Are you at all confused about the difference between NZD and USD gold price (and silver price)?

Here’s a question from a reader wanting some clarity on NZ Dollar versus USD Dollar precious metals prices:

I am a little confused about the difference between the NZD and USD pricing though. Can you explain how the USD affects the NZD and why the values are different when calculated back to NZD. Would we be better off buying gold in the US? Or buying with USD? (Still hazy on how either of these would be accomplished) Many thanks, Lisa

This is actually a common topic for people to get confused on, so Lisa need not think she is the first.

Also there are no stupid questions around here! Only those you don’t ask! So if you have a question, no matter how trivial you may think it is, please send it in. You can do so here on our contact page.

We wrote a post on this very topic of USD gold prices some years ago which still holds true today.

But we’ll summarise the main point of the above article. It is, you should ignore the USD gold price that is commonly quoted in the 6 o’clock news or on the radio. If you are based in New Zealand and buying with NZ dollars then you should track the gold price in NZ dollars.

What is the NZ Dollar Gold Price?

It’s simply the USD gold price converted by the USD/NZD exchange rate.

Today that is: US$1582.45 / 0.6527 = NZ$2424.47

So just keep an eye on what the NZD gold price is doing, to track where the price is at for any purchases you’ve made in the past.

Track the Gold Price in NZ Dollars When Looking to Buy

But you should also track the gold price in NZ Dollars to identify good places to buy in the future (on the dips as the article above says). You can track that in our charts here.

Or sign up to our daily price alerts which also includes some technical analysis of what is happening in the charts each day. Learn more about what you get in our Daily Price Alert here.

What Affects the USD/NZD Exchange Rate?

The USD/NZD exchange rate is affected by what is going on in each country particularly with interest rates.

While the gold price is also driven by many separate variables such as political and economic news. But in the long run the gold price is really a measure of how the global reserve currency, the US Dollar, is being devalued against gold. That is, the USD is really falling in value compared to gold, rather than the USD gold price “going up”.

In the long run the same thing is happening with every other fiat currency on the planet. Whether that be the New Zealand Dollar, Swiss Franc or Japanese Yen. They are all losing value against gold. But just at different speeds.

So sometimes the gold price might “rise” more in US dollar terms (like it has been quite recently). Compared to in other currencies such as the NZ dollar where gold hasn’t been rising so strongly for the start of 2020. (Although the fear surrounding the Coronavirus spreading has knocked the New Zealand Dollar down today. So the local NZ gold price has jumped sharply as a result).

In the Long Run All Currencies are Going Down Against Gold

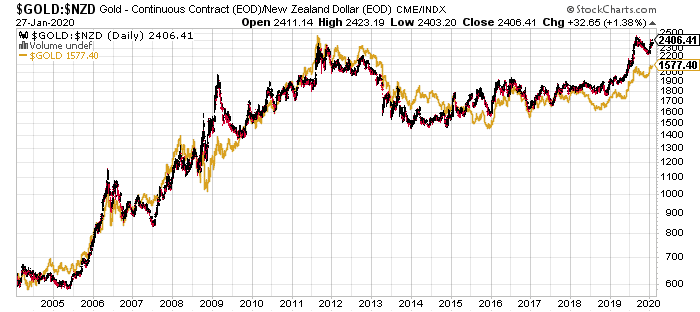

In the long run all currencies are headed in the same direction. This can be seen in the chart below. The NZD gold price is in black/red and the USD gold price is shown in gold. (Bear in mind the right hand axis is only showing the NZD gold price not the USD gold price).

At times they diverge when the USD/NZD exchange rate has a bigger impact on the price. But in the long run both the NZ Dollar and US Dollar have lost value versus gold (shown by both gold prices “going up”).

Would You Be Better Off Buying Gold in US Dollars?

As to Lisa’s question about would you be better off buying gold in US Dollars then?

Well you’d still have to convert your NZD to USD, so the net effect would be the same as just buying gold here in New Zealand with NZD. (In fact it might be slightly worse as you’d also get stung by the currency transaction fees converting NZD to USD, on top of the exchange rate).

So to summarise…

Just Track the Gold and Silver Price in Your Home Country Currency

As that is the currency you will use to purchase the gold. It will also likely be the currency you would convert it to if you “spent” or sold your gold.

Don’t forget to get access to our free daily price alerts. They also include some technical analysis of what is happening in the charts each day. Learn more about what you get in our Daily Price Alert here.

To learn more about when to buy gold or silver check out this article: When to Buy Gold or Silver: The Ultimate Guide

To learn more about the role gold may play in the global monetary system check out this article: If/When the US Dollar Collapses, What Will Gold be Priced in?

Editors note: This article was first published 25 July 2017. Last updated 28 January 2020 to include latest prices and new chart.

Pingback: Gold and Silver Technical Analysis: The Ultimate Beginners Guide - Gold Survival Guide

Pingback: Is Now a Good Time Buy Gold in New Zealand? - Gold Survival Guide

Pingback: The Number One Reason to Buy Gold in New Zealand Today - Gold Survival Guide

Pingback: When to Buy Gold or Silver: The Ultimate Guide - Gold Survival Guide

Pingback: USD Gold Breakout - 6 Year High Above $1400 - What Happens Now? - Gold Survival Guide

Pingback: The Anatomy of a (New) Gold Bull Market: Prices Rises. Short Correction. Bigger Rise to Come? - Gold Survival Guide

Pingback: In a US Dollar Collapse Won't The Rising NZ Dollar Cancel Out Any Gold/Silver Gains? - Gold Survival Guide

Pingback: RBNZ QE Ahead of Plan - Chart Proves There’s More to Come - Gold Survival Guide

Pingback: Gold & Silver Performance: 2020 in Review & Our Guesses for 2021 - Gold Survival Guide

Pingback: Gold & Silver Performance: 2021 in Review & Our Guesses for 2022 - Gold Survival Guide

Pingback: Gold & Silver Performance: 2022 in Review & Our Punts for 2023 - Gold Survival Guide