to equal one Troy pound of gold. It was generally accepted – although fluctuations occurred – at 21 shillings. In 1697, the first blunder happened. A proclamation was made – for reason unknown – that the Exchequer accept guineas at 22 shillings (fixed.) This in effect overvalued gold compared to the rest of Europe: the gold/silver ratio in England had now advanced to 16.01, whereas in the rest of Europe is barely rose above 15. It had the effect of draining silver coin from England and replacing it with European gold: a ‘risk- free’ arbitrage could be made with comparative ease. It must be remembered that the mint was open to both gold and silver in England then. Sir Isaac Newton, master of the royal mint, was consulted about the problem of the vanishing silver specie.

Newton, as one might expect, saw the nature of the problem easily and recommended that the value of the guinea be brought down to be more in line with European rates of gold/silver exchange. The recommendation was taken up and the guinea brought down to 21 shillings by royal proclamation – but this was insufficient according to Newton’s prescription. Even though the implied gold/silver ratio had been brought down from 16.01 to 15.28, it still remained above levels prevailing in continental Europe. In 1715, the Netherland’s West Friesland had an implied gold/silver ratio of 15, as did France. Silver specie continued to flow out of England. Newton, as the records indicate, did not sound out the idea of a floating market rate between the guinea and pound Sterling. As a general frame of thought, ‘change’ is not something the British are generally keen on.

The state of the kingdom’s silver coin had become so dwindled and worn that it was necessary to declare in 1774 that silver should be legal tender for sums over £25 by weight and not by tale (i.e. number of coins.) Silver – completely by blunder – had been replaced by gold, whilst silver remained the legal basis for Pound Sterling. The two states were incongruous. The official closing of the mint to silver in the United Kingdom [as it was by then] was achieved in 1816, when gold became the legal basis for Pound Sterling. This was merely a formality as the gold standard had been implicit for decades as silver left the country.

The road to hell…

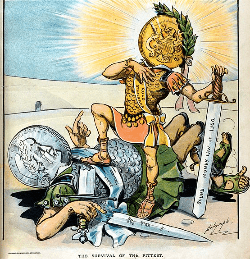

It seems like a series of innocuous events led to the adoption of a gold standard in the United Kingdom. With malice not a forethought, the country ended up on a gold standard. All this due to something as simple as fixing a ratio. Other nations followed suit. The United Kingdom, by 1816, was a power with no equal and the rest of the world could not watch idly. The United Kingdom was the first country of size to ‘de-monetize’ silver. By the end of the 19th century – virtually all of Europe had switched to gold as the legal basis for currency (implicit or not) and silver – by the whim of governments – had become a mere token issue.

This transition had horrific consequences across the world – and it was not as pleasant a sojourn as the British experienced. Silver remained the basis for the currencies of India, China and many more. Those that were last to convert their standard from silver to gold suffered the most. In a very short space of time, these countries found that imports [from gold based countries] were getting far more costly, and exports were being paid for in voluminous amounts of silver. In some cases, this caused a rapid escalation in the general price level. This occurred in China prior to the communist revolution. It had the effect of wiping out the agricultural classes and causing mass destitution paving the way for Mao to take command with his ignorant ideologies. India, under the imperial yoke of Great Britain, did not adopt a gold standard until 1893 – after the majority of the “civilized” world. A similar fate awaited them as China. Attempting to fix a gold coin’s price in silver terms, a seemingly innocent desire, was the progenitor of communism.

The correct way of practicing bimetallism

Silver was the legal basis for money across the entire globe and that is the way it should have remained. The ancient currencies (e.g. Rupee and Pound) were defined in terms of silver alone. That was perfectly sufficient. The introduction of gold coin should have been under a different nomenclature so as to imply no fixed relationship between gold and silver. This was initially done – the gold guinea not being defined initially in terms of pounds Sterling.

The two rates of exchange should be left to the market. With the strict proviso that the mints across all countries are open to both gold and silver in any size tender, any geographical differences in the (market traded) gold/silver ratio will tend to be arbitraged away. The market process would naturally achieve what Newton initially wanted: minimal difference between different countries’ gold/silver ratio rates.

A huge discovery of silver reserves in the United States – as occurred in the 19th century – would have the effect of elevating the gold/silver exchange ratio locally. Perversely, the nominal amount of gold within US borders is likely to increase with this glut of silver. A sharp move higher in the US gold/silver ratio would induce surrounding countries to send gold to the United States in exchange for the cheaper silver to be exported. The effect would be to normalise the gold/silver ratio in the United States in relation to the ratio in surrounding countries.

The problem was not with bimetallism but with the mechanics of its establishment. Bimetallism is paradise so long as exchanges between the metal are free, and mints are open to unlimited tender in both metals. It is up to the people to decide which metal they prefer and there should be no hindrance from government in this choice. From a legal perspective, there was nothing lacking in having silver as the basis for money. What was lacking was the prevailing mentality that gold could and should somehow be fixed in relationship to silver. No other pairs of distinct entities have this kind of relationship forced on them. Gold and silver are no different.

[If you found this piece interesting, here’s some other articles and videos featuring Sandeep that you may find of interest. The one on fractional reserve banking is particularly thought provoking as much like the above view of bimetallsim, it outlines how fractional reserve banking actually worked quite well in the past:Why Fractional Reserve Banking is Not the Problem

Sandeep Jaitly Discusses GOFO and Backwardation

Sandeep Jaitly: Why We’re Deluded About the “Price of Gold”]

Sandeep Jaitly, 9th January 2011

Sources:

Banking and Currency, Ernest Sikes, 1905.

The Early history of Gold in India, Rajni Nanda, 1992.

Hope my rust math is correct. Looks like 5400 grains would be 11.25 troy oz. Today one pound is roughly 0.083 troy oz. So there has been a 135 times increase in silver value.

Pingback: Double Bottom for Gold in NZD? | Gold Prices | Gold Investing Guide