Prices and Charts

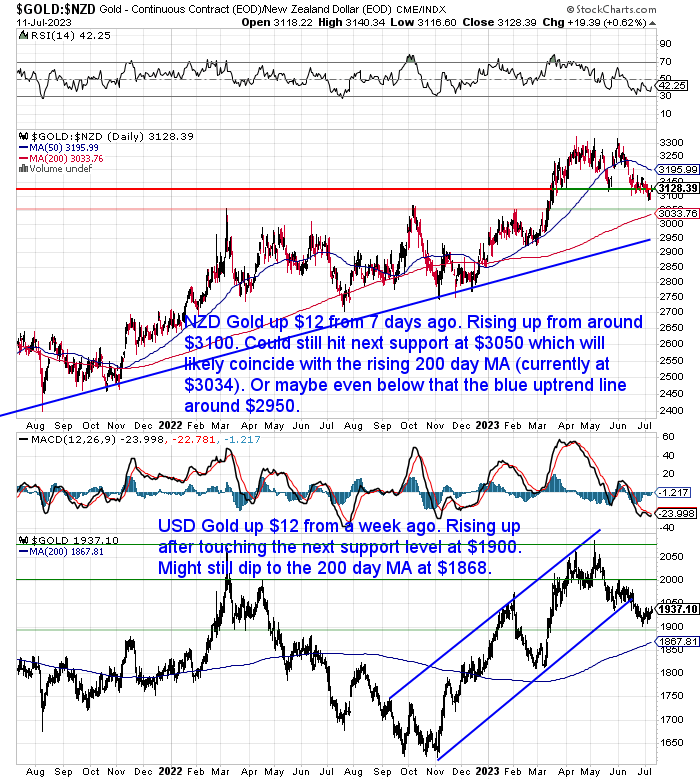

NZD Gold Rising Up From Recent Low at $3100

Gold in New Zealand dollars was up $12 from a week prior. It did dip down to $3100 during the past week before bouncing back. There’s still a chance it could dip down to test the 200 day moving average (MA) which currently sits at $3034 but continues to rise. Or maybe even a dip down to the rising blue uptrend line which is around $2950.

But we’re likely pretty close to the bottom in this correction.

While in USD terms, gold was also up $12 from last week. It has bounced up off the support line at $1900. Still a chance it could dip down to test the 200 day MA which sits at $1868.

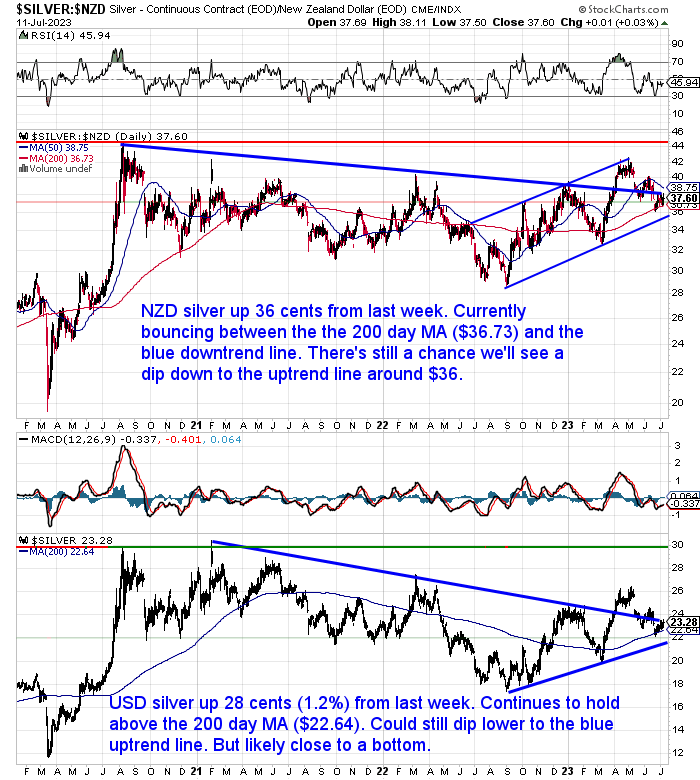

Silver Bouncing Between the 200 Day MA and the Downtrend Line

Meanwhile NZD Silver was up almost 1% to $37.54. It continues to bounce back and forth between the 200 day MA (currently at $36.73 and rising) and the blue downtrend line. We think there’s still a chance we’ll see a dip down to the uptrend line around the $36 mark.

USD silver is in the same position. Rising 28 cents or 1.2% to be back at the downtrend line, having risen up from the 200 day MA. It could also still dip lower to the blue uptrend line. But the bottom looks to be getting very close.

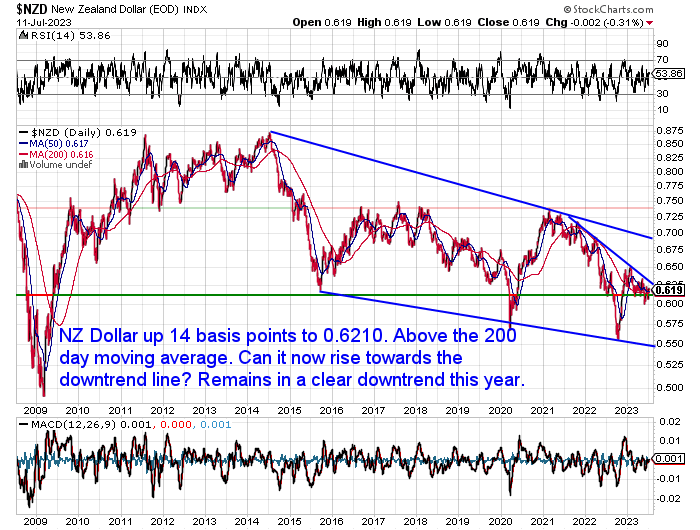

RBNZ Leaves OCR at 5.5% – NZD Up Just a Little

The RBNZ as expected left the official cash rate at 5.5% today. So there wasn’t much movement in the NZ dollar as a result. Since a week ago the Kiwi is up 14 basis points. Remains above the 200 day MA. Can it now push on towards the blue downtrend line?

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

The NZD Gold Price vs Inflation

In this week’s featured article, we delve into the performance of the NZD gold price compared to inflation in New Zealand. Our latest blog post features an easy-to-understand chart that compares the NZ Consumer Price Index (CPI) and the NZD gold price since 2000. We answer a reader’s question about how long it takes to break even on a gold investment. You’ll discover whether gold has outshined inflation over the years and discover valuable insights on wealth preservation. Don’t miss this enlightening article that reveals the relationship between the NZD gold price, inflation, and more.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Bank Deposit Protection Bill Passes Final Reading

The Deposit Takers Bill, which guarantees bank deposits up to $100,000, has passed its final reading. This means that if a bank or other eligible institution fails, people’s deposits will be protected. Currently, most countries have deposit insurance, but New Zealand doesn’t, along with Israel. This bill brings New Zealand in line with international practices. The $100,000 limit will fully protect around 93% of depositors. Wealthier depositors may be able to protect more of their money by splitting it between different institutions. The new compensation framework is expected to be in effect by the end of next year.

The bill also brings all deposit-takers, such as banks, credit unions, and finance companies, under a single regulatory framework. It gives the Reserve Bank the power to set standards, impose requirements, and modernise the regulation and supervision of all deposit-takers. This will strengthen the Reserve Bank’s ability to ensure compliance and prevent breaches.

The guarantee scheme will be funded by a taxpayer-backed fund, similar to the Toka Tū Ake Earthquake Commission fund. Deposit-takers will contribute to this fund through levies, and it is expected that these costs may be passed on to depositors through lower savings and deposit rates. The Reserve Bank and Treasury will consult with banks and other institutions on the funding strategy and levy framework.

The thinking is that overall, the bill strengthens the financial safety net in New Zealand and ensures economic security for the majority of depositors.

However, back in May we wrote that there are also downsides to bank deposit insurance or guarantees:

Does a Government Bank Deposit Guarantee Make Our Banks Safer?

No. It merely shifts some of the risk from deposit holders on to the government. Or rather potentially on to tax payers. As it will take a long long time to build up a buffer via the proposed levy. So in the meantime the fund will be able to take a loan out from the government to cover any bank failures until there are sufficient funds. Which could be many, many years away.

Either way the risk is not to any individual bank. But rather to its deposit holders (via OBR) and taxpayers (via a potential loan to the deposit protection scheme).

In fact there is a very good argument that bank deposit guarantees encourage banks to chase higher returns and therefore take higher risks. As they will not “foot the bill” if they go under. This is known as privatising the profits and socialising the losses.

You can read our full run down on the Government Bank Deposit Guarantee here.

Conflicting News on the Purported New BRICS Currency

Some conflicting news this week on the purported BRICS currency that we have discussed in recent weeks. Originally on June 21 here plus here.

RT India recently report on 7 July with an accompanying video:

#BRICS Plans to Introduce New Gold-Backed Currency

The proposed gold-backed currency will contrast with the credit-backed US dollar, with the decision coming a month ahead of the bloc’s summit in Johannesburg.

The growing initiative has more and more nations lining up to join the initiative.

Source.

Kitco picked up on this along with tweets from the Russian embassy in Kenya (which were later deleted).

But at about the same time the head of BRICS bank says “no immediate plans”:

“The New Development Bank, a financial institution created by the BRICS bloc of emerging markets, doesn’t have any immediate plans for the group to create a common currency, its vice president and chief financial officer said.

While the members of BRICS – Brazil, Russia, India, China and South Africa – are pushing to conduct more trade between each other in local currencies, they aren’t ready to challenge the global dominance of the dollar, Leslie Maasdorp said in an interview on Wednesday with Bloomberg TV’s Haslinda Amin.”

“The development of anything alternative is more a medium to long term ambition,” he said. “There is no suggestion right now to creates a BRICS currency.”

Source.

We guess it depends on how soon “immediate” is? As we said last week, there could be an announcement of an intention more than anything actual concrete.

At the end of the day we’ll have to wait until the BRICS summit in South Africa in August.

But maybe the respective central banks want to keep buying gold and not give any reason to push the price higher right now?

3 of the 5 BRICS nations were among the 8 countries buying in May:

Eight central banks increased their official gold reserves in May, led by Poland (19t). China (16t), Singapore (4t), Russia (3t), Iraq (2t), India (2t), the Czech Republic (2t) and the Kyrgyz Republic (2t) were the other notable buyers.

Source.

It’s also interesting to see central banks that previously have not been buyers of gold joining the gold buying recently. The small gold purchase by the Czech central bank in June was significant:

The Czech National Bank increased its #gold reserves by ~3 tonnes in June – the fourth consecutive month of buying. YTD net purchases of gold now amount to ~8 tonnes, lifting total gold reserves to ~20 tonnes. [Data from CNB]Source.

So the CNB has gone from 12 to 20 tonnes in just the last 4 months. Seems these central banks are preparing for something…

How prepared are you?

Please get in contact for a quote or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: Here’s Why Even If Inflation Drops to 3%, It’s Still Likely Going Higher Again - Gold Survival Guide