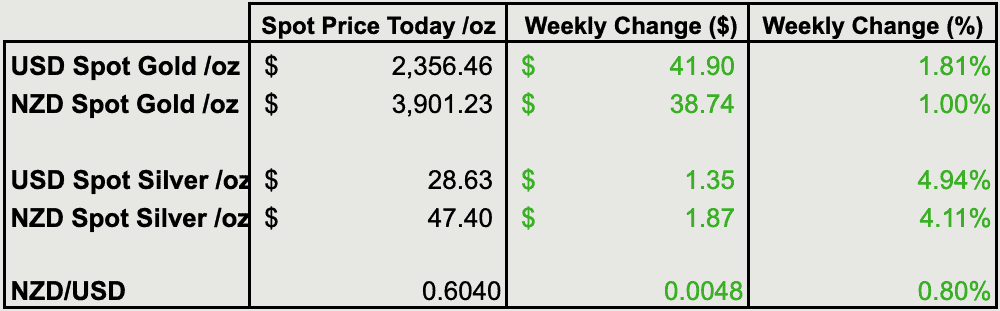

Prices and Charts

| Looking to sell your gold and silver? | |

|---|---|

| Buying Back 1oz NZ Gold 9999 Purity | $3736 |

| Buying Back 1kg NZ Silver 999 Purity | $1411 |

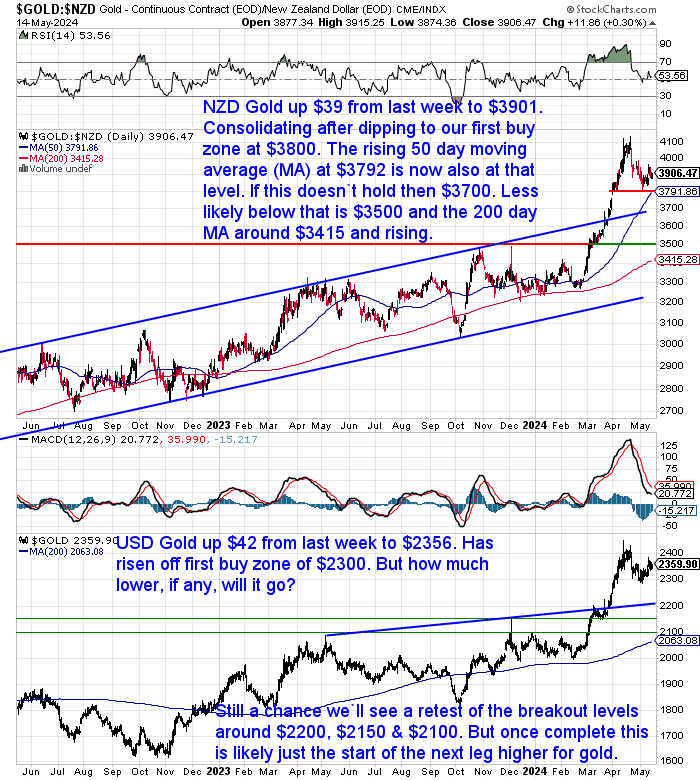

NZD Gold Up 1%

Gold in New Zealand dollars was up $39 or 1% from a week ago. It continues to consolidate above the first buy zone of $3800. The 50-day moving average MA continues to rise sharply and that has now pretty much reached $3800 as well. So that level could continue to be strong support. If it doesn’t hold then $3700 is next, followed by $3500. The 200-day MA also continues to rise (currently $3415). So that will likely be at $3500 or higher before too long as well. If we saw a larger pullback in this consolidation our guess would be that it wouldn’t go below the 200-day MA.

USD Gold is also consolidating, after rising off our first buy zone of $2300. There is of course still a chance we’ll see a retest of the breakout around $2200 or even down to $2150 and $2100.

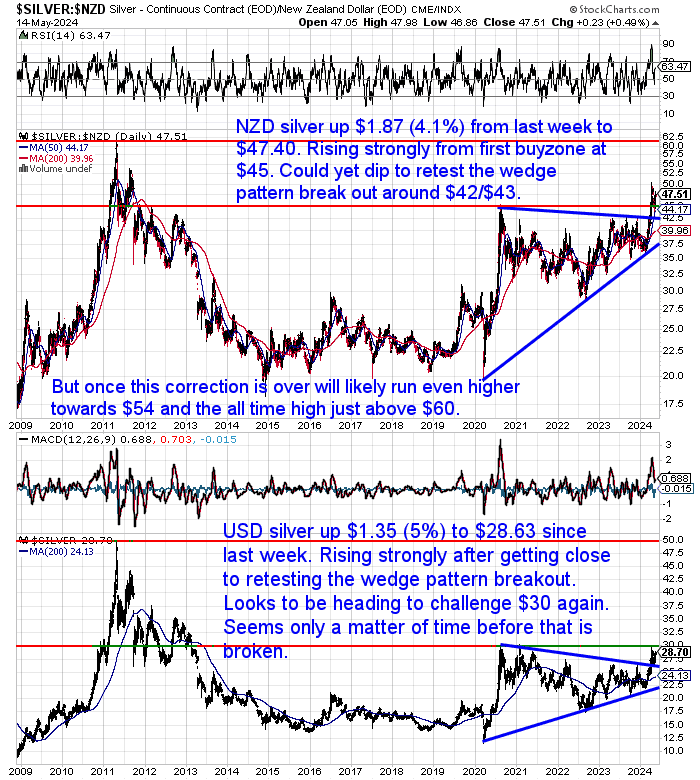

Silver Bounces Back Strongly

NZD silver strongly outperformed gold this past week. Rising over 4% from our first buy zone around $45 to $47.40. It looks to be heading back up to retest $50. But if it doesn’t break that level, NZD silver could dip down to retest the breakout from the wedge pattern around $42 or $43.

USD silver was up $1.35 (5%) from last week to $28.63. It also looks to be heading back to test the recent and 2020 highs around $30. It seems only a matter of time before that is broken. But it is a good idea to layer in on any further pullbacks that might occur.

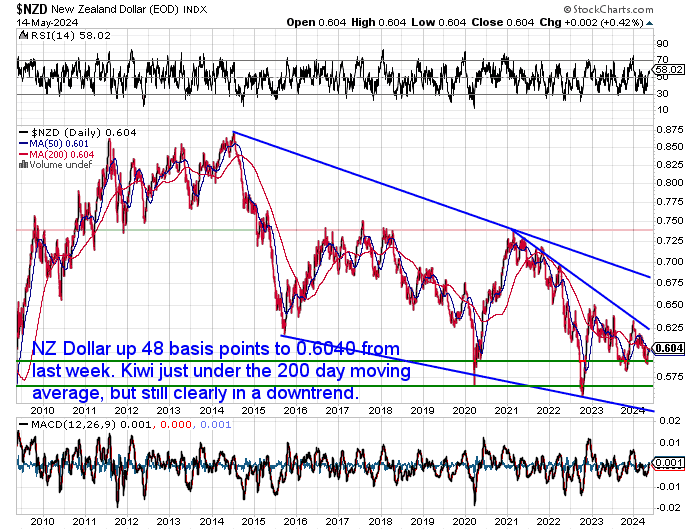

NZ Dollar Back Up to the 200-day MA

The Kiwi dollar was up 48 basis points from last week. Rising back to the 200-day MA. But it is clearly still in a downtrend

Need Help Understanding the Charts?

Check out this post if any of the terms we use when discussing the gold, silver, and NZ Dollar charts are unknown to you:

Gold and Silver Technical Analysis: The Ultimate Beginners Guide

Continues below

Long Life Emergency Food – Back in Stock

These easy-to-carry and store buckets mean you won’t have to worry about the shelves being bare…

Free Shipping NZ Wide*

Get Peace of Mind For Your Family NOW…

—–

The History of Gold Cycles

Tavi Costa had an excellent thread on Twitter/X this week. In fact one of his charts prompted us to take a closer look at gold cycles in this week’s feature article below (and is included there).

Tavi asked:

“…the lingering question remains: are we truly witnessing the onset of another gold cycle?”

Then outlined just some of the reasons why he thinks we are:

- Central banks still allocate less than 20% of their balance sheet to gold, relative to the 75% peak observed in the early 1980s.

- Traditional 60/40 portfolios are only beginning to redefine their allocations to incorporate hard assets like gold.

- This is the first time in 45 years that gold has become less volatile than Treasuries.

- Gold supply is currently at its most restricted, with the quality of reserves deteriorating.

- Precious metals’ production continues to fall, mirroring previous long-term cycles.

- Stubborn inflationary pressures are priming investors to once again favor hard assets as a portfolio allocation.

- Reckless fiscal spending and a dearth of monetary discipline are compelling investors to seek alternatives beyond government-backed securities.

Jan Nieuwenhuijs also wrote a similar article on ZeroHedge this week that is worth checking out:

Why We Are At The Start Of A Multi-Year Gold Bull Market

“Recently the dollar gold price aggressively broke a multiyear resistance level on the back of escalating wars, worrying asset bubbles, and sticky inflation. Long term indicators show gold is undervalued under these circumstances and can easily double in price over the coming years.”

Gold & Silver: A Peek at the Peak? Potential Timeframes for the End of the Current Gold Cycle

Ever wonder when the bull market ends for precious metals? In this week’s feature article, we explore a theory based on historical cycles, potentially offering a glimpse into the future of gold and silver valuations. The article delves into:

- The concept of long-term cycles in precious metals markets

- How historical data on property cycles might provide clues about gold’s trajectory

- Potential timelines for when gold and silver could reach their peak valuations

Intrigued by the possibility of predicting turning points in the precious metals market? This article explores this fascinating concept and equips you with valuable insights, regardless of whether you’re a seasoned stacker or a curious newcomer.

Gold Cycles vs Property Cycles in 2024: When Will Gold Reach Peak Valuation?

Become a Gold Survival Guide Partner

Are you a business owner, blogger, or influencer with an audience interested in gold, silver, and financial preparedness? Partner with Gold Survival Guide and earn commission by referring customers our way!

We offer a lucrative partnership program with access to exclusive marketing materials and ongoing support.

Interested? Contact us today to learn more!

2 Contrarian Indicators

Here’s a couple of Contrarian Indicators spotted this week:

Stansberry is officially shutting down their Gold Stock Analyst newsletter.In other words, there’s zero investor appetite for gold stocks.

Meanwhile, gold prices continue to make new all-time highs.

Gold miners will print cash at these prices, but nobody cares!

Mark Hulbert…a permabear who has hated gold for as long as I can remember…is out with another one of his instant classics.

Gold is overvalued now and won’t help you beat inflation in coming years

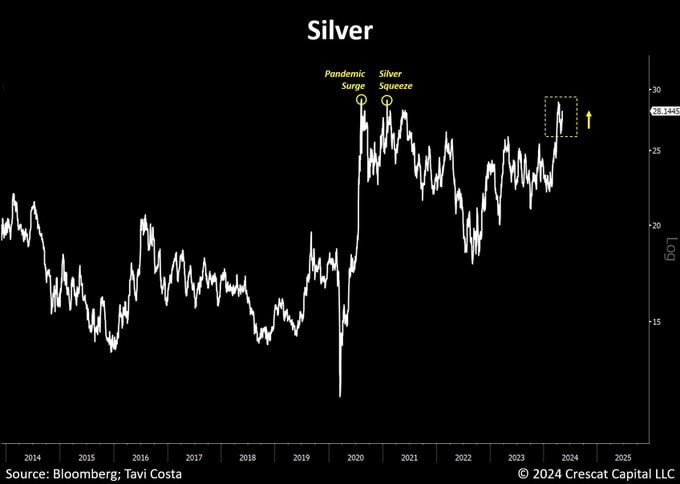

Watch End of June for Silver Buy Signal

This chart from Tavi Costa shows silver has been consolidating at the pandemic highs…

“Rather than another short-term spike, silver has been establishing itself at prices we experienced during the “silver squeeze” of 2021 and the pandemic-related surge, albeit in a much greater sustainable manner this time around.Investors appear to be disregarding the broader opportunity to buy the metal, especially in light of the ongoing breakout in gold prices and the historically high levels of the gold-to-silver ratio.

This is one of the most significant supply/demand mismatches I’ve seen for a monetary metal with inflationary attributes, particularly as it becomes increasingly essential for the green revolution, the upgrading of electrical grids, and the extensive modernization of industrial capabilities globally.”

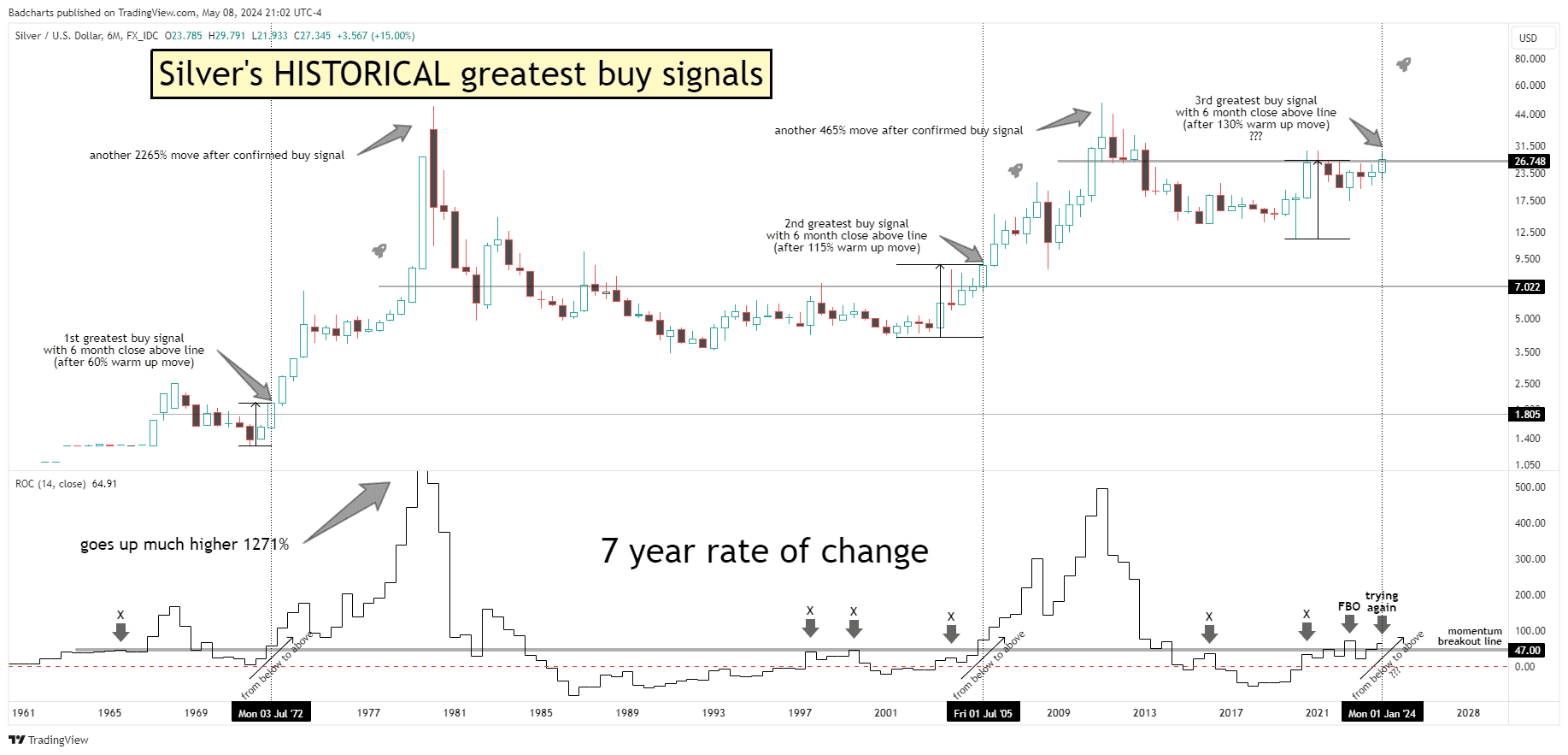

While this interesting chart shows us the 6 month silver price stretching back to the 1960s. Thereby smoothing out the shorter term moves in Silver. We should watch the end of June for what will likely be the 3rd best buy signal for silver. The previous 2 times this buy signal was tripped we saw gains of 2265% and 465% respectively.

“Silver’s HISTORICAL greatest buy signals…

It’s coming!”

Another Sovereign Wealth Fund (Already) Bought Gold

As Tavi Costa pointed out above, central banks and wealth funds are just starting to reallocate some of their assets into gold. In recent weeks we’ve reported how the Thai Pension Fund increased its gold investments. Also how Singapore has followed the Chinese Central Bank into gold. Plus how big, mainly Asian wealth funds have been looking at US Government finances and see deep trouble and so are buying gold.

But this week we came across a Reuters report from back in 2022 that “Australia’s sovereign wealth fund buys gold, commodities as shadow of 1970s looms”

“Australia’s A$200 billion ($134.28 billion) sovereign wealth fund is increasing exposure to gold, commodities, private equity and infrastructure as it warns the future will echo the low-growth, high-inflation era of the 1970s.

The Future Fund outlined the changes, which also included widening its currency basket, in a note on Friday that questioned the value of traditional 60-40 portfolios and called for an investing shift to confront a world dealing with war, inflation and climate change.

“In this kind of environment there is a real risk of simultaneous slow growth, high unemployment, and rising prices that has some parallels with the stagflationary period that struck developed markets in the 1970s,” the note said.”

That sounds a lot like the warnings we’ve been giving for the past couple of years! It seems the Australian Future Fund has shown more foresight than many of its Asian brethren. Certainly more than our own NZ Super Fund. See: Why the NZ Super Fund Should “Invest” in Gold in 2024

If you haven’t yet reallocated a portion of your own investments to gold and silver, then all the above information shows right now might be a good time to start.

Please get in contact for a gold or silver quote, or if you have any questions:

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Shop Online with indicative pricing

This Weeks Articles:

Gold Cycles vs Property Cycles in 2024: When Will Gold Reach Peak Valuation?

Wed, 15 May 2024 8:03 AM NZST

This article explores the fascinating world of historical cycles, outlining a potential timeline for when gold and silver might culminate their current growth phase and reach full valuation. It also looks at property cycles to see how these might interact and compare to precious metals cycles. This article covers: Where in the Real Estate Cycle […]

The post Gold Cycles vs Property Cycles in 2024: When Will Gold Reach Peak Valuation? appeared first on Gold Survival Guide.

As always we are happy to answer any questions you have about buying gold or silver. In fact, we encourage them, as it often gives us something to write about. So if you have any get in touch.

- Email: orders@goldsurvivalguide.co.nz

- Phone: 0800 888 GOLD ( 0800 888 465 ) (or +64 9 2813898)

- or Online order form with indicative pricing

7 Reasons to Buy Gold & Silver via GoldSurvivalGuide

Today’s Prices to Buy

Tube of 25: $1497.01 (pick up price – dispatched in 2 weeks)

Box of 500 coins (dispatched in 4 weeks):

2024 coins: $27,143.44

Backdated coins: $27,060.72

Including shipping/insurance (4 weeks delivery)

Can’t Get Enough of Gold Survival Guide?

If once a week isn’t enough sign up to get daily price alerts every weekday around 9am Click here for more info

We look forward to hearing from you soon. Have a golden week!

David (and Glenn)

GoldSurvivalGuide.co.nz

Ph: 0800 888 465

From outside NZ: +64 9 281 3898

email: orders@goldsurvivalguide.co.nz

The Legal stuff – Disclaimer:

We are not financial advisors, accountants or lawyers. Any information we provide is not intended as investment or financial advice. It is merely information based upon our own experiences. The information we discuss is of a general nature and should merely be used as a place to start your own research and you definitely should conduct your own due diligence. You should seek professional investment or financial advice before making any decisions.

Copyright © 2022 Gold Survival Guide.

All Rights Reserved.Read More…