Prices and Charts

Gold Holding Steady

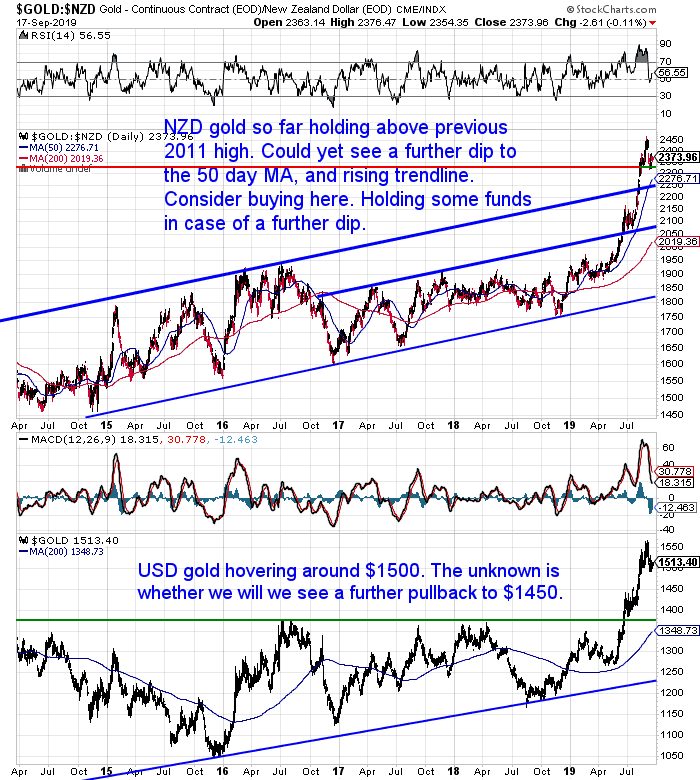

NZD gold is up 2% on a week ago. So far it is holding above the previous all time high from 2011. But it’s really anyone’s guess as to whether it will dip any lower.

At some point we’d expect the price to get back close to the 50 day moving average.

But it could do this either by the price falling further down to where the 50 day MA currently sits at $2275. Or conversely, gold could consolidate around the current price and the 50 day MA will move up to meet it.

After a few months of rising without falling it would not be unreasonable to expect gold to either fall or consolidate for about 6 weeks or half that time. We’re around 2 weeks into that period already.

Bull markets like to fool as many people as possible. So gold will do the opposite of what the majority expect. It’s just that right now we’re not sure what that is exactly!

Silver Also Consolidating

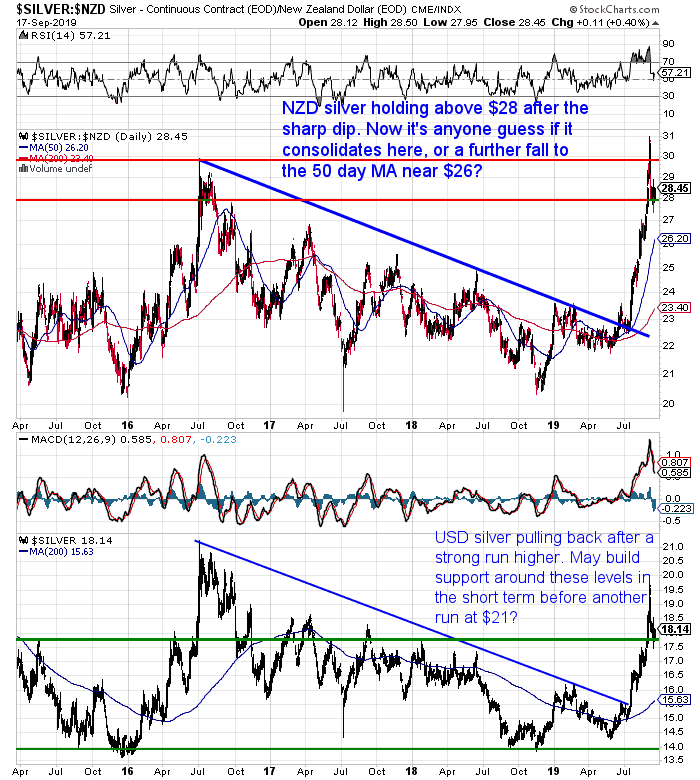

After falling sharply from $31 to below $28, silver is now consolidating above $28.

We could say much the same about silver as gold. A return to the 50 day MA would not be unexpected. The 50 day MA is about twice as far below for silver as it is for gold though.

But what will silver do? Perhaps just march sideways for long enough to frustrate those who bought recently?

Before too long the trend up will resume. But only after silver has shaken off the late comers.

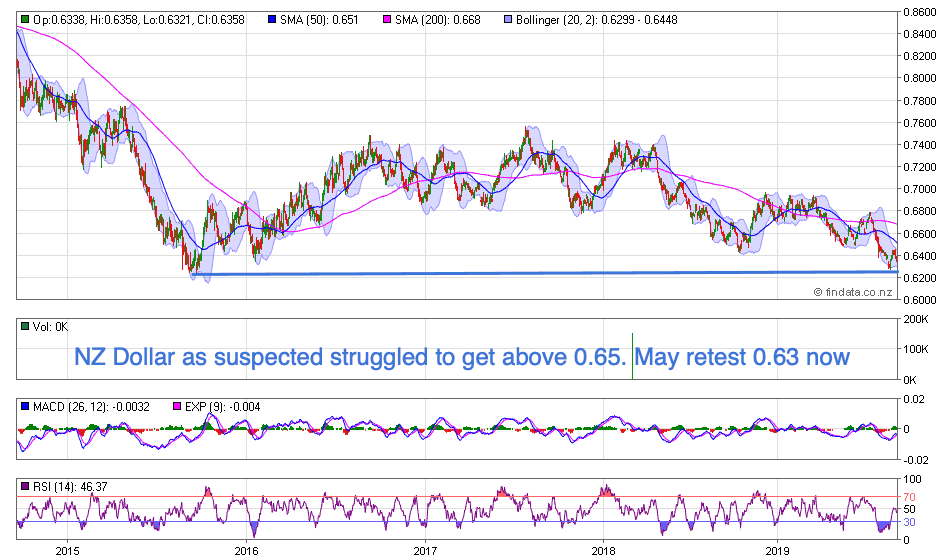

NZ Dollar Dipping as Expected

The New Zealand Dollar did much as expected. Failing to get above 0.65 last week. We may now see it again test the 0.63 level.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

The Latest on Silver Manipulation Exposed

Big news this week were charges laid against 3 JP Morgan Traders. It now turns out that one of them is an LBMA board member.

The good people at GATA are finally getting some recognition for all their work on this subject. The question now is, will there be more arrests to come?

Here’s what we have to say on the subject…

If Gold and Silver Are Manipulated, Why Bother Investing?

Sticking to the manipulation topic, here’s a common question we get. If the precious metals market is manipulated, why bother buying gold and silver?

This is as good an argument as any that we’ve read…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Gold Prices Moving in Tandem with Negative Yielding Debt

There’s been quite a bit happening in markets over the past week.

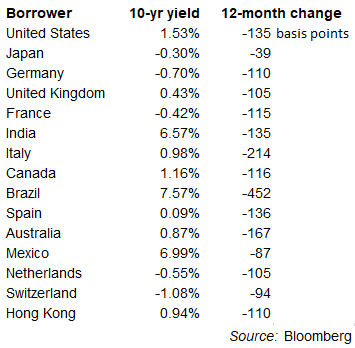

With Europe slowing the European Central Bank (ECB) announced further interest rate cuts, pushing rates deeper into negative territory. See the chart below where 4 of the 5 nations with negative 10 year government bond yields are European.

Houston Molnar, analyst at Casey Research reported:

“[The ECB] also announced it would relaunch its bond buying program.

In other words, the ECB is doing everything in its power to stimulate the economy.

Rate cuts and bond purchases by the central bank are an attempt to lower borrowing costs for businesses. And negative rates mean businesses get paid to borrow, in what’s known as negative-yielding debt.

In short, these irresponsible moves by the ECB are exactly why we invest in gold.

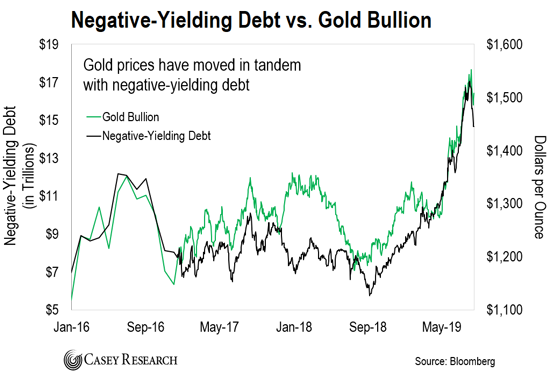

You can see what I mean in the chart below. It shows the price of gold and the sum of negative-yielding debt around the world.

As you can see, gold has moved in tandem with negative-yielding debt. As the pile of negative-yielding debt grows, gold becomes more attractive.”

Saudi Oil Attacks Have the Potential to Snowball into Something Bigger

This past week also saw attacks on Saudi oil facilities. Jim Rickards reports:

“This weekend, drone attacks against two critical Saudi oil production facilities produced extensive damage.

The attacks took out roughly 5.7 million barrels of daily crude production. That’s about 50% of Saudi Arabia’s oil output — and more than 5% of total global daily oil production.

Jeff Currie, head of commodities research at Goldman Sachs, said the attacks amount to a “historically large disruption on critical oil infrastructure,” adding that the attacks represent “a sharp escalation in threats to global supply with risks of further attacks.”

Yemen’s anti-Saudi Houthi rebels, who are supported by Iran, claimed responsibility for the attacks and warned that further attacks can be expected.

Saudi Arabia has pledged to retaliate against whoever is responsible. Reading between the lines, that means Iran.

So today the chances of a regional military conflict are greatly increased. That could include not only Iran and Saudi Arabia but their regional proxies as well.

Not surprisingly, U.S. Secretary of State Mike Pompeo also accused Iran of being behind the attacks, a claim which Iran has denied. And President Trump hinted that U.S. military action is a possibility.

Stay tuned, as this developing situation has the potential to snowball.

…What does this weekend’s attacks mean for oil prices?

Brent North Sea Crude (the international oil market benchmark, which is about two-thirds of all oil pricing) immediately spiked 19.5% to nearly $72 per barrel. That’s the largest intraday surge on record. Today it’s trading at a little over $67.

West Texas Intermediate (the index tracked in U.S. markets) is trading above $61 today. For technical reasons, Brent crude usually trades, say, $2.50–4.00 higher than WTI. So today’s disparity is somewhat higher than normal, but not excessively so.

But if the Saudis cannot repair the damage from this weekend’s attacks rapidly, or if more attacks against critical Saudi oil facilities continue, we could see a dramatic rise in oil prices.

And in the event of a wider conflict that shuts down oil traffic through the critical Strait of Hormuz, oil could easily spike to $100 per barrel.

The global economy is already slowing down. Europe, for example, is close to recession, if not already in recession.

Here in the U.S. the economy seems to be chugging along. But beneath the surface, debt is rising to dangerous levels, the U.S. consumer is maxed out and signs of distress are appearing in the credit marks.

Can the economy withstand an oil shock?

If oil prices do spike, Americans won’t just be paying higher prices at the pump. The effect will ripple through the economy, since oil prices impact transportation costs for all goods.”

Rickards looks at 3 measures in assessing whether oil prices rise or fall. They are:

- basic supply and demand

- inflation/deflation

- geopolitics

Here’s what he thinks about each of them right now…

“This weekend’s attacks definitely have the potential to affect supply. And the single most important factor in the analysis for oil is the supply/demand factor. If this weekend’s attacks blow over and Saudi production comes back on line in a timely fashion, then oil prices will not be dramatically affected.

But if production falls off or more attacks on Saudi oil infrastructure occur, you can expect sustained higher prices.

Meanwhile, global growth is slowing, which normally presages lower oil prices. In an extreme case, a global recession or financial panic would result in lower prices. But the growth slowdown is not yet at that stage. Even if demand for oil flattens, Saudi Arabia can single-handedly boost the price simply by cutting its output (which just happened, although not by choice).

The inflation/deflation factor is neutral at the moment. There is certainly fear of inflation among central bankers wedded to flawed Phillips curve analysis, but the evidence for actual inflation is almost nonexistent. A disinflationary trend is just as likely.

The geopolitical factor is also flashing a warning. A geopolitical shock in the Persian Gulf could send it back to $100, which now seems like a realistic possibility.

I’m not predicting it necessarily, but it cannot be dismissed.

With geopolitics and the supply/demand factor pointing to higher prices, with the inflation/deflation dynamic still pointing to deflation the net of the “three arrows” is higher oil prices in the near future. A conflict in the Middle East could obviously cause oil prices to skyrocket from here.

I’ll be keeping a very close eye on this space.”

The flipside to what Rickards writes is, how much the increased capacity of the North American shale fields could alleviate the drop in Saudi supply?

We might look into the relationship between gold and oil in more detail in the coming weeks. So stay tuned for that.

Regardless of whether there are any further ructions in the middle east, we believe that gold and silver are in a bull market once again.

So things like oil prices and conflict may have a short term impact on the price of precious metals. But in the long run the price is going up regardless of these factors.

This is what we concluded in our study of How War Affects the Gold and Silver Price.

Repeating what we said earlier. Consider taking at least an initial position now. Because it’s anyone’s guess if the bottom is in, or if it’s not, how much lower that will be.

Give us a call. Or book a time online that suits you for a free bullion consultation.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Gold and Silver Bouncing Back Strongly This Week - Gold Survival Guide

Pingback: Why Buy Gold? Here's 15 Reasons to Buy Gold Now

Pingback: What Might Support the Gold Price in 2020? - Gold Survival Guide