Prices and Charts

Weaker NZD Supports NZD Gold Price

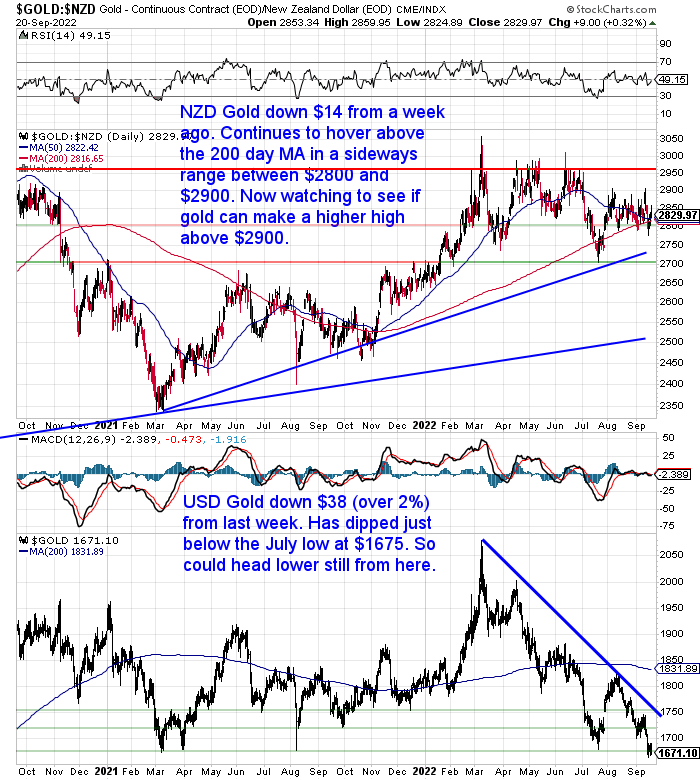

The trend continues of the weaker New Zealand dollar supporting precious metals prices here in New Zealand. NZD Gold was down $14 from a week ago – about half a percent. While gold in USD was down over 2%.

NZD Gold continues to hover above the 200 day moving average in a sideways range between $2800 and $2900. So we are still watching to see if it can break above $2900 to make a higher high and confirm an uptrend.

In USD terms, gold remains in the downtrend it has been in since March. Today dipping just below the July low of $1675. So it could still head lower yet.

Silver Continues to Show Surprising Strength

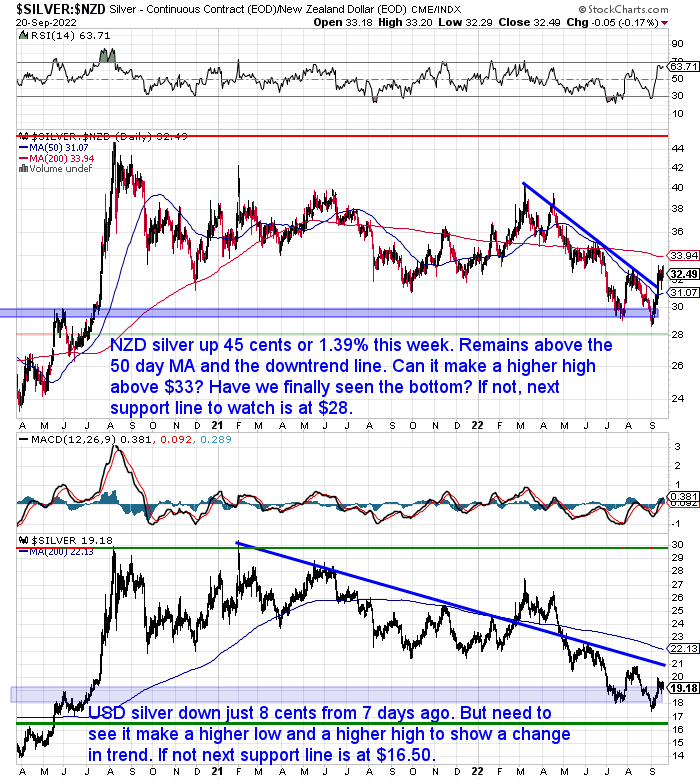

Meanwhile in the face of the weakness in gold, silver continues to show surprising strength. In NZD terms silver was up 45 cents or 1.39% over the past 7 days. Silver remains clearly above the downtrend line and 50 day moving average line. But we need to see NZD silver make a higher high above $33 now.

Silver in USD was down just a touch from last week. So likewise now we need to see it make a higher high and higher low to show a clear change in trend.

NZ Dollar Drops Below Another Support Line

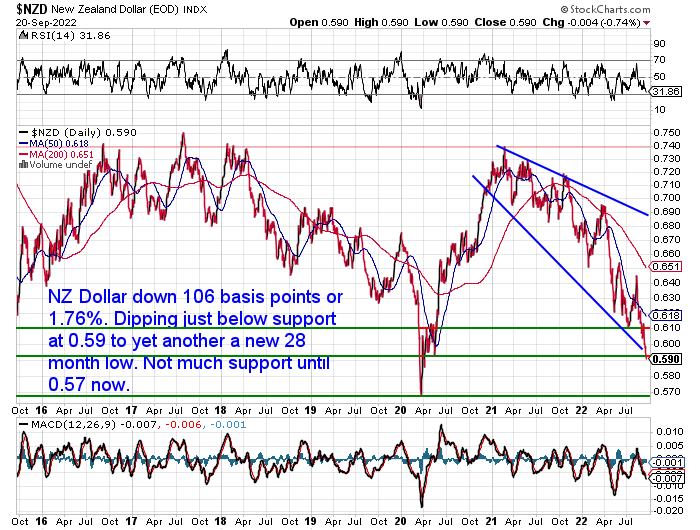

The New Zealand dollar dropped 106 basis points or 1.76% over the past 7 days. Falling below 0.59 today to a 29 month low. There is now very little support until 0.57, the low from 2020. So there could be even more weakness to come yet.

So while gold may not have been performing as well as some might expect, it has continued to offer protection from the weakening Kiwi dollar.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Has Gold Lost its Safe Haven Status?

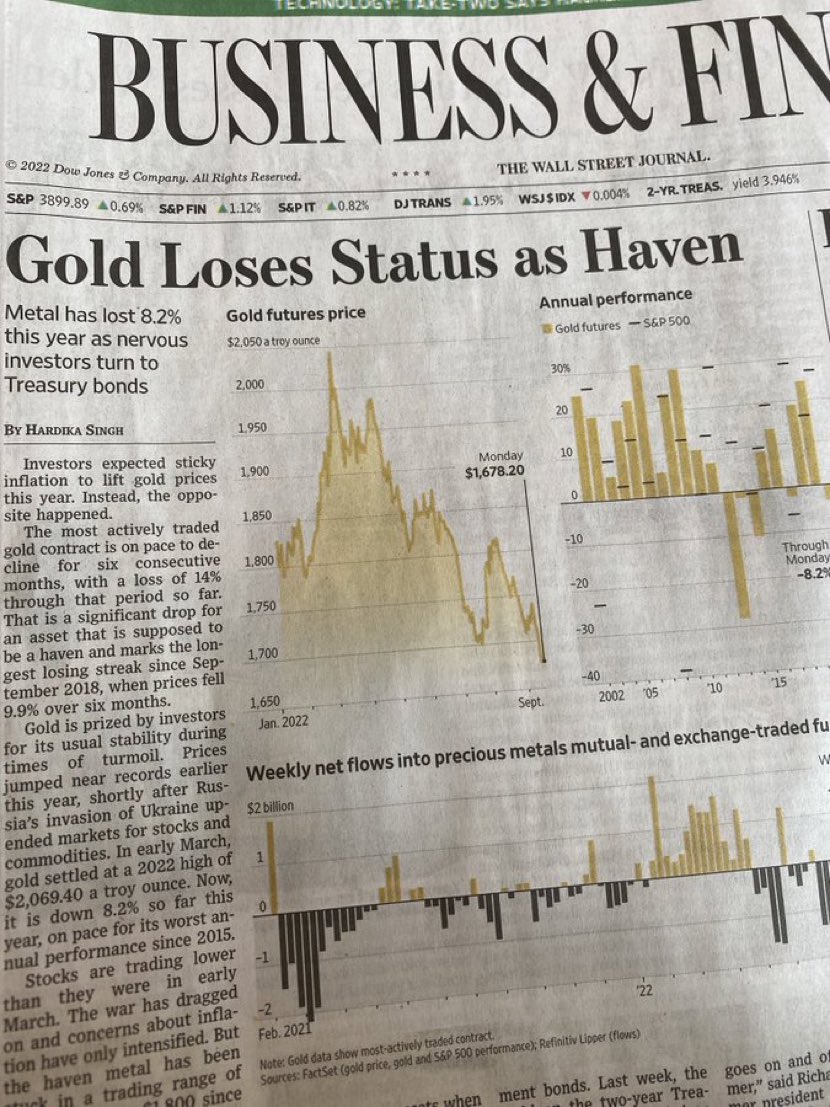

Gold has not performed as well in 2022 as many would have hoped.

Take this recent Wall Street Journal headline “Gold Loses Status as Haven”. Wall Street Silver tweeted:

“Bottom reached for #Gold with this headline in WSJ ?

What do you think?”

Source.

We’ve seen other similar articles too such as this one: Is gold losing its shine as a safe haven asset?

While it might be frustrating to see gold not performing as well as might be hoped, this is not actually unique. In 2008 gold fell from US$1000 right the way back to $700, before staging a powerful comeback for the next number of years.

As the article above points out gold losing 8% is not too bad compared to sharemarket indexes which are down by as much as 40%. Also relevant to us here in New Zealand, the article does at least point out that to many non-US holders of gold, the yellow metal has done pretty well this year. In NZD terms gold is up around 6% since the start of 2022.

In periods like this we think it is worth remembering what we see as the main reason to buy gold. It is not to see the “price go up”. But rather as wealth insurance. As an asset which unlike just about every other asset has never gone and won’t go to zero.

So this week’s feature article covers this concept in detail. We come gold to a home insurance policy covering:

- 5 Reasons to Hold Gold for Wealth Insurance

- What Are You Covered For? 3 Different Ways Your Golden Financial Insurance Covers You

- What Doesn’t Your Gold Insurance Cover You For?

- Why You Need to Hold the Right Type of Gold

- Key Differences Between a Standard Insurance Policy and Gold as Financial Insurance

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Queen and Currency

We’ve had a couple of questions in regarding the NZ currency following the death of the queen:

“Just wondered if RBNZ has made any noises about changing our coinage and $20 note for King Charles III and what effect it would have on our economy if any?”

The RBZN has made an announcement about the New Zealand coinage and $20 note:

“There is no immediate impact on New Zealand’s banknote and coins designs and cash use as a result of a change in Sovereign. All existing coins and $20 banknotes in circulation featuring Queen Elizabeth the Second remain legal tender. It will be several years before we need to introduce coins featuring King Charles the Third, and longer until stocks of $20 notes are exhausted.”

So there is no change to notes and coins for a few years yet. So there shouldn’t be any effect on the NZ economy.

But a petition has been started calling on the RBNZ to include NZ designs rather than the king on New Zealand currency.

However with any changes being a few years away, we wonder whether the currency system itself could have changed by then? Will cash still exist? Will the New Zealand dollar still exist?

Another reader asked:

“With the queen passing does this end the cash system? Is this the start of cdbc’s?”

So as noted above, it doesn’t appear that the New Zealand currency system will be impacted at all for a few years yet. We’d say the Queen’s death is also not likely to have much impact on the introduction of Central Bank Digital Currencies (CBDC). Or rather maybe a better way to put that would be that plans for CBDC’s are already underway all around the world.

(For more on CBDC’s in NZ see:

If New Zealand Introduces a Central Bank Digital Currency, How Will Gold or Silver Be Valued and How Will One Use Them?)

Regardless of your views on the monarchy it seems unlikely that King Charles will garner the same level of respect as the Queen did. We’d guess that the younger portion of the population have much less interest in the monarchy. Perhaps beyond what is posted on instagram.

So the passing of the queen could well be looked back upon as another indicator of the end of an era. Perhaps the death of the queen also signals the death of a system? We just don’t know yet what will replace it. We would hope for decentralisation of everything. But there is a battle between decentralisation and further centralisation that continues to be waged. The outcome of which remains unknown.

As discussed in this week’s feature article gold acts as welath insurance against the known unknown’s and also the unknown unknowns.

Get in touch if you have any questions about securing your wealth and your legacy from such risks:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Here's Why Not to Worry About Silver’s Delayed Reaction to Inflation - Gold Survival Guide