Prices and Charts

LATE UPDATE:

The New Zealand dollar jumped a bit after the RBNZ raised interest rates by 0.25%. So NZ gold and silver prices are down a little on the numbers listed above.

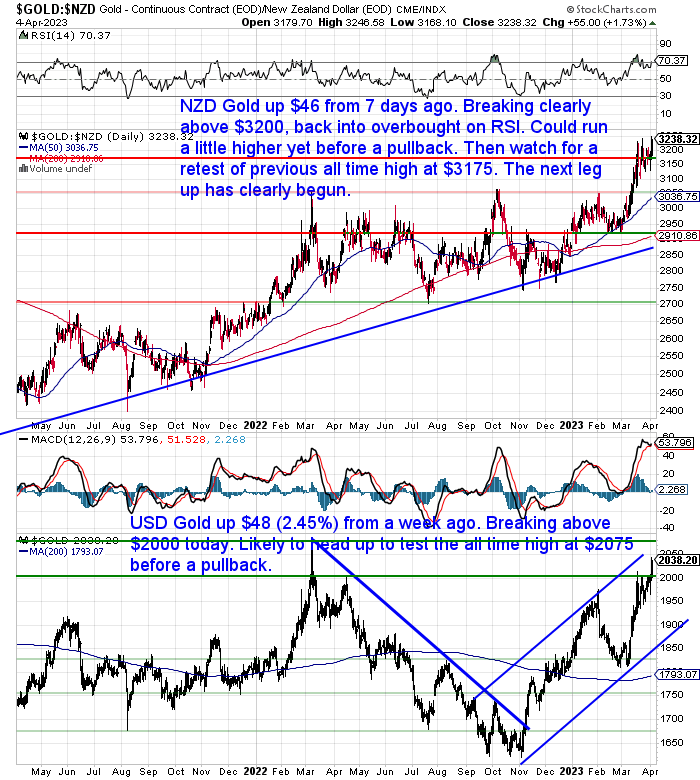

USD Gold Breaks Above US$2000

There was a sharp jump in gold overnight. As a result NZD gold is up $46 from a week ago. A 1.45% rise, closing above $3200. NZD gold is edging into overbought on the RSI (above 70). However there’s a good chance gold could run a bit higher yet before any pullback. When a pullback happens we’d watch for a retest of the previous all time high at $3175 which has now become the horizontal support. Below that would be $3100 and then $3050. But with gold looking very strong there is no guarantee we’ll see a pullback to those levels.

Overnight USD gold broke clearly above US$2000. USD gold is almost overbought too. But we could well see a challenge of the all time high at $2075 before any correction. US$2000 has now become the support line to watch for on any pullback.

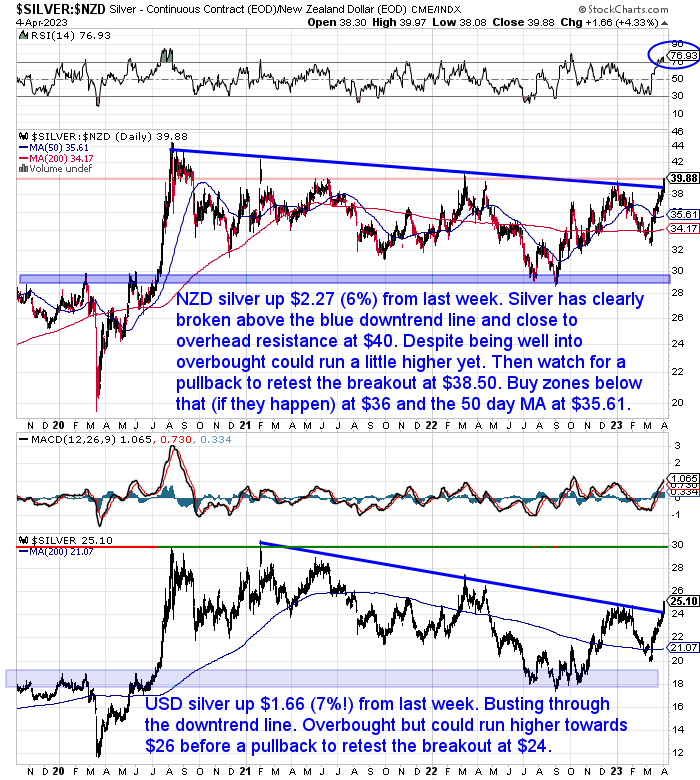

Superstar Silver – Breaks Above Downtrend Line

After languishing behind gold over the past year, it might finally be silver’s time to shine. It has been the superstar this week. Jumping NZ$2.27 or 6% from 7 days ago. Silver has clearly broken above the downtrend line in both NZ and US dollar terms. Despite being well into overbought on the RSI (above 70), NZD silver could run a bit higher yet. But we’d expect to see a retest of the breakout before too long. That will likely be a buying opportunity if this is indeed the start of a full fledged breakout in silver (which we think it likely could be).

There’s a good chance we’ll see a challenge of 2020 highs of NZ$45 and US$30 before too long.

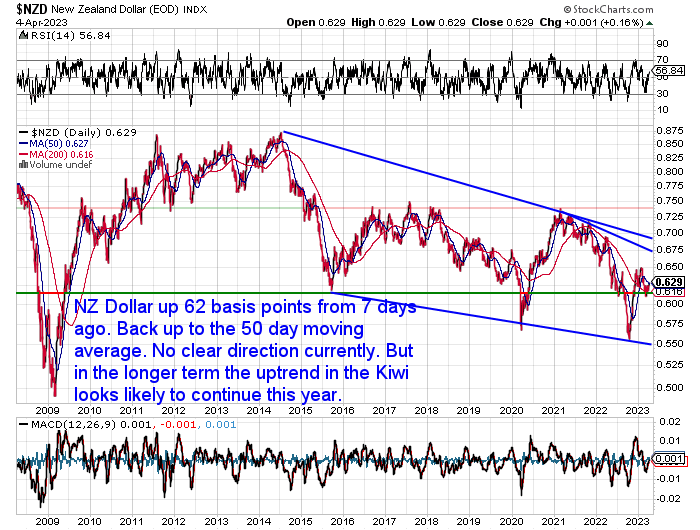

NZ Dollar Up 1%

The New Zealand dollar was up 62 basis points or 1% from last week. It is back up to the 50 day moving average, but with no real clear direction currently. We’re still leaning towards the idea that the NZD will strengthen against the USD over the course of this year. But we don’t think that trend will be as strong as the weakening of the USD 9and NZD) versus gold and also silver.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Don’t Count on a Sustained Bounce Back in Sharemarkets

Stock markets have bounced back a little of late. So we’re seeing a lot of positive reports on the sharemarket particularly from the USA. However even in the mainstream US investment banks there are still some bears who think the worst is not yet over for global sharemarkets.

Here’s some notes from Morgan Stanley and JP Morgan via The Market Ear, on why there still may be worse to come for stock markets:

Shitty risk/reward

Morgan Stanley’s Sheets: “We think risk/reward is poor for global equities relative to high grade bonds,and remain underweight the former and overweight the latter.From here, we believe risky assets would prosper in a scenario of better-than-expected growth, rather than even weaker growth with easier policy. Asia ex Japan, the one region where we see growth strong and accelerating this year, should be a relative outperformer.”

Source.

Mislav’s bearish musings

JPM’s Mislav reiterates his bearish view and sees very poor risk reward chasing stocks here. Main bullets:

1. Market hopes for soft landing and low inflation, but there may be pain to profits and labor.

2. The impact of monetary tightening has historically worked with a lag, and there may not be a sustained rally.

3. Positive assumptions on growth and rates needed to be bullish on equities.

4. Stocks likely to weaken for the rest of the year, and policy rates may not come down quickly.

5. Value style is behind growth, and beta trade is waning, likely to continue as bond yields move lower.

Source.

Worried Wilson

Main bullets summarizing Wilson’s logic:

1. Yield curve steepening and regional bank stocks acting risk-off.

2. Investors should position portfolios defensively.

3. Focus on companies with high operational efficiency and quality earnings.

4. No evidence of a new bull market; bear market has unfinished business.

5. Tech’s outperformance may not be sustainable.

6. Wait for durable low in broader market before adding to Tech aggressively.

Source.

Dow Gold Ratio: How Does Gold Compare to Shares For the Past 100 Years? Where to From Here in 2023?

Regardless of whether the stock market bottoms out this year or not, we think that versus gold it has a lot further to fall yet.

What does this mean?

Check out this week’s post which compares the Dow Jones Industrial Average (US Stock Market index) as a ratio to the price of 1 oz of gold.

You’ll see why in the long run stocks should outperform gold. But why in the next few years it could be a different story…

- So How Does Gold Compare to the Dow For the Past 100 Years?

- Shares Should Outperform Gold Over the Long Term

- Compare Gold with Stocks Using the Dow/Gold Ratio

- What is the Dow Gold Ratio?

- How Might Gold Do Versus Stocks Over the Next Decade or So?

- The Dow Gold Ratio May Make a New Low

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Gold Survival Guide Reality Check Radio Interview by Paul Brennan

An interview with yours truly was due to be aired this morning on the breakfast show of the new Reality Check Radio. We had the pleasure of being interviewed by Paul Brennan, former long time Radio NZ presenter. If you’re sick of the mainstream take on most things then check out Reality Check Radio.

Hopefully there should be a replay link which we can share with you next week.

The (Not So) Slow Death of the Dollar – 9 Recent Indicators of the Dollars Demise

In our conversation with Paul Brennan we discussed how the signposts of the end of the US dollar reserve status seem to be getting closer together.

Even US senators are now pointing this out:

The most important events of 2022 occurred over the first weekend of March when the US:

1. Froze/stole Russia’s offshore foreign currency reserves

2. Cut off Russia’s access to SWIFT

Source.

Then this week Russia looks set to shift from the European dominated Brent oil benchmark to the Dubai oil price benchmark:

“(Reuters) – Russia’s largest oil producer Rosneft (ROSN.MM) and India’s top refiner Indian Oil Corp (IOC.NS) agreed to use the Asia-focused Dubai oil price benchmark in their latest deal to deliver Russian oil to India, three sources familiar with the deal said.

The decision by the two state-controlled companies to abandon the Europe-dominated Brent benchmark is part of a shift of Russia’s oil sales towards Asia after Europe shunned Russian oil following Russia’s invasion of Ukraine more than a year ago.”

Source.

However from ZeroHedge today, here are 7 news items all from the last 2 weeks which highlight “That Global De-Dollarization Has Just Shifted Into Overdrive”:

#1 The BRICS nations account for over 40 percent of the total global population and close to one-fourth of global GDP. So the fact that they are working to develop a “new currency” should greatly concern all of us…

#2 Two of the BRICS nations, China and Brazil, have just “reached a deal to trade in their own currencies”…

#3 During a meeting last week in Indonesia, finance ministers from the ASEAN nations discussed ways “to reduce dependence on the US Dollar, Euro, Yen, and British Pound”…

#4 In a move that has enormous implications for the “petrodollar”, Saudi Arabia just agreed to become a “dialogue partner in the Shanghai Cooperation Organization”…

#5 The Chinese just completed their very first trade of liquefied natural gas that was settled in Chinese currency instead of U.S. dollars…

#6 The government of India is offering their currency as an “alternative” to the U.S. dollar in international trade…

#7 Saudi Arabia has actually agreed to accept Kenyan shillings as payment for oil shipments to Kenya instead of U.S. dollars…

Source.

All national currencies, the NZ dollar included, are today linked to the US dollar. So at first glance the US dollar’s diminished role in international trade may just make you think that the other currencies will rise. However all nations – NZ included – are also destroying the value of their national currency. So the only way to escape this is to remove some wealth from fiat currencies and into hard assets. But when both stocks and real estate prices are falling that doesn’t leave too many options. Maybe just a yellow one and a grey one…

Have you got enough protection?

Get a quote on gold or silver products:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Silver Breakout or Silver Fakeout? - Where to Next for Silver? - Gold Survival Guide