Prices and Charts

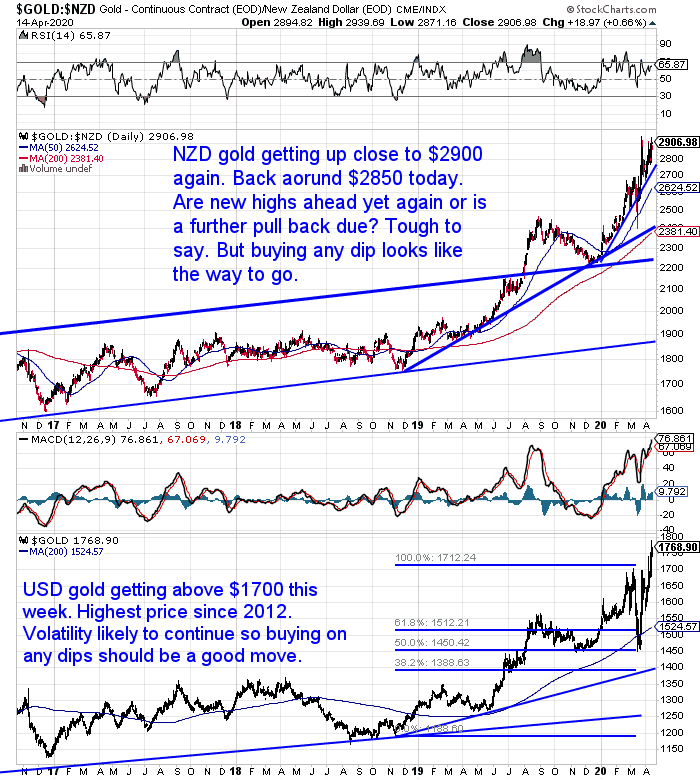

NZD Gold Approaching New All Time High

Gold in NZ Dollars is up just under 3% from last week. Hovering just below $2900 and not far from setting yet another new all time high.

While in US Dollar terms the price this week got back above the $1700. The highest price since 2012. So a new all time high in US Dollars may also be not too far off either.

A correction at any time would not be a surprise. But given gold has just broken above US$1700 higher prices could be to come yet.

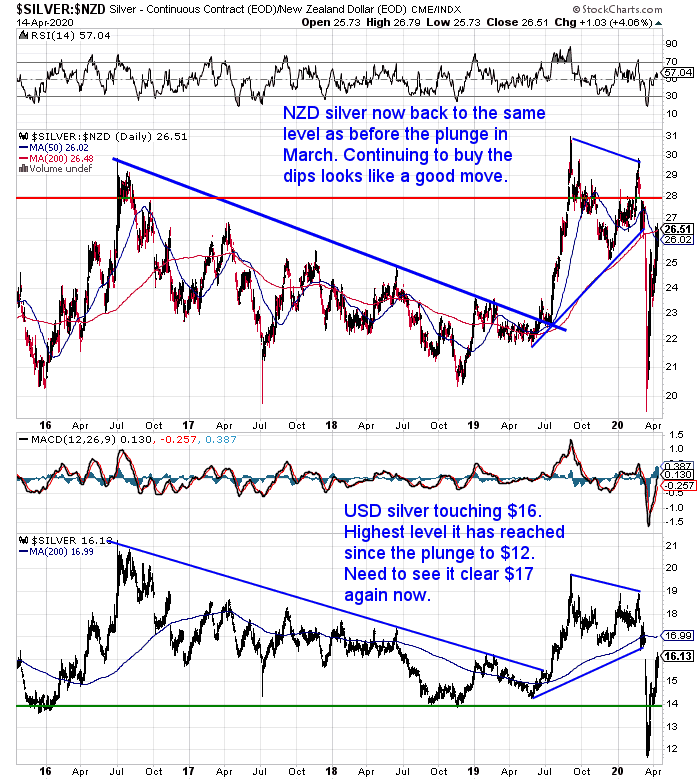

Silver Follows Gold Higher

NZD Silver is now back to where it was before the March plunge down below $20. Back above the 50 day moving average and right on the 200 day MA in the $26 zone.

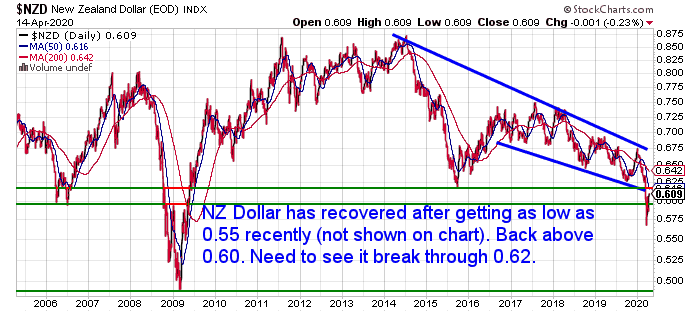

NZ Dollar Bouncing Back by 2 Percent

Both metals were up despite the Kiwi dollar strengthening by over 2%. But we still need to see the NZD get back above 0.6200. This may depend on what happens with the end of the lockdown.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

Gold Ratios April 2020: Dow/Gold, NZ Housing to Gold, & Gold/Silver Ratio

We’ve done an update of our key gold ratios this week. Some have moved significantly since our last update back in November 2019. But we’ll need to see a bit more data filter through before we see significant changes to the NZ Housing to Gold Ratio…

More Interventions from Central Banks – This Past Week and in the Future Too

The US Central Bank wasted no time in launching into another printing spree. AS NIA reports, last Friday announcing that:

“…it is getting ready to print another $2.3 TRILLION including $600 BILLION for mid-sized businesses and $500 BILLION to bailout states, counties, and cities! Since August 28th, the Fed has added $2.052 trillion to its balance sheet… increasing its size by 54.57% to a record $5.812 TRILLION! The Fed is now promising to add at least $2.3 trillion more to its balance sheet, which will increase it to a new all-time high of $8.112 TRILLION! Most shocking about today’s announcement is the Fed will be buying ETFs that invest into high-yield junk bonds!

The Fed is now outright monetizing the U.S. government’s budget deficit spending! When the stimulus deposits get made in the upcoming days it will be a direct injection of inflation into the economy… pure helicopter money just like Bernanke promised us many years ago!

Gold is exploding on this news and is currently up by $38 to $1,722.30 per oz! New all-time high gold prices are now only days/weeks away!”

This now makes 9 NEW lending programs. FED officials also signaled that they were “prepared to expand” it even more if need be. This goes beyond even what former ECB President Mario Draghi promised during the height of the last financial crisis. When he said that the ECB “will do whatever it takes” to save the European union. On Thursday – the FED defined the extent of the programs, launched them and promised even more Red Bull to come!

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

ASB Thinks the RBNZ Will Also Expand QE in May

In a report yesterday, ASB economists believe the NZ central bank is also likely to expand its own currency printing as soon as May. In fact the numbers show that the RBNZ is already ahead of its own timetable in terms of how much it prints each week.

ASB reports:

RBNZ: QE upsize likely in May

• RBNZ has been front-loading government bond purchases.

• We estimate the Bank is $1.4b ahead of the initially communicated run rate.

• Additional government debt issuance warrants a QE-upsize.

• We think the programme could lift from $33b, to $40-50b at the May meeting.

• Inflation-linked bonds to be added to the mix, but not corporate bonds.

Source.

The trouble is, and as the US central bank has discovered, once you go down the currency printing path it is nigh on impossible to extricate yourself from it. Or at least, not without causing an even bigger crisis than the one you were trying to prevent!

Given the RBNZ is a whole crisis behind the Fed and many other central banks, they might not have to get quite as inventive. Well, not yet anyway. But it is almost inevitable they will also have to do more.

NZers: Do You Hold Cash or Gold in the Coming [or Already Here?] Crisis?

An excellent and timely question from customer and reader G.B. this week:

“I am a previous customer and have held over the past year, I have read one commentator advising that the coming storm will drive a huge flood of money back into the US dollar, raising its level and driving down the cost of gold in the shorter term, any thoughts?”

So we dive back into the debate of cash versus gold in a crisis. What should you hold right now? Will we see deflation first? What will gold do in that scenario?

Once you’ve read the above article you’ll see we think holding nothing but cash right now is too big a risk to take. What do you think?

Get in touch if you agree and want some help building your insurance holdings.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Where Will the NZ Govt Get the Money for its Dramatic Increase in Spending? Tax, Borrow or Just Print it? - Gold Survival Guide