Prices and Charts

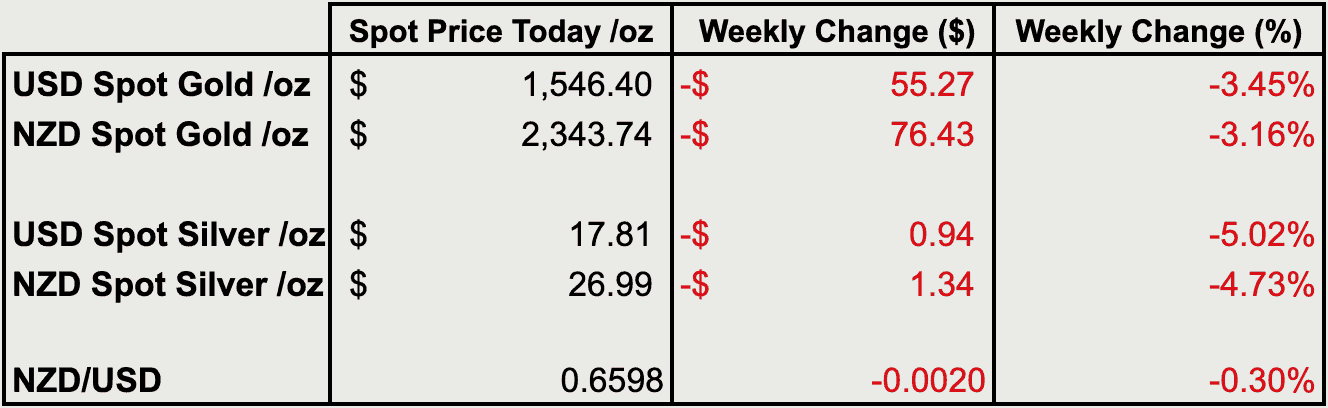

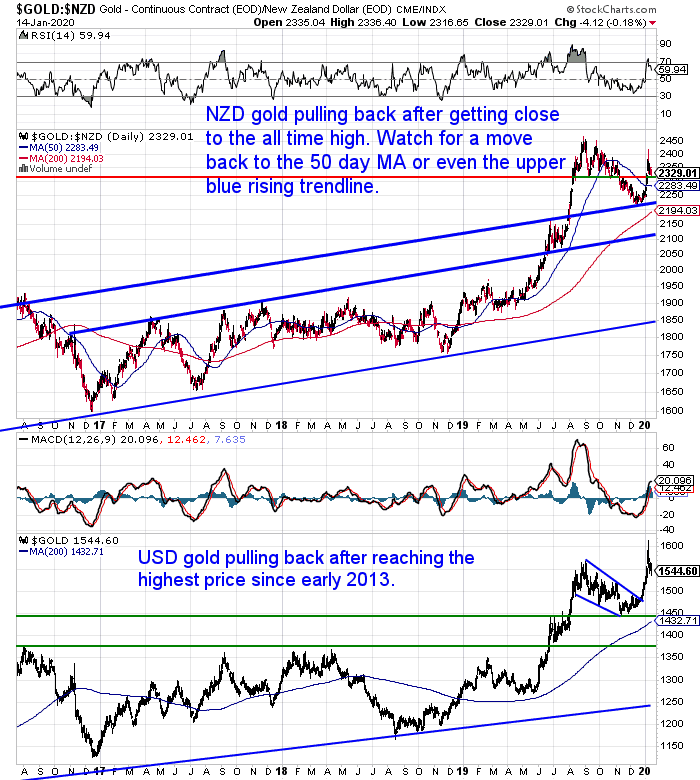

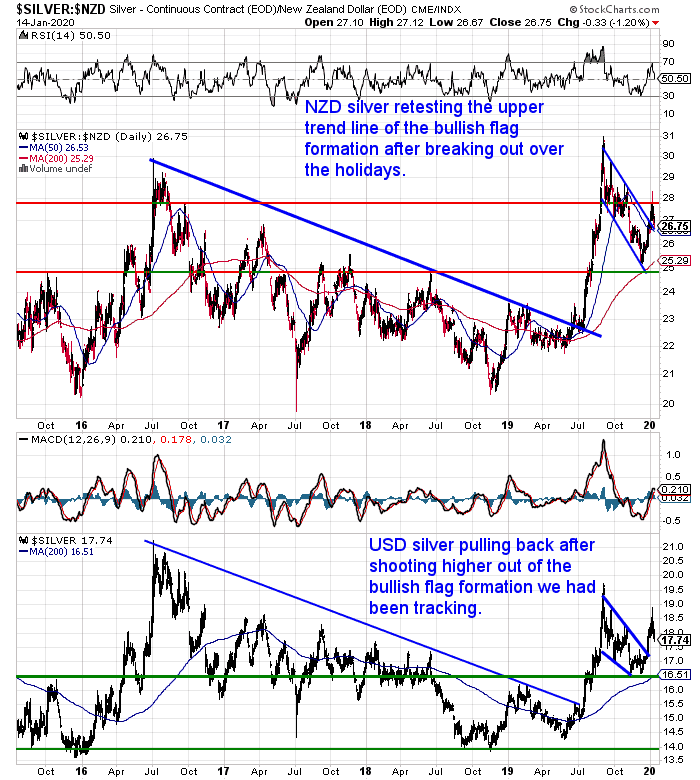

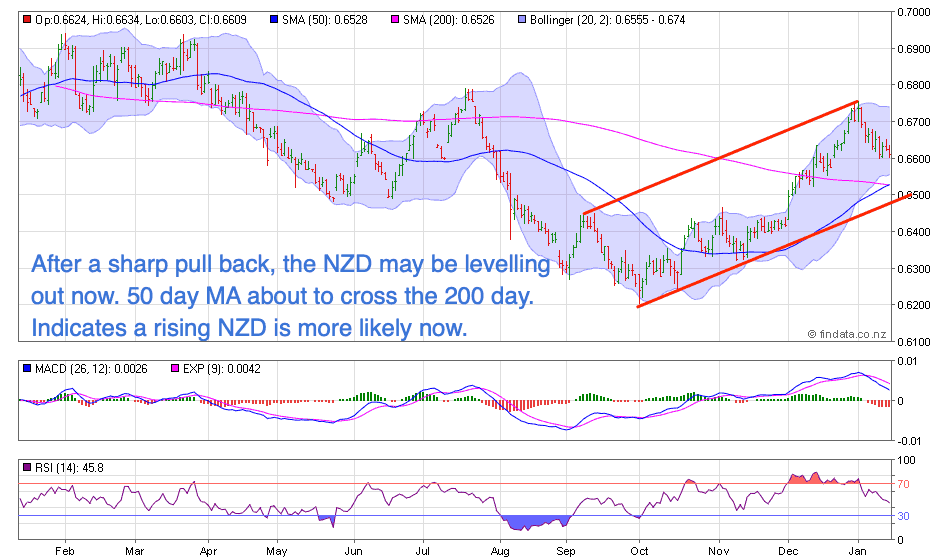

NZD Gold Pulling Back After Sharp RiseAfter an almost $200 per ounce jump since late December, gold in NZ Dollars has pulled back sharply this week. Down just over 3%. With the USA and Iran seemingly looking to de-escalate the tensions. So we could see a pull back to the 50 day moving average (M.A.). Or even down to retest the upper blue trend line. So a good buying zone is approaching now that gold appears to have bottomed out at the end of 2019. Remember the Iran tensions only occurred after New Year. So gold has merely retraced that late surge. Gold was already rising prior to the killing of the Iranian General. Silver Also DippingSilver has already corrected further than gold. Now retesting the upper trendline in the bullish flag formation. Silver is back to neutral on the RSI already though. So given it didn’t rise as strongly as gold due to the Iran conflict, perhaps silver won’t pull back much further? NZ Dollar May Be About to Rise AgainThe NZ dollar may be levelling out now after falling sharply for the last 2 weeks or so. The Kiwi dollar looks to be in an uptrend in the medium term at least. How will this affect gold and silver prices in New Zealand in 2020? This is the subject of this week’s feature article below. Need Help Understanding the Charts?Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you: Gold and Silver Technical Analysis: The Ultimate Beginners GuideContinues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.The Sport Berkey Water Filter Bottle – $69 DeliveredIdeal for travel. Driving, camping, backpacking.

|

||||||

This Weeks Articles:

In a US Dollar Collapse Won’t The Rising NZ Dollar Cancel Out Any Gold/Silver Gains?Thu, 9 Jan 2020 11:20 AM NZST  The US Dollar may well have recently entered another cycle of decline against the other major currencies of the world. This week we have a question from a reader as to how this might impact any gains in the NZ Dollar gold price: When we buy precious metals, all prices are according to USD, then […] The US Dollar may well have recently entered another cycle of decline against the other major currencies of the world. This week we have a question from a reader as to how this might impact any gains in the NZ Dollar gold price: When we buy precious metals, all prices are according to USD, then […]

The post In a US Dollar Collapse Won’t The Rising NZ Dollar Cancel Out Any Gold/Silver Gains? appeared first on Gold Survival Guide.

|

Gold & Silver Performance: 2019 in Review & Our 2020 GuessesWed, 8 Jan 2020 12:55 PM NZST  It’s time for our annual review of the performance of gold and silver in New Zealand dollars. We’ll also look back on our predictions from the start of 2019. Then finish off by making a few guesses as to what 2020 could have in store for us… 2019 saw a complete reversal from 2018 overall […] It’s time for our annual review of the performance of gold and silver in New Zealand dollars. We’ll also look back on our predictions from the start of 2019. Then finish off by making a few guesses as to what 2020 could have in store for us… 2019 saw a complete reversal from 2018 overall […]

The post Gold & Silver Performance: 2019 in Review & Our 2020 Guesses appeared first on Gold Survival Guide.

|

Gold and Silver Surging After Iranian Missile Attack on US Base in IraqWed, 8 Jan 2020 7:18 AM NZST  Prices and Charts Looking to sell your gold and silver? Visit this page for more information Buying Back 1oz NZ Gold 9999 Purity $2274 Buying Back 1kg NZ Silver 999 Purity $846 Iran Launches Missile Attack on US Base in Iraq Happy New Year – we hope you had a relaxing holiday, or – […] Prices and Charts Looking to sell your gold and silver? Visit this page for more information Buying Back 1oz NZ Gold 9999 Purity $2274 Buying Back 1kg NZ Silver 999 Purity $846 Iran Launches Missile Attack on US Base in Iraq Happy New Year – we hope you had a relaxing holiday, or – […]

The post Gold and Silver Surging After Iranian Missile Attack on US Base in Iraq appeared first on Gold Survival Guide.

|

How Does War Affect the Gold and Silver Price?Tue, 7 Jan 2020 2:01 PM NZST  How might a war with Iran affect the gold and silver price? See what can be learnt from past wars and how they impacted precious metals prices… War and Gold and Silver Prices US President Donald Trump ordered the killing of Iranian General Qassim Soleimani over the weekend. The high ranking Iranian General was killed […] How might a war with Iran affect the gold and silver price? See what can be learnt from past wars and how they impacted precious metals prices… War and Gold and Silver Prices US President Donald Trump ordered the killing of Iranian General Qassim Soleimani over the weekend. The high ranking Iranian General was killed […]

The post How Does War Affect the Gold and Silver Price? appeared first on Gold Survival Guide.

|

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

|

| 7 Reasons to Buy Gold & Silver via GoldSurvivalGuide Today’s Prices to Buy |

|

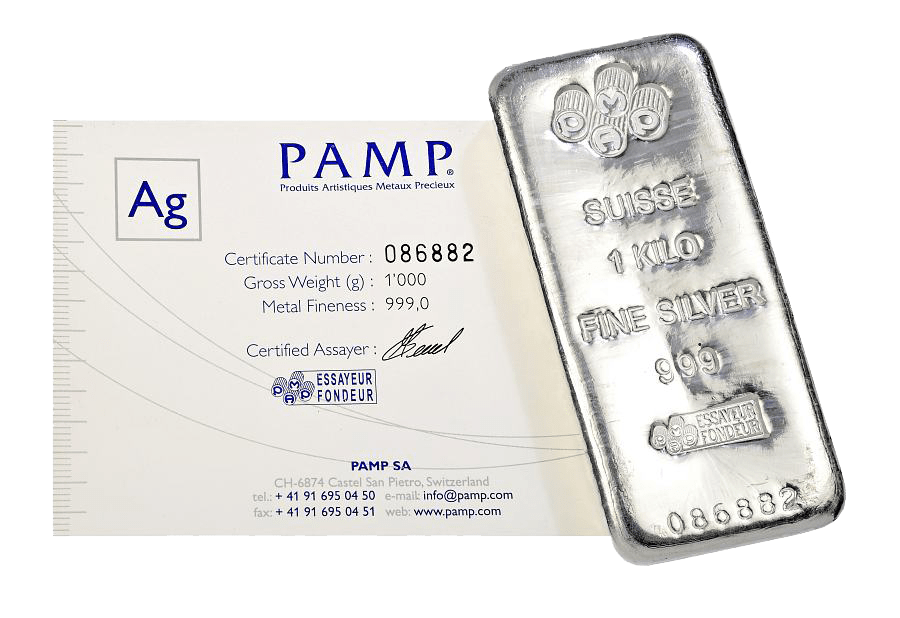

1kg NZ 99.9% pure silver bar

$944 (price is per kilo for orders of 1-24 kgs)

|

| Can’t Get Enough of Gold Survival Guide? If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info |

| We look forward to hearing from you soon.

Have a golden week! David (and Glenn) |

|

|

| The Legal stuff – Disclaimer: We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions. |

| Copyright © 2019 Gold Survival Guide. All Rights Reserved. |

Pingback: The 2019 Top 5: Our Most Read Articles of 2019 - Gold Survival Guide