Prices and Charts

Sorry for the lack of our weekly newsletter the past 2 Wednesday’s. Covid has been doing the rounds and so we have been on reduced hours and have just kept things ticking over.

Just about back to normal now thankfully. But the numbers above are compared to gold and silver prices 3 weeks ago.

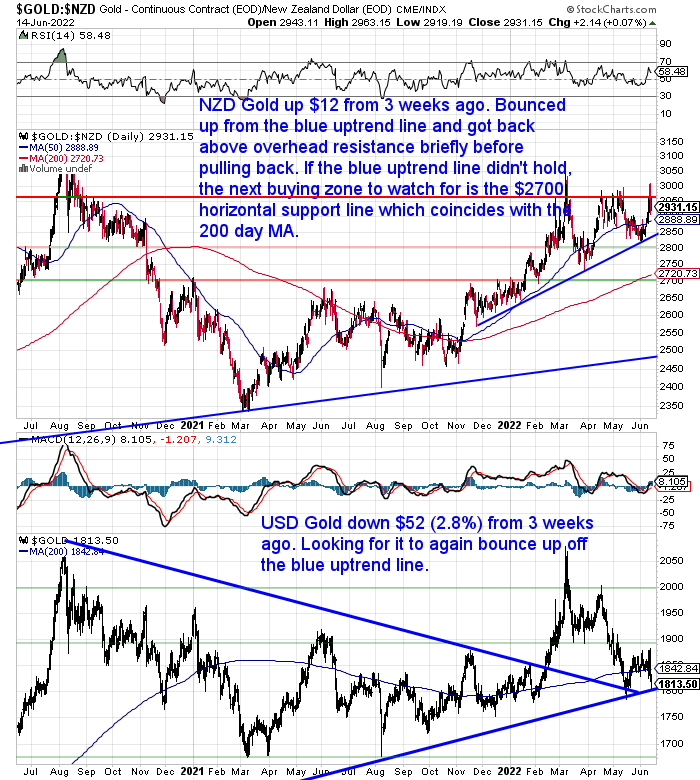

NZD Gold Not Much Change From 3 Weeks Ago

Gold in New Zealand dollars is up $12 from 3 weeks ago. After bouncing up off the blue uptrend line, gold briefly got right back above $3000, pretty much due to the sharply weaker Kiwi dollar (more on that below). But has pulled back this week.

NZD gold is still above the 50 day moving average and well above the blue uptrend line. That trendline has held fast since November 2021 and has proven again and again to be an excellent buying zone. So if we head back near there at all, the odds point to it being a good place to purchase.

Meanwhile the USD gold price is actually down 2.8% from 3 weeks ago. We’re now looking for gold to bounce up off the blue uptrend line again.

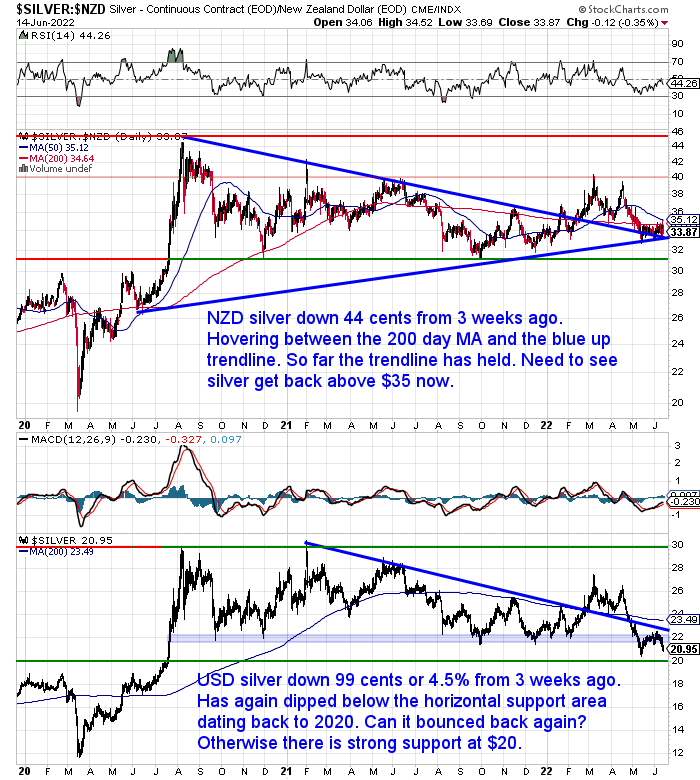

NZD Silver Down 1.3% From 3 Weeks Ago

Silver has been underperforming gold of late, Silver in NZ Dollars is down 44 cents of around 1.3% from 3 weeks ago. NZD silver continues to hover between the 200 day moving average (MA) and the blue uptrend. Which it has been doing since early May. So far the uptrend line has held. We now need to see NZD silver get back above $35.

Like gold, local silver prices have been supported by the sharply weaker NZ dollar. In comparison, USD silver is down a hefty 4.5% from 3 weeks ago. Not far above the May low, but there looks to be strong support at $20 should it dip any lower.

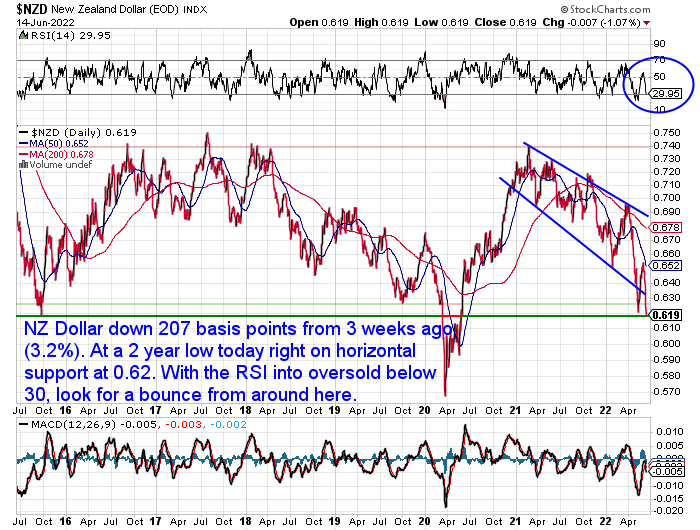

NZ Dollar Plunges 3.2%

The New Zealand dollar has plunged over 200 basis points or 3.2% from when we last wrote 3 weeks ago. Today it sits at a 2 year low and is very close to the horizontal support line around 0.62. The RSI overbought/oversold indicator has dipped into oversold territory below 30. So the odds favour a bounce happening from around here.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food – Back in Stock

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW….

—–

Why Gold Bullion is Your Financial Insurance (& How It’s Still Not Too Late to Buy in 2022)

Given that we hear the price of gold quoted each day in the financial news, it’s not surprising that most people buy gold with the expectation it will go up in price? Perhaps this isn’t the best way to think of gold. So in this week’s featured article, see why you should think in terms of wealth protection first, profit potential second.

You’ll discover:

- 5 Reasons to Hold Gold for Wealth Insurance

- 3 Things That Your Golden Financial Insurance Covers You For

- What Doesn’t Your “Gold Insurance” Cover You For?

- Why You Need to Hold the Right Type of Gold

- Key Differences Between a Standard Insurance Policy and Gold as Financial Insurance

- Why Gold is Wealth Insurance With Upside

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

RBNZ Will Start Reducing their $54 Billion Stockpile of Govt Bonds in July. But Should They Do More?

Radio NZ reports that:

“The Reserve Bank next month will start reducing the $54 billion stockpile of government bonds acquired during the initial outbreak of Covid-19, so it can be ready to buy more in the event of a future economic emergency.”

…The Large Scale Asset Programme (LSAP), otherwise loosely called money printing, was brought in quickly in 2020 when Covid-19 appeared as part of a raft of measures to ensure liquidity in the financial system and keep banks funded to back businesses and households.”

…RBNZ ended the programme last July and will sell $5b a year to the Debt Management Office for the next five years, at the rate of $415 million a month from July through to May, and $435m for the month of June.

[RBNZ senior manager for financial markets Dean] Hill said the RBNZ would sell its long dated bonds first and hold on to the short-term bonds until they matured. The RBNZ would also hold $1.8b worth of local government bonds until maturity.

The central bank should have cleared the LSAP purchases by mid-2027, essentially leaving it with a “clean slate” if it needed to cope with any future emergencies, he said.”

Source.

However…

“Independent economist Rodney Jones is urging the Reserve Bank of New Zealand (RBNZ) to stop figuratively printing money, with inflation at a three-decade high. Jones, of Wigram Capital, says the RBNZ needs to prioritise decreasing the supply of money, rather than just focussing on increasing the cost of money (by hiking interest rates), to curb inflation.”

Jones believes the RBNZ should stop its Funding for Lending Programme, which is not due to end until the end of the year.

The idea of this programme was “to provide banks with a source of funding, should they struggle to attract deposits in the event of the OCR being cut into negative territory.”

However with the OCR now rising and banks hiking interest rates, Jones make the very good point that:

“it’s incongruent for the RBNZ to be tightening monetary conditions by hiking the OCR with one hand, and loosening conditions by adding to the money supply with the other.

The RBNZ argues it needs to stick to its word and keep the programme in place for as long as it said it would.

Jones said this is counterproductive – the situation’s changed, and so should the RBNZ’s policy.”

He also believes the RBNZ should have started shrinking its balance sheet sooner and it now needs to occur faster than their plan to sell all their government bonds by mid 2027.

The RBNZ is going to sell the bonds to the government Treasury, so the Treasury plans to issue up to $20b of new bonds to fund these purchases. Jones rightly points out that:

“Issuing more debt, particularly in a rising interest rates environment, costs taxpayers.”

Instead he believes “the RBNZ should sell some of the bonds on the open market, back to the banks it bought them from. This would reduce the $47b of deposits they have at the RBNZ.”

Source.

Jones makes some good points here. The RBNZ continues to allow banks to borrow from them at very low rates via the ongoing Funding for Lending programme. Even while interest rates are rising. So New Zealand bank’s margins are being helped even more by this.

His point that tightening monetary conditions by shrinking the supply of money, might enable the RBNZ to not have to increase the OCR as much, also makes sense.

It certainly doesn’t make sense to continue stimulating an economy when inflation is running hot and the central bank is increasing interest rates!

Bank Economists Are Finally Admitting a Hard Landing is Looking More Likely

A recent ANZ Business Outlook survey also suggests that the RBNZ may have to rethink its OCR hiking plan…

“BNZ head of Research Stephen Toplis is raising the spectre of the dreaded stagflation after the latest ANZ Business Outlook Survey (ANZBO) provided another very down beat snapshot of how NZ business inc is feeling.

“…The survey confirms diminishing growth prospects are being accompanied by heightened inflation and an excess demand for labour. In other words – stagflation,” Toplis said.

“The big question is, how weak will leading indicators of growth have to be for the Reserve Bank to feel comfortable its targets can be met?

“The RBNZ has confirmed it intends further 50 basis point rate increases [to the Official Cash Rate]. It is difficult for us to ignore its determination to do so and today’s ANZ survey should do little to change its course of action given its stated concerns.

“Nonetheless, we remain strongly of the view the economy’s wheels are beginning to fall off and that, ultimately, the Bank may have to rethink the pace and extent of its currently anticipated tightening cycle,” Toplis said.

Source.

It seems all the banks are starting to sing from the same stagflation songsheet finally too. From the same report:

“Also commenting on the latest survey results, Westpac senior economist Ratish Sanchhod noted that “the times they are a-changin’…and not for the better”.”

ASB senior economist Mike Jones said the question is not whether the RBNZ will eventually get on top of inflation, but more what will need to be sacrificed to get there.

“On this score, the news from the May ANZBO wasn’t flash. It’s not just higher interest rates. The general explosion in costs, supply problems, difficulty sourcing staff, and squeezed profitability are all combining to push business sentiment to extremely depressed levels.

“Risks of a hard landing continue to rise,” Jones said.”

Source.

So it’s looking like a good time to be sure you have enough financial insurance to cover you in what is looking like being harder times ahead of us.

If you agree and want to get some or add to your stash, then please get in touch…

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Shop the Range…

—–

|

Pingback: NZ Consumer Confidence Drops to Lowest Level Since 1988 - GDP Likely to Follow - Gold Survival Guide

Pingback: Russian Gold Ban - Will the “Law of Unintended Consequences” Strike Again? - Gold Survival Guide