Prices and Charts

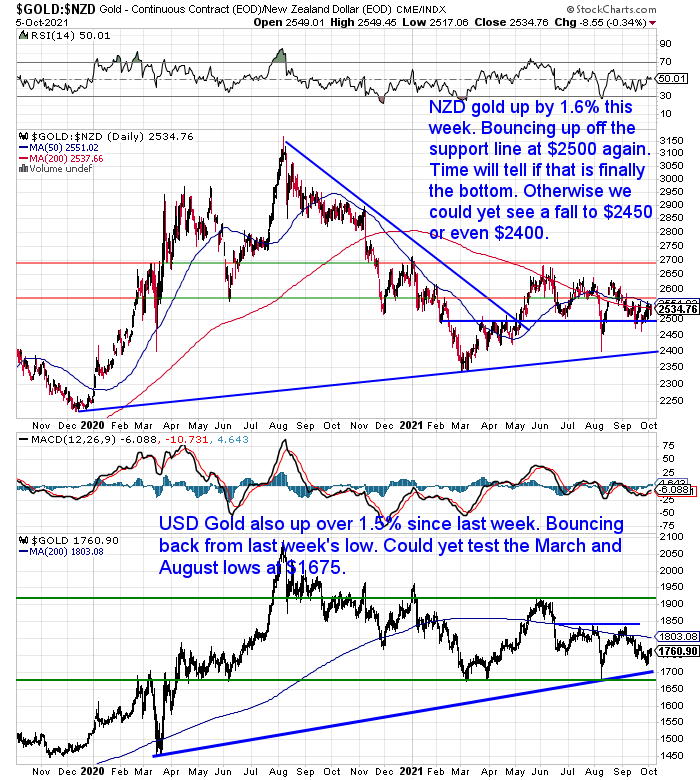

NZD Gold Rising Up Off Support Line By 1.6%

Gold in NZ dollars has bounced up again off the $2500 support line. Ending up 1.6% from 7 days ago. Only time will tell if that is finally the bottom. But our favourite newsletter writer points out this week that a contrarian indicator is showing that a bottom may be close:

Hulbert Sentiment Indicator Tells Us How Hated Gold Is

“Mark Hulbert reviews hundreds of investment newsletters. His Sentiment Indicator has been a marvelous ‘reverse indicator’ in many sectors, since what is most hated is normally the best buy, and what is most loved is the opposite.

Now we see that The Hulbert Sentiment Reading for gold is in the lowest 1% of all readings going back to 2000. It’s as low as March 2020, when gold plunged to around $1200 before almost doubling in the next few months. So, it is not just my gut feeling that the sector is as cheap as it was in 2001.”

Learn more about our secret investment advisor here.

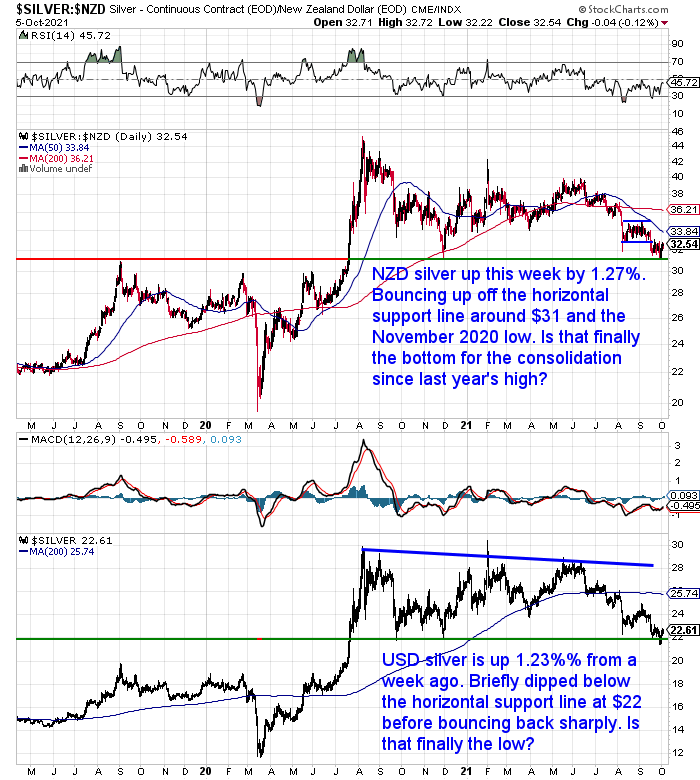

NZD Silver Also Bouncing Back This Week

Silver in New Zealand dollars was also up this week – by 1.27%. Bouncing up off the horizontal support level around $31, which was the November 2020 low. Is that finally the bottom for the consolidation that has been in place since last year’s high?

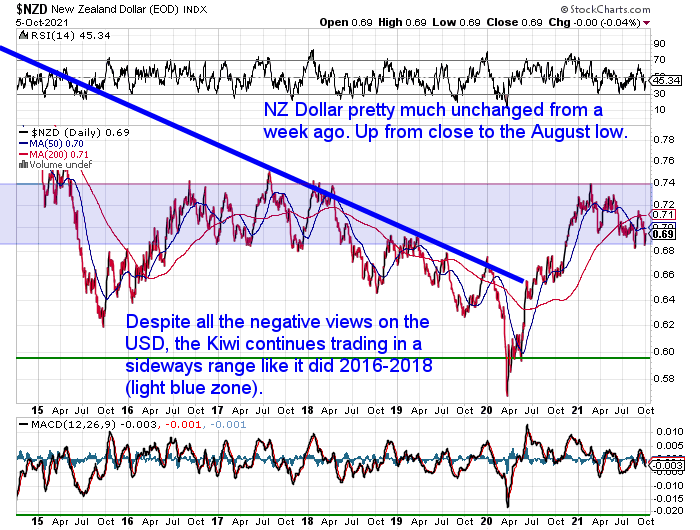

NZ Dollar Unchanged

The Kiwi dollar is unchanged from a week ago. It seems traders are waiting to see what happened in today’s OCR announcement from the NZ central bank. From what we’ve read it seems most are expecting a 0.25% rate rise today.

We’ll wait and see, as this current RBNZ has always leaned to the side of “easy” money. So it wouldn’t surprise us if they just left it where it was yet again.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Long Life Emergency Food

These easy to carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Thoughts on the “Dollar MilkShake” Theory

A recent question in from a reader:

“My question is, to what extent do you subscribe to the “Dollar milk shake theory”, (USD being the last man standing) and how would you see this panning out, affecting NZD? Would it happen slowly, or as a crash?”

Firstly we should explain what the Dollar Milkshake theory” is. Or rather we’ll turn it over to analyst Darren Winters:

“Dollar Milkshake theory views central bank liquidity as the milkshake and when Fed’s policy transitions from easing to tightening they are exchanging a metaphoric syringe for a big straw sucking liquidity from global markets”

Despite all the talk about global de-dollarisation the USD currently facilitates a significant proportion of global trade. Moreover, the entire investment world currently depends on the dollar and its money flow.

Put simply, global loans made in USD need to be paid back with interest in USD.

Dollar Milkshake theory explains a USD rally in terms of market dynamics of demand for dollars exceeding their supply.

When the Fed, the world’s central bank by default, raises base rates and does quantitative tightening, another way for saying the central bank becomes a seller of assets, that limits the global supply of dollars.

Meanwhile, foreign countries and companies “need north of a trillion USD just to make interest payments on dollar-based debt,” according to Brent Johnson. Moreover, to add to this USD liquidity drought the US Treasury is issuing dollar-denominated bonds to obtain funding for US infrastructure projects.

So the Dollar Milkshake theory supports the USD bull market argument going forward.”

Source.

In short, as the US central Bank tightens or tapers it’s ongoing Q.E., US dollars are returned to the US. Because the supply of dollars falls, other countries will bid up the dollar as they need it to do things like pay off their USD denominated loans.

We have written about this previously. Check out this article from the start of the year:

What Would Happen to the NZ Dollar When the US Dollar Collapses?

In particular, see the section headed:

Could Currency Flood Back to the US? How would This Affect the NZ Dollar?

There are others such as Peter Schiff who strongly disagree with the Dollar MilkShake Theory:

Schiff argues that the dollar milk shake theory…

“…is only focusing on the borrower. You also have to factor in the lender. Even though they might be getting paid in dollars, they don’t really want them. A lot of lenders immediately sell the dollars in exchange for their own local currencies.

There are two sides of a market. There are people buying dollars and there are people selling dollars. In fact, there are people buying and selling dollars more than any other currency. So, just because there are a lot of loans that need to be repaid or interest payments that have to be made doesn’t mean the dollar’s going to go up, especially when the people receiving those dollar payments are likely to turn around and sell them to get other currencies.”

Once a lender gets paid back in dollars, they may use them to buy US assets – stocks or bonds. But there is no guarantee they will. In fact, if US assets are too expensive, they’ll get out of dollars and invest in another country with better valuations.

I think that is the key that all the dollar bulls are missing – the massive glut of dollars with no demand.”

The other point that Schiff makes – which is a very good one is:

“…the milkshake theory ultimately depends on central bank tightening. Everybody believed that would happen after the 2008 crisis. That’s why you say that double-peak in 2015 and 2017. But as we know, the tightening process failed. The Fed went back to easing even before the pandemic. Nobody believes the Fed is going to tighten this time around. Peter said once the dollar starts falling, there is no stopping it. There is no floor. There isn’t going to be another currency war. The dollar is just going to lose. There’s not going to be a contest.”

Of course, everyone – including us – is just guessing. Our best guess is we can continue to see both.

The US dollar may continue to depreciate against other countries for long periods of time. But then as 2009 and also last year showed us, in a crisis currency will flood back to the USD causing it to appreciate. So maybe we could simply see oscillations up and down of varying lengths of time? The odds are the US Dollar could be the last man standing, until eventually some other international monetary system is agreed upon.

But the safest call I think will be that against gold, the USD and all other currencies will continue to do down. We’re really just arguing over who is the “prettiest horse in the glue factory.” i.e. they’re all dead in the end.

If all currencies collapse, including the US dollar, the next thought that springs to mind is, what happens next?

This week’s feature article takes a close look at this including:

- 3 Ways the Infamous “Dollar Collapse” Could Take Place

- How Previous Currency Collapses Have Been Localised

- 6 Possible Options for How Gold Could be Priced in a US Dollar Collapse

- Another Option is There Might Not be a Complete Collapse of the Dollar

- A Common Theme in All These Options

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

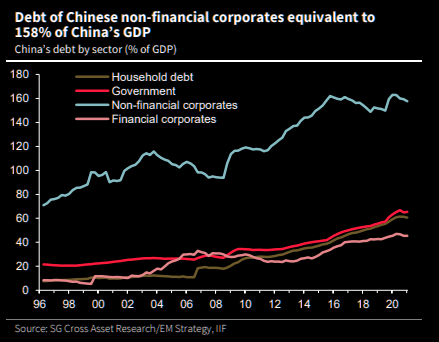

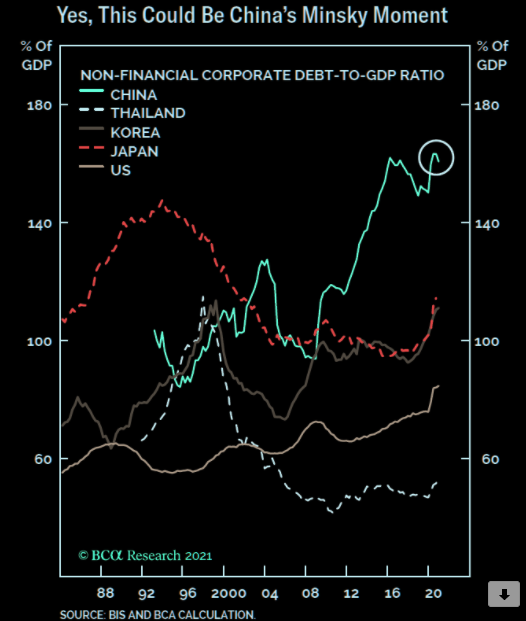

Evergrande: China’s Minsky Moment?

We haven’t mentioned it so far but we’ve been keeping a close eye on the potential collapse of the property firm Evergrande in China.

The unknowable question is will the potential bankruptcy of Evergrande be the straw that breaks the camel’s back? Will it be China’s Minsky Moment?

Note: Minsky Moment refers to the onset of a market collapse brought on by the reckless speculative activity that defines an unsustainable bullish period. (We’ve certainly been seeing one of those in action for quite some time!).

China’s Minsky or not?

Nobody knows, but there is definitely a lot of leverage in the system to consider. Much more than Japan ever had.

Soc Gen on the matter:

“The repercussions from Evergrande’s prospective collapse will likely contribute to China’s ongoing economic deceleration, which in turn anchors global growth and inflation, and casts a pall over commodity prices”.

The investment bank also notes: Debt owed by China’s non-financial corporates amount to 158% of GDP, dwarfing the average EM corporate debt ratio of 63.5% of GDP.

Irrespective of how China decides dealing with Evergrande, it will most likely be a very long process…so buying all that protection (VIX) after the house started burning will probably be a painful trade.

Soc Gen

Source.

Our “secret” investment advisor Chris Weber also made a good point this week:

“Sure, the Chinese central bank can bail out the largest companies and those people who are deemed the most important, or the best-connected. But can it bail out all those people who invested in real estate so much that they will be hurt as property prices fall? The government there will have problems reconciling the two very important goals they have set with continued economic growth: They want to remove the dangerously high amounts of leverage in their economy, and they also want to reduce their reliance on fossil fuels because of the massive pollution it has caused, along with the ire of the rest of the world it has caused. But both of these things: leverage and use of fossil fuels have been the two great engines of recent economic growth in China. That’s a huge dilemma for them, with no easy way out.”

“…China’s energy problems are just part of a mosaic of them. At the very time Chairman Xi is backtracking away from freedoms and again toward the Marxist-Leninist model of stricter State control, the almost certain decrease in economic growth that he’ll face will not make for a happy populace. (See the foolish outlawing of all crypto currencies.) I still keep in mind how Communist Russia only lasted from 1917 to 1990, or 73 years. How many years has it been for China since 1949 –72 years?”

And finally here’s an article worth reading on Evergrande from the excellent historian Niall Ferguson.

So who knows if Evergrande will bring on a collapse? There are likely a lot more wobbling dominoes out there waiting to fall even if it doesn’t.

Make sure you have your financial insurance in place well in advance.

Local refinery operations have commenced again under Level 3. But dispatches to Auckland addresses and collections have been suspended as goods cannot be inspected, counted or signed for by the customer.

Dispatches will stored and insured free of charge until it is safe again to dispatch them and signatures can be obtained. When we drop down a level, you will be advised when your order is ready to collect and to book in a collection time to ensure an adequate distance between customers.

Although, currently imported orders are continuing to be delivered via Fedex. So that is an option if you are looking to spend more than around NZ$10-15,000.

Please get in contact if you’d like a quote or have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

—–

|

Pingback: RBNZ Raises Rates and NZ Dollar Falls? - Gold Survival Guide

Pingback: Currency in Circulation, vs Stocks and Gold - Gold Survival Guide