Prices and Charts

Gold Consolidation Continues

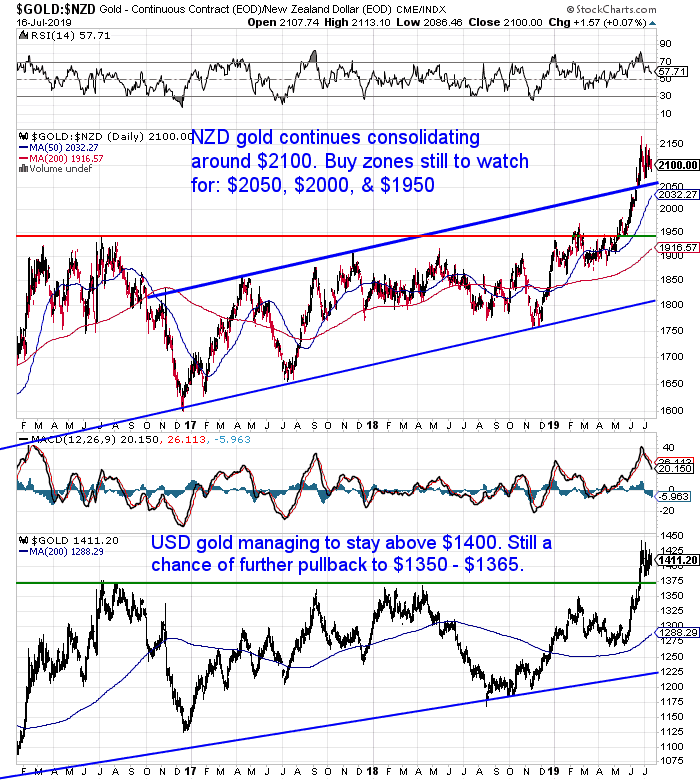

As we noted last week, gold continues to surprise by holding up so well.

After the strong run higher we would have expected a larger correction by now. Instead gold in NZ dollars is holding around the $2100 level.

It could continue to do this for a little longer instead of a further pullback. Any drop lower from here is likely a buy the dip opportunity now that gold is in the accension again.

USD gold is also holding above the $1400 mark. Looking strong.

It’s impossible to say what the price will do in the shorter term. However in the longer term we do look set up for much higher prices ahead. For more on this see: USD Gold Breakout – 6 Year High Above $1400 – What Happens Now?

Silver Moving Higher

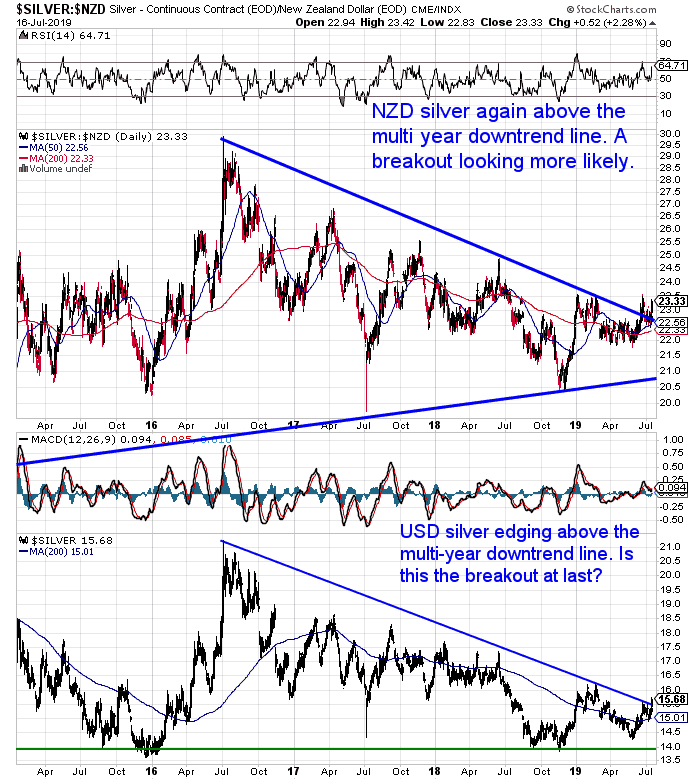

While gold consolidates silver has started to move higher.

In NZD dollars it is once again above the multiyear downtrend line. Also close to the $23.50 horizontal resistance line which it hasn’t been above in over a year.

Importantly today USD silver also has moved above the multiyear downtrend line (see lower half of the chart below).

So could this finally be the breakout beginning for silver too?

Now that gold has broken out, it has to happen sooner or later for silver too.

We’d want to see it rise a little higher to confirm this. First above NZ$23.50 and then also $25.00. This would create a series of “higher highs” and would confirm the breakout.

While in USD terms watch for US$16.25 and US$17.50.

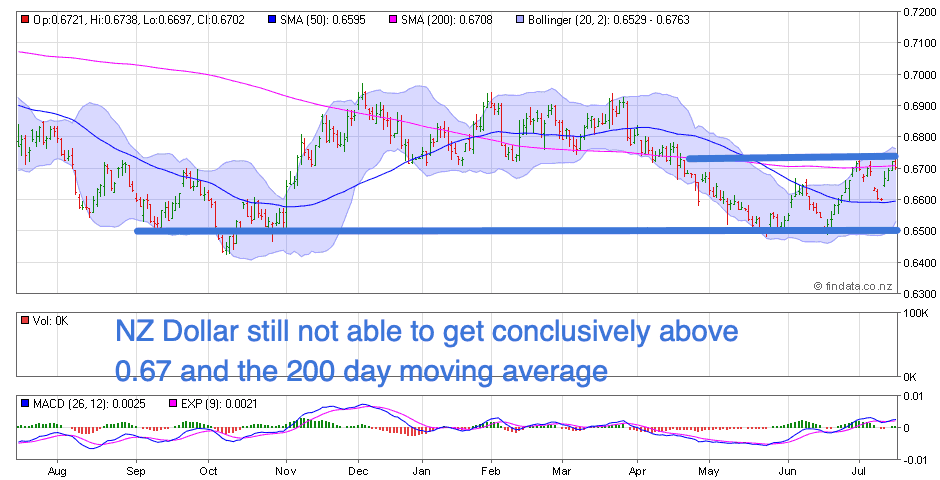

The New Zealand Dollar rose strongly this week. Up almost 1.5%. But so far it still hasn’t managed to get above the 0.67 resistance line.

We continue to believe the NZD/USD exchange rate will have less impact on prices here in New Zealand than the metals prices themselves.

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver and NZ Dollar charts are unknown to you:

Continues below

—– OFFER FROM OUR SISTER COMPANY: Emergency Food NZ —–

Preparation also means having basic supplies on hand.

Are you prepared for when the shelves are bare?

For just $240 you can have a 56 serving emergency food supply.

Free Shipping NZ Wide.

Has the Silver Breakout Started?

As noted in our charts silver might just be starting to break out.

We’ve read a few things on this topic this week that are worth checking out.

This post from the SRSROCCO Report yesterday looks quite timely given the move higher today…

THE SILVER PRICE: Setting Up For A Breakout?

After silver has gone sideways to down for so long, what might be causing the price to rise now?

Alisdair Macloed has conducted some really interesting analysis of the silver futures market.

If you’re new to the topic it might be worth your while to first check out our Beginners Guide to the Gold and Silver Commitment of Traders (COT) Report.

Anyway the gist of the article is that he believes the silver futures data shows that 1 of the 8 large traders is accumulating long positions in silver. These are sizeable and highly unusual. In fact the net long position of the 4 largest positions is at a record high.

He believes this large trader is a bullion bank likely acting on behalf of China.

“The next largest 4 traders can also be calculated by taking the concentration ratios of the eight largest and subtracting the four largest. It turns out, as one would expect when gold is very overbought, the silver positions of the next largest four at net short 40,305 contracts are close to a record short. The second four see prices have hardly moved, and the speculators in the Managed Money category are only moderately long. Despite their individual short positions, they don’t realise they are in acute danger of being victims of a major bear squeeze.

They appear to be blissfully unaware that they are as a group short to a very larger buyer in their own ranks.”

He concludes:

“The message for silver investors is seven of the eight largest traders appear to have become complacent. If China is the whale in the market, then discovery could be a very painful process for them. Its unfolding could be dramatic, likely to coincide with the next move upwards in the gold price.”

Check out the full post here: A Whale Is Accumulating Silver Futures

Mike Maloney has done a very good job of explaining this set up with a series of excellent charts. So we’d recommend if you don’t read Alisdair Macleod’s post to watch this video instead:

What is Up With the Silver Market? Who Is the Whale?

If this really is the start of a silver breakout, and if Macleod is right about these long positions and who holds them, then we could indeed be about to witness a substantial move in silver.

Gold Ratios Update: Dow/Gold, NZ Housing to Gold, & Gold/Silver Ratio – July 2019

With the price of gold recently moving higher, it’s time for another updated look at a number of gold and silver charts and gold ratios including:

- Shares versus Gold Ratio

- Gold Silver Ratio

- Housing to Gold Ratio

These help us value gold versus a variety of other assets. The latest numbers indicate gold is starting to outperform the likes of shares and property…

Your Questions Wanted

Remember, if you’ve got a specific question, be sure to send it in to be in the running for a 1oz silver coin.

Should I Buy Gold Today or Wait? 6 Factors to Consider

A common problem with new buyers of gold and silver is that of over analysing. Trying to assess all the factors that might affect the price of gold. Trying to determine when the price will rise and therefore when to buy.

If that sounds like you then this article is for you…

There are 6 factors that we consider such as:

- How Precious Metals Can Rise Without a Crisis

- Inflation vs Deflation?

- Consider the Psychology of Buying Gold

- What Might Happen in the US?

- Why You Shouldn’t Bet on the Bond Market Falling Over yet

It’s looking like moves higher in gold and silver are on the horizon. But you need to have a position to benefit.

Get in touch if you have any questions whatsoever.

The current deal on 5oz Perth Mint gold bars for less than local gold is hard to beat.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

— Prepared for the unexpected? —

Never worry about safe drinking water for you or your family again…

The Berkey Gravity Water Filter has been tried and tested in the harshest conditions. Time and again proven to be effective in providing safe drinking water all over the globe.

This filter will provide you and your family with over 22,700 litres of safe drinking water. It’s simple, lightweight, easy to use, and very cost effective.

Royal Berkey Water Filter

Shop the Range…

—–

|

Pingback: Silver is the Star this Week - Gold Survival Guide

Pingback: Silver Breakout or Silver Fakeout? - Where to Next for Silver? - Gold Survival Guide