We received the below question from a reader a couple of weeks ago:

“With all the evidence emerging of active manipulation of ALL markets, including precious metals, why would one bother with technical analysis at all? Doesn’t effective technical analysis rely on a market where buyers and sellers are rational participants? Participants that wouldn’t do things like sell 400 tons of gold contracts all in one go at times of the lowest market activity to obtain the worst possible price?”

As it happens it’s currently a very appropriate time to address this question.

Why is that?

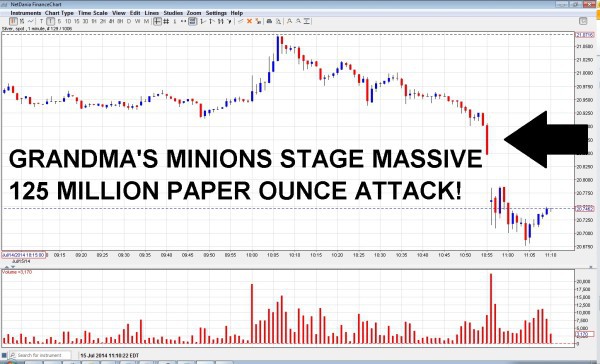

Because in the past couple of days we have again seen very large sell orders placed on the COMEX futures market. Two days ago there were reports of a huge $1.37 billion sale of gold futures placed right at the New York market open, sending the gold price plunging $20.

Similarly in silver there was reportedly a 125 million ounce sell made. The impact of which on the silver price is shown in this chart by Brother JohnF.

So a rather prescient comment as it happens by our reader. As these sell large sell orders again don’t make sense unless the sole intention was to force the price lower i.e. manipulation.

So Why Bother with Technical Analysis of Gold and Silver Then?

Back to the question then: If all markets are manipulated to some degree or other including gold and silver why would one bother with technical analysis at all.?

We’ve kind of commented on this some time ago. In fact in the below video which looks at some basic technical analysis back in May 2011 – worth a look if you are new to the area of technical analysis. (By the way, more videos can be found on our Youtube Channel).

In this written version of that video we said:

“Personally we believe using technical analysis in isolation is of limited value. When markets are being flooded with printed money they won’t necessarily follow historical trends, which, in its simplest form is basically what technical analysis is.

However, used in conjunction with other indicators and fundamental analysis, technical analysis has its place. “

Even in the face of manipulation we’d still stick by the comment that technical analysis has its place.

But surely, you might think if prices are manipulated, then as our reader points out there is no point in looking at charts to see when a good time to buy might be?

Well, charts and technical analysis are still closely followed by many. We’d also guess those that are looking to force prices lower (or higher) are likely looking at them too. Say, to use them to work out at what levels they might be able to trip a flood of sell orders perhaps?

Thus causing the price to plunge lower, so they could then cover existing short positions of theirs, before going long instead. So they make money on the way down and then again on the way back up.

So there are no guarantees that if you make a purchase just above a “support” level (in technical analysis support means a level that the price has previously bounced off i.e. found support) that the manipulators won’t then still send the price below that level.

But of course even in the complete absence of manipulation, there is still no guarantee a support level will hold. It is just a tool to aid in decision making.

There is an element of the “self fulfilling prophecy” about charting

While enough people still follow them we still reckon it is worth keeping an eye on technical indicators when looking at when to make a purchase of gold or silver. As while not all buyers and sellers may be “rational” (as our reader put it), many are. So many are still looking at charts and taking note of support levels, MACD’s, RSI’s and moving averages in making decisions on buying and selling.

So if plenty of people are still following these indicators they still likely have some value.

On top of this, it seems to us that those doing the manipulating are perhaps only able to nudge the price in a certain direction but it still takes a good many other buyers or sellers to keep it going in that direction. So if these market participants are watching levels of support and resistance and other indicators, then you could again argue that it is also worth keeping an eye on them too. Particularly when it comes to trend changes.

So we’d say there is still a use for technical analysis, as long as it’s not in isolation and that you remain aware of its shortcomings.

However we still mainly look to fundamentals and other indicators to help us determine whether to remain in precious metals. (See this article for a list of what those indicators are: When will you know it’s time to sell gold? And this one updates some of these indicators: Why It’s Not Time to Sell Gold & Silver Yet)

Update: As it happens we’ve also today posted an article (which includes a couple of short videos) that looks at a couple of technical indicators that have just recently flashed a buy signal – for silver in particular:

Gold and Silver Technical Indicators Flash “Buy”

For more on this topic check out this article:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

To learn more about when to buy gold and silver see this article: When to Buy Gold or Silver: The Ultimate Guide

Pingback: Gold Prices | Gold Investing Guide Dairy prices plunge - NZ dollar follows - Gold Prices | Gold Investing Guide

Pingback: Beginners guide to technical analysis - Gold Prices | Gold Investing Guide

Pingback: Gold and Silver Technical Analysis: The Ultimate Beginners Guide - Gold Survival Guide

Pingback: If Gold and Silver Are Manipulated, Why Bother Investing? - Gold Survival Guide