Prices and Charts

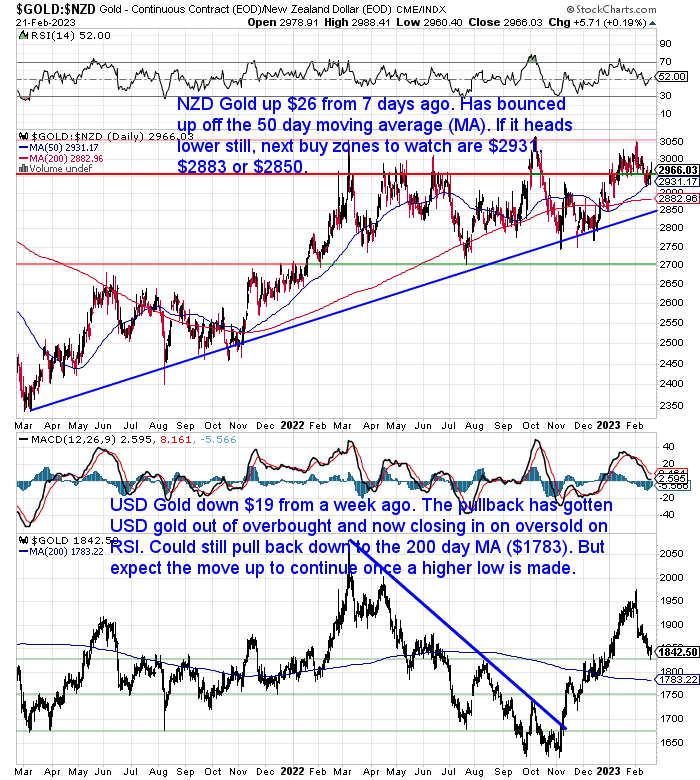

NZD Gold Still Holding Above the 50 Day Moving Average

Gold in New Zealand dollars is up $8 from last week. It continues to hold above the 50 day MA. With the RSI in neutral territory near 50, NZD gold is somewhat directionless here. If it heads lower still, then the buy zones to watch for are $2883 or the uptrend line around $2850.

USD gold is a bit of a different story though. It has just edged up from touching oversold. It could still head a little lower down to the 200 day MA ($1782), but USD gold looks to be getting close to putting in a bottom.

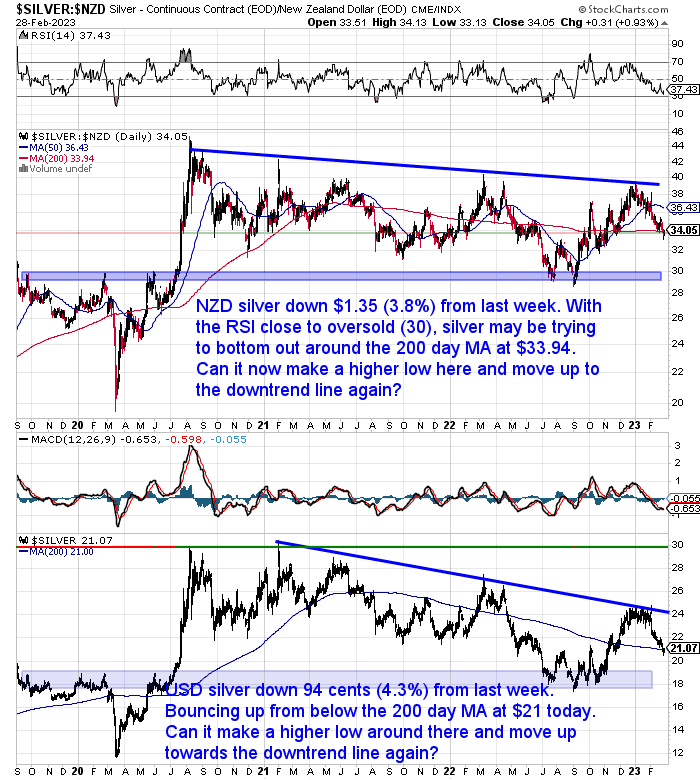

NZD Silver Close to Oversold

Silver in New Zealand dollars is down close to 4% from 7 days ago. The RSI overbought/oversold indicator is not far above 30 (below 30 is oversold). So silver may be trying to bottom out around the 200 day moving average upon which silver currently sits. Can NZD silver make a higher low here and then move up to the downtrend line again?

Meanwhile USD silver also sits on the 200 day MA. Although it has now just moved up from oversold on the RSI. So it too looks to be close to bottoming out around these levels.

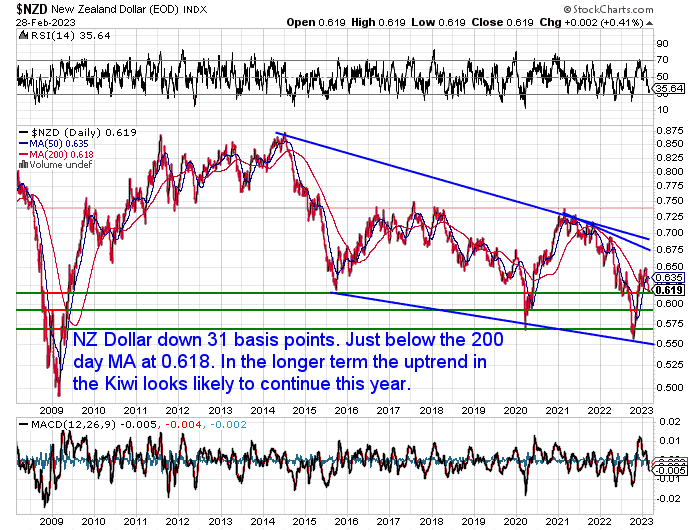

NZ Dollar Back Just Under the 200 Day MA

The New Zealand dollar is down 31 basis points from last week. Sitting just below the 200 day MA at 0.6180. In the longer run this year the uptrend in the Kiwi looks like to continue.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Measuring NZ House Prices in Silver

In last week’s newsletter we shared why we like to value property in gold ounces rather than purely in dollars terms.

But you might also be interested to see property in silver ounces. So this week we have crunched the numbers on silver. This week’s feature article covers:

- What is the Housing to Silver Ratio?

- How Have NZ House Prices Varied Over the Past 50 Years When Priced in Silver?

- NZ Housing to Silver Ratio Bottomed in 1980 at 1000 ozs

- The Ratio Peaked in 2003-2005 at Almost 30,000 ozs

- How Many Ounces of Silver to Buy the Average NZ House Today?

- How Does the Housing to Silver Ratio in New Zealand Compare to the USA?

- Here’s How to Buy a Median Priced House in NZ Freehold, for Only $44,815…

- Is the 1970’s Repeating?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Weather, Inflation and a Wage/Price Spiral

The Cyclone and various flooding events around the North Island of New Zealand are likely to cause the cost of living to increase even further.

Here’s a couple of items we’ve seen on this topic:

An economist says New Zealand will likely see inflation rise over the coming years as communities rebuild from the destruction caused by Cyclone Gabrielle. The cost of damage following the cyclone is estimated to be around $13 billion, according to Finance Minister Grant Robertson.

Read more

Economist Brad Olsen warns Cyclone Gabrielle will be ‘inflationary event’

Read more

These economists state that insurance premiums are sure to rise along with the cost of various building supplies. Plus, much like the Christchurch earthquakes, rents may also rise. On top of this food prices will also rise as the breadbasket that was Hawkes Bay has been badly impacted.

And they talk about all of these things will cause inflation to remain high for longer than previously expected.

But as usual the mainstream just blames inflation on everything but the largest factor, that of currency supply growth!

So even without the cyclone there is likely enough fuel in the system to create a wage/price spiral.

That is where wages are raised to make up for price rises. But prices continue to rise, so wages are put up higher. So we get a vicious circle happening.

The US is even seeing proposals such as this one from New York Governor Kathy Hochul:

“I’ve proposed a plan to peg the minimum wage to inflation — if costs go up, so will wages. “

Source.

But this excellent long form tweet from “Paulo Macro” explains what such a peg would cause:

“We could see [interest] rates at 10% and wages still going up. And what’s worse is wage increases, while crazy, are still negative real, so govts will want to step in and “help” with stimmies and garbage disaster ideas like [the one above from Governor Kathy Hochul.]

You know who’s really good at “indexation” like the above example (price controls where every price is linked to CPI)? Places in LatAm. Like Argentina. This is INFLATION INERTIA: a feature of inflationary regimes everywhere after they allow the genie to get out of the bottle.

Add to this an extremely polarized and dysfunctional political environment where politicians aren’t concerned about the country but instead in winning the next election at any cost (“we can fix it later”). This increases the risk of policy mistakes exponentially.

This is why inflation will keep coming and going in waves. The Fed ultimately cannot fix this problem. Their ZIRP short-circuited the natural market reaction to the fiscal profligacy which the Fed had enabled – but the fiscal profligacy is now bipartisan.

And if you look around at Congress there is no end in sight. Trump took deficits to extremes after 16 years of growing fiscal gaps. There is nobody to stand for fiscal rectitude anymore. The connection between the taxpayer and the national debt is completely untethered…

…and so govts will just run the tab until the bond markets fully crowd out private investment.

And while this is happening, the peasants will feel flush, all while they gradually get poorer as their money buys less.

Inflationary recessions create monetary illusions.

Parting thought: the Fed’s primary motivation is to avoid embarrassment- they only pivoted hawk in Dec21 when inflation was the #1 Gallup issue and politicians were calling. Now gas is sub $4 and nobody complains about inflation, so the Fed can slow-walk it.

This suggests to me a window where the economy is screaming and the Fed falls behind the curve.

Inflation related trades should scream.”

Source.

Gold and silver have held up fairly well over the past year, but they are far from “screaming”. So perhaps they are some of the “Inflation trades” that the writer is referring to?

Have you got enough protection from a wage/price spiral?

Get a quote on gold or silver products:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: What Will the Long Term Impacts of SVB and Signature Bank Bailouts Be? - Gold Survival Guide