Share Markets plunged yesterday led by the US. In this article we’ll try and answer:

- What was the cause?

- What might happen from here?

- How is New Zealand affected?

US share markets (or stock markets as they would say in the USA) have had their biggest one day point drop. With the Dow Jones Index falling 1600 points Monday US Time. Although that is misleading as it makes more sense to track percentage moves. Nonetheless the fall was rapid.

What Caused the Share Market Fall?

The likely reason for the rapidity of the fall? The Daily Reckoning has a good stab at it this morning, citing “Computer trading, triggered by spiking volatility acting in conspiracy with soaring 10-year Treasury yields.”:

“Algorithmic trading can also be triggered by ‘correlation’ trades,” says a BBC story citing Piers Curran, head of trading at Amplify Trading, “when movement in one market will trigger a trade in a different market.”

Some of those “correlation” trades link VIX to the Dow Jones.

And once VIX spiked around 3 o’clock, the machines got it in their heads to sell…

US Treasury bond yields also approached the key 3% mark. The trading machines identified this and kicked into selling mode.”

“…Everyone looks for a reason for why the fall happened. One of them was that bond yields rose up toward the magic number of 3%… There seems to have been a trigger at 2.9% for automatic trading to sell and once that trigger was pulled the markets went into free fall.”

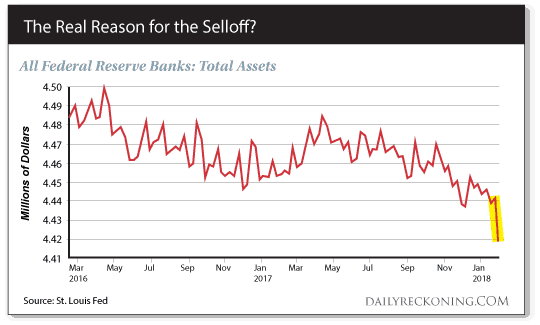

Here’s another possible reason for the plunge though. Check out the chart below (which we think should say trillions not millions):

“The Fed sold just $22B of $4.4 Trillion “assets” it bought over the last 9 years. Its largest one week sale since this experiment began with QE1/TARP. Watching “paint dry” Yellen told us.”

Never has paint dried with such… dramatic effect.

Our Nomi Prins noted recently that the Fed’s balance sheet reductions prior to last week have amounted a “rounding error.”

Perhaps last week’s sizable reduction finally flustered the fish.

Will this episode cause new Federal Reserve chairman Powell to suspend the planned balance sheet reductions?

“After the stumble this past week,” says analyst Lance Roberts, “it will be interesting to watch the Fed’s balance sheet over the next month to see if they continue with their planned $30 billion/month reduction.”

Mr. Powell is thus presented with this conundrum…

If he clings to the current balance sheet-reducing course he risks a market collapse and/or recession.

If he suspends reductions he leaves the bubble inflated at perilous extremes… and the eventual pop could be a thing for the ages.

Pay now or pay later, that is.

But either way… pay.”

The impact of the Federal Reserve Balance sheet reduction was discussed last year and so may be coming to pass. See: Federal Reserve Balance Sheet Reduction: What Impact Will it Have?

Is There a Bigger Share Market Fall to Come?

Regardless of the cause, which let’s face it no one really knows, the bigger question is what happens now?

Is there a bigger fall to come?

Yes definitely. But will it be now or or in a year or 2 still?

Here’s hedge fund bigwig Carl Icahn:

“The market itself is way over-leveraged,” Icahn said on “Fast Money Halftime Report,” predicting that “one day this thing is just going to implode.” He described the possible implosion as “maybe eventually worse than 1929,” making reference to the stock market crash that contributed to the Great Depression.

“The market has become a much more dangerous place,” he said, adding the current volatility is a precursor of potential trouble. “It’s telling you something, giving you a warning.”

Investors are piling into index funds thinking they’ll never go down, Icahn said. “Passive investing is the bubble right now, and that’s a great danger.”

But as much as he was sounding alarm bells, Icahn said, “I don’t think this is the explosive time.” The market will “probably bounce back,” he continued. “I don’t think this is the beginning of the end.”

Our favourite newsletter writer Chris Weber also thinks there could still be more upside ahead for US stock markets. Others like Steve Sjuggerud have also believed for some time that we will see a “melt up” phase in stocks and that we aren’t there yet. And that this melt up may stretch into 2019.

This actually gels with something we wrote a few months ago about cycles identifying that 2019 might be the negative year for markets. See: Gold Cycles vs Property Cycles: When Will Gold Reach Peak Valuation?

What Happens Next for Stock Markets?

Such a rapid plunge pushed US Markets into oversold territory so a bounce back seems likely now…

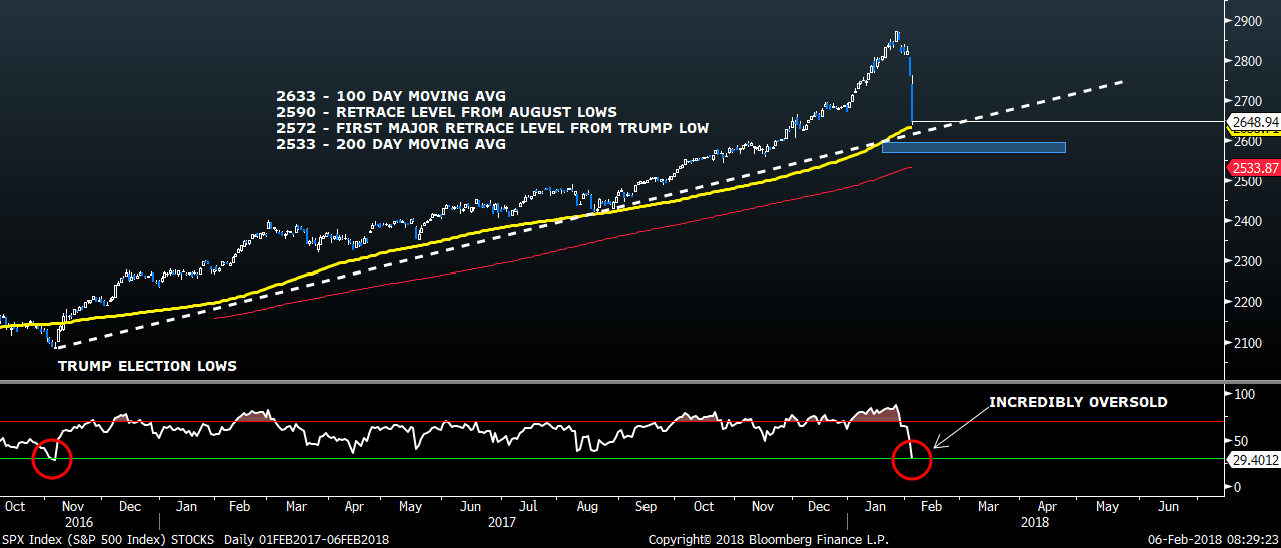

Here is a long-term chart of the S&P 500 Index going back to November 2016 lows when President Donald Trump was elected:

Prices have declined to just above the 100-day moving average (yellow line), which is around 2,630. The long-term trend line (white dash), which serves as the uptrend support in this bull market since Trump’s election, falls around 2,615-2,620.

So we are looking at the first level of major support between 2,615 and 2,630.

Next comes the first major support level (the blue box) of 61.8% of 2,590-2,595, which is from the breakout lows in August of last year.

If the decline really becomes a waterfall event, then 2,570 comes into play… followed by 2,533, which is the 200-day moving average (red line). A significant break below this level will start getting institutional-money programs to hit the sell button – a major change in the long-term trend of equities.

However… look at the relative strength index (“RSI”) at the bottom of the chart. Prices are incredibly oversold. In fact, the last time the indicator reached this level was during the lows around the presidential election (red circles).

I’m expecting whipsaw moves with such oversold levels on the RSI and major support levels coming into play this week.

How is the New Zealand Share Market Affected?

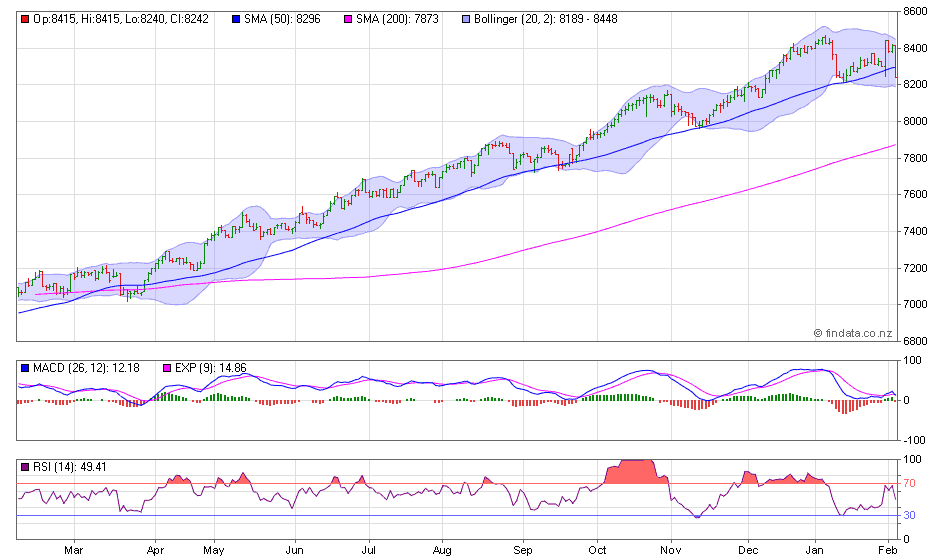

New Zealand share markets may have escaped some of the carnage due to our markets being closed for Waitangi day yesterday. But the NZX50 was not unscathed falling 2% today. The biggest dip in some time.

The NZX50 is only just below the 50 day moving average (MA). It has remained above the 50 day MA for almost all of 2017. Like the US Dow Index, the NZ index is also massively above the 200 day MA. Something that is not very common in any markets. Both are well overdue for a return to these levels.

But these would result in corrections of only around 9% and 12% respectively for the NZ and US sharemarkets. So while significant would not be “the end of the world”.

At some point there will be much worse to come. The trouble is in identifying this before it happens.

You simply won’t be able to.

With the “robo” trading in place that we discussed earlier, imagine what a real crash will look like today! A 50% fall could happen in no time at all.

Gold and Silver: Non-correlated Assets

The benefit of gold and silver is that they are uncorrelated with sharemarkets. While they may dip initially (like they have the last few days), 2008 showed that they bounced back by 4 times as much as sharemarkets lost.

So far in 2018 precious metals have also been inversely correlated with cryptocurrencies.

But you need to own gold and silver before the sticky stuff strikes. As picking when exactly the next crisis will hit is incredibly difficult to do. Go here to get a quote.

Along with protection from a share market crash, here’s another reason to buy gold and silver: Derivatives – a Beginner’s Guide to “Financial Weapons of Mass Destruction”

Pingback: Saxo Bank's CIO: Now Is The Time To Be In Capital-Preservation Mode - Gold Survival Guide