Confused by terms like “gold spot price” and “silver spot price”? You’re not alone! These terms are essential for navigating the precious metals market, but for beginners, they can be cryptic. This guide unravels the mystery, explaining exactly what spot prices mean and how they impact your buying and selling decisions.

Table of contents

- What Does the Gold Spot Price (or Silver Spot Price) Mean?

- When is the Gold Spot Price (or Silver Spot Price) Set?

- Where is the Gold Spot Price (or Silver Spot Price) Set?

- Who Sets the Spot Price of Gold (or Silver)?

- How is the Spot Price of Gold (or Silver) Determined?

- Simplifying the Gold Spot Price (or Silver Spot Price)

Estimated reading time: 7 minutes

What Does the Gold Spot Price (or Silver Spot Price) Mean?

In simple terms the gold spot price (or silver spot price) means the price for delivery of a commodity like gold or silver, right now. The gold spot price relates to the price for 1 troy ounce of gold (or 1 troy ounce of silver for the silver spot price).

What are Gold Futures Prices (and Silver Futures Prices)?

The spot price is different to the forward or future price. These refer to the price for delivery of gold or silver at a specific date in the future. These futures contracts allow producers, miners and end users of gold and silver to hedge or to mitigate price risk. They of course also allow speculators to “bet” on the future price of gold or silver.

(If you wanted the pedantic answer it would be that spot doesn’t actually exist. There is only “The Bid” – what someone is prepared to pay. And “The Ask” – what someone is prepared to sell for. And one has to meet the other. The spot price is just a theoretical price midway between the Bid and the Ask).

Gold Spot Prices Are Not the Same as Retail Gold Prices (and Silver Prices)

For those new to gold and silver investment, it’s important to realise that gold and silver spot prices are different to retail prices. When buying smaller bars, coins and ingots, the spot price doesn’t include other costs that may be involved. Costs such as: manufacturing and minting costs for bars, ingots or coins; seller mark ups; storage costs; or delivery and insurance costs.

So this is why prices are quoted as “spot + 3.5%” for example.

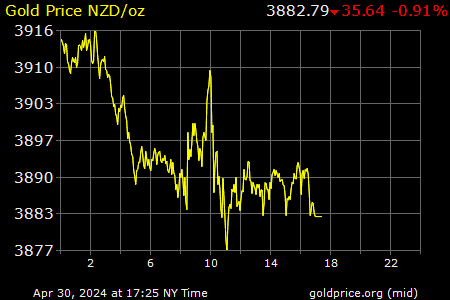

Gold and Silver Spot Prices in NZ Dollars

Also bear in mind that the spot price generally reported in the media is usually in US dollars. So when buying precious metals here in New Zealand the “spot price” is first converted to NZ dollars using the prevailing USD/NZD exchange rate. Then the premium of say 3.5% for example is added to that NZD spot price. This results in the retail price for a particular product.

Check out this article discussing this topic further: Avoid worrying about the NZD/USD exchange rate when buying gold

Plus you can track the NZ dollar gold and silver price on our prices and charts page. There are also historical charts of both metals on there too.

When is the Gold Spot Price (or Silver Spot Price) Set?

The gold and silver markets are open almost 24 hours a day. Unlike stock exchanges such as the New Zealand Stock Exchange, or the New York Stock Exchange which generally trade only in business hours.

This shows just how widely traded an asset gold (and silver) is compared to most other commodities.

Therefore the spot price is changing throughout the day. This can best be seen on the below Kitco gold chart. Look at the small area highlighted in yellow. There is only a small window where the New York Globex market is closed at 5.15 New York time (shown by the yellow bar below). Otherwise throughout the rest of the 24 hour period, somewhere in the world there is a gold market trading.

Gold trading starts Sunday at 6:00 pm New York time. This is when the Japanese markets opens. The Gold market closes on Friday at 4:30 pm New York time.

Source. Kitco.com

Where is the Gold Spot Price (or Silver Spot Price) Set?

The spot price of gold (or silver) is set in different countries depending upon the time of the day. For example the gold spot price could be set in New York, Hong Kong, London or Sydney.

If you hear reference to “the closing price of gold or silver”, this is usually referring to the spot price at New York close each week day.

Whereas you may also hear the term “London Fix”. This is a gold price that is set every morning at 10.30am and each afternoon at 3.00pm London time. So there is a London AM and a London PM fix. This is now officially known as the LBMA Gold Price (London Bullion Market Association). A new pricing methodology was arrived at in 2015. This followed a lot of publicity concerning the (lack of) transparency of the old London Fix, and evidence of price manipulation by the banks involved.

“IBA (ICE Benchmark Administration) provides the price platform, methodology as well as the overall administration and governance for the LBMA Gold Price. The IBA’s platform provides an electronic, auction-based, tradeable, auditable and fully IOSCO-compliant solution for the London bullion market.” Source: LBMA

There is still plenty of debate about whether the new system is in fact any better.

Both the New York close (red line) and the London AM (blue squares) and PM Price (purple diamonds) are shown in the chart below:

Who Sets the Spot Price of Gold (or Silver)?

Who sets the spot price of gold (or silver) again depends upon the time of the day and which market is open. For example it could be the COMEX in New York or the LBMA in London.

How is the Spot Price of Gold (or Silver) Determined?

This is where things get a little more complicated and a bit tougher to get your head around!

With a Stock Exchange where there is only one exchange and therefore one price for a share in a company. Whereas pricing the gold and silver markets are significantly more complex. Prices from multiple markets are taken, and as explained above, these vary depending on the time of the day.

Because there is not one centrally controlled and regulated gold marketplace, you will see slightly different prices and charts on different websites, depending upon where they get their pricing “feed” from. However these will generally not differ by much.

The spot price may be determined by taking into consideration Over The Counter (OTC) trades between large gold and silver traders. The bullion trading desks of Bullion Banks publish their prices from trading between one another. The likes of Reuters or Bloomberg will licence and distribute this pricing.

In countries with Futures exchanges, the spot price of gold (or silver) may also be determined by the “front” or nearest futures contract.

However to complicate things even further, the spot price could also be the next futures contract month with the most volume.

A later month may have more volume because a more recent month is expiring. So in this case the later month might be used to determine the spot price.

Simplifying the Gold Spot Price (or Silver Spot Price)

That’s probably more than enough detail for the average person!

You can see that the concept of the gold spot price is not as straight forward as it might first seem!

However, understanding the specifics of how the spot price of gold or silver is determined is not that critical for the average buyer or seller of physical gold and silver bullion.

More important is to know that the overall retail price you are paying is fair and reasonable in comparison to other bullion dealers. So it will be the margin or mark up above spot price that will have the biggest impact on the price you pay. Not which price feed the bullion dealer takes their gold or silver spot price from. Visit our products page to see current pricing on gold and silver bars and coins. We have multiple suppliers we use to ensure you get the best possible price.

Now that you know all about how spot prices are determined, you might also want to read about a popular silver product: The Silver Maple Monster Box – The Complete Guide

Editors Note: This post was first published 11 September 2017. Last updated 21 May 2024 with new charts.

Pingback: What to Make of Legal Tender (Face Value) Gold and Silver Coins? - Gold Survival Guide

Pingback: When to Buy Gold or Silver: The Ultimate Guide - Gold Survival Guide

Pingback: What Type of Gold Bar Should I Buy? - Gold Survival Guide

Pingback: Buy Silver in New Zealand

Pingback: What Type of Silver Bar Should I Buy? - The Ultimate Guide to Silver Bars - Gold Survival Guide

Pingback: Buying Precious Metals: Common Questions from First Time Buyers

Pingback: Paper Gold vs Physical Gold - What Should You Buy? - Gold Survival Guide

Pingback: NZD Gold Makes New All Time High - Rising With Hardly a Pause - What to Do? - Gold Survival Guide

Pingback: Should I Buy Gold or Silver in 2019? 7 Factors to Consider in Gold vs Silver - Gold Survival Guide

Pingback: More All Time Highs: USD Gold Breaking $2000 - NZD Gold Over $3050 - Gold Survival Guide

Pingback: Bullion Coins or Numismatic (Collectible) Coins? Which Should I Buy ? - Gold Survival Guide

Pingback: What is a Troy Ounce? Troy Ounce vs Standard Ounce - Gold Survival Guide

Pingback: Will The “Reddit Raiders” Cause Silver to Skyrocket? - Gold Survival Guide

Pingback: How Much is All the Gold in the World Worth? - Gold Survival Guide

Pingback: Will We See Multiple Waves of Inflation? - Gold Survival Guide

Pingback: The NZD Gold Price vs Inflation: Analysing the Performance and Break-Even Potential - Gold Survival Guide

I am in possession of silver articles. Mostly usable at home. I wish to consize storage space and convert into silver bar. Kindly let me know the business card details in Mumbai Maharashtra India.

Converting silver various articles into silver bar.

Hi Mrs Patil, You’d be best to check with a local precious metals dealer in Mumbai for this, as we are based in New Zealand.