A couple of weeks ago we reported on the prospect of negative interest rates arriving in New Zealand as soon as November.

The Westpac chief economist expected the RBNZ to signal its change of plan in its August Monetary Policy Statement, and make a 75-point cut to -0.5% in November.

Since then we’ve had a few questions from readers on the topic of negative interest rates. So today we’ll have a crack at answering them. We have these in written form along with a video answering the questions. So you can either read or watch/listen…

New Zealand Extreme Central Bank Monetary Policy Instruments: Now and What’s to Come?

First a bit of background on where we are at currently in New Zealand in terms of these extreme central bank monetary policy instruments…

Last week the RBNZ not surprisingly increased its currency printing or QE programme from $33 Billion to $60 Billion.

RBNZ nearly doubles quantitative easing programme to $60 billion; Reaffirms forward guidance to keep OCR at 0.25%, but specifically says it’s prepared to reduce the OCR further; Sees deflation occurring in 2021.

Source.

But already, ANZ economists are saying the bond buying programme will need to be increased to $90 billion pretty soon…

“The RBNZ launched its bond buying programme less than two months ago, originally with a targeted size of $30 billion. If the ANZ economists are right, this means the amount targeted to be bought by the RBNZ will have tripled, potentially by August.

In their Weekly Focus publication, the ANZ economists say they believe the RBNZ will increase the QE programme “in light of the giant government bond issuance programme unveiled at the Budget”.

“We are now forecasting a further scaling-up of QE at the August MPS to a $90 billion limit. This will help to absorb the bigger-than-expected programme of Government bond issuance to fund all that spending. The RBNZ has received an indemnity from the Government to increase QE as outstanding bonds grow, so the hurdle has been lowered, but an expansion will still need sign-off from the Monetary Policy Committee. We expect this will happen at the August MPS, if not earlier,” the economists say.

They say the increased QE will be in order to “keep the yield curve low and flat, in order to keep debt-servicing costs low and provide further assistance to the economic recovery”.

In the short term, the RBNZ may choose to front-load bond purchases with the current $60 billion limit, if the upward pressure on yields seen after the Budget persists, the economists say.

The central bank can also conduct purchases to assist with market functioning and soothe market concerns.

“But by August, we expect the asset purchase programme to be expanded to $90 billion. This would allow the RBNZ even greater flexibility to absorb issuance and keep the yield curve sustainably low and flat in order to support the economy.”

Source.

Once QE Starts… It’s Hard to Go Back

As we said when the RBNZ first began it’s QE in April, once you down this path of currency printing it’s very hard to return to normal…

Therefore it’s likely we’ll see negative interest rates here in New Zealand too. This is another tool the central planners will use to keep interest rates low. Low interest rates will be needed, given the amount of debt the government is intending to rack up in the coming years. They will also be required to keep real estate prices up. Higher interest rates would likely put a lot of mortgage holders in trouble.

The RBNZ monetary policy committee has as good as confirmed this too. Here’s an excerpt from last week’s decision to increase QE:

“…there are policy tools available that have not yet been used. The Committee agreed that it will stand ready to deploy further tools as needed, should the need for stimulus continue to increase. Tools available include further reductions in the OCR; a term lending facility; and adding other asset classes, such as foreign assets, to the LSAP programme.

The Committee noted that a negative Official Cash Rate (OCR) will become an option in future, although at present financial institutions are not yet operationally ready. The current goal of monetary policy tools is to reduce borrowing rates for New Zealanders, and further OCR reductions at this stage would not be effective in achieving that. Consequently, the Committee reaffirmed its forward guidance that the OCR will remain at 0.25 percent until early 2021. It was noted that discussions with financial institutions about preparing for a negative OCR are ongoing.”

Source.

To us that looks like a “when” not an “if”.

And the driver for “when” is technological restrictions. Simply because New Zealand banks aren’t yet set up to handle negative interest rates.

Questions on Negative Interest Rates From Readers

Now let’s look at some of the questions we’ve received on the topic of negative interest rates in New Zealand. You can watch the video below or read on for our answers.

Question: What would negative interest rates mean for NZ? What does that actually mean? Would I be paying to store money at the bank?

Okay, so first what are negative interest rates exactly?

The interest rate being referred to is that set by a central bank. Here in New Zealand it’s called the Official Cash Rate (OCR). It is the rate that commercial or retail banks are charged by the Reserve Bank of New Zealand (RBNZ) for keeping excess reserves with the RBNZ. That is, reserves that banks don’t want to lend out at that moment.

The theory is that by making this rate negative, it will encourage banks to lend money out to customers. As they won’t want to lose money by keeping excess reserves with the central bank. This should stave off deflation and keep the money-go-round going.

Negative interest rates do not necessarily mean that retail deposit holders (a.k.a average Jo and Joanna savers) are charged to keep savings in a bank. But that is possible. It would depend on how low the negative rates got. If they got low enough then the banks may choose pass this on to customers by also charging them on their deposits.

In some European countries where there have been negative interest rates as far back as 2012, some larger commercial deposit holders have been charged to hold cash with the bank.

In Germany some retail deposit holders are also being charged to keep deposits with some banks.

There is also the potential for retail customers to be paid to have a mortgage!

This has happened in the likes of Denmark. We reported in June 2019 how homeowners in Denmark were “about to get negative interest rates on their loans for all maturities through to five years, representing multiple all-time lows for borrowing costs.”

This may not quite have meant they were getting paid to borrow. As after fees etc it would have been closer to free rather than being paid to borrow. But it does show how perverse things have gotten, by leaving it up to a few people to control what is “the price of money” – interest rates.

Question: If the RBNZ goes into negative interest rates will it need to BAN CASH first?

No they wouldn’t. Other countries already have negative interest rates and they haven’t had to ban cash first. As the first aim of negative interest rates is to encourage banks to lend. The central bank sets its main lending rate negative. So banks are charged to hold money with the central bank short term. The aim of the negative rate is that banks will instead choose to lend out to customers rather than hold excess reserves with the central bank.

However the banning or removal of cash is not a crazy idea – well from the central planners perspective at least! As this would mean negative interest rates could also be set for customer savings deposits with retail banks. The aim would be to get people spending money rather than saving it. The idea is to get money circulating and increase inflation.

If this were to occur then people would obviously withdraw money from the bank and hold cash instead. As 0% is better than say -1% or -2%.

So the removal of cash also removes the escape mechanism from negative interest rates on bank savings accounts.

Of course there still exists another escape mechanism…

Buying gold or silver to protect your purchasing power and as an alternative to holding cash.

Read more on this topic: War on Cash: Implications for New Zealand(Opens in a new browser tab)

Real Interest Rates

However, it doesn’t require negative interest rates to be set by the central bank in order for you to lose money.

Interest Rates are already negative in real terms in New Zealand. That is the interest rate after inflation is already negative.

A question just in today ties into this topic of real interest rates nicely too:

Question: Are my savings in the bank keeping up with inflation or am I losing money?

Another reader question is:

“Are my savings in the bank keeping up with inflation or am I losing money?

Annual inflation in New Zealand has increased to 2.5% in the first quarter of 2020 from 1.9% in the previous three months.

If the savings in my bank account is gaining the interest of, let’s say 2.5% and the inflation rate is 2.5%, am I gaining any interest while the nation’s currency is being devalued on top of inflation?”

Well, you’re definitely not gaining anything. Firstly because the 2.5% interest rate also has to have withholding tax taken out of that. So call that at least 20% depending upon your tax rate and 2.5% is down to 2%. Straight away your returns are negative.

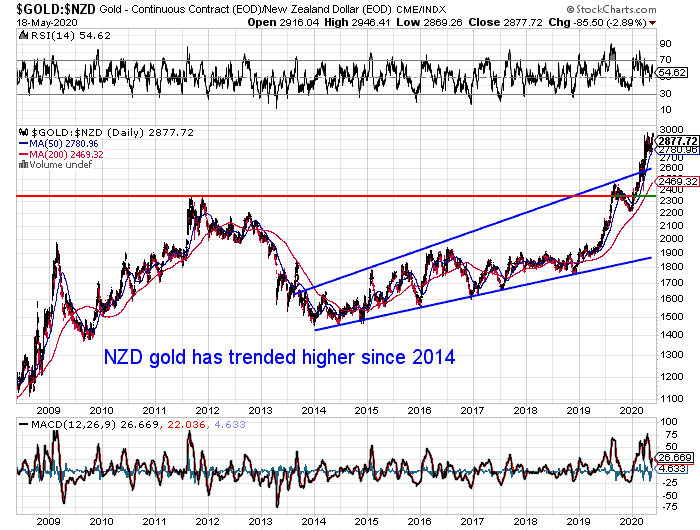

On top of this you’re also missing out on potential returns elsewhere – what is known as the “opportunity cost”. Gold has been going up steadily in NZ dollars since 2014.

So any funds in the bank are also missing out on those returns.

Real Interest Rates Will Stay Negative. Nominal Interest Rates Also Likely Will Go Negative

So odds favour gold continuing to trend higher. Just as it has done while real interest rates have been negative in recent years. So protect your cash from a virtually guaranteed loss of value. See the options to buy gold here. Plus make sure you get free access to our precious metals research and updates below.

Pingback: RBNZ Nearly Doubles QE to $60 Billion - More to Come? - Gold Survival Guide

Pingback: Clarification on Negative Interest Rates - Gold Survival Guide

Pingback: RBNZ Currency Printing Continues on Schedule - Gold Survival Guide

Pingback: Is the Mainstream in New Zealand "Waking Up" to the Benefits of Owning Gold? - Gold Survival Guide