The New Year is here and the sun is shining across the length and breadth of New Zealand it seems! While many are still lazing on the beach, we take our usual look back at how gold and silver performed in NZ dollars during the past year.

Then we’ll have a crack, as always, at what 2015 might have in store for us. As much for our own amusement as anything else.

First up, while we might say here that gold rose or fell versus the dollar, we say that only because that’s what most are used to hearing. We prefer to think in terms of paper money/fiat currency fluctuations against gold itself. i.e. It is paper that is losing or gaining value against gold rather than vice versa.

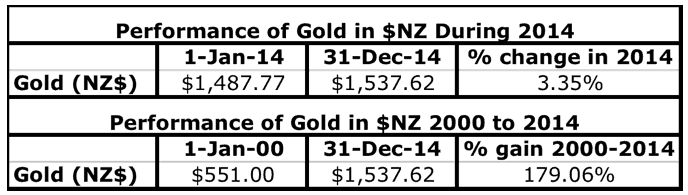

Performance of Gold in $NZ During 2014

While it may not have felt like it, gold actually rose versus the New Zealand dollar over the course of 2014. It may have been up only 3.35% but it was up nonetheless. After the hammering precious metals have taken in price (and in sentiment) over the past couple of years we’ll take even a small gain!

While over the longer run, since the start of the new millenium, gold in NZ dollars is up 179%.

Side note: Gold actual rose in all major currencies except the US dollar during 2014, which it fell against by only 1.76%. And of course in some like the Russian Ruble it soared, as detailed in this article from last week:

Lessons from Russia: Gold Was Up 73% Last Year!

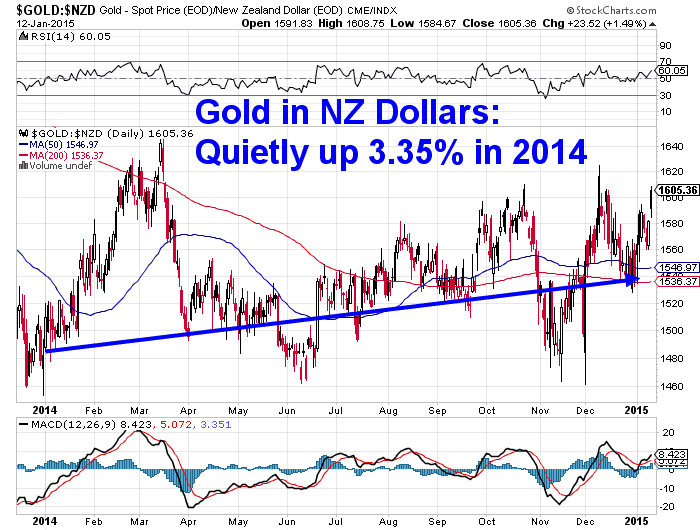

As we’ve said repeatedly in the past we don’t put too much stock in technical analysis in such manipulated times as these we live in. However charts are certainly good to see where the price has been.

The arrow we’ve drawn on the chart below showing where the price began and ended 2014 actually ends up being a pretty good indication of the trend for the past year. The price didn’t managed to get to much above this line or too far below it.

Also of note is that for the latter part of the year the NZ dollar gold price has been above the important 200 day moving average (MA) (red line). Generally this is taken as an indicator of being in a bull market. So it could be significant that the price is holding for the most part above the 200 day MA. More on what 2015 might have in store for us later.

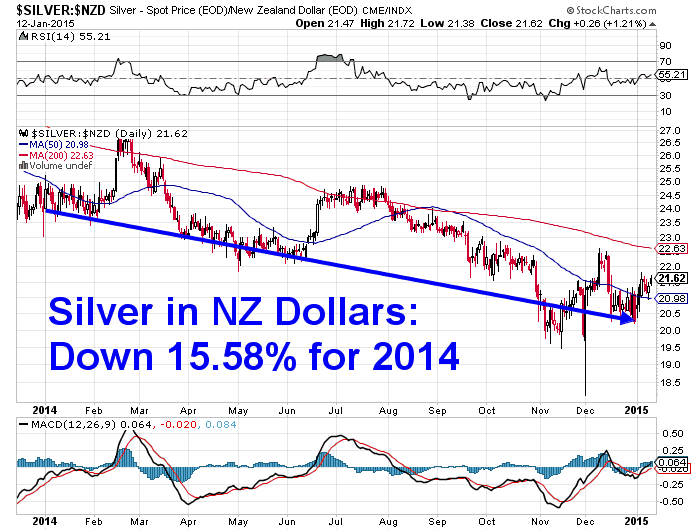

Performance of Silver in $NZ During 2014

Silver again this year fared much worse than gold and was down in most major currencies including the NZ dollar during 2014.

It’s descent has slowed from 2013 but NZD silver was still down 15.58% for 2014. This further fall has also taken silver’s rise since 2000 back below 100% to 96.41%.

The chart for silver in NZ dollars shows clearly that silver has remained in a downtrend this past year. Unlike gold it hasn’t managed to push above the 200 day MA for any significant period of time. It’ll need to get well above the NZ$24 mark before the trend has decisively changed too.

Some Back Up for Our Answer to “Should I Buy Gold or Silver?”

This disparity between gold and silver last year reinforces our thoughts on the answer to the question of “which to buy?”.

We still see this as a good reason to have some of each. The two often don’t perform in exactly the same way at exactly the same time. So having some of each can smooth out the volatility somewhat. If you’d had a bit of both last year the gold would have at least held purchasing power and made up somewhat for the losses in silver.

We still think silver will outperform gold in the long run, but you’ll have to put up with the serious downtimes like we’ve had the past few years while you wait.

A Look Back at Our 2014 Predictions

So how did we do with our guesses last year?

Our guess is that 2014 should be a return to gold and silver finishing above where they started the year. Though given the length of this correction it could be a while before we get back to new highs (see more on this below). The level of confidence in the recovery throughout the mainstream is pretty high so this could remain a headwind for the precious metals for little bit yet.

So we were right with gold finishing above where it started 2014 but a big cross for silver.

Gold may continue to underperform other sectors.

Also while other sectors head higher this will also likely have a dampening effect on gold and silver. Odds are we will see shares and property continue to bubble higher. But a bubble isn’t fully formed while many people are talking about a bubble. And that is the case with stocks in the US and with property here. While we continue to see articles in the mainstream discussing NZ property being in a bubble, it probably means it hasn’t really been fully inflated yet. Likewise prices around the rest of New Zealand other than Auckland and Christchurch are yet to rise much. Until these follow we probably haven’t reached bubble level yet either.

A few ticks for us here. Gold did lag stocks and property in 2014. Of course the time to buy financial insurance is when everything else is doing well. So that would continue to be now.

Where to for Gold in NZD in 2015?

Three times over the course of 2014, gold in NZ dollars dipped down to around the $1460 level and bounced up from there each time. (See the chart posted earlier.) So it seems to have built a pretty good base at this level.Therefore our guess is that we should again see gold higher by the end of the year compared to where it started it. As mentioned already it has held up above the 200 day moving average level for 4 of the last 5 months of 2014, so that too is a good sign.

Another positive is that while early days, so far the start of the year has seen precious metals strengthen while the USD has also continued to strengthen. This is the opposite of what most expect. When the USD goes up gold is “meant” to go down.

It also seems to us that it is widely expected that the US dollar will continue to strengthen on the expectation that the US Fed will raise interest rates this year. As we’ve mentioned a number of times in recent months we’ll believe it when we actually see it.

When just about everyone is expecting something, the opposite is likely to happen. So maybe we’ll see the USD weaken this year, which would likely give gold and silver a boost.

There is some historical evidence to back up to this idea even if US interest rates do rise. We learnt in a letter this week from Jawad S. Mian, called STRAY REFLECTIONS via John Mauldin that:

“Over an extended period of time, rising US interest rates are not necessarily accompanied by a rising foreign exchange value of the US dollar. Fed rate hiking since the early 1970s has actually been, on average, consistent with the dollar getting weaker, not stronger.”

Our guess is that the NZD/USD exchange rate will have a lessor impact on the local NZD gold price this year than the last. That is, it will be driven more by what the USD gold price is doing than the NZD/USD exchange rate.

Where to for Silver in NZD in 2015?

Silver is a little harder to pick. Given that unlike gold, it remains firmly in a downtrend still. However we’ll stick our necks out and say we think it too might finish the year higher than it starts it. To be honest maybe out of hope as much as anything!

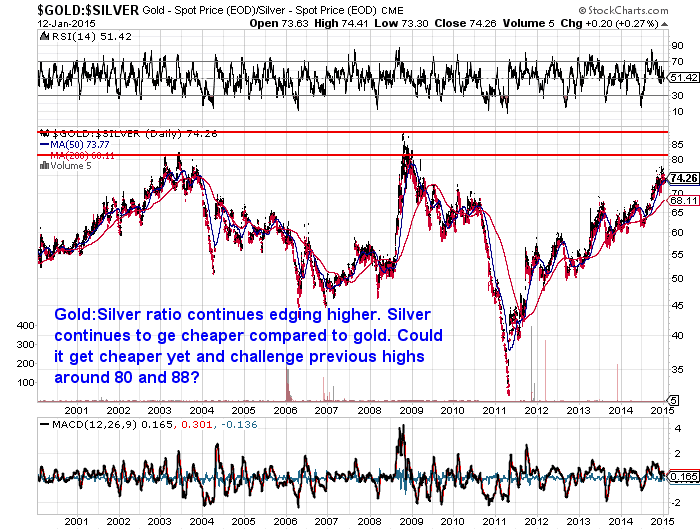

Although there’s a good chance we could see the gold/silver ratio extend a bit higher yet. It’s currently not too far from previous highs in the 80 range.

This means gold might continue to outperform silver for a bit yet. That doesn’t necessarily mean silver will fall, but that gold could just rise faster than silver.

But it’s important to note that when the ratio has reached extremes in the past (such as 2003 and 2008), it has fallen very rapidly after this. That is silver has soared. So we might well see some hefty gains in silver by the end of this year.

What Are the Reasons We Hold Precious Metals?

We do firmly believe that this remains a pause (albeit a lengthy one) in this precious metals bull market. The reasons we personally hold gold and silver still have not changed.

Well we could repeat ourselves but we’ve written about them before and they still hold true today.

So check them out if you’re wondering whether to keep holding or if you should buy if you don’t hold any currently.

As we skim through them we can’t really identify any that no longer apply. In fact some apply even more now than when we wrote these a couple years back.

What do you reckon 2015 has in store for gold and silver in NZ dollars? Will it be a better year than last? Show us you’re alive and leave a comment below.

Pingback: Predictions for 2015 - both ours and others - Gold Prices | Gold Investing Guide

I think the silver bullion price has been totally manipulated, and undervalued; and will at some point rise up to it’s correct position.

Hi Mandy, Thanks for leaving a comment. Yes we’d agreed by a number of measures paper fiat currency remains overvalued compared to both gold and silver.

Pingback: RBNZ takes a leaf out of the Fed’s book - Gold Prices | Gold Investing Guide