Prices and Charts

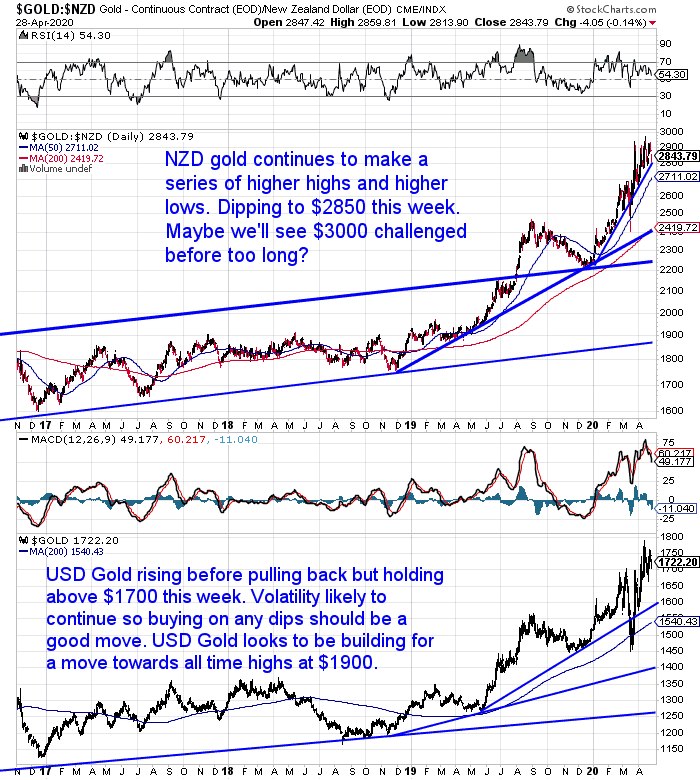

NZD Gold: Higher Highs, Higher Lows

Since the current crisis began, gold in New Zealand dollars continues to make a series of higher highs and higher lows. Although the NZ dollar has strengthened this week which has held the local gold price back.

In comparison the commonly quoted USD gold price moved back above $1700 this week. It looks to be building for a move towards the all time highs at US$1900.

Gold has risen without too much focus on it in recent weeks. So a move up to the all time high in US dollars would come a little under the radar.

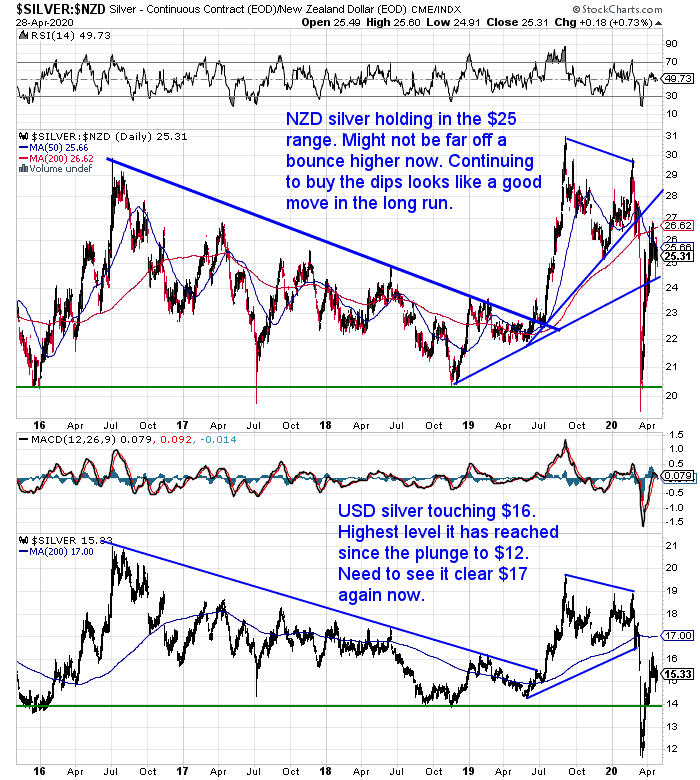

NZD Silver Flat This Week

NZD silver is little changed from a week ago. Holding in the $25 region. It is looking like it is ready to bounce a little higher.

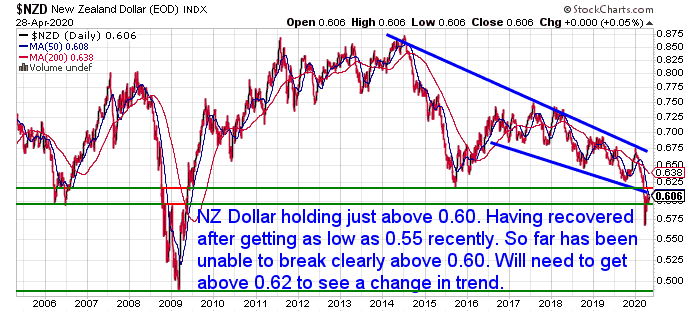

NZ Dollar Edging Above 0.62

As noted above, the Kiwi dollar has moved up almost a cent since last week. Now back above 0.60. However we’ll need to see it get above 0.62 to see a change in trend.

Perhaps the markets are pricing in New Zealand having the virus under control? However, have they priced in the longer term economic impacts of the shut down?

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

Negative Interests Rates in NZ by November?

We’ve been discussing negative interest rates here for many years. Back in 2018 we wrote: RBNZ Prepared to Print Money and Implement Negative Interest Rates in a Crisis

Then last June we asked: Could Negative Interest Rates Be in Store for New Zealand?

This week the governor of the Reserve Bank of New Zealand (RBNZ) said “that negative interest rates are not off the table in its response to the economic fallout of the coronavirus crisis”.

Source.

This was after the RBNZ cut the official cash rate (OCR) to 0.25% in March, and pledged to keep it at that level for at least 12 months.

Bloomberg reported that the NZ Dollar may have trouble getting any higher due in part to these RBNZ comments:

“The rally in the New Zealand dollar from a more-than-decade low is in danger of coming to an end amid the backdrop of a weakening economy and a central bank that stands ready to act.

While the kiwi has risen about 9% from its March 19 intraday low against the dollar — buoyed by news from Prime Minister Jacinda Ardern that lockdown restrictions are set to be eased — it has been unable to break higher from its recent trading range, thanks in part to comments from Reserve Bank of New Zealand Governor Adrian Orr.

The RBNZ chief suggested that not only do negative rates remain a policy option on the table, but that he is even open minded about the monetization of government debt. The dovish remarks will only increase investor focus on upcoming economic data, which could act as a catalyst for further monetary easing.

While investors are pricing in about a 42% probability of a rate cut to 0% by November, a sharp decline in this week’s consumer and business confidence data could boost those easing bets and weigh on the kiwi.

“Price action looks stronger, but we wonder how sustainable it is given RBNZ dovishness and sentiment challenges facing the kiwi should the risk-on environment we’re now in change,” wrote ANZ Banking Group Ltd. economist Liz Kendall and strategist David Croy in a note Friday.

Kiwi-dollar may test trading range support as bearish momentum rises

Chart watchers will be looking out for a breach of technical support at the 58.44 cent level — the lower boundary of this months trading range — for a sign that the kiwi’s rally is over. That would open up the door for a move toward 56 cents. The kiwi traded around 59.8 cents Friday.

Still, leveraged funds are sitting on the sidelines, with no significant positions in either direction, according to the latest Commodity Futures Commission data. And some strategists suggest the central bank is unlikely to move further on rates.

“Debt monetization is effectively what the RBNZ is doing already, with the government issuing bonds to the market and the RBNZ coming in behind and buying bonds in large amounts to soak up the supply and keep rates down,” said the Bank of New Zealand’s Jason Wong. “We are skeptical that the RBNZ will cut the OCR further.”

Then we also saw the Westpac chief economist predicting that the RBNZ will cut interest rates into negative territory as soon as November:

“Stephens expects the RBNZ to signal its change of plan in its August Monetary Policy Statement, and make a 75-point cut to -0.5% in November.

When the RBNZ on March 16 cut the OCR from 1% to 0.25%, Deputy Governor Geoff Bascand told interest.co.nz (in a video interview) that not all trading banks’ systems were ready to deal with negative interest rates.

He compared the situation to that at the change of the millennium when people were concerned about how IT systems would respond to the date ticking over from ’99 to ’00.

Yet Stephens said: “Holding off on a negative OCR until November should get around that, but the timing of the RBNZ’s move will depend on how long it takes trading banks to prepare, which is uncertain.”

So it’s likely only technology that is stopping it happening sooner! We guess the computer programmers putting the banks systems together decades ago couldn’t foresee the perverse and bizarre world we are now living in!

Stephens goes on to say he expects QE to nearly double:

“Stephens also expected the RBNZ to increase its Large-Scale Asset Purchase programme to $60 billion at its May 13 Monetary Policy Statement.

“We estimate that total Government debt will be over $130 billion by June next year, so the RBNZ will be on track to own about 45% of the New Zealand Government Bonds on issue,” he said.

“In our assessment even more monetary stimulus will eventually be required. In theory the RBNZ could just continue with an even bigger QE programme.

“But based on RBNZ commentary, we think they would prefer to switch to a negative OCR at that point.

“The RBNZ has said that it would be uncomfortable owning much more than 40% to 50% of the total bond market, because this would affect market liquidity and functioning. By contrast, the RBNZ has previously said that it favours the option of a negative OCR.”

Source: Westpac chief economist and Triple T Consulting founder expect the RBNZ will have to take the OCR into negative territory earlier than indicated

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Where is All the Money Coming From?

Last week we asked: Where Will the NZ Govt Get the Money for its Dramatic Increase in Spending? Tax, Borrow or Just Print it?

This opinion piece in Stuff asks a similar question. A question that perhaps the general public should be asking: Where is all the money coming from?

It attempts to explain Quantitative Easing (QE) or currency printing, doing not too bad a job overall. It also points out the risks of QE before concluding:

“Inflation can also result from QE.

“At some point, if central banks create too much money, they will produce an increase in inflation – too many dollars chasing too few goods – or they will have to raise interest rates to slow the economy to restrain inflation. We are not yet at that point, though,” Brookings says.

The institution emphasises that due to the massive cut in national output, no country is insulated from some Covid-19 pain.

According to ANZ chief economist Sharon Zollner, New Zealand is well placed to ride out the coming economic storm.

“A lot of countries have spent their bullets in the past 10 years. We haven’t,” she said.

Yes, but who is going to pick up the bill? You guessed it. Future generations will have to pay but with interest rates low, the bill should be manageable.

The alternative, a financial collapse similar to the Great Depression starting in 1929, would probably be a lot worse for everyone.

Those generations will need to support ageing populations and their health needs as well.

But that’s a problem for another day.”

That seems to be the current theory summed up. It’s a problem to worry about in the future.

But, the big assumption here is that interest rates stay low for a long long time. Borrowing and QE is taking money from the future to spend today. Maybe it will all work out if interest rates stay at all time lows? But will they? Recency bias means we humans have trouble recalling what things were like in the past.

Even if rates stay low, we are still putting a huge debt load on future generations. All because of the monetary system we are operating under. One where the answer to too much debt is… more debt. Of course, when money is in fact debt, there can be no other answer.

The biggest risk of this pandemic is what is being (and likely is still to be done) in the financial system. We run the risk of a widespread move into socialism or fascism, as governments slowly but surely digest more and more of the private sector. The USA seems to be marching steadily along this path. We are quite a few steps behind currently.

What Can We Do?

So what can “we the people” do about this? Write to your MP? Start a petition?

We have our doubts how well any of that will work. Plus the answer to a top down problem is not a top down solution. If we rely on the politicians things won’t improve. We’ll just get more of the same.

To get a bit philosophical “Be the change you want to be”. All change begins at the individual level. We need more people to be educated on the trouble with the monetary system as it stands. So spread the word to your friends and family. Don’t try and force anything down their throat. No one likes that. But when these topics come up, pose questions that will get them thinking and looking for answers.

- Why are we here?

- Why do so few people have any financial backstop or cushion for times of trouble?

- Why are property prices so high in many places across the planet?

- What causes these bubbles?

Then if they are ready to learn a bit more on the topic of money, send them along to our free ecourse.

Or maybe a link to this week’s feature article might also be a good starting point for anyone wanting to learn more or considering to buying gold:

Bloomberg: Australia is heading into its deepest downturn in almost 100 years

Meanwhile another Bloomberg report thinks “Australia is heading into its deepest downturn in almost 100 years.”

“Australia appears to have succeeded in flattening the coronavirus curve, but such an optimistic health outcome won’t prevent the economy from experiencing a deep downturn. Our base case anticipates the largest contraction since the 1930-1931 Great Depression.

Significant stimulus — both monetary and fiscal — is cushioning households and helping businesses to survive and retain workers. Despite this, Australia’s small open economy has already seen considerable damage and faces headwinds from subdued global demand and trade. Significant monetary-fiscal coordination to provide further stimulus will be required to recover the economy over the years ahead.”

Full article reprinted here.

There can be little doubt that the recovery is going to be a hard slog the world over. Perhaps New Zealand will be better off than many with our primary industries likely to do well in the coming months. We could fare a little better than our Aussie cousins perhaps?

Even though we can see the financial “fire” has started it’s not too late to get your financial insurance in place yet. Precious metals generally do better as we exit a crisis, rather than right at the start. Gold (and eventually silver) will likely shine bright in the years ahead.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: What Would Negative Interest Rates Mean for New Zealand? - Gold Survival Guide