Prices and Charts

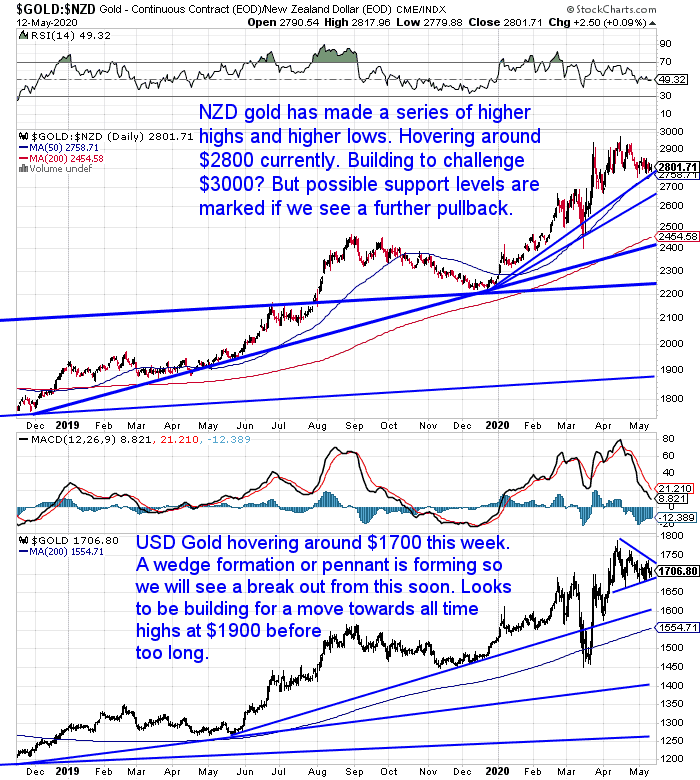

Gold Hovering Around $2800

Gold in New Zealand dollars has continued to hover around the $2800 region this week. It’s sitting on the rising support line and just above the 50 day moving average today.

The chart below shows various support levels to watch for should prices dip lower. At some point gold is likely to return to the 200 day moving average (red line). However there is every chance we will see a challenge of the $3000 mark before too long.

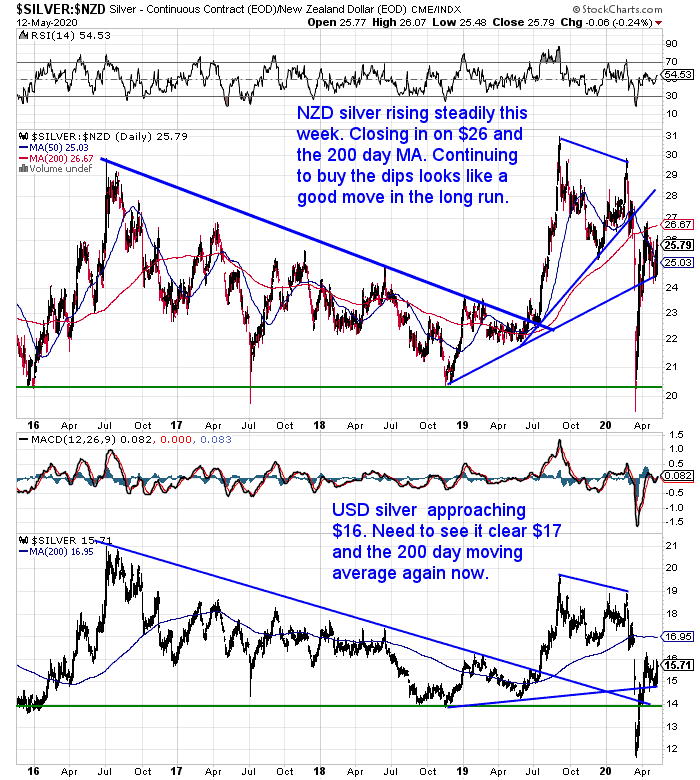

Silver Building and Closing in on 200 Day MA

For a change silver has out-performed gold this week. Rising just under 3% from last Wednesday. NZD silver is closing in on the 200 day moving average. It seems like silver is adopting a wait and see approach to see if global share markets will again turn lower.

A possibility that may be diminishing with all the central bank interventions and currency printing going on. While the real economy is likely to stay stagnant and struggle for some time, this new currency could help to stop financial markets from tumbling further.

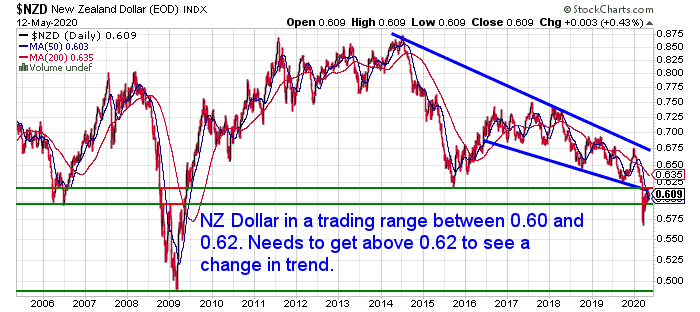

NZD Range Bound Under 0.62

The New Zealand dollar continues to be range bound between 0.60 and 0.62. It, like silver, appears to be adopting a wait and see approach. 0.62 will need to be breached before the Kiwi can head much higher.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

Gold Backing to Debt Ratio: A Reset Like in 1934 and 1980 Would Mean $25,000 Gold

This article was mentioned in our video from last week – Is it too late to buy gold?

It’s been updated to show what the projected gold price would now be given the size of the US government debt today. Funnily enough the projected number matches closely the numbers we reached in last weeks feature article… How Do You Value Gold | What Price Could Gold Reach? Updated 2020

These are large numbers but history shows these resets have happened before and we are overdue.

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Here’s Why it’s Almost Guaranteed Currency Printing and Debasement Will be Used to “Solve” the Debt Crisis

Hat tip to Gareth Vaughn for spotting this one.

Ray Dalio, founder of investment management firm Bridgewater Associates, has published an appendix to chapter two of his upcoming book The Changing World Order. In it Dalio looks at four levers policy makers can pull to bring debt and debt-service levels down relative to the income and cash-flow levels required to service debts. In a COVID-19 ravaged world, governments, corporates and households will be looking to do this.

The four levers Dalio cites are austerity, or spending less, debt defaults and restructurings, transfers of money and credit from those who have more than they need to those who have less than they need (e.g. raising taxes), and printing money and devaluing it.

In comparison to the other options, he argues printing money is the most expedient, least well-understood, and most common big way of restructuring debts.

“In fact it seems good rather than bad to most people because it helps to relieve debt squeezes, it’s tough to identify any harmed parties that the wealth was taken away from to provide this financial wealth (though they are the holders of money and debt assets), and in most cases it causes assets to go up in the depreciating currency that people use to measure their wealth in so that it appears that people are getting richer.

You are seeing these things happen now in response to the announcements of the sending out of large amounts of money and credit by central governments and central banks.

Note that you don’t hear anyone complaining about the money and credit creation; in fact you hear cries for a lot more with accusations that the government would be cheap and cruel if it didn’t provide more. There isn’t any acknowledging that the government doesn’t have this money that it is giving out, that the government is just us collectively rather than some rich entity, and that someone has to pay for this. Now imagine what it would have been like if government officials cut expenses to balance their budgets and asked people to do the same, allowing lots of defaults and debt restructurings, and/or they sought to redistribute wealth from those who have more of it to those who have less of it through taxing and redistributing the money. This money and credit producing path is much more acceptable. It’s like playing Monopoly in a way where the banker can make more money and redistribute it to everyone when too many of the players are going broke and getting angry. You can understand why in the Old Testament they called the year that it’s done “the year of Jubilee.”

Full Article from Dalio here.

The Federal Reserve is Already Showing They Intend to Go Down This Path

Here’s proof the central planners will go down the print and devalue path, with the latest announcement from the US central bank that they will be buying Exchange Traded Funds (ETF’s) that hold corporate bonds. The plan is to bail out bankrupt companies across the USA.

From Simon Black at Sovereignman.com…

“the Fed is going to conjure money out of thin air, and use that money to buy corporate bonds and bond ETFs.

Their plan is to help companies like [Airlines, hotels, restaurant chains, factories, shipping companies, retail stores, daycare facilities, construction companies, etc] roll over their debts, and hopefully prevent a chain reaction of defaults across the entire financial system.

According to yesterday’s press release, the Fed estimates spending $750 billion initially, though it’s clear they could easily blow past that number.

That, of course, is on top of the trillions of dollars worth of other commitments they’ve already made, the $2.6 trillion they’ve already printed, and the trillions of dollars of other facilities they’ll create in the future.

I’ve been writing about this a lot lately, but at the risk of beating this horse to death, I believe it’s worth repeating:

There is so much we don’t know about the economic consequences of this pandemic. Will we see major inflation? Depression? Stagflation?

No one really knows for sure.

But one thing that has become totally obvious is that central banks around the world are going to continue printing incomprehensible sums of money– this is ‘whatever it takes’ monetary policy.

I won’t bother opining on whether what they’re doing is right or wrong. It doesn’t matter.

The reality is that it’s happening; they’re printing ridiculous quantities of money, and that’s that. Nothing we can do will change that fact.

Our only decision is how we choose to react.

Again, there’s no playbook here, and every possible scenario is on the table.

But historically speaking, whenever central banks devalue their currencies by printing vast amounts of money, real assets (and especially gold and silver) generally tend to be safe havens from the monetary consequences.”

if you’re looking to buy a “safe haven” asset, suppliers are starting to clear the backlog of orders so delivery times seem to be coming down now.

Get in touch if you have any questions about buying gold or silver.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: RBNZ Nearly Doubles QE to $60 Billion - More to Come? - Gold Survival Guide