Prices and Charts

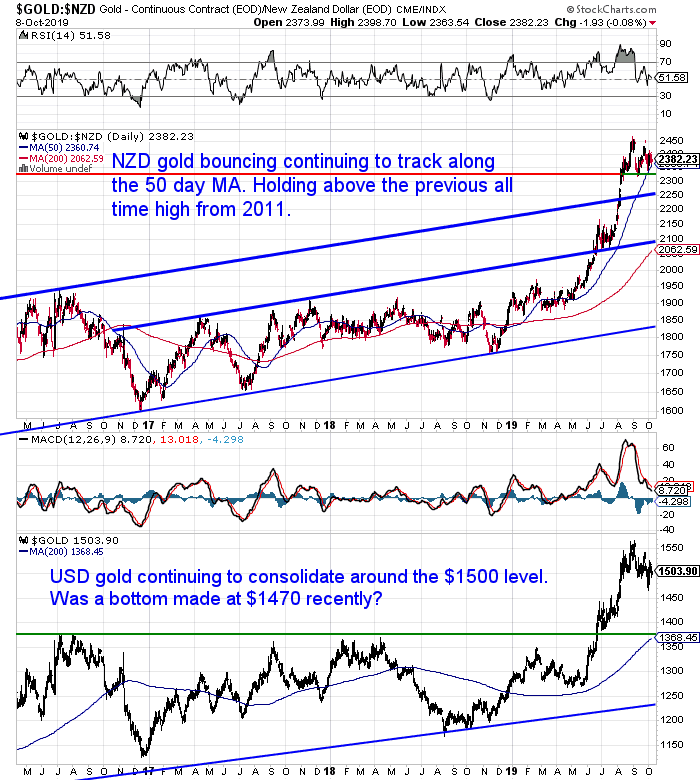

NZD Gold Holding At the 50 Day Moving Average

After bouncing back to again touch the previous high from 2011, gold in NZ dollars is now tracking along the rising 50 day moving average.

The 50 day and 200 day MA’s are good bull market indicators to track. The fact that gold continues to hold above this line is very positive. Gold looks to be building for its next run higher.

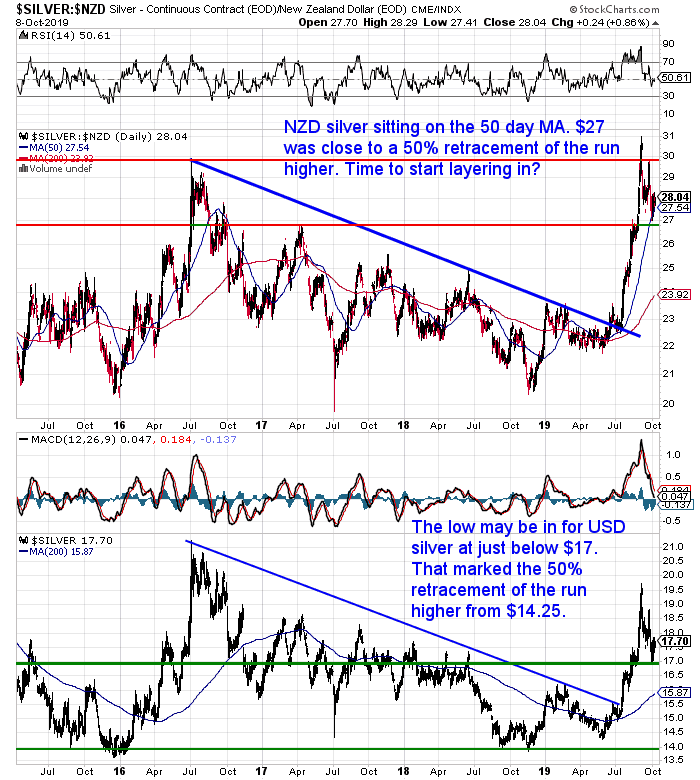

Silver Also Sitting on 50 Day MA

NZD silver is also now tracking along the 50 day MA. There is a chance that we won’t see any lower prices ahead. So now is a good time to be layering in with silver purchases.

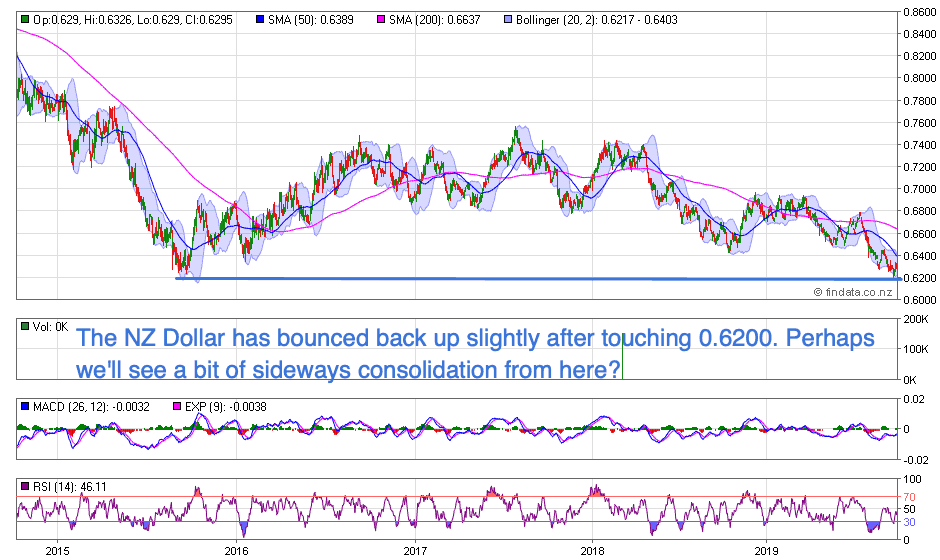

NZ Dollar Bouncing Back a Little

The Kiwi dollar bounced back a bit this week. Much as expected. Perhaps we’ll see it head sideways for a bit from here? 0.6200 could prove to be decent support. But if it breaks below that level, it’s watch out below. There is not much support down to the 2009 lows at 0.5000!

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

Are the Federal Reserve’s “Temporary” Money Injections Becoming Permanent?

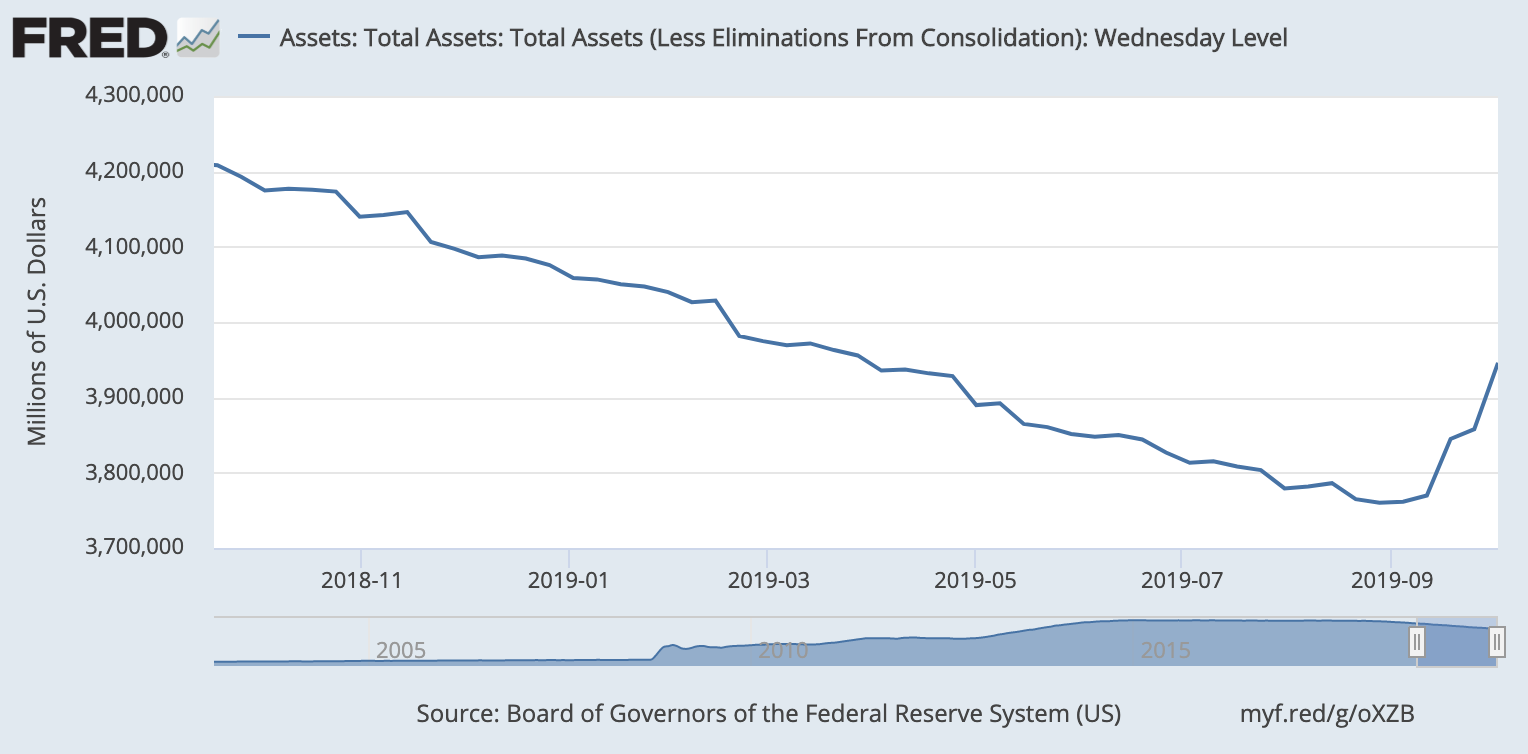

The troubles in the US repurchase (Repo) market continue.

On the 24th September we discussed how the Federal Reserve balance sheet had started to expand again. And pondered what the cause of this was.

Ron Paul points out that:

“The need for the Fed to shove billions into the repo market to keep that market’s interest rate near the Fed’s target shows the Fed is losing its power to control the price of money.”

Source.

What started out as a day or 2, has turned into a week or 2. Then extending to a month or 2 as per these Fed tweets:

Today the Fed chairman has gone a step further.

“my colleagues and I will soon announce measures to add to the supply of reserves over time.”

…I want to emphasize that growth of our balance sheet for reserve management purposes should in no way be confused with the large-scale asset purchase programs that we deployed after the financial crisis.

Neither the recent technical issues nor the purchases of Treasury bills we are contemplating to resolve them should materially affect the stance of monetary policy…”

Or as Zero Hedge puts it:

Fed Chair Powell Announces QE4… But “Don’t Call It QE4”

But with Central Bankers it’s a case of watch what they do – NOT what they say.

The Fed balance sheet has actually been expanding since early September. The growth in just one month has the Fed balance sheet back to where it was 6 months prior to that!

As we’ve been saying for a while, central banks will continue to do the only thing they know how. Bank on that.

Is Now a Good Time to Buy Gold in New Zealand?

With the price of gold in New Zealand Dollars (and many other currencies) recently hitting an all time high, surely now isn’t the best time to be buying?

If you’re pondering such a question then check out this week’s feature article…

ASB Says OCR Could Bottom Between -0.25 and -0.75

We’ve been warning that negative interest rates were a possibility in New Zealand as far back as May 2018.

The Banks are finally waking up to that fact too. This week ASB put out a report saying a possible floor for the Official Cash Rate (OCR) was between -0.25% and -0.75%.

ASB: Interest Rate Outlook: How low can you go? A checklist for the RBNZ

We believe the OCR floor is somewhere between -0.25% and -0.75%.

Our preference would be for the OCR lever to be fully exercised before other measures are contemplated.

There are a variety of other unconventional policy options available, but none are without cost. To provide the best bang for your policy buck, closer co-ordination will be needed.

However the ASB view is that the OCR bottom will be 0.50% this cycle (or slightly below it).

“But if the proverbial does hit the fan, a suggested course of action for the RBNZ could be the following:

– Cut the OCR to its limit – the floor could be as low as -0.75% according to our estimates. However, where this floor is depends crucially on the policy settings of other central banks;

– Introduce tiered lending to mitigate the impact of the low OCR on financial institutions;

– Provide explicit forward guidance, committing to hold the OCR at the lower bound for either a long period of time or until there are signs that the trend in inflation is above the midpoint of the 1-3% inflation target;

– Conduct asset purchases, via purchasing NZ Government bonds;

– Direct market intervention via receiving long-term interest rate swaps to hold down long-term yields;

– Providing long-term funding to banks to support credit creation; and

– Undertake unsterilised FX intervention to lower the NZD.”

The Warnings of Negative Interest Rates in NZ Are Becoming Widespread

This week also brought an article by David Hargraves on interest.co.nz.

He points out that:

“…with an Official Cash Rate that could well be as low as 0.5% by Christmas, it is not too hard to imagine an OCR with a minus sign in front of it by later next year.”

There are more and more of these pieces popping up now. So slowly the public is being prepared for what would have been unthinkable, as little as a couple of years ago.

Whereas think it just about looks inevitable considering where the rest of the world is going.

Plus our “Celebrity” Central Bank Governor appears far less conservative than past RBNZ head honchos. Over a year ago we said there were warning signs emanating from the RBNZ.

Now even a University of Auckland economist is singing from the same song book:

A celebrity Reserve Bank governor is a shock to New Zealand businesses, a University of Auckland economist says. Robert MacCulloch said new governor Adrian Orr was a significant change from previous governors of the central bank, and that could have a negative effect on business confidence.

Source.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Martin Hawes: Find Alternatives to Term Deposits (What About Gold?)

Well respected financial advisor and author, Martin Hawes, is warning people they will need to find alternatives to term deposits. He even warns of risks of a bank failure:

“Term deposits with a major, well-rated bank are about the safest investment. Although they come with no guarantee (unlike nearly all other countries) our banking system is well regulated and sound, and there seems little chance of a bank failure anytime soon.

Nevertheless, they are not perfectly safe – it does not happen often, but banks do fail (and have done so in this country). Moreover, if you think of risk as the probability of failing to meet an objective, it could be argued that they are not safe: low interest rates and the prospect of further reductions mean that after tax and inflation there is likely to be little return, if any.

If a real investment return is the objective, people relying solely on term deposits are in grave risk of failure.

Moreover, investors who invest only in term deposits have concentrated their wealth to just one asset class. Such a strategy always carries greater risk and the failure of the asset class could mean a cataclysmic failure of the strategy. Everything invested with banks means that if there is a bank failure you are in real trouble.”

Source.

He goes on to discuss managed funds as an option. In particular, those that have some shares, property, bonds and cash.

Perhaps not surprisingly, for a mainstream financial advisor, there is no mention of gold. Even though many studies have shown that having gold in an investment portfolio can make a real difference in the bad times.

We’d say one of the reasons gold has been rising is because it has seen the coming negative interest rates globally. When the bank gives you nothing in return, or even starts charging you, then the small cost to “carry” gold is more than made up for by the lack of counter-party risk (a bar of gold can’t “fail”).

So with gold you’ll for sure get a “return of your investment”. Then the rising “price” is an added bonus – or a “return on your investment”. But only if you buy before everyone else is.

Give us a call. Or book a time online that suits you for a free bullion consultation.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Central Bank: "If The Entire System Collapses, Gold Will Be Needed To Start Over" - Gold Survival Guide

Pingback: The Biggest Take-Away From this Years LBMA Event in China - Gold Survival Guide