Prices and Charts

Consolidation Continues in Gold

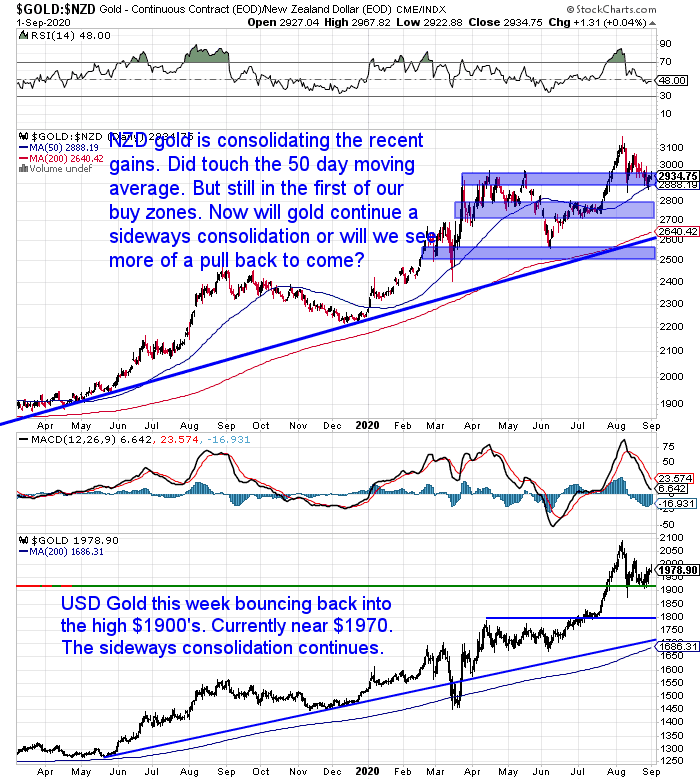

Gold in NZ dollars is down about 1% on last week. Whereas in US dollars gold is up just over 2%. This difference is due to a sharp rise in the Kiwi dollar. More on that below.

We stil can’t count out the possibility of a deeper correction. But so far gold has not fallen very far from the recent all time nominal highs. So it is looking promising for a sideways consolidation to wear off some of the heightened interest in gold. Rather than a bigger fall.

Silver Outperforming Gold

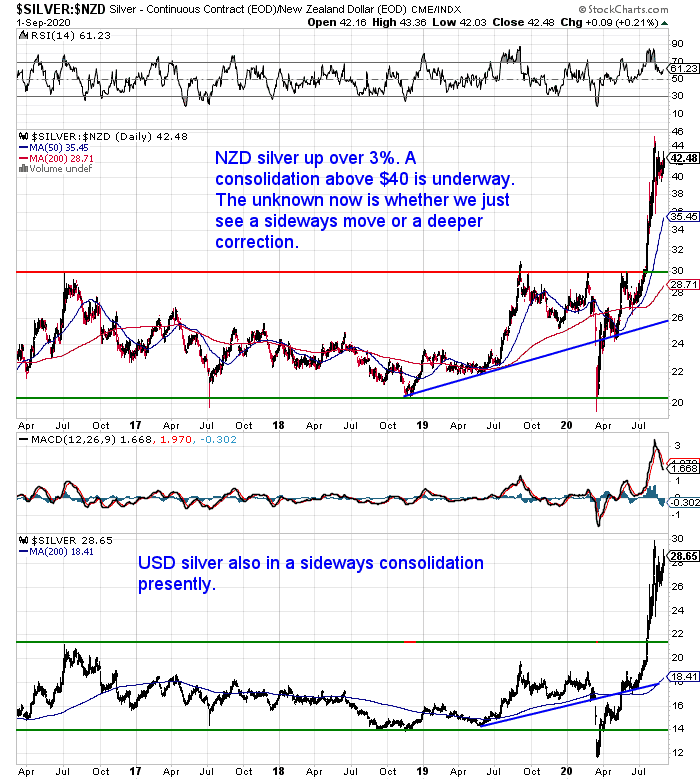

Silver in New Zealand dollars was up about 3% on a week ago. While in US dollars it was up 6% – again due to the strengthening NZ dollar.

Silver is holding up even better than gold, consolidating above NZ$40.

Since the start of August, gold is down almost 2%. While Silver is up almost 13% in the same period.

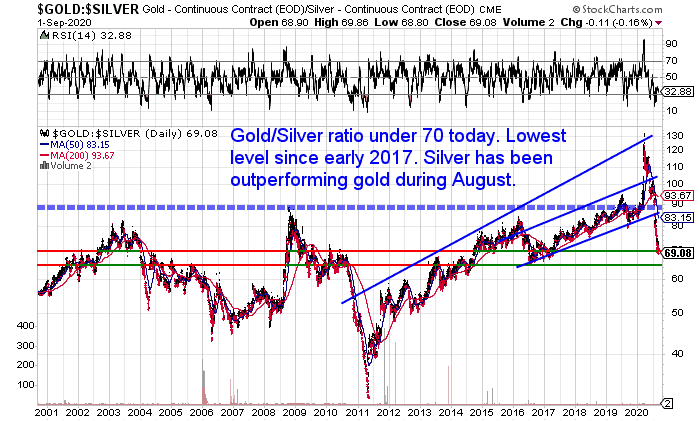

This out-performance by silver is shown by the gold to silver ratio chart. It reached a new low this week under 70. So it only takes 69 ounces of silver to buy an ounce of gold.

For silver to do so much better than gold during a correction or consolidation is quite unusual. Usually when the precious metals sector undergoes a correction, silver falls further than gold. Generally this is because silver rises much fruther further than gold in the prior run up.

We’re not sure what to make of that exactly. Could it be signaling a change of fortune for silver after years of under-performance?

Since the start of August, gold is down almost 2%. While Silver is up almost 13% in the same period.

This out-performance by silver is shown by the gold to silver ratio chart. It reached a new low this week under 70. So it only takes 69 ounces of silver to buy an ounce of gold.

For silver to do so much better than gold during a correction or consolidation is quite unusual. Usually when the precious metals sector undergoes a correction, silver falls further than gold. Generally this is because silver rises much fruther further than gold in the prior run up.

We’re not sure what to make of that exactly. Could it be signaling a change of fortune for silver after years of under-performance?

NZ Dollar Up Over 3%

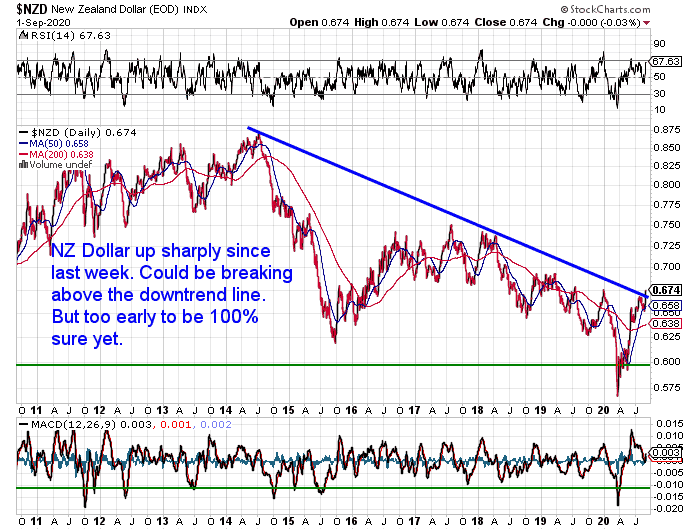

As already stated the Kiwi dollar rose sharply this week. Up over 3% in fact. The chart below shows that the NZ dollar may be about to break out of the multi year downtrend it has been in against the US dollar. Although it’s a little early to be sure on this yet.

This change in trend would simply mean the NZ dollar is joining just about every other currency in the world to be outperforming the US dollar at the moment. However just about all those other currencies are also losing value against gold and silver too.

As we’ve said before, comparing fiat currencies is much like the prize for the prettiest horse in the glue factory. They’re all destined for the knackers yard, it’s just a case of which one drops first!

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

NEW: Certified Organic Long Life Emergency Food

This easy to carry bucket has 90 servings of organic breakfasts and mains

Free Shipping NZ Wide

Get Peace of Mind For Your Family NOW….

—–

Where Are We in the Psychology of the Silver Market Cycle in 2020?

With silver outperforming gold over the past month, it is timely to look at where we are in the cycle of investor psychology towards silver.

All markets go through cycles from depression to euphoria. Where are we currently for silver? What might come next?

Find out in this weeks feature article. Along with a very interesting 40 year chart for silver…

Why Will Gold Still be Valuable in the Future?

A good question in recently week from a reader:

“My biggest question is – why will society continue to value gold in the future? Besides its ornamental use, its use in society appears quite limited. What is the guarantee that society will continue placing value on gold going forward?”

Here’s our answer to her…

Good question. Gold (and silver) have been valued by humanity for many thousands of years.

Despite all the technological advances, we still think gold and silver make the best money for reasons outlined here: What Good is a Bar of Gold When the Shelves are Empty?

So we don’t see that changing. In fact we see the interest in gold most likely continuing to grow in the coming years. Perhaps even returning to the monetary system as we outlined recently here: The Gold Standard & A Free Market For Money: How Could This Work?

This other article may also be of interest to you: Societal Breakdown: Are Gold and Silver Coins Better Than Tradable Items Like Tools, Water and Wine?

While gold may seem like it does not play a role currently, behind the scenes it is much more important than most people would realise.

Despite doing their best to cast aspersions on gold, central banks the world over still own large hoards of gold too (although not our Reserve Bank!).

Central banks went from being net sellers to net buyers of gold in 2010. This has continued ever since.

Central banks like to make it sound like they hold gold due to “tradition” but the real reason is that it is a store of value and a hedge against all the paper (and digital) money the central banks themselves have created. Countries concerned about the US dollar have been buying large amounts of gold in recent years. Russia and China are the largest regular buyers, but many others such as Iran, Turkey, Kazakhstan, Mexico and Vietnam have been purchasing too.

Much like we said about Warren Buffett recently, with central banks it’s a case of following what they do – not what they say. Most are holding, if not buying, gold. Perhaps you should consider the same?

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Exit Strategy for Gold and Silver Funds

Another question this week:

“Obviously, the price of gold will not rise forever. Holding a mutual fund that invests in gold and mines that is profitable at some point must be sold, What is the best strategy for selling theses shares?”

Here’s our thoughts…

Good question. Some people will say that it is a good idea to have a stop loss in pace for timing when to exit shares. Usually a trailing stop loss is used. This means you decide on a percentage – let’s say 25% and as the share or fund rises, you move the stop loss up. So you will lose 25% but not more.

This is generally a good strategy. However the trouble with gold mining shares and funds is they can be quite volatile. They are likely to go through periods where they could correct 25% or more but still be in a long term bull market – or uptrend. So in this case you would be stopped out early and potentially miss the gains to come. You could use an even larger size like 33% or even 50%.

But a better option might be to use various measures to value when gold itself might be reaching full valuation. Then exit the gold funds at this time. This post highlights some of these measure to monitor: When Will You Know It’s Time to Sell Gold

Also we have a financial newsletter we subscribe to for Chris Weber. He is a bit under the radar but has a definite “guru” sense of knowing when the big turns in markets are due. Especially gold and silver. For example, he got the peak in 2011 right and told people to lighten up on gold and silver then. He also went through the 1970’s bull market and got out at the end of that and moved into treasury bonds when interest rates were very high. So you may also want to consider a subscription to him. We have a deal for our readers with him which you can access here.

Of course, before you can exit (likely some years away yet is our guess), you first have to enter the precious metals market. So please get in touch if you have any questions.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Here’s how to always have clean fresh drinking water on hand.

The Sport Berkey Water Filter Bottle – $69 Delivered

Ideal for travel. Driving, camping, backpacking.

Free Shipping NZ Wide.

—–

|